Is SGL safe?

Pros

Cons

Is SGL A Scam?

Introduction

SGL, or Spark Global Limited, positions itself as an online forex broker operating in the financial markets, specifically focusing on forex and CFDs. As the forex trading landscape continues to expand, traders are increasingly aware of the importance of choosing a reliable broker. Given the potential risks associated with trading, including the loss of capital and the presence of fraudulent platforms, it is crucial for traders to conduct thorough evaluations of brokers before investing their hard-earned money. This article aims to assess the safety and trustworthiness of SGL by examining various aspects, including its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

One of the primary considerations when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to established standards and practices. Unfortunately, SGL operates as an unregulated broker, which raises significant concerns regarding its legitimacy and the protection of client funds.

Here is a summary of SGL's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation means that SGL is not held accountable by any financial authority, which can lead to a lack of transparency and potential risks for traders. Additionally, the broker is based in regions known for less stringent financial oversight, such as the United Arab Emirates and Saint Vincent and the Grenadines. This situation heightens the need for caution among potential clients, as unregulated brokers often lack the necessary investor protections.

Company Background Investigation

SGL's history and ownership structure are critical in assessing its reliability. Established as an online forex broker, SGL has not provided comprehensive information about its history or development. The lack of transparency surrounding the company's operations raises questions about its credibility. Furthermore, details regarding the management team and their professional backgrounds are scarce, which can lead to concerns about the broker's overall governance and operational integrity.

Transparency is a crucial factor in evaluating a broker's trustworthiness. SGL's failure to disclose pertinent information about its operations, including office locations and management profiles, may indicate an attempt to obscure potential issues. Traders are advised to be cautious when considering SGL as a trading partner due to these transparency concerns.

Trading Conditions Analysis

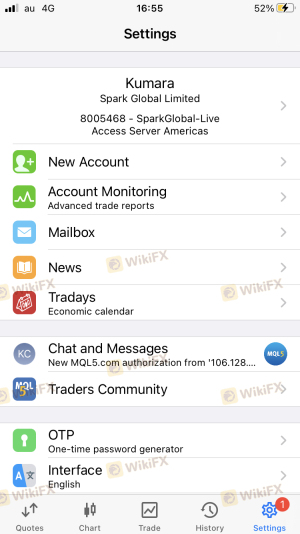

When evaluating a broker, understanding its trading conditions is essential. SGL offers a trading platform that utilizes MetaTrader 5, a widely recognized trading software. However, the overall cost structure associated with trading at SGL raises some red flags.

Here is a comparison of SGL's core trading costs:

| Cost Type | SGL | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not disclosed | Varies by broker |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The lack of clarity regarding spreads, commissions, and overnight interest rates can be concerning for traders. Unusual fees or hidden charges may exist, which could erode potential profits. A transparent and competitive fee structure is vital for traders, and the ambiguity surrounding SGL's costs could indicate potential issues.

Customer Fund Safety

The safety of client funds is paramount when considering a forex broker. SGL's lack of regulation raises significant concerns regarding the security measures in place to protect client deposits. Without regulatory oversight, there are no guarantees regarding fund segregation, investor protection schemes, or negative balance protection policies.

Traders should be particularly wary of brokers that do not provide clear information about their fund safety measures. In SGL's case, there have been no documented incidents of fund security issues, but the absence of protective measures is a significant risk factor. Traders are encouraged to thoroughly assess the safety protocols of any broker they consider working with.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reputation. Reviews and complaints about SGL indicate a mixed experience for users. Common complaints include difficulties in withdrawing funds, lack of responsive customer service, and issues with account management.

Here is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inconsistent |

| Account Management | High | Poor |

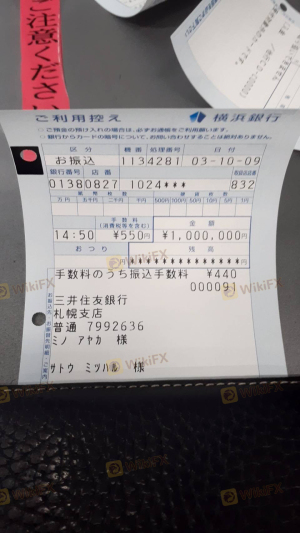

For instance, several users have reported being unable to withdraw funds, leading to frustration and distrust. These complaints highlight the need for potential clients to exercise caution when considering SGL as their broker.

Platform and Trade Execution

The performance and stability of the trading platform are crucial for a seamless trading experience. SGL utilizes the MetaTrader 5 platform, which is known for its user-friendly interface and comprehensive features. However, the quality of order execution, including slippage and rejection rates, is a critical aspect to consider.

Traders have reported varying experiences with SGL's execution quality, with some noting delays and issues with order fulfillment. Such occurrences can significantly impact trading outcomes, especially in a fast-paced market environment. Traders should be aware of the potential for execution issues when trading with SGL.

Risk Assessment

Using SGL as a broker presents several risks that potential traders should consider. The lack of regulation, unclear trading conditions, and mixed customer feedback contribute to a higher risk profile.

Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Transparency | Medium | Limited disclosure of fees and conditions. |

| Customer Service Risk | High | Poor response to complaints. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and be cautious with their investments.

Conclusion and Recommendations

In conclusion, the analysis of SGL raises several red flags regarding its credibility and trustworthiness. The lack of regulation, transparency issues, and mixed customer experiences indicate that traders should exercise caution when considering SGL as a trading partner.

For those seeking a reliable broker, it may be prudent to explore alternatives that offer regulatory oversight, transparent fee structures, and positive customer feedback. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a safer trading environment and may better protect traders' interests.

In summary, while SGL may offer trading services, the potential risks associated with this broker suggest that it may not be the safest option for traders. It is essential to prioritize safety and transparency when selecting a forex broker, and potential clients should remain vigilant in their evaluations.

Is SGL a scam, or is it legit?

The latest exposure and evaluation content of SGL brokers.

SGL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SGL latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.