Bi-Crypto FX 2025 Review: Everything You Need to Know

Executive Summary

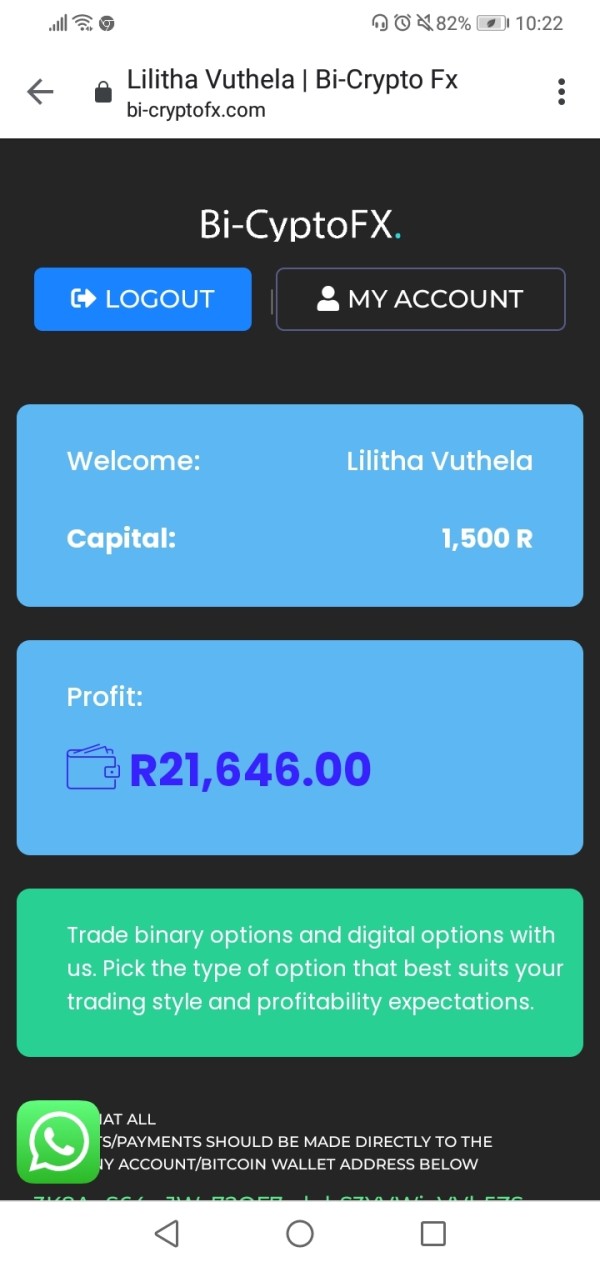

In this comprehensive bi-crypto fx review, we present a neutral assessment of this online forex broker. The broker operated between 2018-2021 and offered various trading services during that time. Based on available public information and user feedback, Bi-Crypto FX positions itself as a multi-asset trading platform offering access to various financial instruments including forex, commodities, indices, bonds, and cryptocurrencies.

Our evaluation reveals a mixed picture for this broker. While the platform demonstrates diversity in its trading offerings, significant concerns arise from the lack of detailed regulatory information and transparent trading conditions. The broker appears to target traders seeking exposure to diversified financial markets. These traders show particular interest in both traditional forex trading and cryptocurrency investments.

However, potential clients should exercise considerable caution. According to WikiFX monitoring data, the broker has received 1 neutral review and 4 exposure reviews from users, with no positive reviews recorded. This feedback pattern, combined with limited transparency regarding regulatory oversight, suggests that traders should thoroughly research and consider alternatives. They should complete this research before committing funds to this platform.

Important Notice

This bi-crypto fx review is based on publicly available information and user feedback collected from various sources. Our assessment has not involved actual trading testing or direct verification of all claimed services. Traders should be aware that information regarding specific regulatory jurisdictions and detailed trading conditions was not clearly specified. The available sources did not provide this crucial information clearly.

The evaluation methodology incorporates data from multiple review platforms, regulatory databases, and user testimonials. However, given the limited transparency from the broker regarding its regulatory status and operational details, potential clients are strongly advised to conduct additional due diligence. They must complete this research before making any trading decisions.

Rating Framework

Broker Overview

Bi-Crypto FX emerged as an online forex broker sometime between 2018 and 2021. The company positioned itself in the competitive retail trading market during this period. The company operates as a multi-asset broker, attempting to cater to traders interested in both traditional financial instruments and the growing cryptocurrency market. According to available information, the broker's business model centers on providing online trading services across multiple asset classes. However, specific details about its corporate structure and operational headquarters remain unclear in public documentation.

The broker's approach appears to target traders seeking diversified portfolio exposure through a single platform. However, the limited available information about the company's background, leadership team, and operational history raises questions about transparency. Potential clients should carefully consider these transparency concerns.

This bi-crypto fx review reveals that while the broker offers access to various asset classes including forex, commodities, indices, bonds, and cryptocurrencies, crucial information about trading platforms, regulatory compliance, and operational procedures remains insufficiently documented. The public sources do not provide adequate detail about these important aspects. The absence of clear regulatory oversight information represents a significant concern for traders prioritizing safety and regulatory protection. These traders focus heavily on regulatory protection in their broker selection process.

