Goldstone Financial Group Scam 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Goldstone Financial Group is a financial advisory firm that has garnered significant controversy due to numerous allegations of fraudulent activity, regulatory violations, and questionable business practices. Founded by Anthony and Michael Pellegrino, Goldstone has faced scrutiny for its involvement with unregulated investment schemes, particularly the notorious 1 Global Capital saga. The Securities and Exchange Commission (SEC) has imposed penalties on the firm and its founders due to their failure to disclose fees and their involvement in unregistered transactions.

Potential investors should approach Goldstone Financial Group with extreme caution. The firm's troubled history with regulatory bodies and its ongoing reputation issues present significant risks. Understanding these factors, alongside a detailed analysis of the firm's operations and practices, is essential for any individual seeking financial guidance.

⚠️ Important Risk Advisory & Verification Steps

When considering a financial firm like Goldstone Financial Group, it's vital to protect yourself by taking several precautionary measures:

- Conduct Thorough Research: Investigate the broker's regulatory status and reputation through official financial regulatory sites.

- Check Disciplinary Records: Look for any past complaints against the firm or its advisors, focusing on any histories of misconduct or disciplinary action.

- Review the Fee Structure: Ensure understanding of all fees and charges, especially those that might not have been disclosed upfront.

- Seek Third-Party Opinions: Review independent evaluations and user experiences to get a balanced view of the firm.

Before proceeding, consider the following steps to verify the legitimacy of a financial advisory service:

- Visit Regulatory Websites: Search the firm's name on sites like FINRA's BrokerCheck or the SEC's Investment Adviser Public Disclosure.

- Read User Complaints: Check forums and financial review sites for real client feedback.

- Request Documentation: Ask for detailed justification regarding their investment strategies and fee structures.

- Consult with a Trusted Advisor: Seek opinions from independent financial advisors to understand the risks involved.

Rating Framework

Broker Overview

Company Background and Positioning

Established in 2015, Goldstone Financial Group is headquartered in Oak Brook Terrace, Illinois. The firm was founded by Anthony and Michael Pellegrino, who initially promoted the company as a reliable wealth management service. However, the firm has seen its reputation severely damaged as allegations of fraud and misconduct have come to light, notably the involvement in unregistered securities and the 1 Global Capital scandal.

Core Business Overview

Goldstone Financial Group offers a range of investment advisory services, including retirement planning, wealth management, and financial consultancy. Despite its claims of regulatory compliance and a professional approach, the firm's history is marred by allegations regarding its investment recommendations and lack of transparency about its fees. Crucially, both Anthony and Michael Pellegrino have been subjected to regulatory penalties, indicating systemic issues within the firm's operations.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Goldstone Financial Group has faced serious allegations regarding its operations, particularly its connection with the fraudulent 1 Global Capital scheme, which raised over $320 million in illegal securities from thousands of investors. As per the SEC's findings, both Anthony and Michael Pellegrino were implicated in promoting unregistered securities without disclosing associated fees, a clear breach of fiduciary duty. These factors call into question the integrity and compliance of the firm.

User Self-Verification Guide

- Search Goldstone on the SEC Database: Visit the SEC's Investment Adviser Public Disclosure site.

- Check BrokerCheck: Utilize FINRA's BrokerCheck to look up the firm's advisors and their disciplinary history.

- Review User Feedback: Explore platforms that aggregate user reviews for further insights into client experiences.

- Consult Regulatory Bodies: Reach out to financial regulatory agencies to validate any claims about the firm's operating status.

