Regarding the legitimacy of Triumph FX forex brokers, it provides FSA and WikiBit, .

Is Triumph FX safe?

Pros

Cons

Is Triumph FX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Triumph Int. (SC) Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

info@tfxi.sc, info@tfxi.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.tfxi.sc, http://www.tfxi.comExpiration Time:

--Address of Licensed Institution:

5, Block B, Global Village, Jivan's Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

4322001Licensed Institution Certified Documents:

Is Triumph FX A Scam?

Introduction

Triumph FX is an international forex brokerage that has been operational since 2009, primarily based in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker aims to provide a platform for both novice and experienced traders to engage in foreign exchange trading, offering various account types and trading instruments. However, with the proliferation of forex trading platforms, traders must exercise caution when selecting a broker, as the risk of scams and fraudulent activities is prevalent in the industry. This article aims to objectively assess whether Triumph FX is a scam or a safe broker by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk factors.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for ensuring that it adheres to industry standards and protects client interests. Triumph FX is regulated by multiple authorities, which adds a layer of credibility to its operations. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 293/16 | Cyprus | Active |

| FSC | 17901 | Vanuatu | Revoked |

| FSA | SD 080 | Seychelles | Active |

CySEC is known for its stringent regulatory standards, requiring brokers to maintain segregated client accounts and adhere to the European Markets in Financial Instruments Directive (MiFID). This regulation is designed to protect clients' funds and ensure market integrity. However, it is important to note that Triumph FX has faced regulatory scrutiny in the past, including the revocation of its license by the Vanuatu Financial Services Commission (FSC). This history raises questions about the broker's compliance and operational integrity. While Triumph FX is currently regulated by CySEC, the concerns surrounding its offshore operations and the previous loss of its Vanuatu license warrant caution among potential clients. Therefore, when asking, "Is Triumph FX safe?" it is essential to consider both its current regulatory status and its historical compliance issues.

Company Background Investigation

Triumph FX was founded in 2009 and has since developed a multi-faceted business model aimed at democratizing forex trading. The company operates under the umbrella of Triumph International Limited, which has expanded its reach to various regions, including Europe and Asia. The ownership structure appears to be straightforward, with the company's headquarters located in Limassol, Cyprus. The management team comprises individuals with experience in the financial services sector, but specific details about their backgrounds are often limited in public disclosures.

Transparency is a critical factor in assessing a broker's legitimacy. Triumph FX provides some information about its operations; however, the lack of comprehensive details regarding its management team and ownership can be concerning for potential clients. A transparent brokerage typically discloses its leadership team and their qualifications, fostering trust among traders. The absence of this information raises questions about the company's commitment to accountability. Furthermore, the company's historical challenges with regulatory compliance, particularly with its offshore entities, further complicate the assessment of its legitimacy. Therefore, while Triumph FX presents itself as a legitimate broker, the lack of transparency and past regulatory issues should prompt potential clients to approach with caution.

Trading Conditions Analysis

When evaluating a broker's overall safety, understanding its trading conditions is essential. Triumph FX offers a range of trading accounts, each with varying fees and conditions. The fee structure is critical in determining the overall cost of trading, influencing profitability. Below is a comparison of key trading costs associated with Triumph FX:

| Fee Type | Triumph FX | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.6 pips | 0.3 - 1.0 pips |

| Commission Model | $0 - $6 per lot | $5 - $10 per lot |

| Overnight Interest Range | 2.5% | 2.0% - 3.0% |

Triumph FX's spreads start at 0.6 pips for premium accounts, which is competitive but not the lowest in the industry. The commission structure varies by account type, with premium accounts incurring a commission of $6 per lot. This fee structure can be seen as a potential red flag, as high commissions can significantly impact a trader's profitability. Additionally, the broker charges overnight interest, which can add to trading costs, particularly for those holding positions long-term.

The overall trading conditions may appear attractive at first glance, but it is essential to scrutinize the details. Traders should be aware of the potential for hidden fees and unfavorable conditions, particularly when dealing with offshore entities. Therefore, when assessing "Is Triumph FX safe?" it is crucial to consider not only the advertised trading conditions but also the potential pitfalls that could affect trading outcomes.

Customer Funds Security

The safety of customer funds is paramount when evaluating a broker's reliability. Triumph FX claims to implement various security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, which is a standard practice among regulated brokers. This practice is particularly important in the event of bankruptcy, as it helps safeguard client assets.