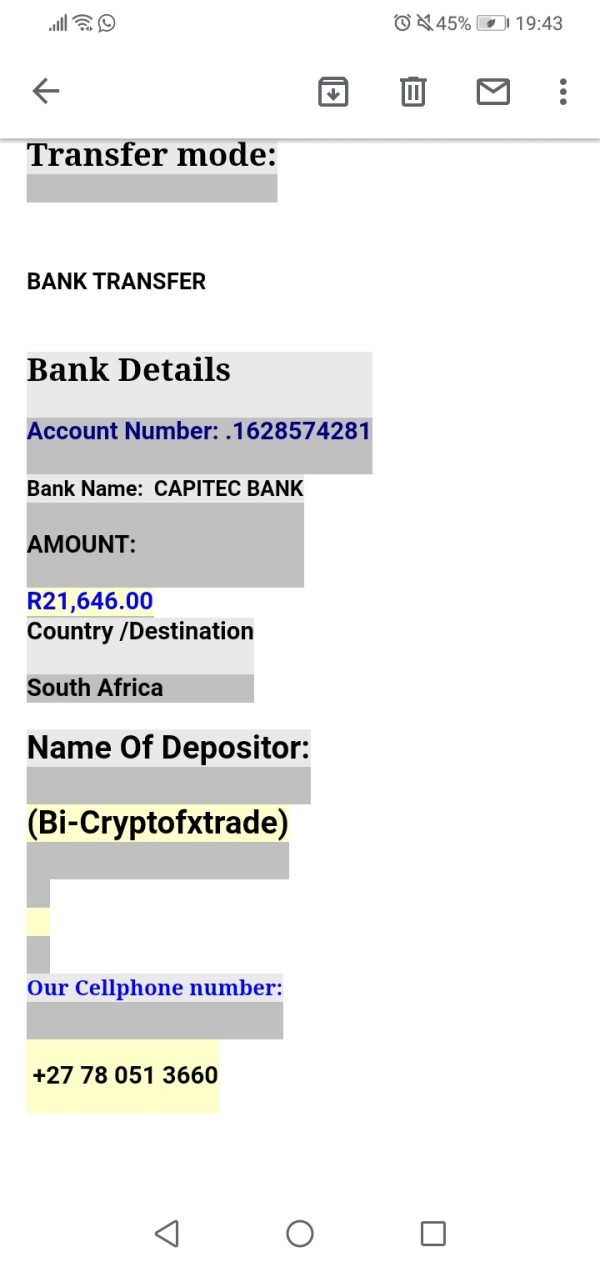

Regulatory Jurisdictions: Available information does not specify clear regulatory oversight or licensing from recognized financial authorities. This represents a significant transparency gap that affects trader confidence.

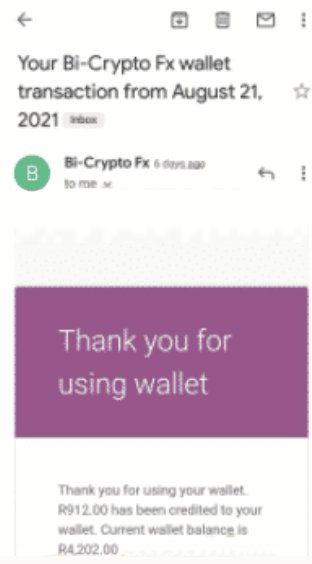

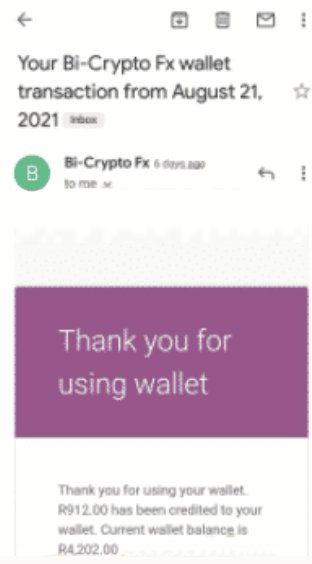

Deposit and Withdrawal Methods: Specific payment methods, processing times, and associated fees for deposits and withdrawals are not detailed in available sources.

Minimum Deposit Requirements: The minimum deposit amount required to open trading accounts is not specified. Available documentation does not include this basic information.

Bonus and Promotions: Information regarding welcome bonuses, promotional offers, or incentive programs is not provided in available sources.

Tradeable Assets: The broker offers access to forex pairs, commodities, stock indices, bonds, and cryptocurrency instruments. This provides diversified market exposure for traders seeking variety in their portfolios.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not clearly outlined in available documentation. This makes cost comparison difficult for potential clients.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in accessible sources.

Platform Options: The trading platform technology and available software options are not specified. Current bi-crypto fx review materials do not include this information.

Geographic Restrictions: Information about restricted countries or regional limitations is not provided in available sources.

Customer Service Languages: Supported languages for customer service are not specified. Accessible documentation lacks this detail.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Bi-Crypto FX's account conditions proves challenging due to limited publicly available information. Standard industry practices typically include multiple account tiers with varying features, minimum deposits, and trading conditions. However, specific details about the broker's account structure remain undisclosed in accessible sources.

Without clear information about account types, minimum deposit requirements, or special features such as Islamic accounts for Muslim traders, potential clients cannot make informed comparisons with other brokers. The absence of detailed account opening procedures and verification requirements also raises concerns. These concerns focus on the broker's operational transparency.

Industry standards suggest that reputable brokers provide comprehensive account information including spreads, commissions, and available leverage for each account type. The lack of such transparency in this bi-crypto fx review indicates that traders should request detailed account specifications directly from the broker. They must obtain this information before making any commitments.

The missing account condition details represent a significant limitation for traders attempting to evaluate whether the broker's offerings align with their trading strategies and capital requirements.

Bi-Crypto FX demonstrates strength in asset diversity, offering trading access across forex, commodities, indices, bonds, and cryptocurrencies. This multi-asset approach provides traders with opportunities to diversify their portfolios and access different market sectors through a single platform. This can be advantageous for traders seeking comprehensive market exposure.

However, the evaluation reveals significant gaps in information about research and analysis resources. Professional traders typically require access to market analysis, economic calendars, trading signals, and educational materials. They need these tools to make informed decisions. The absence of detailed information about such resources limits our ability to assess the broker's value proposition for serious traders.

Educational resources, including webinars, tutorials, and market commentary, are essential for trader development. These resources prove particularly important for newcomers to forex and cryptocurrency markets. Without clear information about educational offerings, potential clients cannot assess whether the broker supports trader growth and skill development.

The lack of information about automated trading support, API access, or third-party platform integration also limits our assessment. We cannot properly evaluate the broker's technological capabilities and suitability for advanced trading strategies.

Customer Service and Support Analysis

Customer service quality represents a critical factor in broker selection. Yet available information provides insufficient detail about Bi-Crypto FX's support infrastructure. Essential elements such as available contact channels, response times, and service quality metrics are not documented in accessible sources.

Professional trading requires reliable customer support, particularly during market volatility or technical issues. The absence of information about support availability, including operating hours and multilingual capabilities, makes it difficult for potential clients to assess whether the broker can provide adequate assistance. This assessment becomes crucial when traders need immediate help.

Industry best practices include multiple contact methods such as live chat, telephone support, and email assistance. These services often operate with 24/5 availability during market hours. Without clear documentation of support channels and response time commitments, traders cannot evaluate the broker's service reliability.

