SphereX Review 1

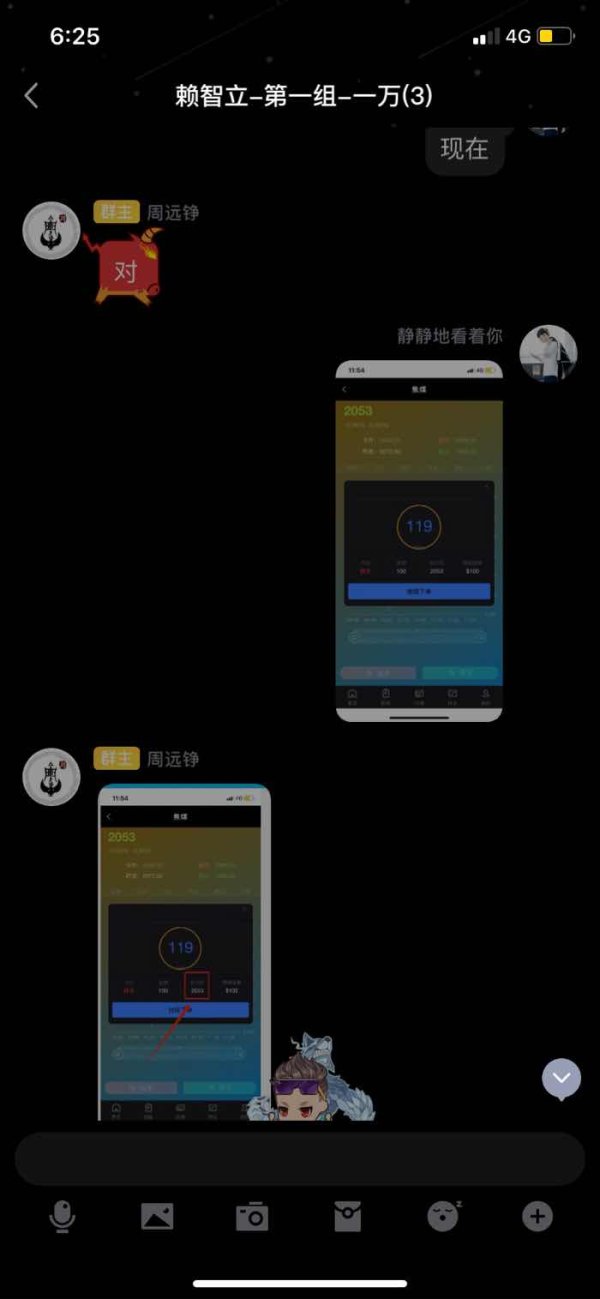

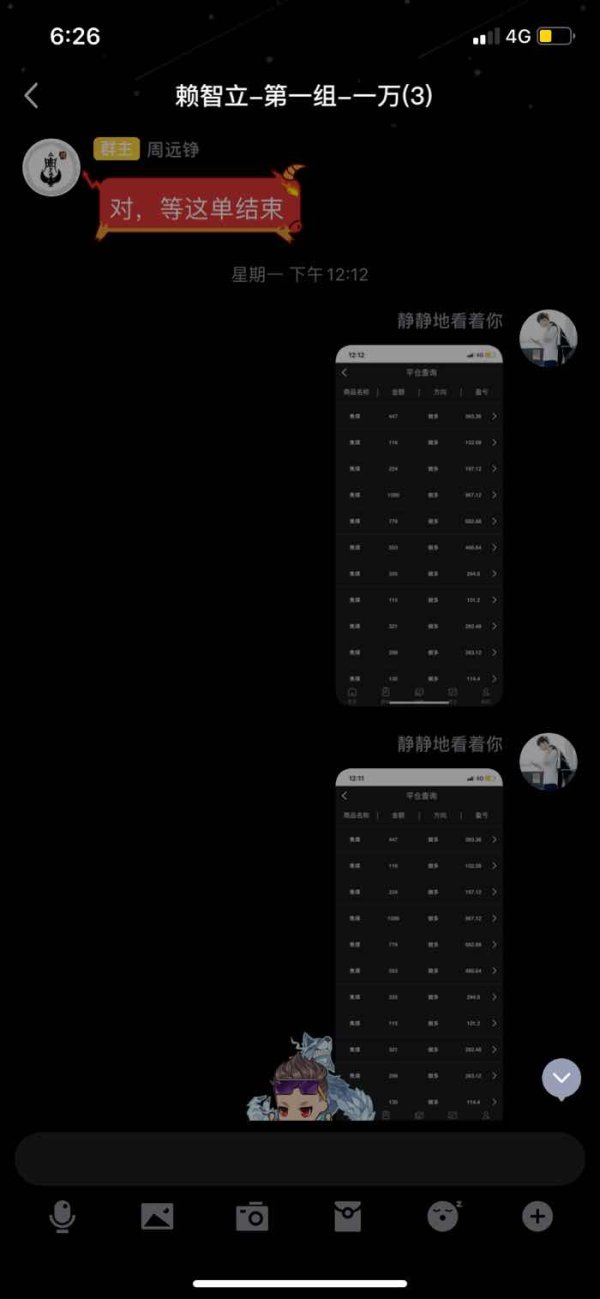

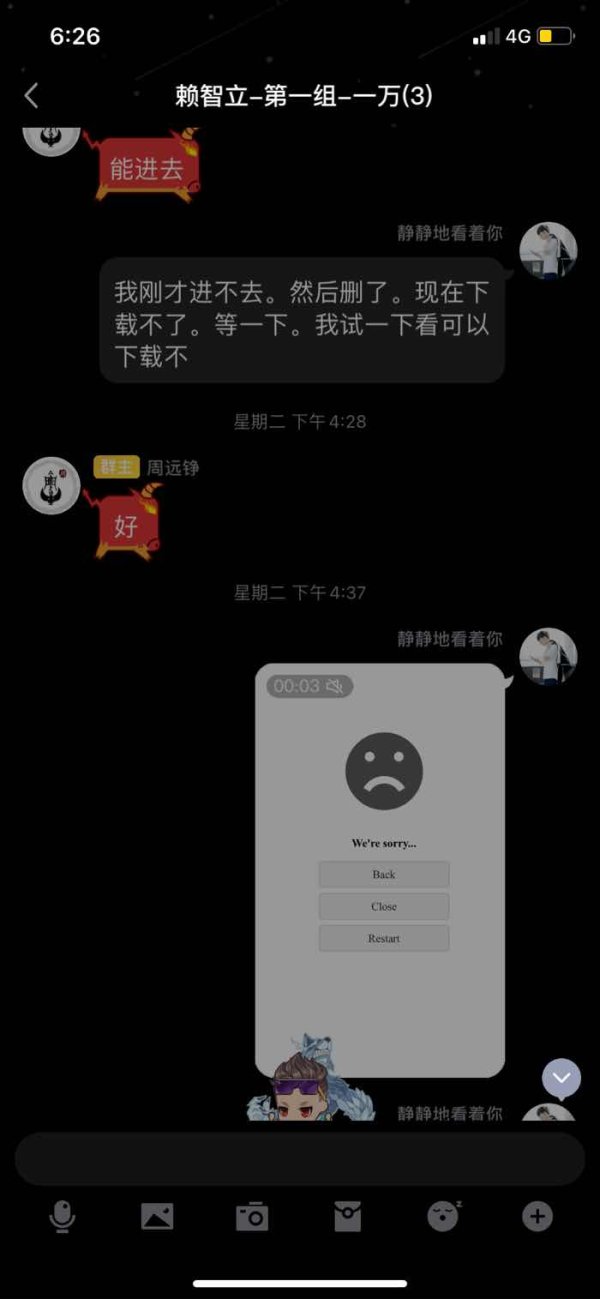

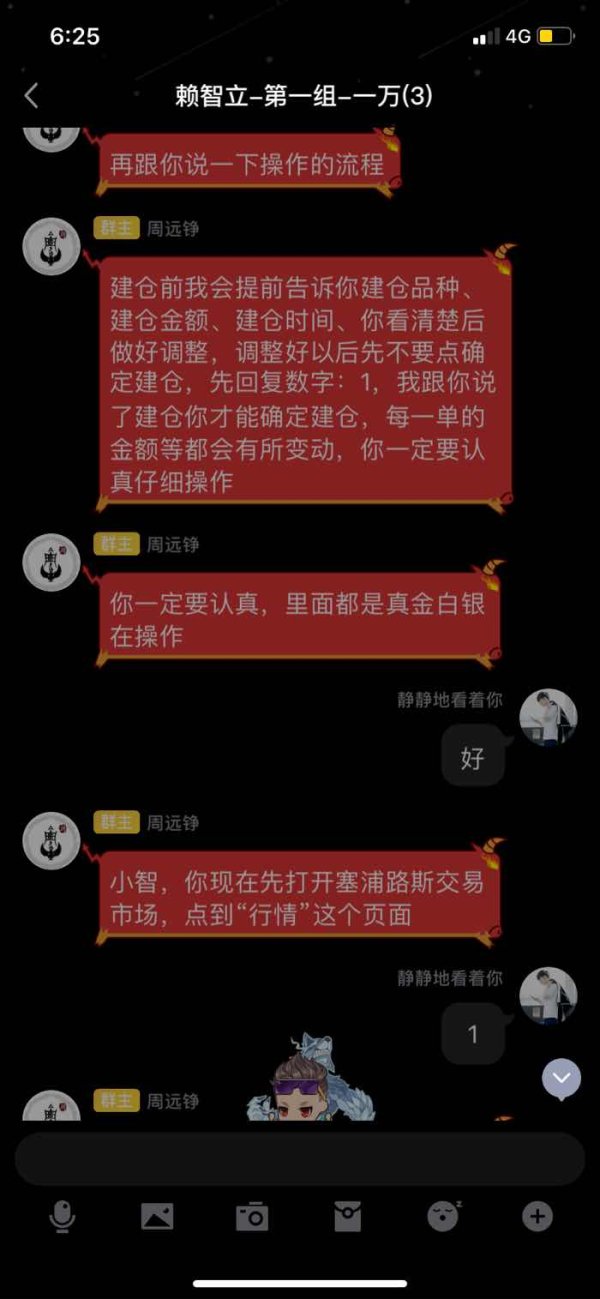

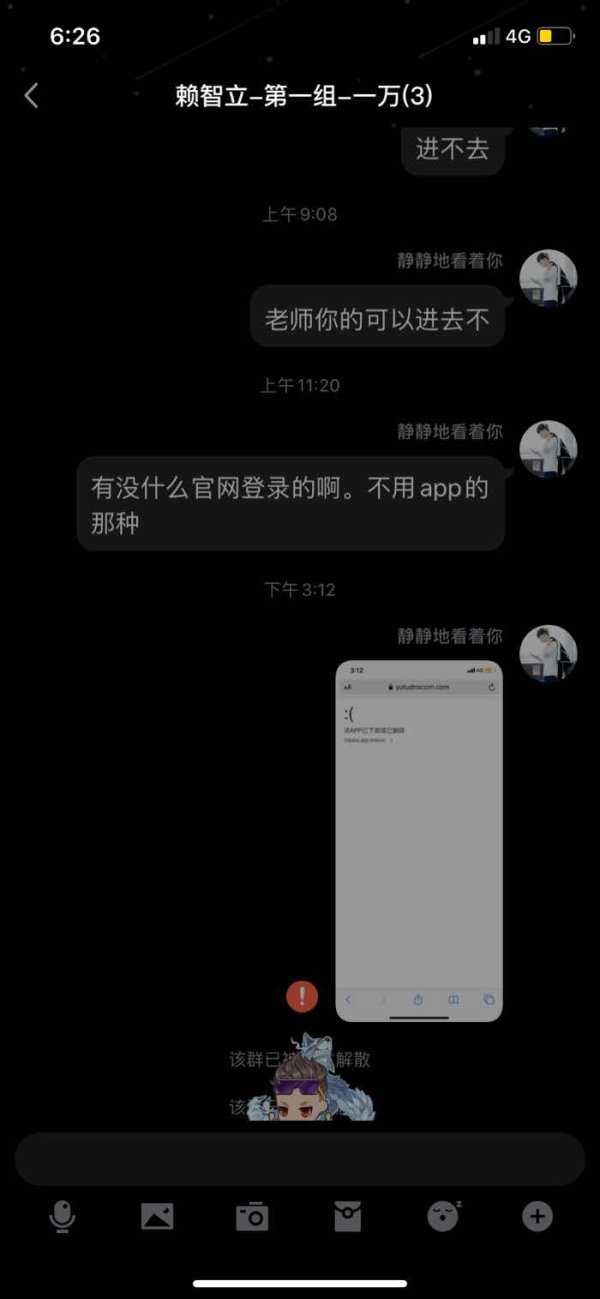

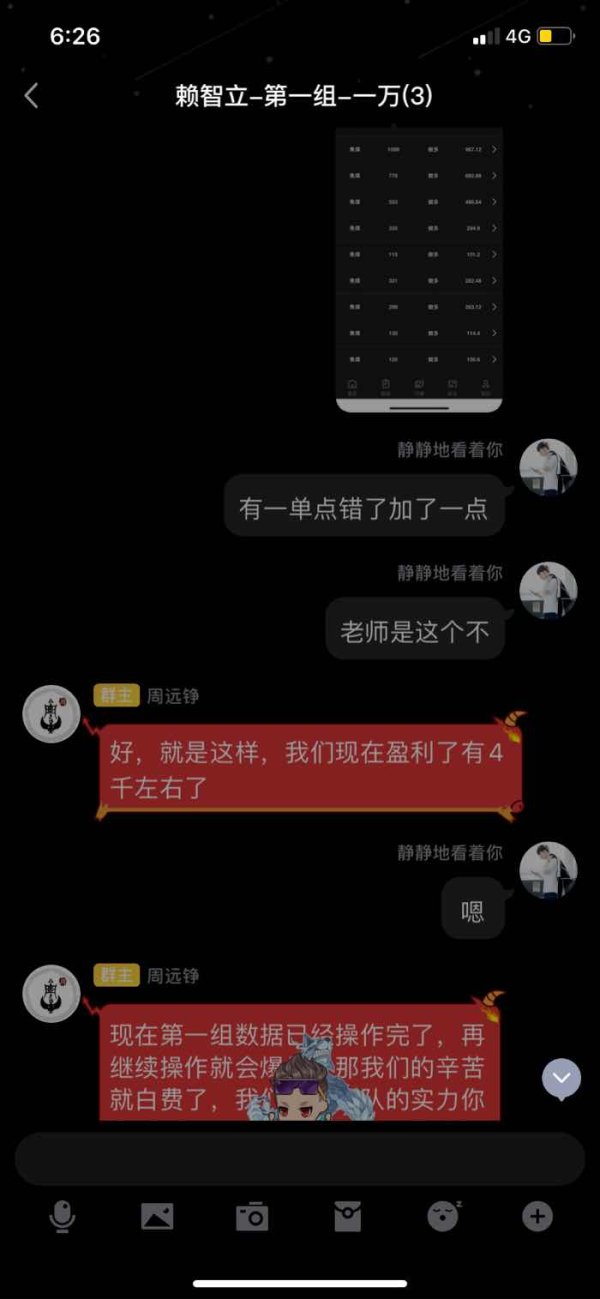

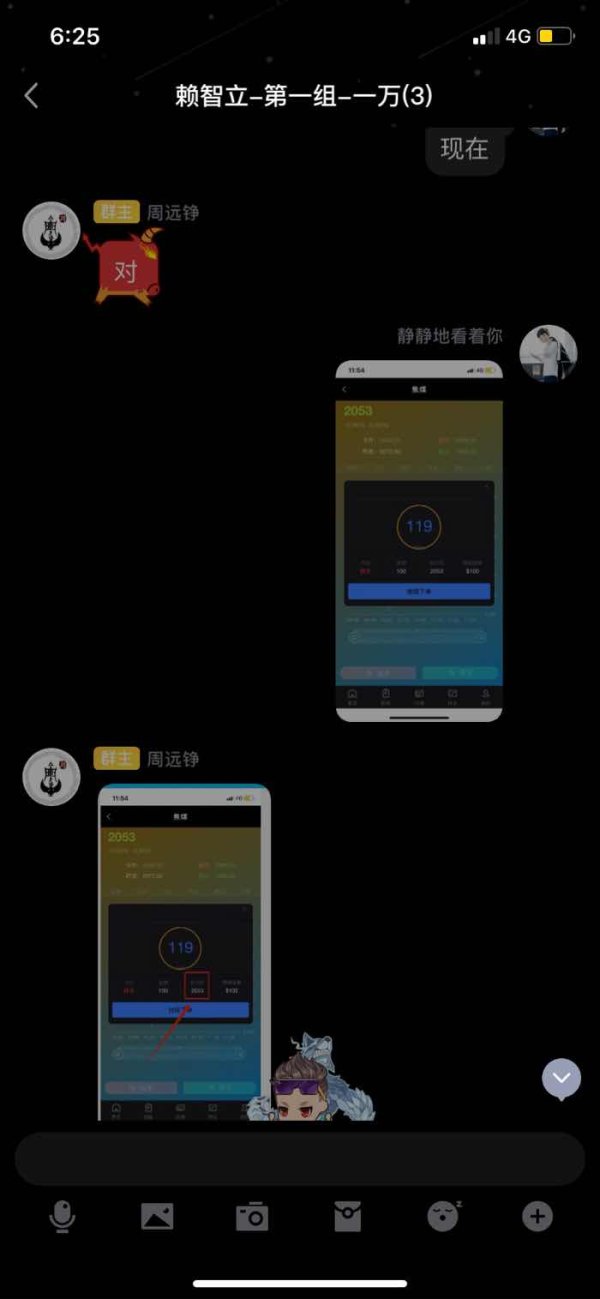

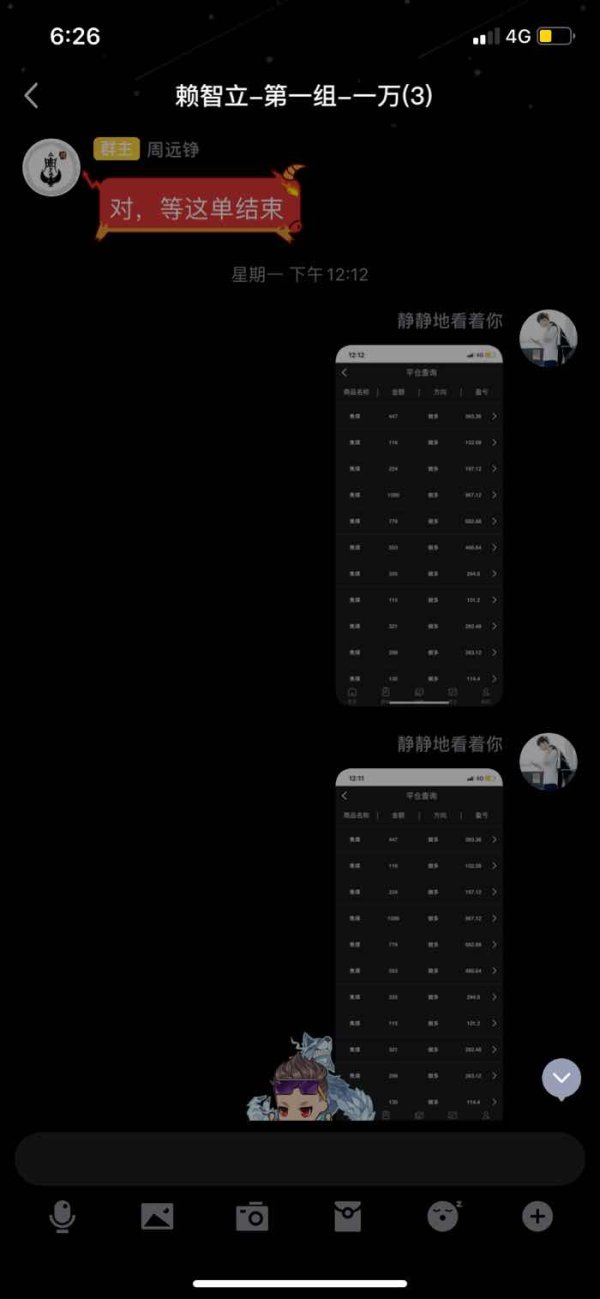

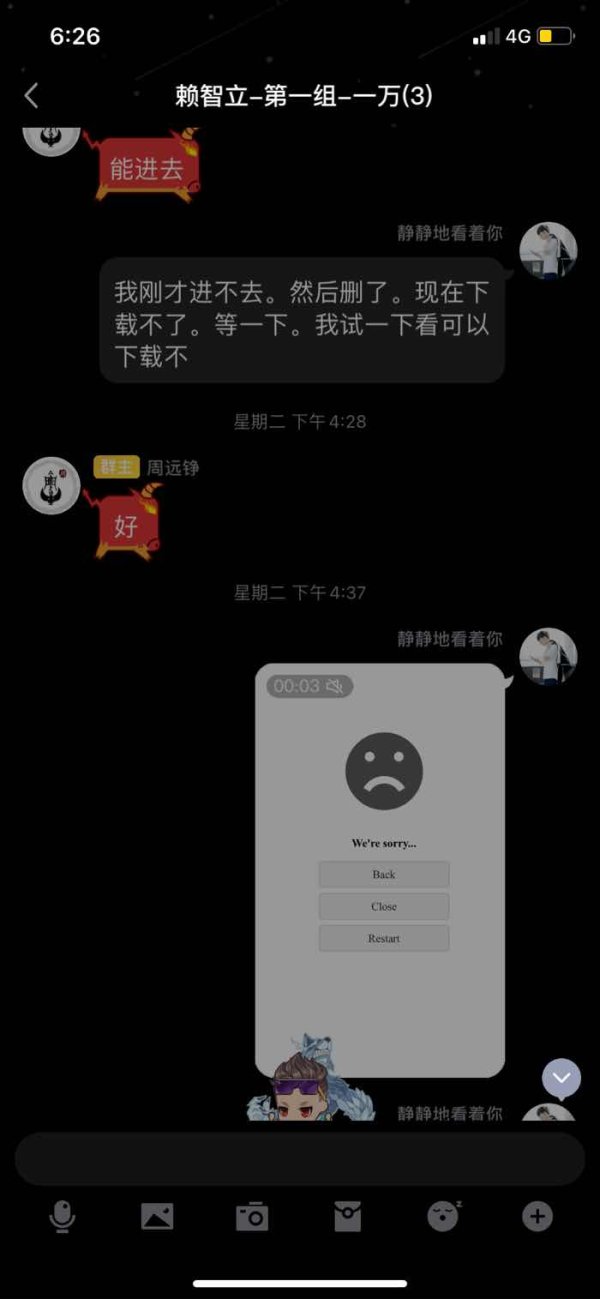

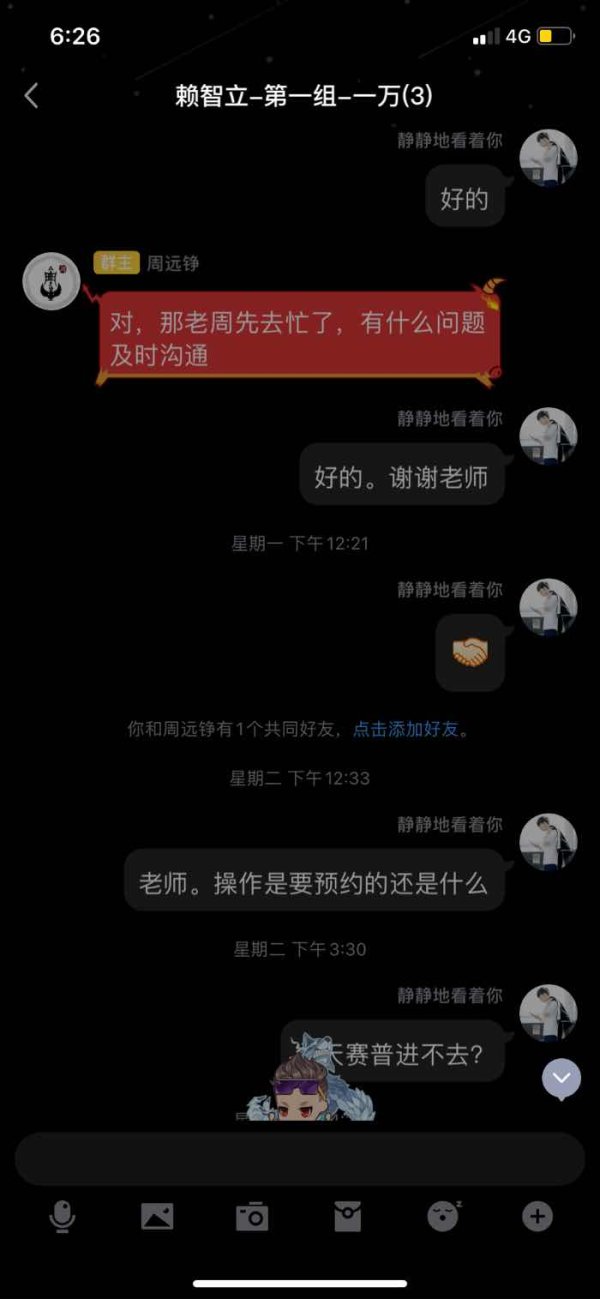

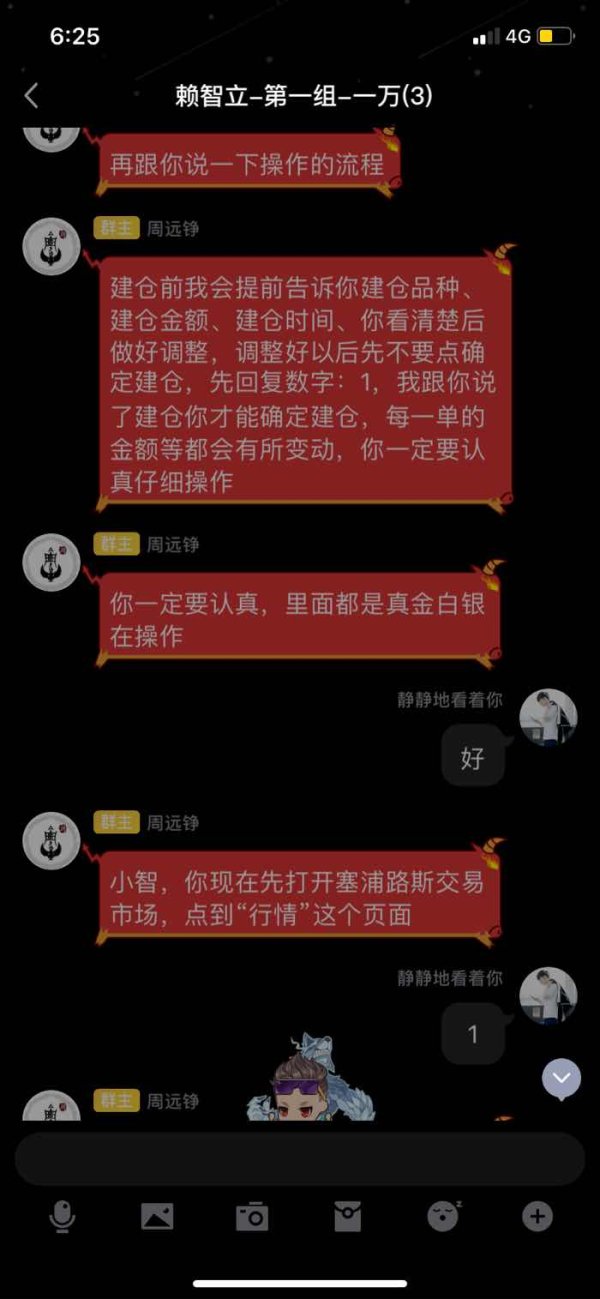

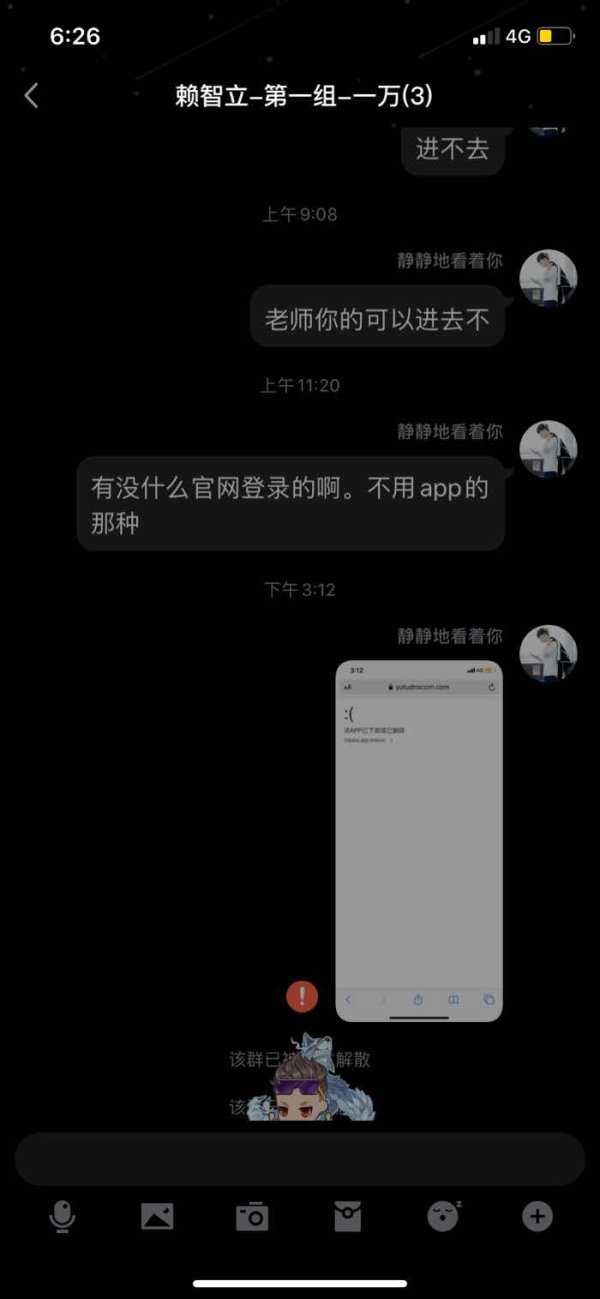

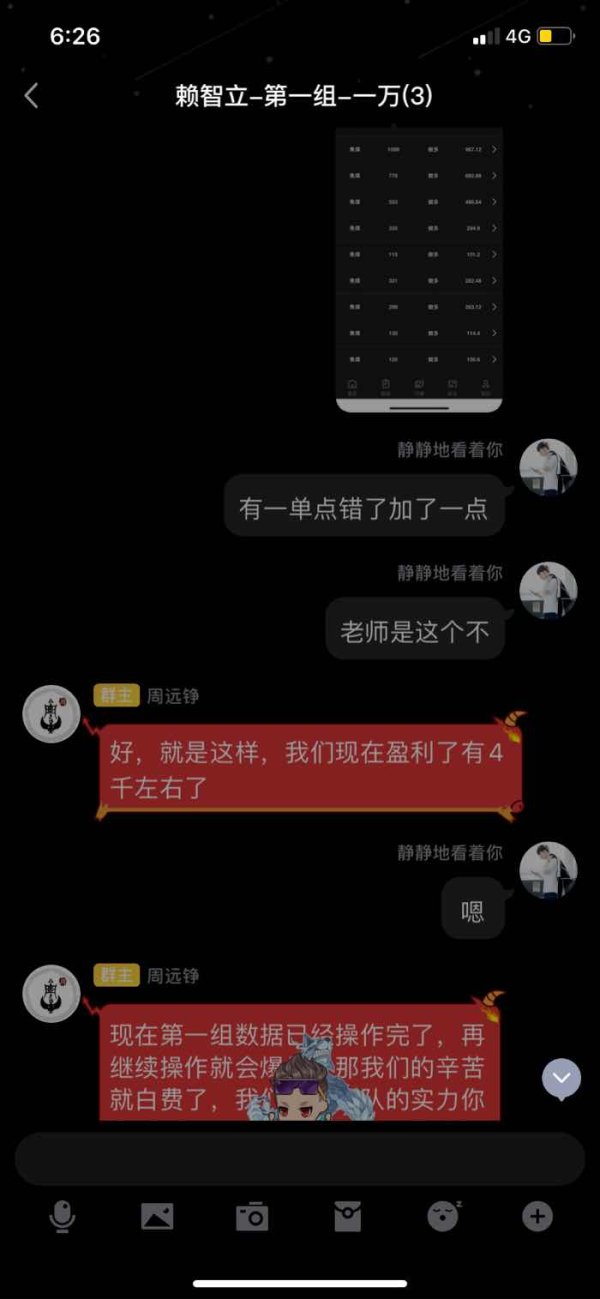

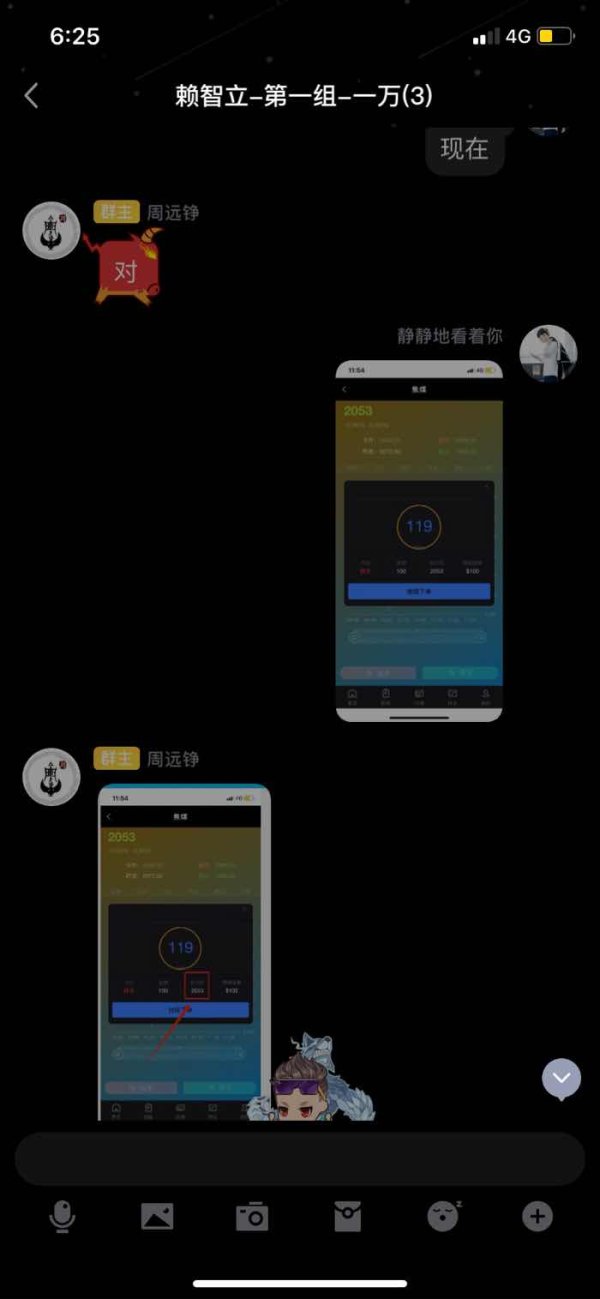

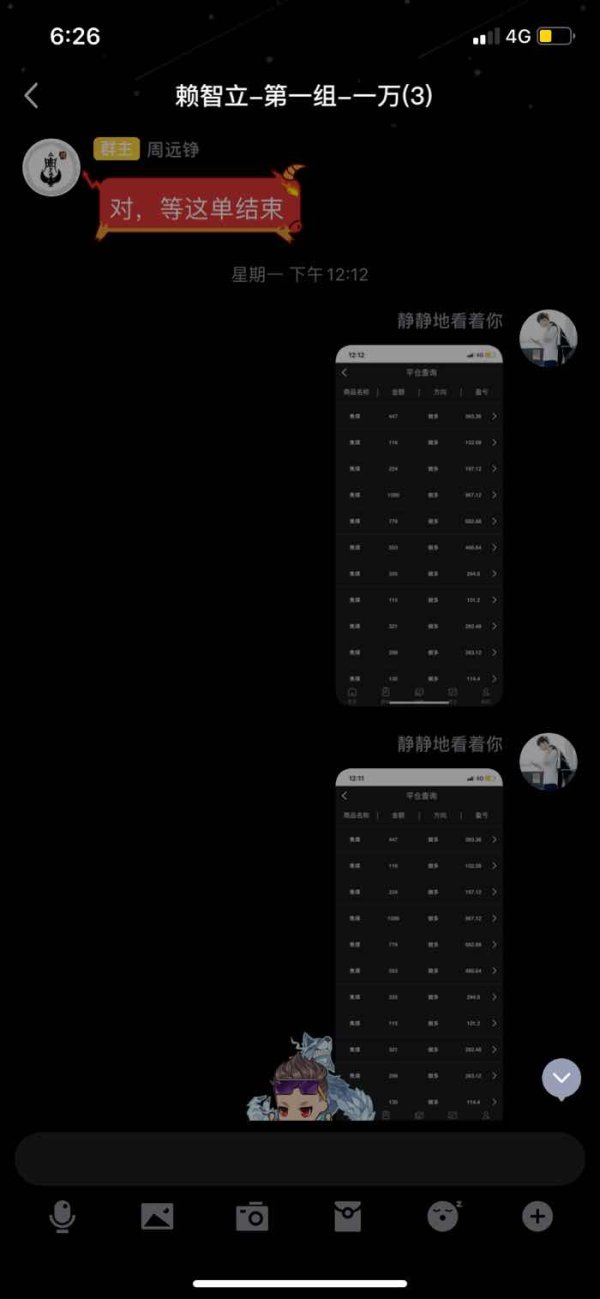

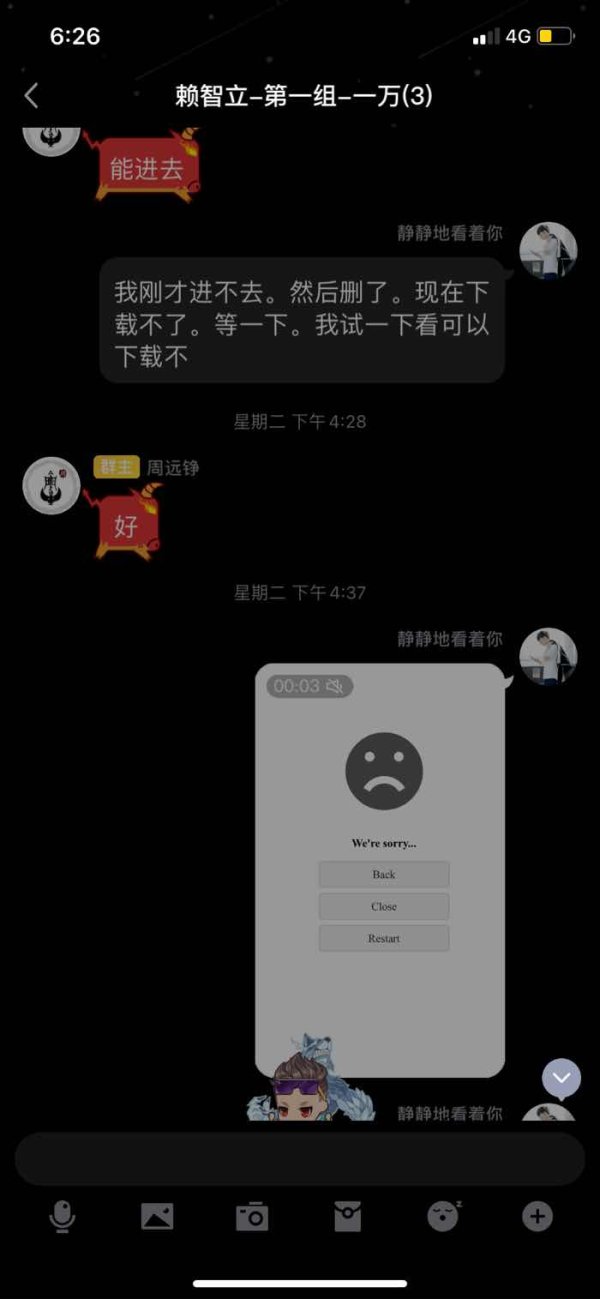

The trader leads the order. I can’t access the app for a day after I’ve deposited the money.

