Is SphereX safe?

Pros

Cons

Is Spherex Safe or a Scam?

Introduction

Spherex is an online forex brokerage that claims to offer a range of trading services, including forex, commodities, and cryptocurrencies. Positioned as a competitive player in the forex market, Spherex has attracted attention for its purported regulatory compliance and trading features. However, the increasing prevalence of online trading scams necessitates that traders exercise caution when evaluating brokers. In this article, we will investigate the legitimacy of Spherex, focusing on its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk assessment. Our analysis is based on a comprehensive review of available data, including user feedback and regulatory records.

Regulation and Legitimacy

One of the foremost aspects to consider when assessing whether Spherex is safe is its regulatory status. Regulation is crucial in the financial services industry, as it provides a level of oversight that can protect traders from fraud and malpractice. According to various sources, Spherex claims to be regulated by the National Futures Association (NFA) and states that clients are protected under the Commodity Futures Trading Commission (CFTC). However, upon further investigation, it appears that Spherex is not listed in the NFA registry, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Region | Verification Status |

|---|---|---|---|

| NFA | N/A | USA | Unregulated |

The lack of a valid regulatory license indicates that Spherex operates without the necessary oversight, which is a significant red flag for potential investors. Unregulated brokers often engage in practices that can jeopardize clients' funds, making it imperative for traders to be wary of such entities. The absence of regulatory backing not only undermines Spherex's credibility but also suggests that it may be operating in a high-risk environment, where the likelihood of fraud is elevated.

Company Background Investigation

Spherex's company history and ownership structure are also critical factors in determining whether Spherex is safe. The broker claims to be based in Colorado, USA, and is owned by Spherex Limited. However, the lack of transparency regarding its founding date and ownership details raises questions about its operational legitimacy. Furthermore, the absence of a robust management team with a proven track record in the financial services sector can be concerning for potential clients.

The information available regarding Spherex's management team is sparse, making it difficult to assess their qualifications and experience. Transparency in company operations is vital for building trust with clients, and Spherex's limited disclosure undermines this essential aspect. Additionally, the unavailability of a direct contact number, combined with a generic email address for customer support, adds to the opacity surrounding the broker's operations. This lack of clarity is a strong indicator that potential investors should proceed with caution.

Trading Conditions Analysis

When evaluating whether Spherex is safe, it is essential to analyze its trading conditions, including fees and spreads. Spherex claims to offer competitive spreads and leverage up to 1:100, which can be attractive to traders looking for high-risk, high-reward opportunities. However, the minimum deposit requirement of $500 can be seen as a barrier for many traders, particularly beginners.

| Fee Type | Spherex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of detailed information about the fee structure is concerning. Many traders have reported issues with unexpected fees and withdrawal problems, indicating that Spherex may not be as transparent as it claims. Such practices are often characteristic of unregulated brokers, making it essential for traders to thoroughly investigate the cost of trading before committing to any broker. The opaque fee structure raises significant concerns about the overall trading conditions offered by Spherex.

Customer Funds Safety

Another critical aspect to consider when determining if Spherex is safe is the safety of customer funds. Reliable brokers typically implement stringent measures to protect client funds, including segregating client accounts and providing negative balance protection. However, reports indicate that Spherex does not offer such protections, leaving clients vulnerable to potential losses.

The absence of investor protection mechanisms is alarming, especially for a broker that claims to operate in a regulated environment. Historical accounts of clients encountering difficulties when attempting to withdraw funds further highlight the risks associated with trading with Spherex. Without a regulatory body overseeing its operations, Spherex has little incentive to prioritize the safety of its clients' funds, which is a significant concern for any potential investor.

Customer Experience and Complaints

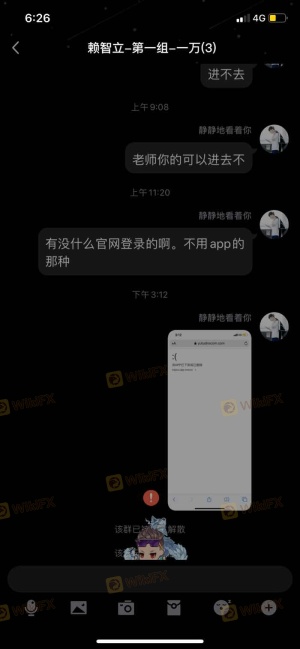

Customer feedback is a vital indicator of a broker's reliability and trustworthiness. In the case of Spherex, numerous users have reported negative experiences, particularly regarding withdrawal issues and customer service responsiveness. Common complaints include difficulties in accessing funds, unexpected fees, and inadequate support from the broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Average |

| Misleading Information | High | Poor |

One notable case involved a trader who deposited funds only to find their account suspended when attempting to withdraw. This pattern of behavior aligns with common tactics employed by fraudulent brokers, raising further doubts about Spherex's legitimacy. The overall user experience suggests that Spherex may not be a reliable option for traders seeking a trustworthy brokerage.

Platform and Execution

The performance and reliability of a trading platform are crucial factors in assessing whether Spherex is safe. Traders expect a stable platform with efficient order execution and minimal slippage. However, reports indicate that Spherex's trading platform may not meet these expectations. Users have reported issues with order execution quality, including high slippage and instances of rejected orders, which can significantly impact trading outcomes.

The potential for platform manipulation is another concern, as traders rely on fair and transparent execution of trades. If a broker is found to manipulate prices or reject orders unfairly, it can lead to significant financial losses for traders. Therefore, the reported platform performance issues further contribute to the overall risk associated with trading with Spherex.

Risk Assessment

When evaluating the overall risk of trading with Spherex, it is essential to consider various factors that may pose threats to traders. These include regulatory risks, operational risks, and market risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker lacking oversight. |

| Operational Risk | High | Issues with withdrawals and support. |

| Market Risk | Medium | High leverage amplifies potential loss. |

Given the high levels of regulatory and operational risks, traders should approach Spherex with extreme caution. It is advisable to conduct thorough research and consider safer alternatives before investing funds.

Conclusion and Recommendations

In conclusion, the investigation into Spherex raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, combined with numerous user complaints and operational issues, suggests that Spherex is not safe for traders. Potential investors should be wary of the risks associated with unregulated brokers and consider alternative options that offer better protection and transparency.

For traders seeking reliable brokerage options, it is recommended to explore well-regulated firms that have a proven track record of customer service and fund security. Brokers regulated by top-tier authorities such as the FCA, ASIC, or NFA are generally safer choices. By prioritizing security and transparency, traders can better protect their investments and achieve their trading goals.

Is SphereX a scam, or is it legit?

The latest exposure and evaluation content of SphereX brokers.

SphereX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SphereX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.