The lack of user feedback specifically addressing customer service experiences in available sources further limits our ability to assess support quality. Potential clients should directly test the broker's responsiveness and service quality. They should complete this testing before committing significant trading capital.

Trading Experience Analysis

The assessment of trading experience with Bi-Crypto FX faces limitations due to insufficient information about platform stability, execution quality, and overall trading environment. Critical factors such as order execution speed, slippage rates, and platform uptime are not documented in available sources.

Professional traders require reliable platform performance, particularly during high-volatility periods when rapid execution can significantly impact trading outcomes. Without specific data about execution quality and platform stability, potential clients cannot assess whether the broker can meet their performance expectations.

Mobile trading capabilities have become essential in modern forex trading. These capabilities allow traders to monitor and manage positions while away from their primary trading stations. The absence of detailed information about mobile platforms and their functionality represents another evaluation limitation. This limitation affects the completeness of this bi-crypto fx review.

Trading environment factors such as available order types, charting capabilities, and analytical tools significantly impact trader effectiveness. The limited available information about platform features and trading tools makes it difficult to assess whether the broker provides a comprehensive trading environment. This environment should be suitable for different trading styles and strategies.

Trust Level Analysis

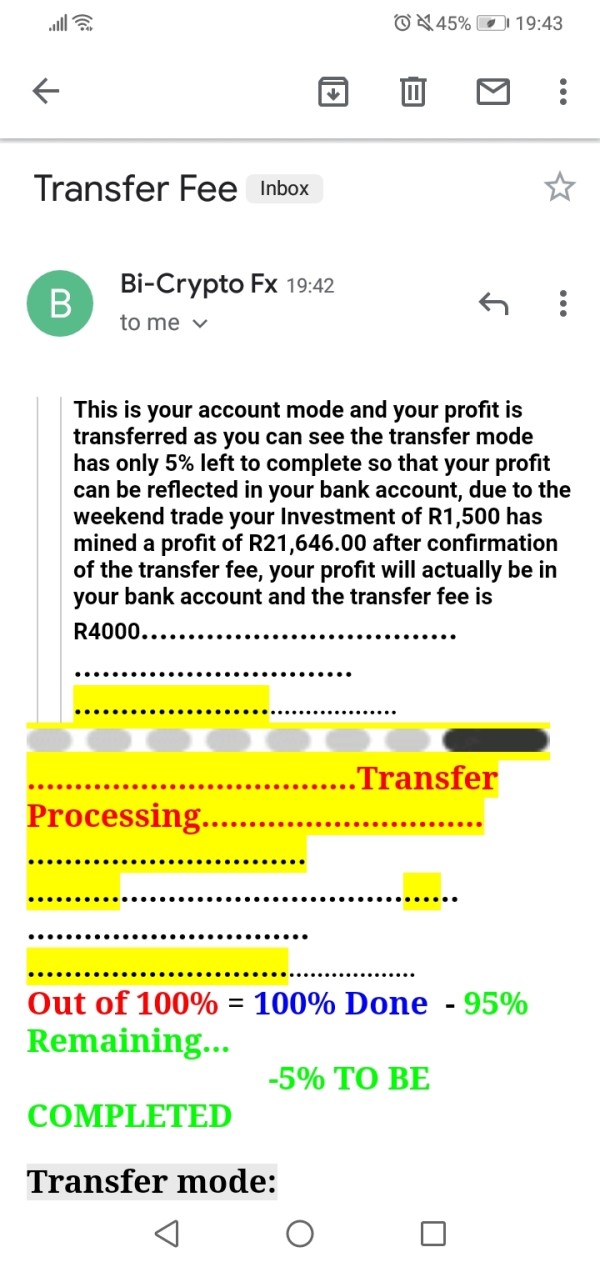

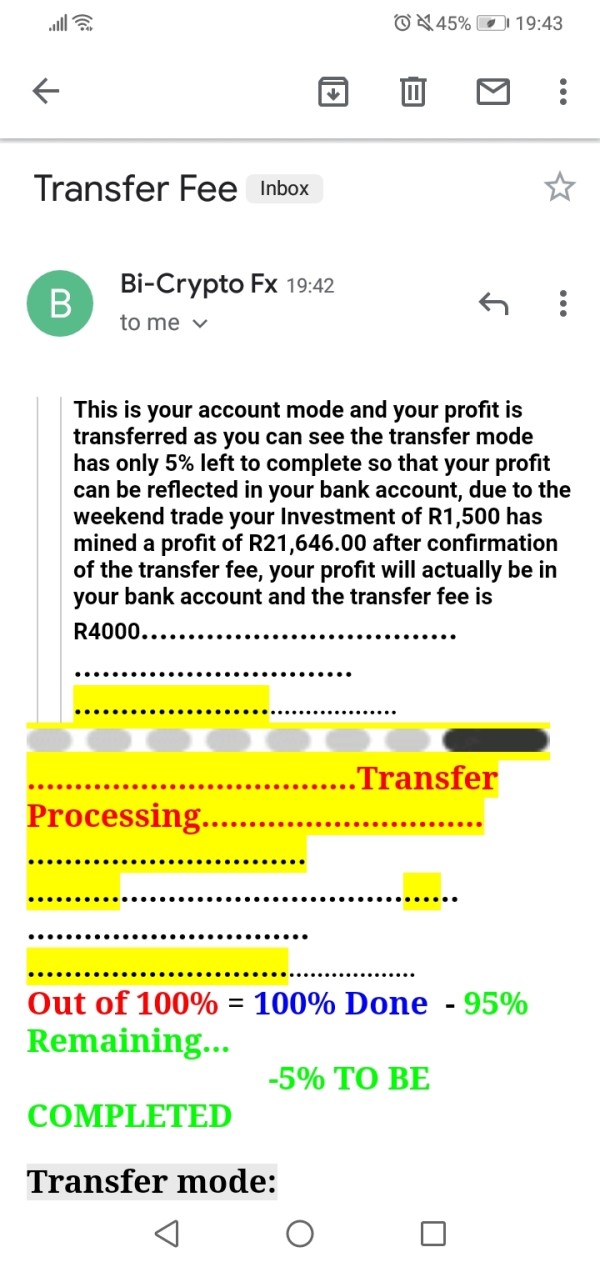

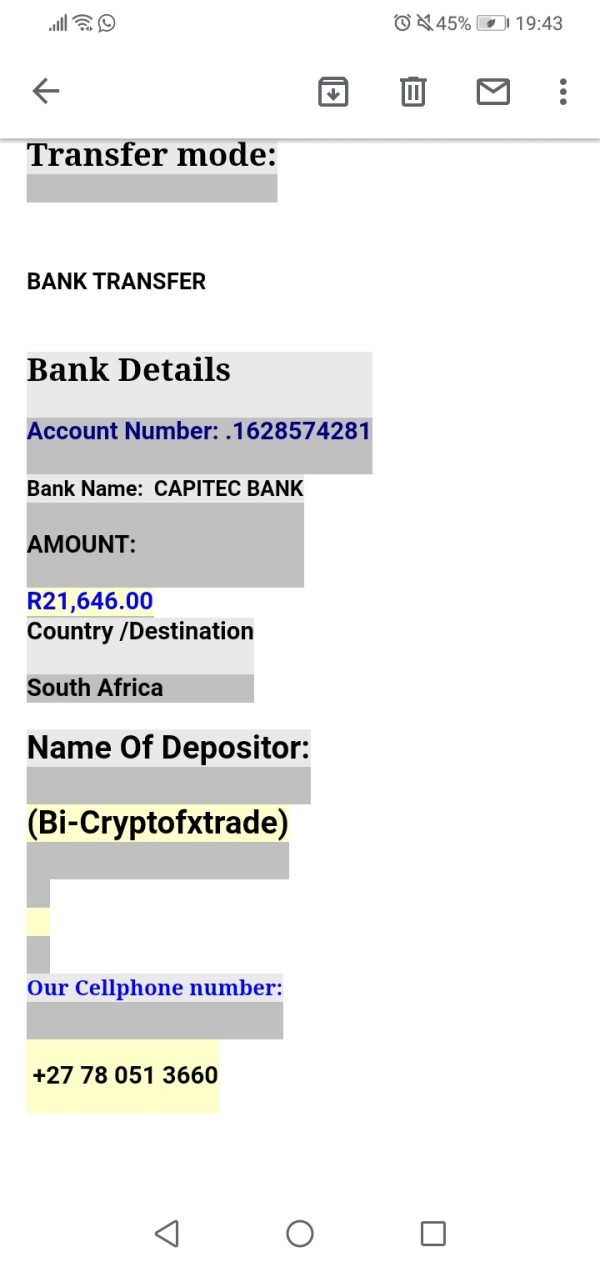

Trust assessment for Bi-Crypto FX reveals significant concerns primarily stemming from limited regulatory transparency. The absence of clear regulatory oversight from recognized financial authorities represents a major red flag. This concern particularly affects traders prioritizing safety and regulatory protection.

Regulatory compliance provides essential protections including segregated client funds, compensation schemes, and operational oversight. These protections help ensure broker reliability and client asset protection. Without clear regulatory status, traders face increased risks regarding fund safety and dispute resolution mechanisms.

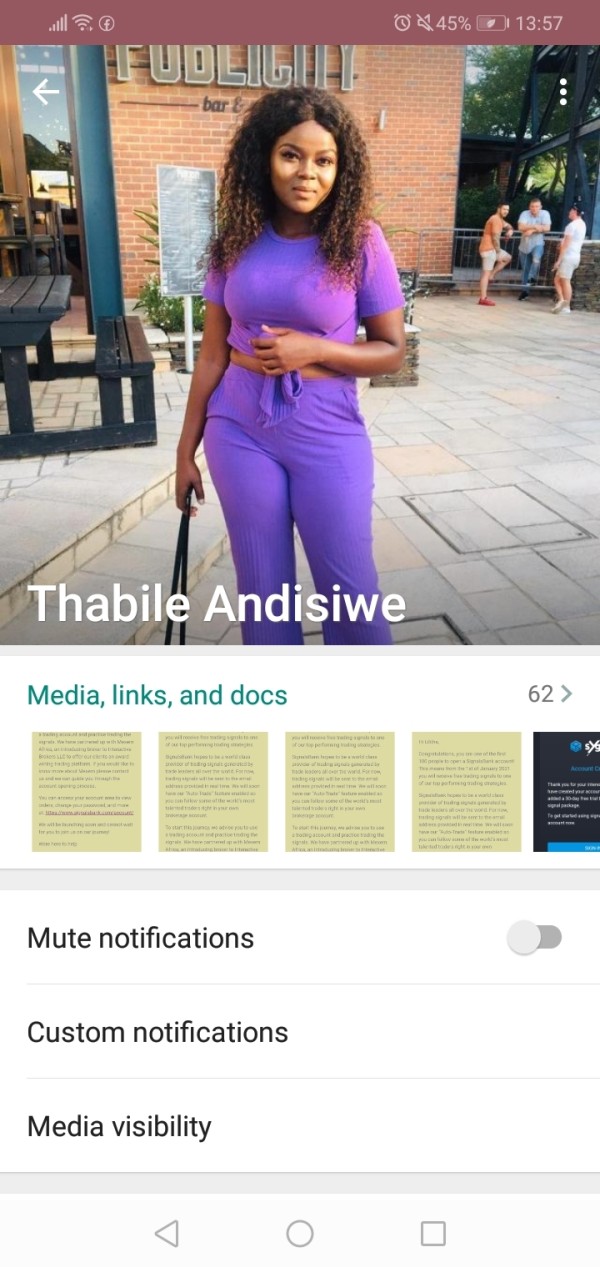

Corporate transparency, including clear information about company ownership, operational locations, and management team, contributes to overall trustworthiness. The limited available information about Bi-Crypto FX's corporate structure and operational transparency raises additional concerns. These concerns focus on the broker's credibility.

Industry reputation and third-party evaluations provide important trust indicators. However, available sources show concerning user feedback patterns with exposure reviews outnumbering positive experiences. This feedback pattern suggests potential issues that prospective clients should carefully investigate. They should complete this investigation before engaging with the broker.