SphereX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The trader leads the order. I can’t access the app for a day after I’ve deposited the money.

This SphereX review gives you a complete look at the decentralized cryptocurrency exchange that has recently gained attention in the blockchain space. SphereX works as a pioneering decentralized exchange platform. It offers innovative features including offline matching capabilities and cross-margin trading functionality. The platform has secured significant investment from SNZ Holding. This shows institutional confidence in its business model.

Based on available information, SphereX receives a neutral overall assessment due to limited transparency regarding regulatory oversight and specific trading conditions. The platform shows promise with its high-performance trading infrastructure and innovative approach to decentralized finance. However, user ratings show mixed experiences. Employee reviews average 3.2 out of 5 stars based on limited feedback.

SphereX primarily targets cryptocurrency traders and users interested in decentralized finance solutions. The platform's focus on decentralization appeals to traders seeking alternatives to traditional centralized exchanges. However, potential users should carefully consider the limited regulatory information available before engaging with the platform.

This evaluation is based on automated analysis of multiple data sources available as of 2025. Information regarding cross-regional entity differences was not mentioned in available sources. Readers should verify regulatory compliance in their specific jurisdictions before trading.

The assessment methodology uses publicly available information, user feedback, and industry reports. However, specific regulatory information and detailed trading conditions were not fully detailed in source materials. This requires potential users to conduct additional due diligence.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Information not mentioned in available sources |

| Tools and Resources | 7/10 | High-performance trading platform with innovative features |

| Customer Service and Support | N/A | Information not mentioned in available sources |

