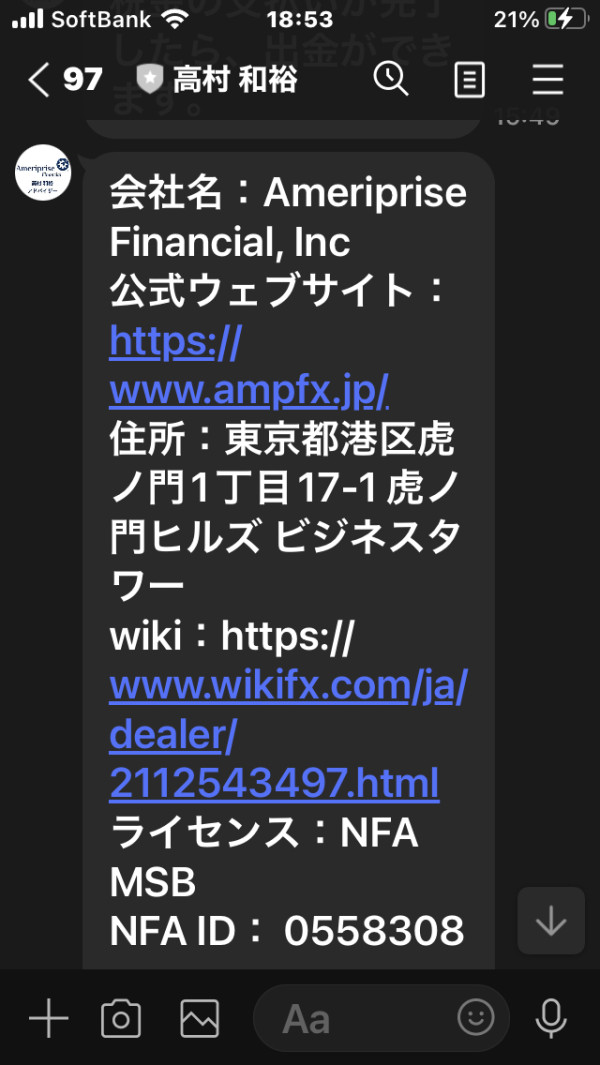

Ameriprise Financial 2025 Review: Everything You Need to Know

Executive Summary

Ameriprise Financial is a strong brokerage firm. The company has an amazing 130-year history and focuses on tax efficiency and cost management for investors. John Tappan founded the company in 1894 as Investors Syndicate. This Fortune 500 company has grown into the second-largest independent brokerage and financial advisory firm in the United States. The firm shows strong customer satisfaction levels with an A+ rating for complaint resolution. However, it keeps a moderate user rating of 3 out of 5.

Ameriprise Financial offers many investment services. These include stocks, bonds, mutual funds, ETFs, unit investment trusts, structured notes, options, and various alternative investments. The platform works especially well at providing diverse investment products with a focus on tax-efficient strategies. This ameriprise financial review shows that the firm works well for investors seeking complete financial advisory services and those who put tax management first in their investment approach. However, the platform may not be the best choice for beginner investors looking for user-friendly interfaces with low fees.

Important Notice

This review focuses mainly on Ameriprise Financial's operations within the United States market. International users should know that the firm's services and rules are mostly designed for US-based clients, with different regional requirements possibly applying outside this area. The company operates under strict US rules from the Securities and Exchange Commission and the Financial Industry Regulatory Authority.

This assessment uses publicly available information, customer feedback, and industry reports available as of 2025. The review aims to provide an honest evaluation of Ameriprise Financial's services, though individual experiences may vary based on specific client needs and situations.

Rating Framework

Broker Overview

Company Foundation and Background

Ameriprise Financial started in 1894 when John Tappan created Investors Syndicate with a small beginning of 1,000 investors contributing $5 each. Over more than a century, the company has changed into a financial powerhouse, earning its position as the second-largest independent broker-dealer in the United States. As a Fortune 500 company, Ameriprise Financial has built its reputation on providing complete financial advisory services with a special focus on tax efficiency and smart cost management.

The firm operates as both an independent broker-dealer and one of the largest registered investment advisors in the country. This dual ability allows Ameriprise to offer a broad range of financial services while keeping the flexibility to provide personalized investment strategies tailored to individual client needs.

Service Portfolio and Regulatory Framework

Ameriprise Financial's investment platform includes an extensive range of asset classes designed to meet diverse investor requirements. The firm provides access to stocks, bonds, mutual funds, exchange-traded funds, unit investment trusts, structured notes, options, and various alternative investment vehicles. This complete approach positions the firm as a one-stop solution for investors seeking portfolio diversification.