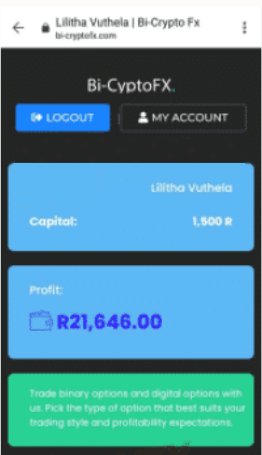

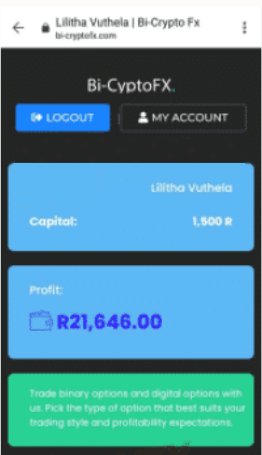

User Experience Analysis

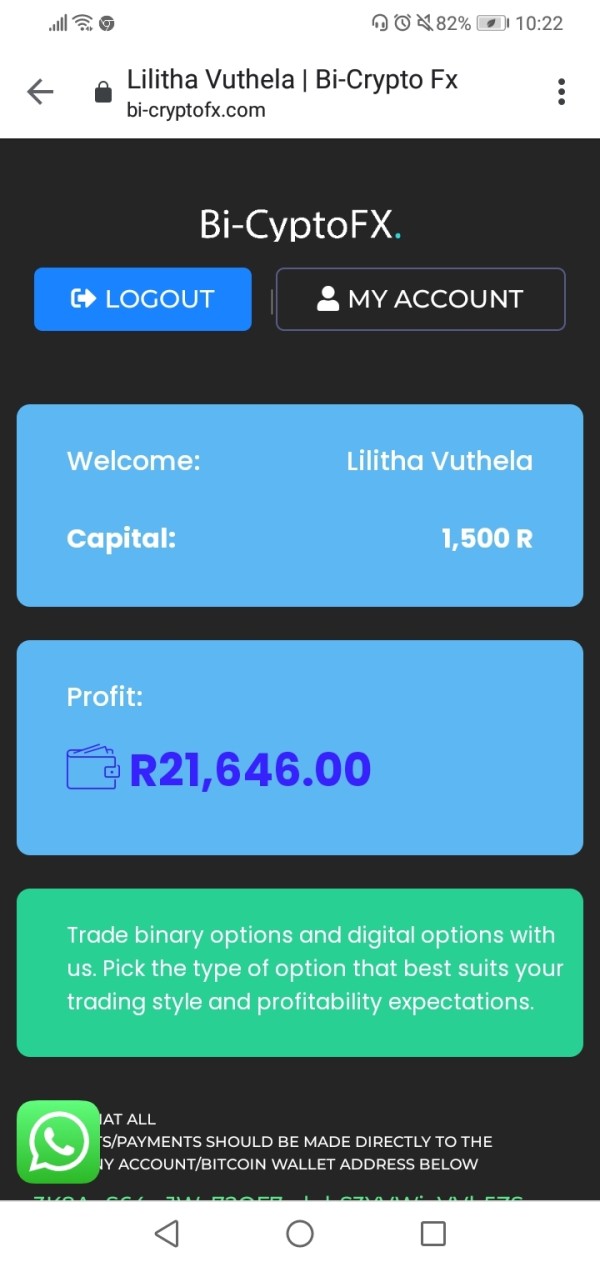

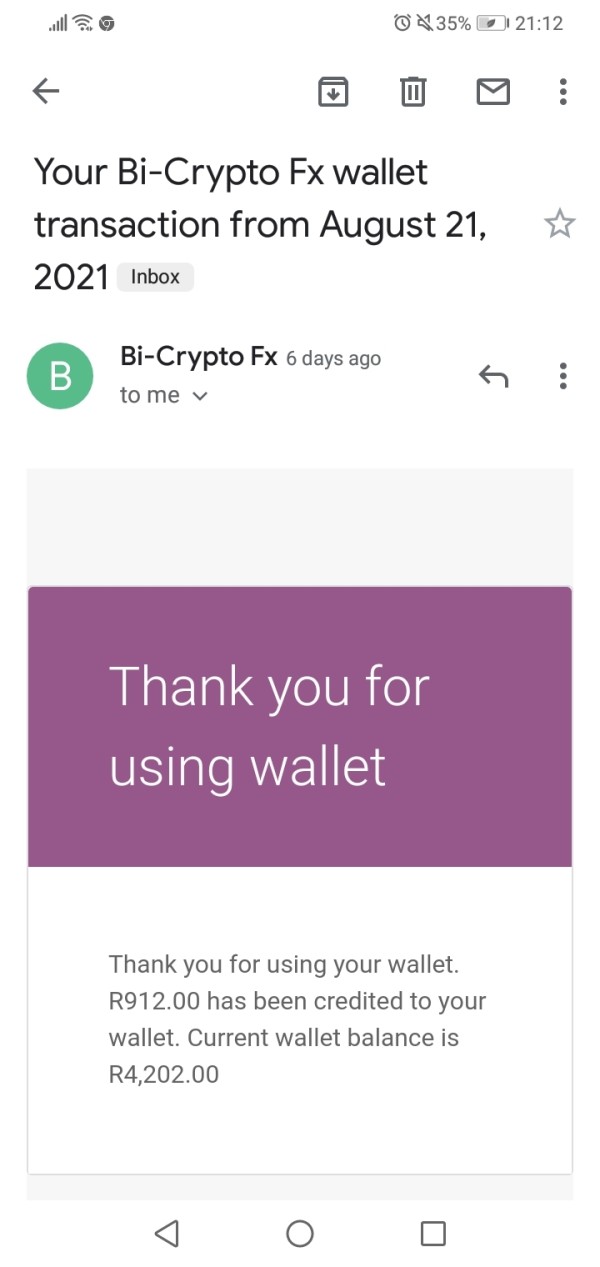

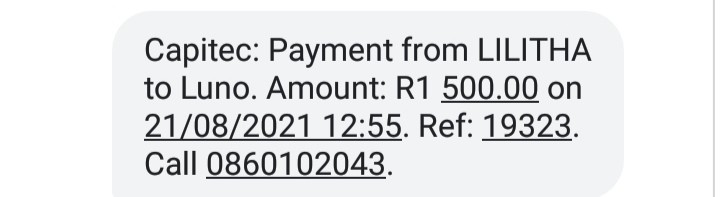

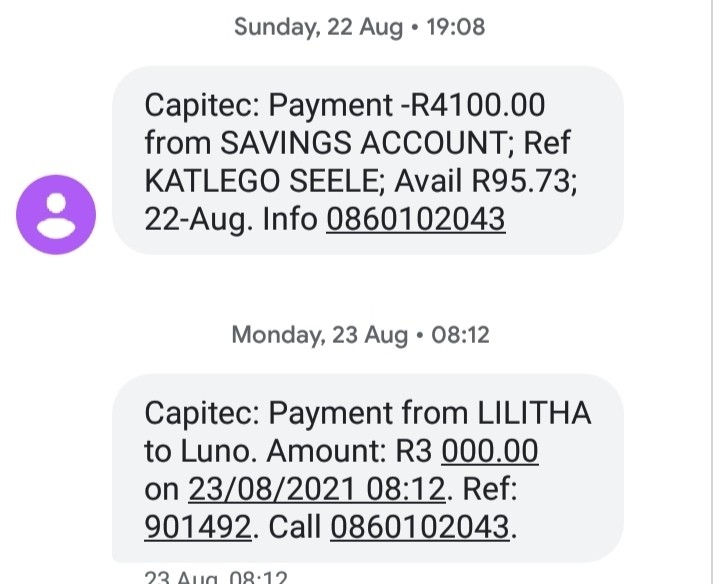

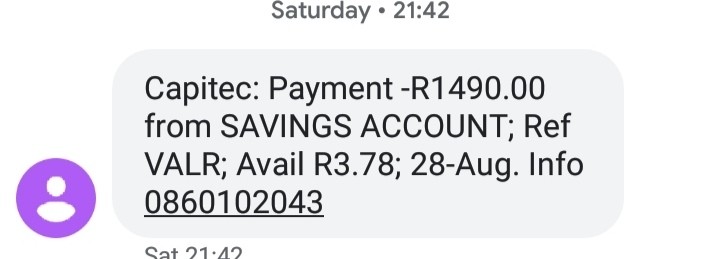

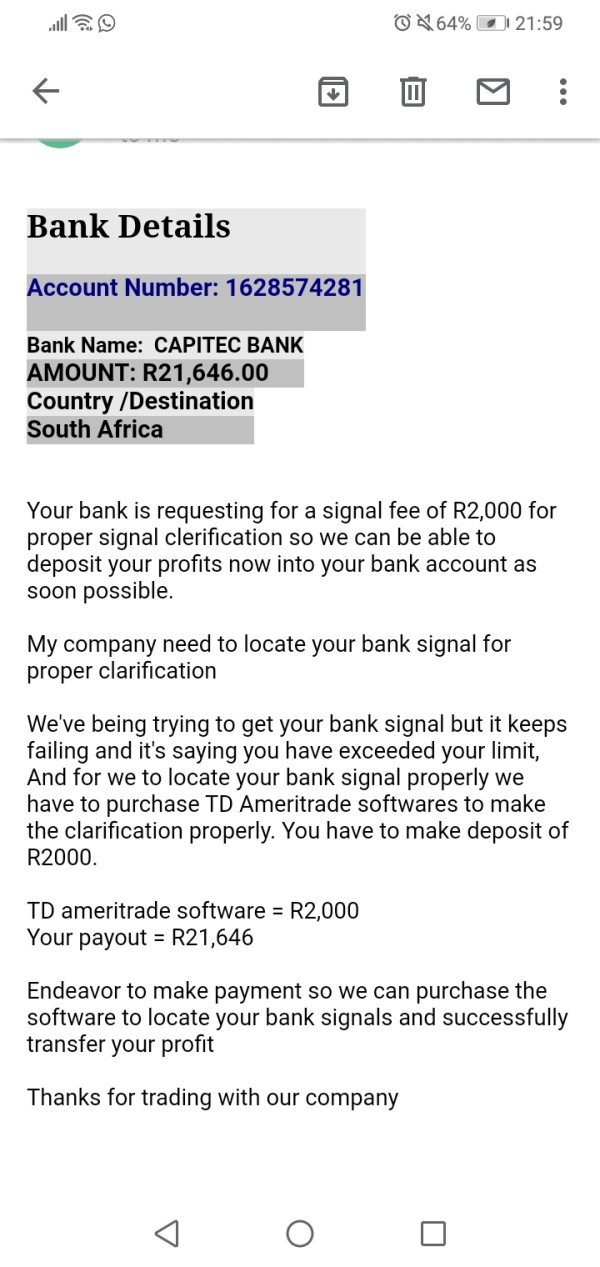

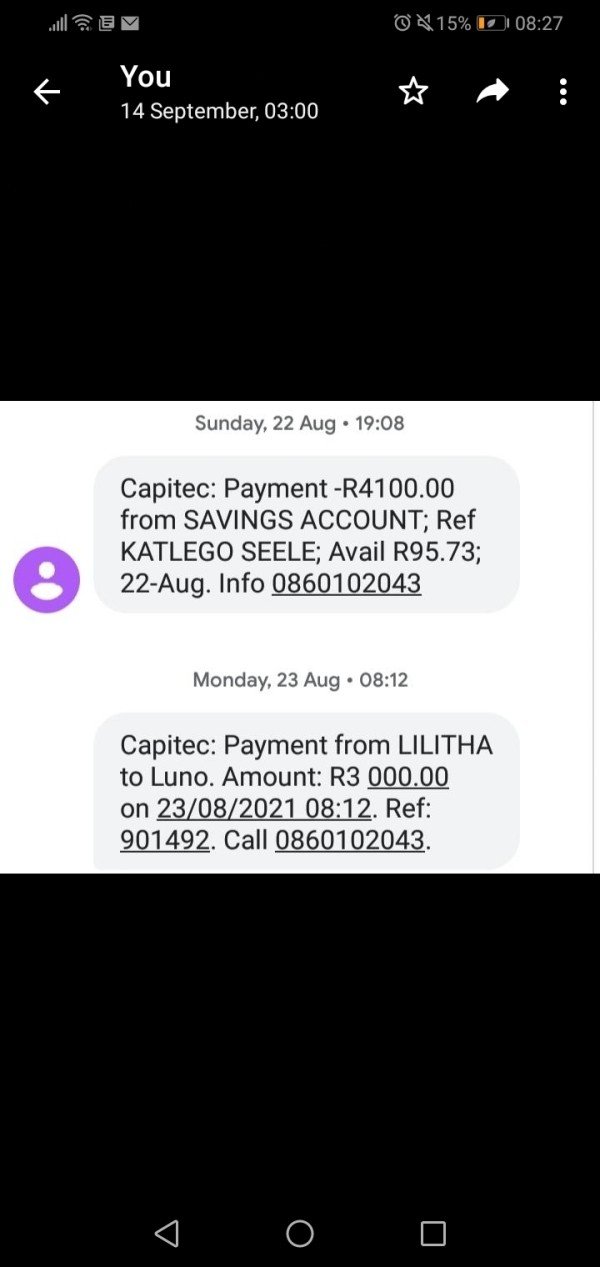

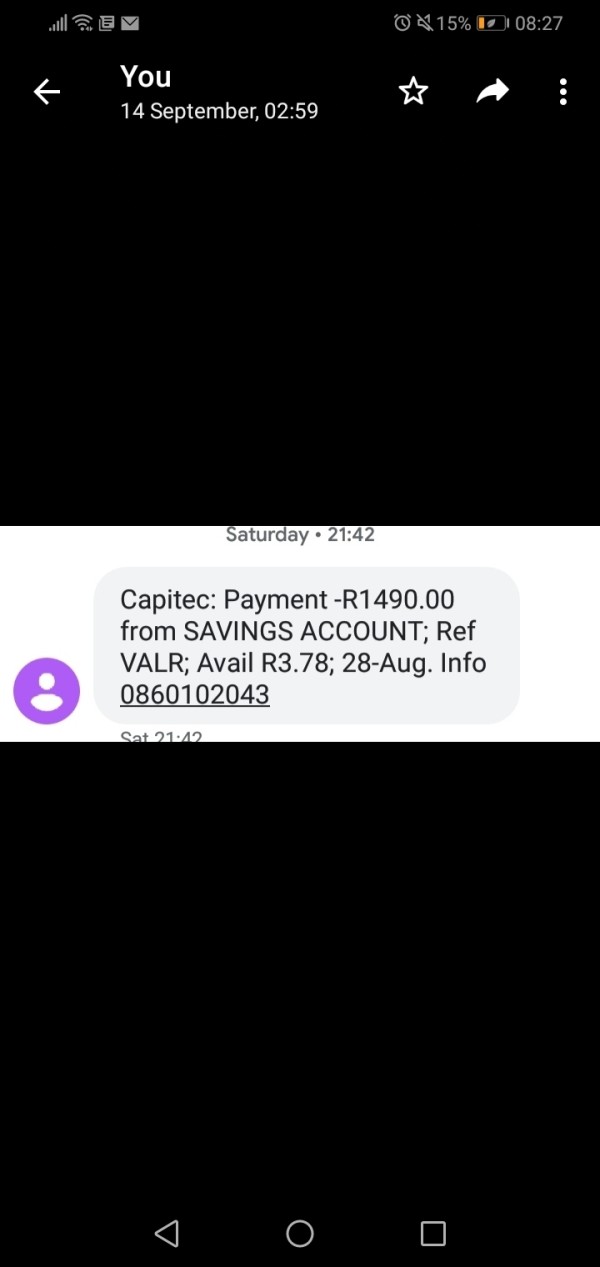

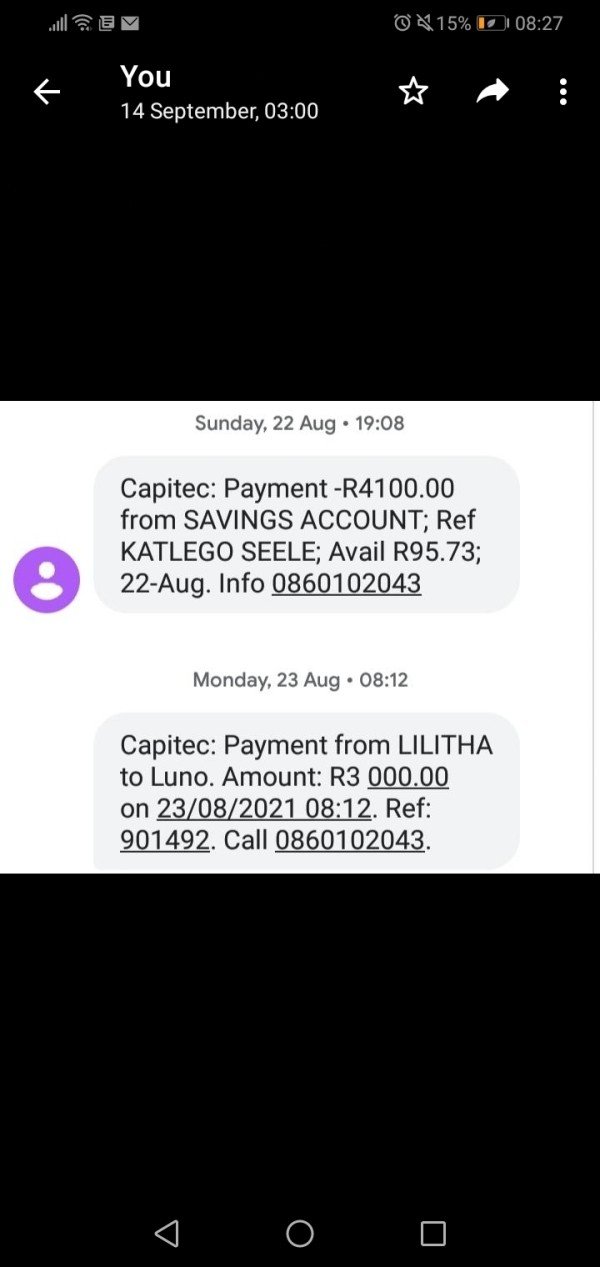

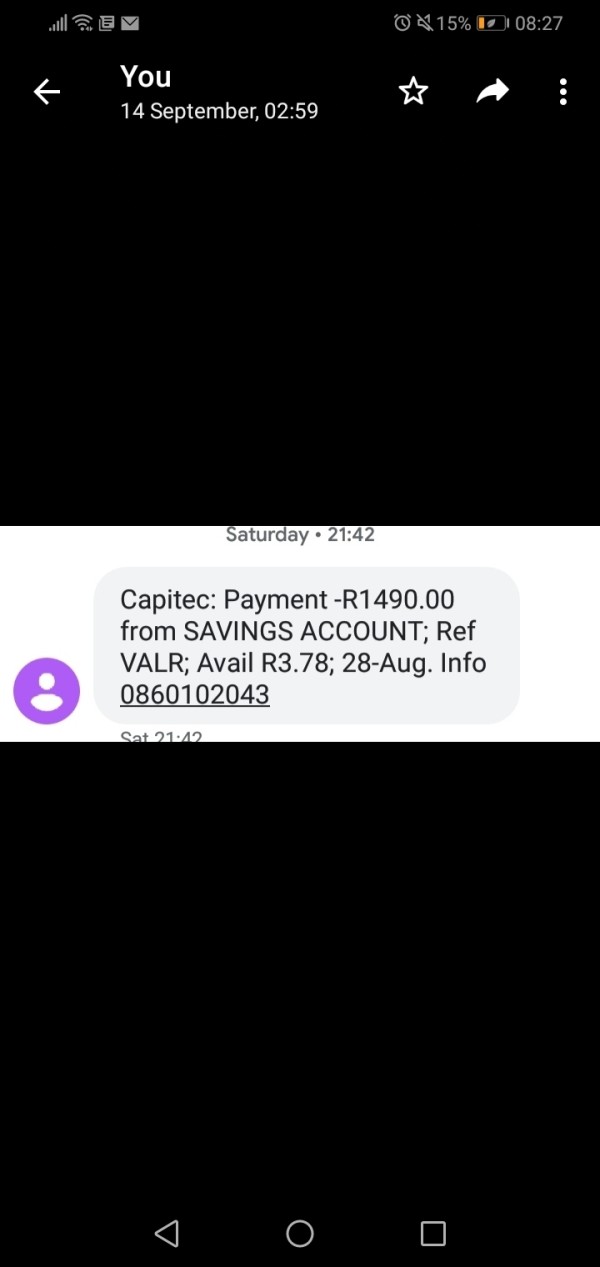

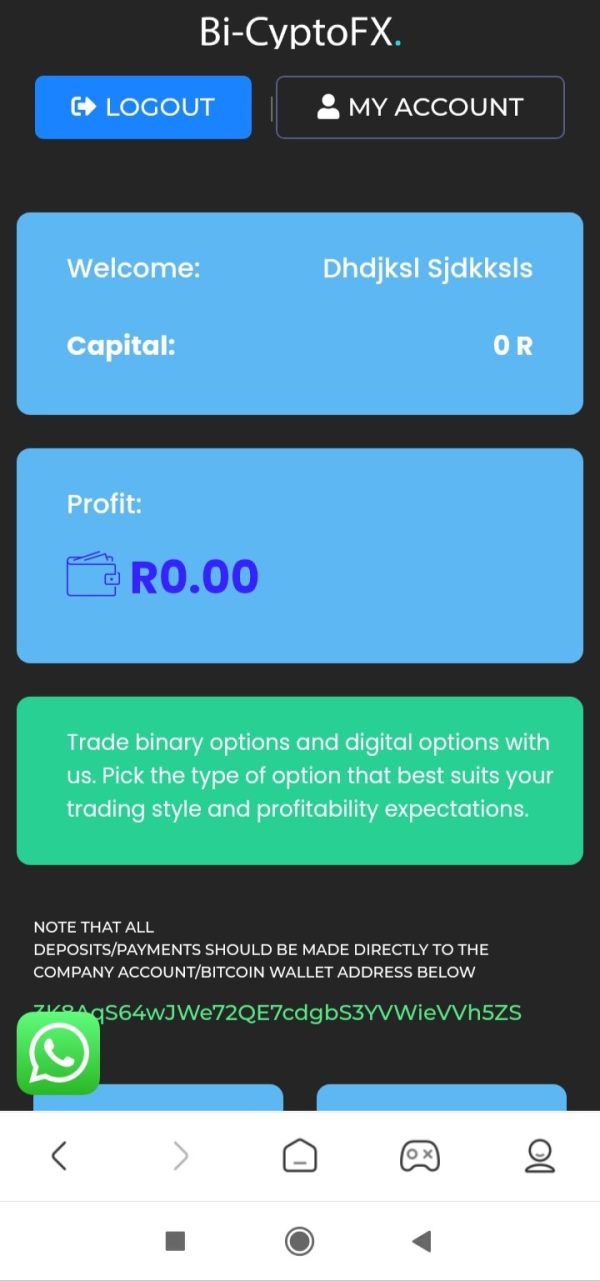

User experience evaluation for Bi-Crypto FX reveals concerning patterns based on available feedback data. According to WikiFX monitoring, the broker has received 1 neutral