Is Bellon Capital safe?

Business

License

Is Bellon Capital Safe or Scam?

Introduction

Bellon Capital is a forex broker that has garnered attention in the trading community for its offerings and market positioning. As a relatively new player in the forex market, it is crucial for potential traders to carefully evaluate the trustworthiness and legitimacy of Bellon Capital before committing their funds. The forex market is rife with opportunities, but it also harbors risks, particularly from unregulated or poorly regulated brokers. This article aims to provide a comprehensive analysis of Bellon Capital, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation draws on various online sources to present a balanced view of whether Bellon Capital is safe for trading or if it raises red flags for potential scams.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. Regulatory bodies oversee brokers to ensure they adhere to strict standards, protecting traders from fraud and malpractice. In the case of Bellon Capital, it is essential to assess its regulatory framework and compliance history.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Bellon Capital operates without any regulatory oversight from recognized authorities such as the FCA (UK), ASIC (Australia), or SEC (USA). This lack of regulation is a significant concern, as it means that traders have no formal recourse in the event of disputes or financial losses. The absence of a regulatory framework raises questions about the broker's legitimacy and operational practices. Furthermore, there have been reports of complaints from users regarding difficulties in withdrawing funds, which is often a hallmark of unregulated brokers. Therefore, it is crucial to exercise caution when considering whether Bellon Capital is safe for your trading activities.

Company Background Investigation

Understanding the companys background can provide insights into its reliability and operational practices. Bellon Capital appears to have a limited online presence, which is unusual for a forex broker of its nature. Information regarding its ownership structure, management team, and historical background is sparse. This lack of transparency can be a red flag for potential investors.

The management teams experience and expertise in the financial sector are critical for ensuring that the broker operates efficiently and ethically. However, due to the limited information available, it is challenging to gauge the qualifications of the individuals behind Bellon Capital. A reputable broker typically provides detailed information about its founders and key personnel, including their professional backgrounds and qualifications.

Moreover, the companys transparency regarding its operational practices and financial disclosures is lacking. Traders should be wary of brokers that do not openly share information about their business model, funding sources, and operational history. In this context, the question of whether Bellon Capital is safe becomes increasingly pertinent, as the absence of credible information can indicate potential issues.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Bellon Capital claims to provide competitive trading conditions, but a closer examination reveals potential concerns regarding fees and costs.

| Fee Type | Bellon Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.5 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | Variable | Variable |

The spreads offered by Bellon Capital are higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about hidden fees that may not be disclosed upfront. Traders should be cautious of brokers that do not provide transparent information about their fee structures, as this can lead to unexpected costs and diminished returns.

Furthermore, the lack of clarity regarding overnight interest rates and other potential charges can create confusion for traders. It is essential to fully understand the costs associated with trading before opening an account. In light of these factors, one must question if Bellon Capital is safe for traders looking for a transparent and cost-effective trading environment.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. A reliable broker should implement robust measures to protect clients' capital, including segregated accounts, investor protection schemes, and negative balance protection policies.

Unfortunately, there is little information available regarding Bellon Capital's safety measures for client funds. The absence of regulatory oversight suggests that the broker may not be required to adhere to strict capital protection regulations. This lack of security raises significant concerns about the safety of funds deposited with Bellon Capital.

Traders should inquire about the measures in place to protect their investments and ensure that their funds are kept in segregated accounts. The absence of such measures can expose traders to substantial risk, particularly in the event of financial difficulties faced by the broker. Given these considerations, it is crucial to assess whether Bellon Capital is safe in terms of safeguarding client funds.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews and testimonials can provide insights into the experiences of other traders and highlight any recurring issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

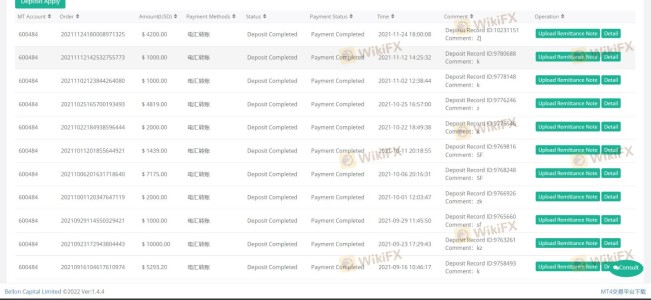

Numerous complaints have surfaced regarding Bellon Capital, with many users reporting difficulties withdrawing their funds. This issue is particularly alarming, as it often indicates deeper problems within the broker's operational structure. Additionally, the quality of customer support has received mixed reviews, with some users expressing frustration over delayed responses and inadequate assistance.

Two notable cases involve traders who claimed they were unable to withdraw their funds despite repeated requests. In both instances, the traders reported a lack of communication from the broker, leading to increased frustration and concern about the safety of their investments. These types of complaints warrant serious consideration when evaluating whether Bellon Capital is safe for potential clients.

Platform and Execution

The trading platform's performance and order execution quality are critical factors in a trader's overall experience. A reliable platform should offer stability, fast execution speeds, and minimal slippage.

Bellon Capital claims to provide access to popular trading platforms, but there have been reports of execution issues, including delayed order fills and high slippage. Such problems can significantly impact trading outcomes, particularly for those employing scalping or high-frequency trading strategies.

Additionally, any signs of platform manipulation, such as sudden price spikes or unexplainable order rejections, should raise red flags. Traders must ensure that the platform they choose is reliable and offers a fair trading environment. Given the reported issues, it is crucial to question whether Bellon Capital is safe in terms of platform reliability and execution quality.

Risk Assessment

Trading with any broker involves inherent risks, and it is vital to assess these risks comprehensively.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Stability | Medium | Lack of transparency regarding financial practices. |

| Customer Support Risk | High | Reports of poor customer support and withdrawal issues. |

The overall risk of trading with Bellon Capital is elevated due to its unregulated status and the numerous complaints regarding fund withdrawals and customer service. Traders should be cautious and consider the potential for significant financial loss. To mitigate risks, it is advisable to conduct thorough research and potentially seek alternatives with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bellon Capital may not be a safe option for traders. The lack of regulation, combined with numerous complaints regarding fund withdrawals and customer service, raises serious concerns about the broker's legitimacy.

For traders seeking a secure trading environment, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as Interactive Brokers, OANDA, or Forex.com are examples of well-regulated options that offer a higher level of safety for traders.

Ultimately, potential clients should exercise extreme caution and conduct thorough due diligence before engaging with Bellon Capital or any similar unregulated brokers. The risks associated with trading in a potentially unsafe environment are significant, and it is crucial to prioritize safety and security in the forex market.

Is Bellon Capital a scam, or is it legit?

The latest exposure and evaluation content of Bellon Capital brokers.

Bellon Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bellon Capital latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.