Operating under the strict oversight of the Securities and Exchange Commission and the Financial Industry Regulatory Authority, Ameriprise Financial maintains high standards of compliance and investor protection. This ameriprise financial review confirms that the firm's regulatory standing provides clients with confidence in the security and legitimacy of their investment activities.

Regulatory Jurisdiction: Ameriprise Financial operates under complete US regulatory oversight, with primary supervision from the SEC and FINRA, ensuring compliance with federal securities laws and industry standards.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal mechanisms is not detailed in available source materials. However, standard industry practices typically apply.

Minimum Deposit Requirements: Current information sources do not specify minimum deposit thresholds for various account types offered by the firm.

Promotional Offers: Details regarding current bonus promotions or special offers are not available in the reviewed materials.

Tradeable Assets: The platform provides extensive access to stocks, bonds, mutual funds, ETFs, UITs, structured notes, options, and alternative investments. This offers complete market exposure.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in available source materials. However, investment fee concerns have been noted in user feedback.

Leverage Ratios: Leverage specifications are not provided in current information sources.

Platform Options: Detailed platform specifications and trading software options are not elaborated in available materials.

Geographic Restrictions: Specific regional limitations are not detailed in source materials. However, the firm primarily serves US-based clients.

Customer Service Languages: Language support details are not specified in available information sources.

This ameriprise financial review indicates that while the firm offers complete investment services, specific operational details require direct consultation with the company for complete information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Ameriprise Financial's account conditions faces limitations due to insufficient specific information in available source materials. Traditional brokerage account structures typically include various account types such as individual, joint, retirement, and corporate accounts. However, the firm's specific offerings, features, and requirements are not detailed in current information sources.

Minimum deposit requirements, which significantly impact accessibility for new investors, are not specified in available materials. This lack of transparency regarding entry-level investment thresholds may present challenges for potential clients attempting to assess their eligibility for services. The account opening process, verification requirements, and timeline for account activation similarly lack detailed documentation in reviewed sources.

User feedback indicates some concerns regarding investment fees. This suggests that account-related costs may be a consideration for potential clients. However, without specific fee structures or account maintenance charges, it becomes difficult to provide a complete assessment of the value proposition offered by different account types.

The absence of detailed account condition information in this ameriprise financial review highlights the importance of direct consultation with Ameriprise Financial representatives. Potential clients should understand specific account features, requirements, and associated costs before making investment decisions.

The assessment of Ameriprise Financial's tools and resources encounters significant limitations due to the lack of detailed information in available source materials. Modern investment platforms typically provide complete research tools, market analysis resources, educational materials, and portfolio management utilities. However, specific details about Ameriprise's technological offerings are not elaborated in current sources.

Research and analysis capabilities form crucial components of any serious investment platform. These enable clients to make informed decisions based on market data, fundamental analysis, and technical indicators. However, the specific nature, quality, and completeness of Ameriprise Financial's research resources remain unspecified in available materials.

Educational resources play a vital role in investor development. This is particularly true for clients seeking to enhance their market knowledge and investment skills. The availability, format, and quality of educational content provided by Ameriprise Financial are not detailed in reviewed sources. This makes it challenging to assess the firm's commitment to client education and development.

Automated trading support and advanced order types represent important features for sophisticated investors. However, information regarding these capabilities is not available in current source materials. The absence of detailed tool and resource information suggests the need for direct inquiry with the firm to understand the full scope of available trading and analysis utilities.