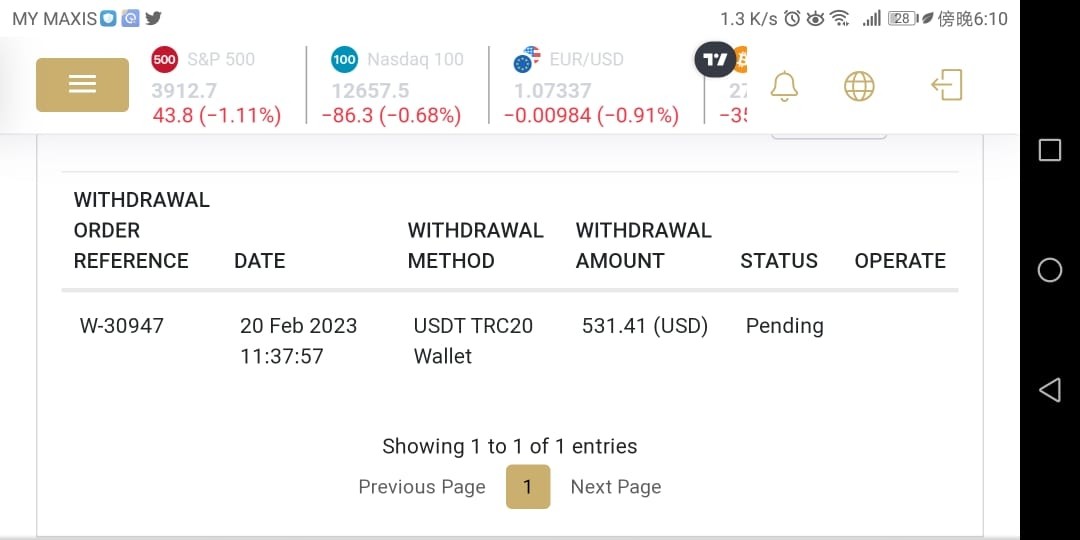

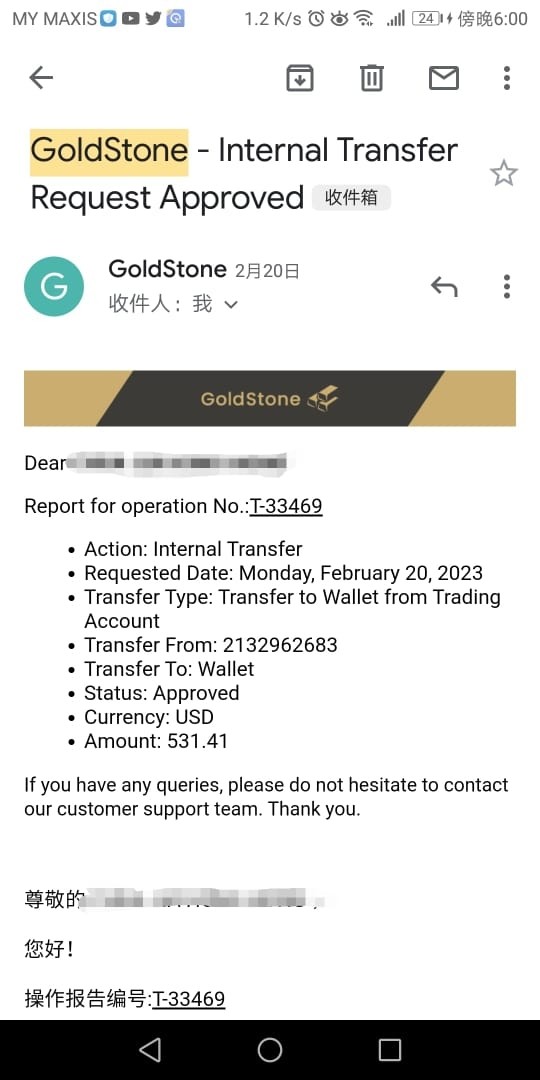

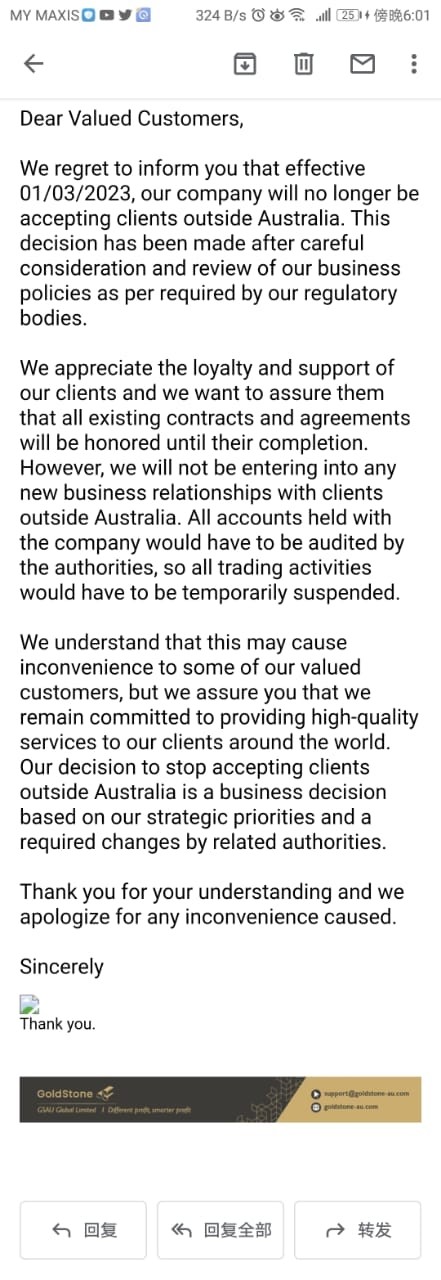

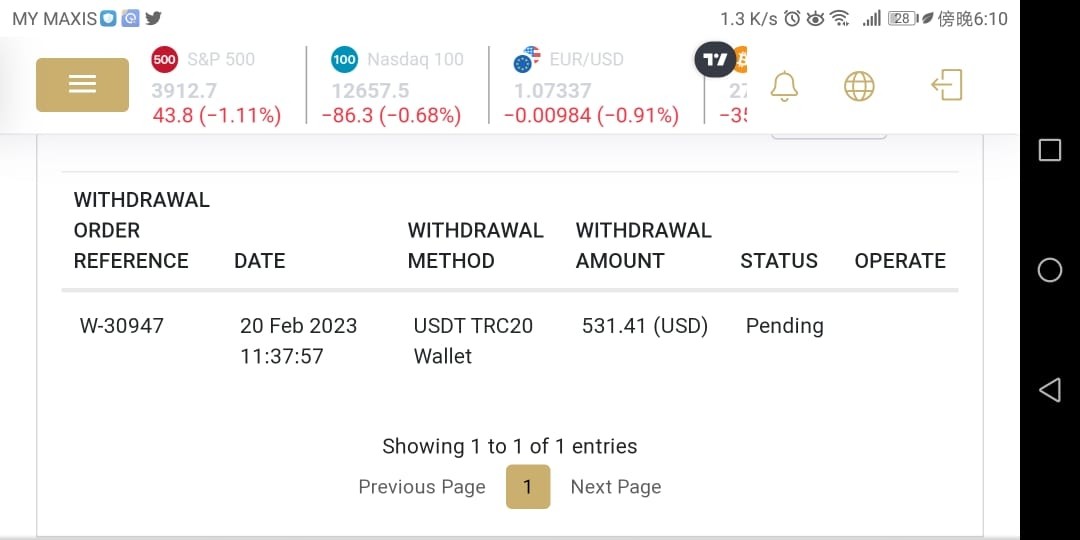

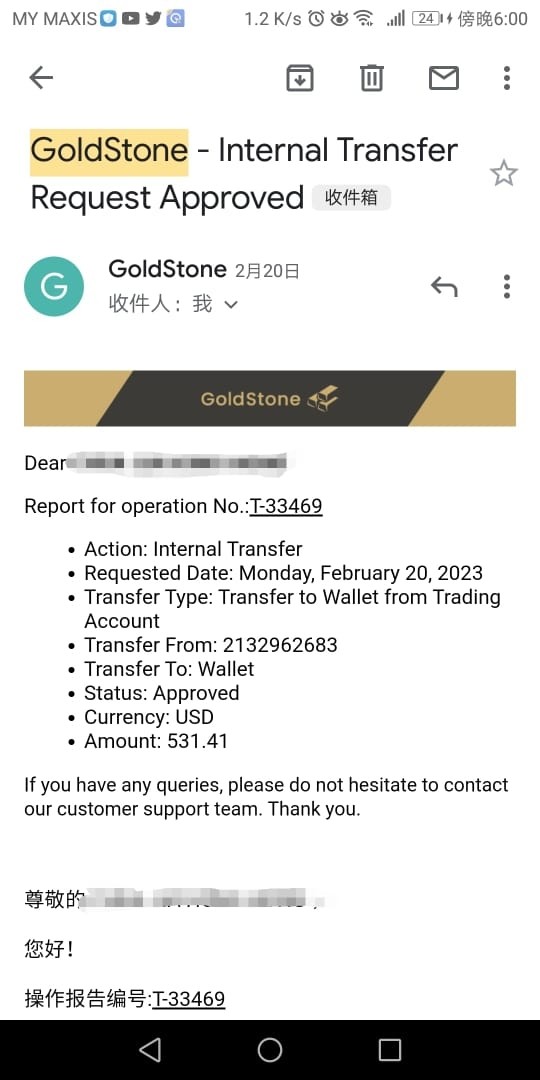

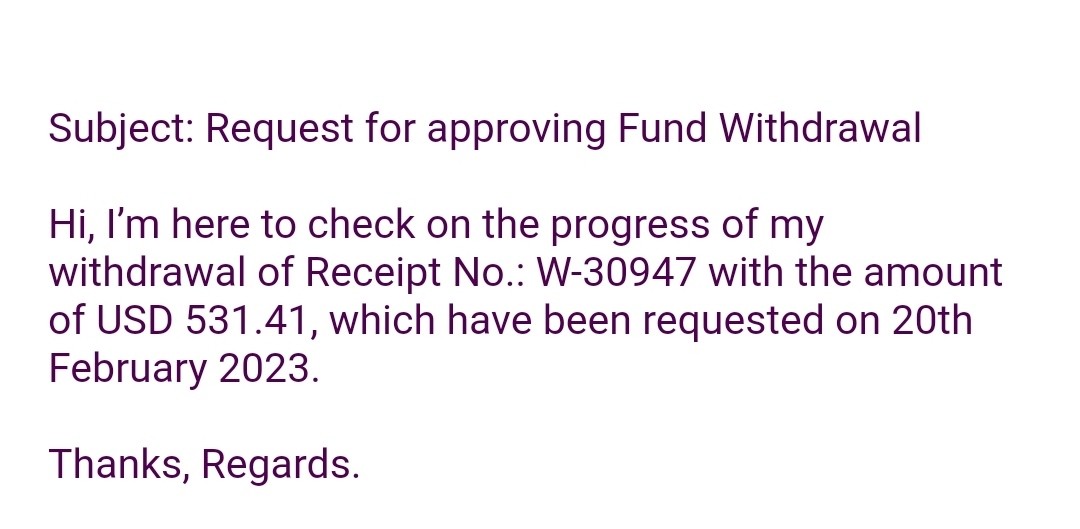

Industry Reputation and Summary

Feedback from users and regulators consistently reflects a lack of trust in Goldstone Financial Group. Clients have reported difficulty in withdrawing funds, deceptive practices, and high-pressure sales tactics. This overall negative perception leads to a decisive conclusion about the firms trustworthiness.

Trading Costs Analysis

Advantages in Commissions

Goldstone may present some advantages in commission structures but is overshadowed by its failure to disclose critical information to clients. The average fee charged by the Pellegrinos, at approximately 4.3%, is significantly above the industry norm, raising red flags for potential investors.

The "Traps" of Non-Trading Fees

Numerous user complaints indicate serious issues regarding hidden fees. For instance, one user stated:

"I tried to withdraw my funds but was told the withdrawal channel is being maintained and cannot be used for withdrawal."