Additionally, Triumph FX participates in the Investor Compensation Fund (ICF), which provides further protection for clients in the event of insolvency. The ICF guarantees compensation payments of up to €20,000 to eligible clients, adding an extra layer of security. However, it is crucial to note that these protections do not extend to offshore entities, which may operate under different regulatory standards.

Despite these protective measures, historical issues have arisen regarding fund withdrawals and customer complaints about difficulty accessing funds. Such incidents raise concerns about the effectiveness of Triumph FX's security measures and overall reliability. Therefore, while Triumph FX appears to have implemented several safeguards, potential clients should remain vigilant and consider the historical context when determining whether "Is Triumph FX safe?"

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Triumph FX has garnered mixed reviews from users, with many praising its trading platform and execution speed. However, a significant number of complaints have surfaced, particularly concerning withdrawal issues and customer support responsiveness.

Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often unresolved |

| Customer Support Issues | Medium | Limited availability |

| Account Blocking | High | Inconsistent responses |

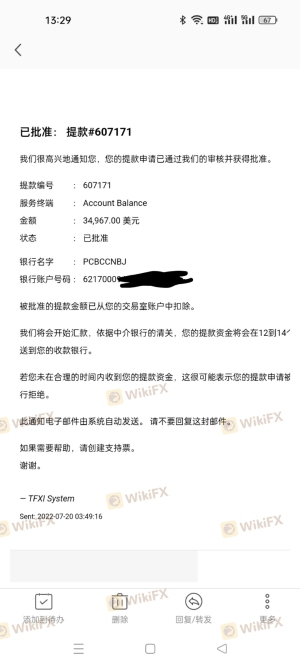

One notable case involved a trader who reported being unable to withdraw funds after increasing their deposit, leading to significant frustration. The trader claimed that their account was blocked without clear communication from Triumph FX, highlighting a potential lack of transparency and responsiveness. Such experiences can severely undermine trust and raise questions about the broker's commitment to customer service.

The recurring theme of withdrawal difficulties is particularly concerning and should not be overlooked. While Triumph FX may provide a robust trading platform, the negative customer experiences related to fund access and support raise valid concerns. Therefore, when evaluating "Is Triumph FX safe?" it is crucial to consider the overall customer experience, as it plays a significant role in determining a broker's reliability.

Platform and Trade Execution

The performance of a trading platform is a critical factor in a broker's overall reliability. Triumph FX utilizes the popular MetaTrader 4 (MT4) platform, which is well-regarded for its user-friendly interface and advanced trading tools. Traders can access the platform via desktop, mobile, and web, allowing for flexibility in trading.

In terms of order execution, Triumph FX claims to offer fast execution speeds and low slippage. However, some users have reported instances of slippage and order rejections during volatile market conditions, raising concerns about the platform's reliability. These issues can impact trading outcomes, particularly for those employing high-frequency trading strategies or scalping.

While the MT4 platform is widely used and trusted in the industry, the specific execution quality and potential for manipulation should be thoroughly evaluated. Traders should be cautious and consider the platform's performance alongside other factors when determining if "Is Triumph FX safe?"

Risk Assessment

When considering the overall safety of Triumph FX, it is essential to evaluate the associated risks. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | History of license revocation and scrutiny |

| Withdrawal Risk | High | Frequent complaints about withdrawal issues |

| Transparency Risk | Medium | Limited information about management and operations |

| Customer Support Risk | Medium | Inconsistent responsiveness and support availability |

Given these risk factors, potential clients should approach Triumph FX with caution. While the broker may offer competitive trading conditions and a popular platform, the historical issues and customer complaints raise valid concerns. To mitigate risks, traders should conduct thorough research and consider alternative brokers with a stronger reputation and more transparent practices.

Conclusion and Recommendations

In conclusion, while Triumph FX is regulated by CySEC and offers various trading options, significant concerns remain regarding its overall safety and reliability. The historical loss of its Vanuatu license, combined with ongoing complaints about withdrawal issues and customer support responsiveness, raises red flags for potential clients. Therefore, when asking, "Is Triumph FX safe?" it is prudent to approach with caution and conduct thorough research.

For traders seeking a reliable forex broker, it may be advisable to consider alternatives with a stronger reputation and more transparent operations. Brokers such as Pepperstone, XM, and IG offer robust regulatory frameworks and positive customer feedback, making them worthy alternatives for traders looking for a secure trading environment. Ultimately, the decision to engage with Triumph FX should be based on careful consideration of the risks and benefits, ensuring that traders can make informed choices regarding their investments.

Is Triumph FX a scam, or is it legit?

The latest exposure and evaluation content of Triumph FX brokers.

Triumph FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Triumph FX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.