Customer Service and Support Analysis

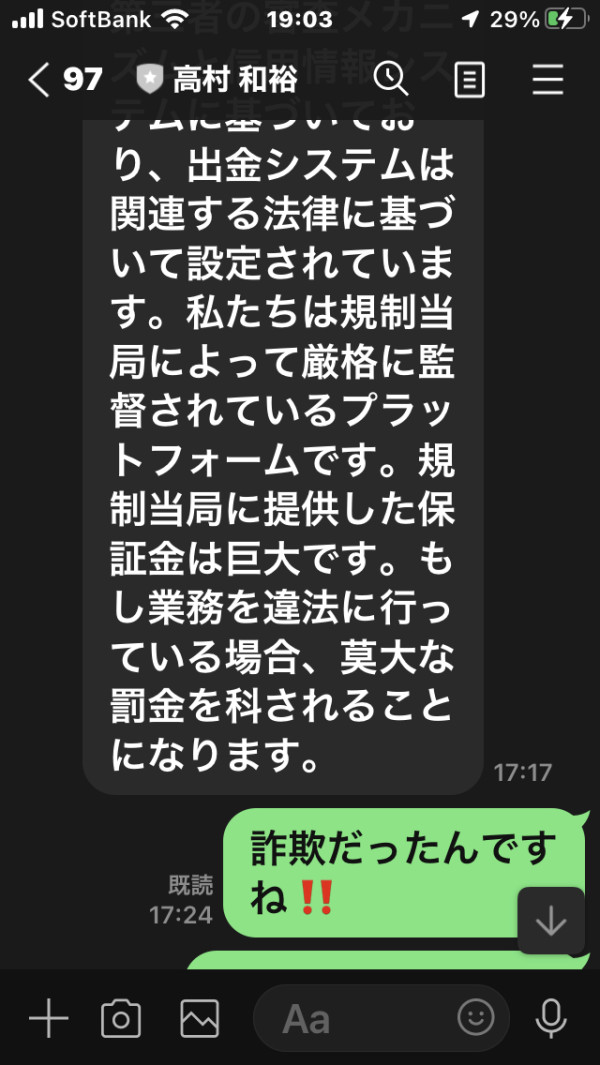

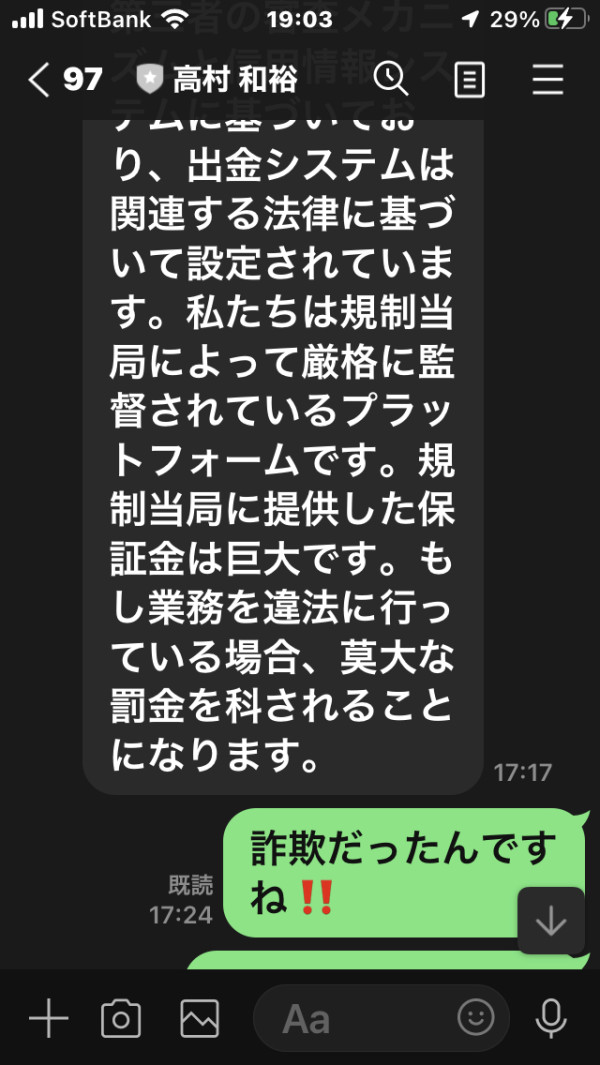

Ameriprise Financial demonstrates strong performance in customer service and support. This is evidenced by its A+ rating for complaint resolution from the Better Business Bureau. This exceptional rating indicates the firm's commitment to addressing client concerns effectively and maintaining high standards of customer satisfaction. The company's approach to customer service reflects its long-standing reputation and dedication to client relationships.

Customer satisfaction levels appear generally positive. However, specific metrics regarding response times, service quality consistency, and customer retention rates are not detailed in available source materials. The firm's 130-year operational history suggests a deep understanding of client needs and the importance of maintaining strong customer relationships in the competitive financial services industry.

The availability of multiple customer service channels would typically be expected from a firm of Ameriprise's stature. These include phone support, online assistance, and in-person consultations, though specific details about service accessibility and hours of operation are not provided in reviewed sources. Multi-language support capabilities and specialized assistance for different client segments also remain unspecified.

Problem resolution capabilities appear robust based on the A+ complaint resolution rating. This suggests that Ameriprise Financial has established effective processes for addressing client issues and maintaining customer satisfaction. This strong performance in complaint handling represents a significant positive factor for potential clients considering the firm's services.