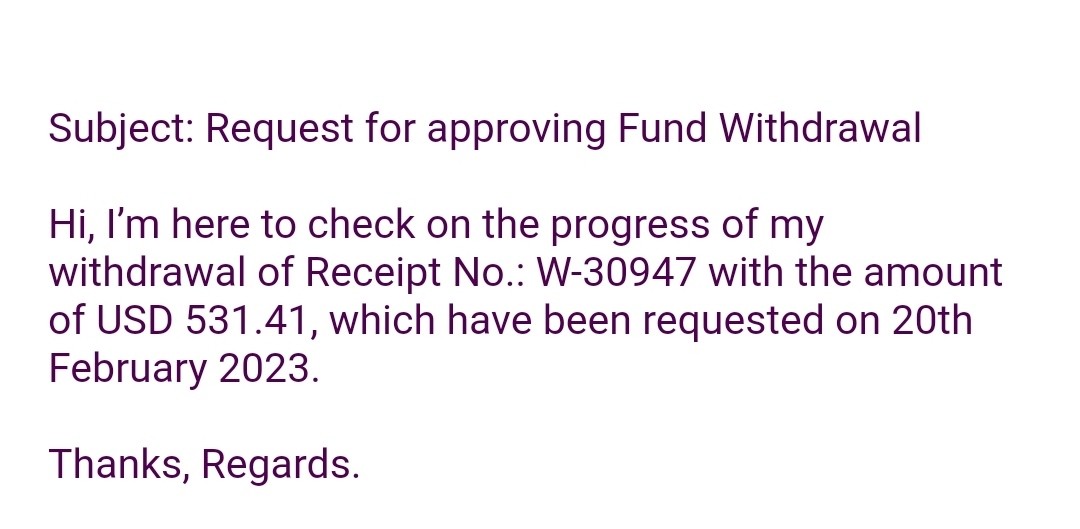

Difficulties in the withdrawal process have been echoed by several investors, leading to frustrations and losses that significantly impair the overall investment experience.

Cost Structure Summary

While some aspects of Goldstones fee structure may initially seem competitive, the hidden costs and high overall expenses render it unfavorable for many types of investors. Additionally, the risks associated with investing in a firm with a dubious past may outweigh any potential benefits that the fee structure provides.

Goldstone Financial Group primarily utilizes the MetaTrader 4 platform, recognized for its flexibility and robust trading features. However, the lack of support for modern trading tools and applications raises concerns. Users have reported that certain features are outdated and difficult to navigate.

The MetaTrader 4 platform does provide a range of technical analysis tools and resources designed to assist traders. Nevertheless, the absence of critical updates and support for newer tools may limit its effectiveness for modern traders.

User experiences with Goldstones trading platforms reveal a significant level of dissatisfaction. Comments include issues with outdated features and a lack of user-friendly interfaces, which could deter novice traders from effectively utilizing the service.

User Experience Analysis

"They wont let me withdraw for 5 months."

Such systemic problems have contributed heavily to a negative overall user experience with Goldstone Financial Group.

Level of Satisfaction:

Clients report being unsatisfied not only with the access to their investments but also with the level of support provided during the investment process.

User Experience Summary:

In conclusion, the overall user experience at Goldstone Financial Group is notably poor, featuring significant complaints regarding withdrawal capabilities and overall dissatisfaction with service.

Customer Support Analysis

-

Support Accessibility:

Support avenues consist mainly of phone and email communication but have been reported as subpar in responsiveness. For instance, users repeatedly remarked on their inability to receive timely assistance from customer service representatives.

Quality of Support:

Feedback from clients suggests a lack of effective resolution capabilities in customer service interactions, leading to further frustration and distrust.

Customer Support Summary:

Overall, the customer support at Goldstone Financial Group is lacking in efficiency and effectiveness, contributing to growing concerns among clients about the quality of service offered.

Account Conditions Analysis

-

Account Restrictions & Difficulties:

Many clients have expressed frustration with the inability to access or withdraw funds according to the established terms. There are reports indicating that, upon reaching out for withdrawals, customers were subjected to delays and misleading responses.

Minimum Deposits and Fees:

While specific details surrounding minimum deposits remain elusive, the high fees associated with Goldstones investment services substantially affect overall investment viability.

Account Conditions Summary:

In light of user feedback illustrating severe accessibility issues and high fees, potential clients may wish to reconsider engaging with Goldstone Financial Group.

Conclusion

Goldstone Financial Group emerges as a broker riddled with regulatory issues, client complaints, and ethical concerns, culminating in their reputational crisis. With multiple sanctions from regulatory bodies concerning fraud and non-disclosure of critical financial information, potential investors should approach this firm with caution. Given its troubled history and the substantial risks it poses, individual investors would be wise to thoroughly review any financial service provider before entrusting them with their resources. Investing with Goldstone Financial Group could very well lead to a financial trap rather than an opportunity for growth.