Is Fod Fx Ltd safe?

Business

License

Is Fod FX Ltd Safe or a Scam?

Introduction

Fod FX Ltd is a relatively new player in the forex trading market, having been established in June 2023. As a broker, it claims to provide a range of trading services, including access to various financial instruments like forex pairs and cryptocurrencies. However, the emergence of numerous unregulated brokers in the forex market has led to increased skepticism among traders. It is crucial for potential investors to conduct thorough evaluations of brokerage firms before committing their funds. This article aims to analyze the safety and legitimacy of Fod FX Ltd, utilizing a combination of regulatory assessments, company background investigations, and user reviews to provide a comprehensive overview.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical indicators of its legitimacy. Brokers that are regulated by recognized financial authorities are generally considered safer for traders. In the case of Fod FX Ltd, it operates without any regulatory oversight, which raises significant concerns about its reliability and accountability. Below is a summary of the core regulatory information related to Fod FX Ltd:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Fod FX Ltd does not adhere to established financial standards that protect traders. Without a governing body overseeing its operations, the broker is not bound to uphold any ethical or financial practices, which can lead to potential exploitation of clients. This lack of oversight is a major red flag and suggests that traders should approach Fod FX Ltd with caution. The historical compliance of regulated firms often provides a safety net for traders; however, Fod FX Ltd's unregulated status means it lacks this essential layer of protection.

Company Background Investigation

Fod FX Ltd presents itself as a legitimate trading platform, but the details surrounding its history and ownership structure are limited. The company claims to operate from the United Kingdom and the United States, but its lack of transparency regarding its management team and ownership raises questions about its credibility. A broker's management team plays a vital role in its operations, and a lack of information can lead to skepticism.

The company's website offers minimal information about its founders, executives, or any professional experience in the financial sector. This lack of transparency can deter potential clients who seek assurance regarding the broker's legitimacy. Moreover, the short lifespan of the company, having been registered only six months ago, contributes to concerns regarding its stability and long-term viability in the competitive forex market.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value to traders. Fod FX Ltd claims to provide competitive trading fees; however, the absence of detailed information on its fee structure can be alarming. Below is a comparative overview of the core trading costs associated with Fod FX Ltd:

| Fee Type | Fod FX Ltd | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information on spreads, commissions, and overnight interest rates suggests that Fod FX Ltd may employ hidden fees or unfavorable trading conditions that could impact traders' profitability. Such opacity can lead to unexpected costs, making it difficult for traders to plan their investments effectively. Therefore, it is crucial for traders to seek brokers with transparent fee structures to avoid potential pitfalls.

Client Fund Security

The security of client funds is paramount in the forex trading industry. A trustworthy broker should have measures in place to protect traders' investments. Unfortunately, Fod FX Ltd has not provided sufficient information regarding its fund security protocols. Key aspects to consider include fund segregation, investor protection, and negative balance protection policies.

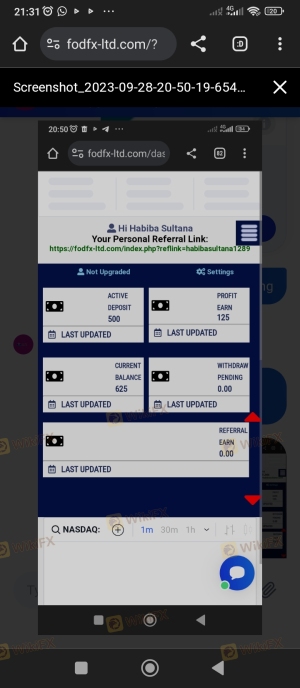

Without regulatory oversight, Fod FX Ltd may not be required to segregate client funds from its operational capital, which poses a risk in the event of financial instability. Additionally, the lack of information about investor protection mechanisms raises concerns about how traders would be compensated in case of a broker failure. Historical issues regarding fund security, such as blocked accounts and withdrawal difficulties, have been reported by former clients, further underscoring the risks associated with trading through Fod FX Ltd.

Customer Experience and Complaints

Analyzing customer feedback is critical for assessing a broker's reliability. Reviews and complaints from users can provide insights into the broker's operational integrity and customer service quality. Fod FX Ltd has garnered numerous negative reviews, particularly concerning withdrawal issues and poor customer support.

Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blockages | High | Poor |

| Lack of Customer Support | Medium | Poor |

For instance, some clients have reported that their accounts were blocked without explanation, and their withdrawal requests went unanswered for extended periods. Such patterns indicate a troubling trend that could signify deeper issues within the company's operational practices.

Platform and Execution

The trading platform's performance is crucial for traders, as it directly impacts their trading experience. Fod FX Ltd claims to offer a user-friendly trading interface; however, the lack of detailed information about the platform's functionality raises concerns. Traders should be wary of platforms that do not provide clear information about order execution quality, slippage, or rejection rates.

Without transparency regarding these critical aspects, traders may face unexpected challenges that can affect their trading outcomes. Signs of potential platform manipulation, such as frequent execution delays or unexplained slippage, can further exacerbate concerns about the broker's integrity.

Risk Assessment

Using an unregulated broker like Fod FX Ltd entails inherent risks that traders must consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Fund Security Risk | High | Lack of information on fund segregation and protection policies. |

| Customer Service Risk | Medium | Numerous complaints about withdrawal issues and support quality. |

| Platform Risk | Medium | Lack of transparency regarding execution quality. |

To mitigate these risks, traders should conduct thorough research on any broker before investing and consider using regulated alternatives that provide better protections and transparency.

Conclusion and Recommendations

In conclusion, based on the gathered evidence, it is clear that Fod FX Ltd raises multiple red flags that suggest it may not be a safe trading environment. The absence of regulatory oversight, coupled with numerous complaints regarding fund security and customer service, indicates that potential clients should exercise extreme caution.

For traders seeking a reliable and trustworthy brokerage experience, it is advisable to consider regulated alternatives that offer greater transparency, customer protection, and robust trading conditions. By prioritizing safety and conducting thorough due diligence, traders can minimize their risks and enhance their chances of success in the forex market.

In summary, is Fod FX Ltd safe? The evidence suggests otherwise, and traders are recommended to explore more reputable options in the forex trading landscape.

Is Fod Fx Ltd a scam, or is it legit?

The latest exposure and evaluation content of Fod Fx Ltd brokers.

Fod Fx Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fod Fx Ltd latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.