Trading Experience Analysis

The evaluation of Ameriprise Financial's trading experience faces significant challenges due to limited specific information in available source materials. Modern trading platforms typically emphasize execution speed, platform stability, order accuracy, and user interface design. However, detailed assessments of these critical factors are not available for Ameriprise's trading environment.

Platform stability and execution speed represent fundamental requirements for effective trading. This is particularly true in volatile market conditions where timing can significantly impact investment outcomes. However, specific performance metrics, uptime statistics, and execution quality data are not provided in current source materials. This makes it difficult to assess the technical reliability of Ameriprise's trading infrastructure.

Order execution quality plays a crucial role in overall trading performance. This includes fill rates, slippage management, and price improvement capabilities. The absence of detailed execution statistics and client feedback regarding trading performance limits the ability to provide complete assessment of the firm's trading capabilities.

Mobile trading functionality has become increasingly important for modern investors who require access to their accounts and trading capabilities while away from desktop platforms. Specific information about mobile app features, functionality, and user experience is not available in reviewed sources. However, such capabilities would be expected from a major financial services firm.

The lack of detailed trading experience information in available materials suggests that potential clients should conduct thorough platform demonstrations. They should also discuss specific trading requirements directly with Ameriprise Financial representatives before committing to their services.

Trust and Reliability Analysis

Ameriprise Financial demonstrates strong credentials in trust and reliability. These are supported by complete regulatory oversight and a well-established industry presence. The firm operates under the supervision of both the Securities and Exchange Commission and the Financial Industry Regulatory Authority. This provides clients with robust regulatory protection and compliance assurance.

As a Fortune 500 company with 130 years of operational history, Ameriprise Financial has demonstrated remarkable longevity and stability in the financial services sector. This extensive track record provides evidence of the firm's ability to navigate various market cycles, regulatory changes, and economic challenges while maintaining operational continuity and client service standards.

The Better Business Bureau's A+ rating for complaint resolution further reinforces the firm's commitment to maintaining high standards of business conduct and client satisfaction. This rating reflects the company's effective processes for addressing client concerns and maintaining transparent business practices.

Industry reputation and peer recognition contribute significantly to the firm's trustworthiness profile. As the second-largest independent brokerage and financial advisory firm in the United States, Ameriprise Financial has achieved recognition for its market position and service capabilities within the competitive financial services landscape.

While specific information about client fund protection measures, insurance coverage, and cybersecurity protocols is not detailed in available sources, the firm's regulatory status and industry standing suggest adherence to standard industry practices for client asset protection and data security.

User Experience Analysis

User experience assessment for Ameriprise Financial reveals a mixed picture. The firm receives a moderate rating of 3 out of 5 from users, indicating room for improvement in overall client satisfaction. This rating suggests that while the firm provides adequate service, there are aspects of the user experience that could benefit from enhancement.

