Is GoldStone safe?

Pros

Cons

Is Goldstone Safe or Scam?

Introduction

Goldstone is an offshore forex broker that has gained attention in the trading community for its offerings in foreign exchange trading. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with Goldstone. The forex market is rife with opportunities but also with risks, particularly when dealing with unregulated brokers. In this article, we will explore whether Goldstone is a safe trading option or if it poses significant risks to its clients. Our investigation is based on various sources, including regulatory information, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of Goldstone is a significant factor in assessing its safety. An unregulated broker can expose traders to various risks, including the potential for fraud and the inability to recover funds in case of disputes.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 338674 (cloned) | Australia | Not verified |

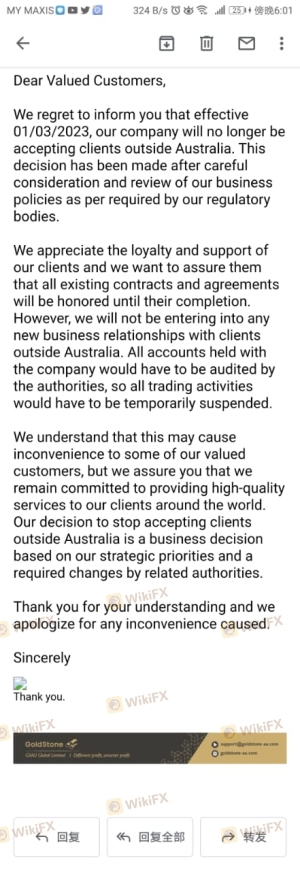

Goldstone claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, investigations reveal that this license is a clone, meaning it is not legitimate. The absence of a valid regulatory framework raises concerns about the broker's operational practices and the protection of client funds. Regulatory authorities serve as a safeguard for traders, ensuring that brokers adhere to strict guidelines and standards. Consequently, the lack of regulation suggests that Goldstone may not provide the necessary investor protections, making it a risky choice for traders.

Company Background Investigation

Goldstone's history and ownership structure are essential in determining its credibility. The broker is reportedly registered in Australia but operates with a suspicious regulatory license. Limited information is available regarding its management team and their professional backgrounds.

The opacity surrounding Goldstone's ownership and operational history raises significant concerns. A reputable broker typically offers transparent information about its founders and management, allowing clients to gauge the team's expertise and experience. However, Goldstone lacks such transparency, which can be a red flag for potential investors. This lack of clarity can lead to questions about the broker's long-term viability and trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by Goldstone is vital for evaluating its overall appeal. The broker primarily focuses on forex trading, but the details regarding its fee structure and trading costs are not readily available.

| Cost Type | Goldstone | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-3% |

The absence of clear information regarding spreads, commissions, and overnight interest rates can be concerning. Traders should be wary of brokers that do not disclose their fee structures, as hidden fees can significantly impact profitability. In contrast, established brokers typically provide transparent information regarding their costs, helping traders make informed decisions.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Goldstone's measures for securing client funds are unclear, which can lead to anxiety among potential investors.

A reputable broker should employ robust security measures, such as segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, Goldstone does not provide adequate information on these critical aspects. The history of complaints regarding withdrawal issues further exacerbates concerns about the safety of funds held with this broker. Traders should be cautious and consider the potential risks involved in trading with Goldstone.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and responsiveness. A review of user experiences with Goldstone reveals a pattern of complaints, particularly regarding withdrawal difficulties.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Transparency Issues | High | Poor |

Many users have reported being unable to withdraw their funds, with some stating that their requests have gone unanswered for months. This lack of responsiveness can be a significant deterrent for potential clients. Effective customer support is essential for resolving issues promptly and maintaining trust. The negative experiences shared by clients indicate that Goldstone may not prioritize customer satisfaction, raising further doubts about its reliability.

Platform and Trade Execution

The trading platform's performance and execution quality are critical components of the trading experience. Goldstone offers the widely used MetaTrader 4 platform, known for its user-friendly interface and advanced features. However, the broker's overall platform stability and execution quality remain questionable.

Traders have reported instances of slippage and order rejections, which can lead to unfavorable trading conditions. The presence of these issues may indicate a lack of effective risk management practices and could signal potential platform manipulation. Traders should be cautious and consider whether Goldstone provides a reliable trading environment.

Risk Assessment

Engaging with Goldstone carries inherent risks that traders must consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of transparency regarding fund security. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Given these risks, traders should weigh their options carefully. It is advisable to consider alternative brokers that offer better regulatory oversight and client protections.

Conclusion and Recommendations

In conclusion, the evidence suggests that Goldstone may not be a safe option for traders. The broker's unregulated status, lack of transparency, and numerous client complaints raise significant red flags. Traders should exercise caution and consider the potential risks associated with engaging with Goldstone.

For those seeking safer trading environments, it is advisable to explore regulated brokers with established reputations in the industry. Some reputable alternatives include brokers that are fully regulated and provide comprehensive support and transparent fee structures. Ultimately, prioritizing safety and reliability should be the guiding principle for any trader navigating the forex market.

Is GoldStone a scam, or is it legit?

The latest exposure and evaluation content of GoldStone brokers.

GoldStone Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GoldStone latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.