| Trading Experience | 6/10 | User rating of 3.2/5, trading functionality present but limited details |

| Trust and Security | 6/10 | Positive trust indicators but lacking regulatory information |

| User Experience | 5/10 | Based on limited employee feedback, restricted user reviews |

SphereX emerged as a decentralized cryptocurrency exchange focusing on providing alternative trading solutions to traditional centralized platforms. According to available reports, the company recently secured major investment from SNZ Holding, a prominent backer in the blockchain space. This strengthens its financial position and development capabilities. The platform positions itself as a pioneering DEX solution. It emphasizes high-performance trading infrastructure and innovative technological features.

The exchange operates on a decentralized business model, offering users direct peer-to-peer trading capabilities without traditional intermediary oversight. SphereX integrates offline matching technology and cross-margin trading features. This distinguishes it from conventional cryptocurrency exchanges. The platform's focus on decentralization aligns with broader industry trends toward user-controlled financial services. However, this approach also presents unique considerations regarding regulatory oversight and user protection mechanisms.

This SphereX review indicates that while the platform demonstrates technological innovation and has attracted institutional investment, comprehensive information about its operational structure, regulatory compliance, and detailed service offerings remains limited in publicly available sources.

Regulatory Oversight: Available sources do not mention specific regulatory authorities overseeing SphereX operations. This represents a significant consideration for potential users requiring regulated trading environments.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes was not detailed in available sources. Users need to contact the platform directly for clarification.

Minimum Deposit Requirements: Source materials do not specify minimum deposit amounts or account funding thresholds.

Promotional Offers: Information regarding bonus programs or promotional incentives was not mentioned in available documentation.