review and 4 exposure reviews, with no positive user reviews recorded. This indicates potential issues with user satisfaction and service delivery.

The absence of positive user reviews represents a significant concern. Satisfied clients typically provide favorable feedback about their experiences. The presence of multiple exposure reviews suggests that some users have encountered problems serious enough to warrant public warnings. These warnings concern their experiences with the broker.

Without detailed information about user interface design, platform usability, and registration processes, it becomes difficult to assess the overall user experience quality. Professional trading platforms should provide intuitive interfaces that facilitate efficient trade execution and account management.

The limited user feedback available does not provide sufficient detail about common user complaints or specific issues encountered during trading. Potential clients should seek additional user experiences and testimonials. They should gather this information before making decisions about engaging with this broker.

Conclusion

This comprehensive bi-crypto fx review presents a cautious assessment of a broker that offers multi-asset trading opportunities but lacks crucial transparency in key operational areas. While the broker provides access to diverse financial instruments including forex, commodities, indices, bonds, and cryptocurrencies, significant information gaps regarding regulatory oversight, trading conditions, and operational details raise important concerns.

The broker may suit traders specifically seeking exposure to diversified financial markets. These traders show particular interest in both traditional forex and cryptocurrency trading. However, the limited regulatory transparency and concerning user feedback patterns suggest that most traders would benefit from considering more established and transparent alternatives.

The primary advantages include multi-asset trading capabilities, while significant disadvantages encompass limited regulatory information, lack of detailed trading conditions, and concerning user feedback patterns. No positive reviews have been recorded for this broker.