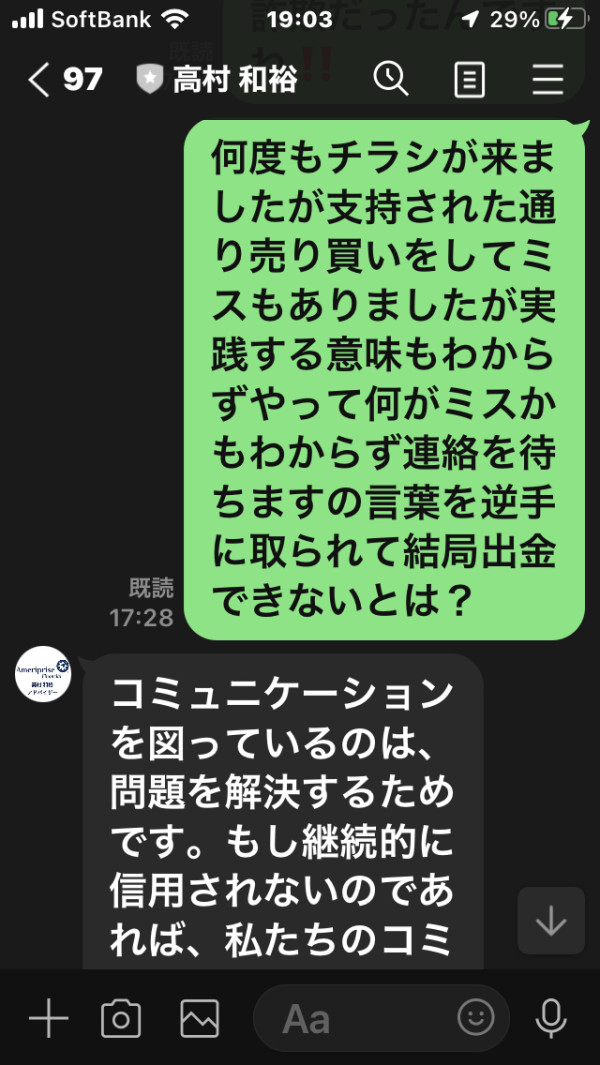

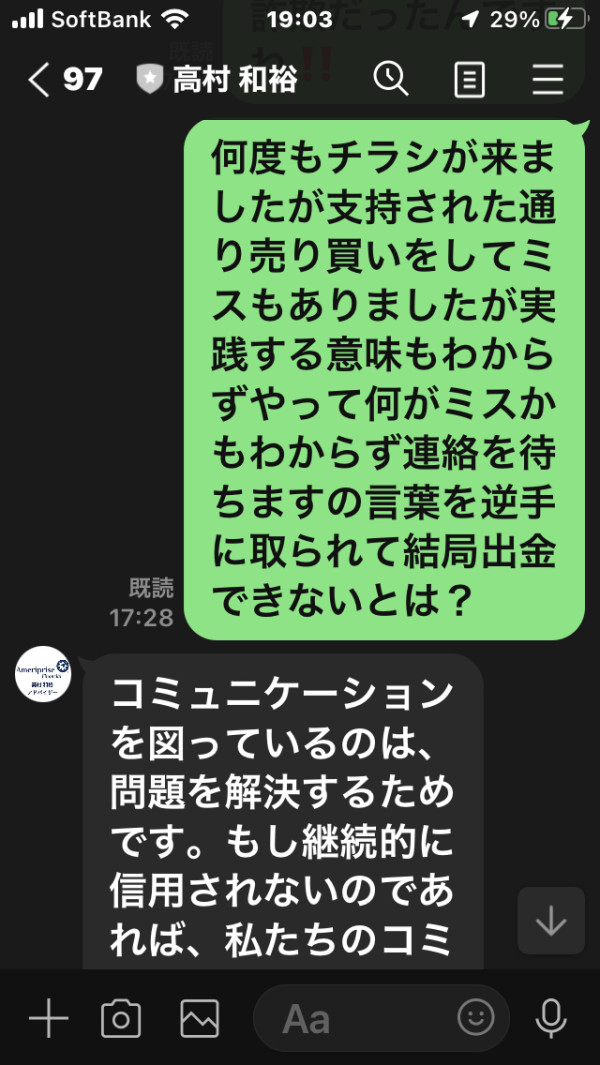

Investment fee concerns represent a primary area of user complaints. This indicates potential issues with fee transparency, cost competitiveness, or client communication regarding charges. These concerns suggest that prospective clients should carefully review and understand all associated costs before engaging with the firm's services.

The firm's focus on tax efficiency and cost management appeals particularly to investors who prioritize strategic financial planning and long-term wealth preservation. This positioning makes Ameriprise Financial especially suitable for clients seeking complete financial advisory services rather than basic self-directed trading platforms.

User interface design and platform usability details are not specified in available source materials. However, the firm's positioning suggests a focus on complete service delivery rather than simplified trading interfaces. This approach may better serve sophisticated investors who value advisory support over streamlined self-service platforms.

The registration and account verification processes, while not detailed in available sources, would typically reflect the firm's complete approach to client onboarding and regulatory compliance. However, specific information about process efficiency and user-friendliness is not available for assessment.

Conclusion

This complete ameriprise financial review reveals a well-established financial services firm with significant strengths in regulatory compliance, customer service, and investment product diversity. Ameriprise Financial's 130-year history and Fortune 500 status provide strong foundations for client confidence. The A+ complaint resolution rating demonstrates commitment to customer satisfaction.

The firm appears ideally suited for investors seeking complete financial advisory services with emphasis on tax efficiency and strategic cost management. Sophisticated investors who value professional guidance and diverse investment options will likely find Ameriprise Financial's offerings aligned with their needs. However, the platform may be less suitable for beginner investors or those prioritizing low-cost, self-directed trading platforms.

Primary advantages include strong regulatory oversight, extensive operational history, excellent complaint resolution, and complete investment product access. Key limitations involve limited transparency regarding specific account conditions, fee structures, and trading platform details, along with moderate user satisfaction ratings and investment fee concerns. Prospective clients should conduct thorough due diligence and direct consultation with firm representatives to fully understand service offerings and associated costs.