Tradeable Assets: The platform primarily focuses on cryptocurrency trading. However, specific asset listings and supported trading pairs were not fully detailed in source materials.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not available in reviewed sources. This makes cost comparison challenging.

Leverage Options: Specific leverage ratios and margin trading terms were not mentioned in available information.

Platform Selection: SphereX operates as a decentralized trading platform with integrated offline matching capabilities.

Geographic Restrictions: Information about regional limitations or restricted jurisdictions was not specified in source materials.

Customer Support Languages: Available sources do not detail supported languages for customer service communications.

This SphereX review highlights the need for potential users to seek additional information directly from the platform regarding these operational details.

Available information does not provide specific details about SphereX account types, opening requirements, or account management features. The absence of comprehensive account condition information in source materials prevents thorough evaluation of this criterion. Potential users should directly contact SphereX to understand available account options, minimum balance requirements, and account-specific features.

The lack of detailed account information represents a transparency concern for traders used to comprehensive broker documentation. Traditional brokers typically provide extensive details about account tiers, benefits, and requirements. However, SphereX's decentralized nature may contribute to different information disclosure practices.

Without specific account condition data, this SphereX review cannot provide meaningful comparison with industry standards or competitor offerings. Users considering the platform should prioritize obtaining detailed account information before committing funds or beginning trading activities.

SphereX demonstrates strength in technological innovation, offering a high-performance trading platform with advanced features including offline matching and cross-margin trading capabilities. These innovative tools suggest significant technical development investment. They differentiate the platform from basic cryptocurrency exchanges.

The platform's focus on high-performance infrastructure indicates commitment to providing reliable trading execution. However, specific performance metrics and uptime statistics were not available in source materials. The integration of offline matching technology represents an advanced feature that could benefit active traders seeking improved order execution.

However, information about research resources, educational materials, and analytical tools was not mentioned in available sources. Traditional trading platforms typically provide market analysis, educational content, and research reports to support trader decision-making. SphereX's offerings in these areas remain unclear.

The technological capabilities suggest SphereX prioritizes platform performance and innovative features. This earns a positive assessment despite limited information about supporting resources and educational tools.

Source materials do not provide information about SphereX customer service channels, response times, or support quality metrics. The absence of customer service details represents a significant information gap for potential users who may require assistance with platform navigation, technical issues, or account management.

Traditional brokers typically offer multiple support channels including live chat, email, phone support, and comprehensive FAQ sections. The availability and quality of these services at SphereX remains unclear based on available information. This prevents meaningful evaluation of customer support capabilities.

User feedback regarding customer service experiences was not detailed in source materials. This eliminates the possibility of assessing support quality through user testimonials or reviews. The limited employee review data available does not specifically address customer service performance or responsiveness.

Without comprehensive customer service information, this evaluation cannot provide guidance on support expectations or service quality. This requires potential users to test support channels directly before relying on the platform for significant trading activities.

User ratings indicate mixed trading experiences, with available feedback showing a 3.2 out of 5 star rating based on limited employee reviews. This moderate rating suggests adequate but not exceptional trading conditions. However, the small sample size limits the reliability of this assessment.

The platform's high-performance infrastructure and innovative features suggest potential for positive trading experiences, particularly for users interested in decentralized trading capabilities. The offline matching technology and cross-margin trading features could enhance execution quality for sophisticated traders.

However, specific information about platform stability, execution speeds, order types, and mobile trading capabilities was not available in source materials. These factors significantly impact trading experience quality. They represent important considerations for active traders.

This SphereX review indicates that while technological capabilities suggest positive trading potential, limited user feedback and absent performance data prevent comprehensive trading experience evaluation. Users should consider testing the platform with small positions before committing significant trading capital.

SphereX demonstrates positive trust indicators through securing investment from SNZ Holding, a prominent blockchain industry backer. This institutional support suggests professional evaluation of the platform's business model and technical capabilities. It provides some confidence in the project's legitimacy and development potential.

However, the absence of specific regulatory oversight information raises questions about user protection mechanisms and compliance frameworks. Traditional regulated brokers offer established dispute resolution processes and regulatory protections that may not be available through decentralized platforms.

The decentralized nature of SphereX operations presents both advantages and considerations regarding security. While decentralization can reduce counterparty risk associated with centralized exchanges, it may also limit recourse options for users experiencing technical issues or disputes.

Available sources indicate positive trust scoring, though specific security measures, fund protection protocols, and operational transparency details were not fully documented. Users should carefully evaluate their risk tolerance regarding regulatory oversight and protection mechanisms when considering decentralized trading platforms.

Limited user feedback based on employee reviews averaging 3.2 out of 5 stars suggests moderate user satisfaction levels. However, the small sample size restricts the reliability of this assessment. The availability of only employee reviews rather than comprehensive user testimonials limits insight into actual trading experience quality.

Interface design, ease of use, and platform navigation details were not mentioned in available sources. This prevents evaluation of user experience factors that significantly impact trader satisfaction. Modern trading platforms typically prioritize intuitive design and user-friendly interfaces. However, SphereX's approach to these elements remains unclear.

Registration and verification processes, which significantly impact initial user experience, were not detailed in source materials. The decentralized nature of the platform may result in different onboarding procedures compared to traditional regulated brokers.

The target user base appears to focus on cryptocurrency traders and decentralized finance enthusiasts. This suggests the platform may prioritize functionality over accessibility for traditional retail traders. Users should consider their technical expertise and familiarity with decentralized platforms when evaluating SphereX suitability for their trading needs.

This comprehensive SphereX review reveals a platform with innovative technological capabilities and institutional backing, but limited transparency regarding operational details and regulatory oversight. The exchange demonstrates strength in high-performance infrastructure and advanced features like offline matching and cross-margin trading. This appeals to sophisticated cryptocurrency traders interested in decentralized finance solutions.

SphereX appears most suitable for experienced cryptocurrency traders comfortable with decentralized platforms and willing to accept reduced regulatory oversight in exchange for innovative trading features. The platform's institutional investment from SNZ Holding provides positive credibility indicators. However, limited user feedback prevents comprehensive experience assessment.

The main advantages include technological innovation, institutional backing, and decentralized trading capabilities, while disadvantages include limited regulatory information, absent detailed trading conditions, and restricted user feedback availability. Potential users should conduct thorough due diligence and consider starting with small positions while evaluating platform suitability for their trading requirements.

FX Broker Capital Trading Markets Review