Is ExtrendCap safe?

Business

License

Is ExtrendCap Safe or a Scam?

Introduction

ExtrendCap is a forex broker that positions itself within the competitive landscape of online trading, offering various financial instruments including forex, commodities, indices, and CFDs. As the forex market continues to grow in popularity, attracting both seasoned investors and newcomers, it becomes increasingly crucial for traders to carefully evaluate the brokers they choose to work with. The potential for high returns is often accompanied by the risk of encountering fraudulent practices. This article aims to provide a comprehensive assessment of ExtrendCap, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a thorough analysis of multiple sources, including user reviews, regulatory information, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. A well-regulated broker is typically subject to stringent oversight, providing traders with a level of protection against fraud and malpractice. ExtrendCap claims to be registered in Australia and asserts compliance with the Australian Securities and Investments Commission (ASIC). However, our investigation reveals discrepancies in this claim.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Revoked |

Despite its claims, ExtrendCap is not found in ASIC's official registry, indicating that it is not authorized to operate as a forex broker in Australia. The revocation of its license raises significant concerns about the broker's legitimacy. Furthermore, the lack of regulation from other reputable authorities further compounds these issues. Unregulated brokers often operate with little to no oversight, exposing traders to higher risks of fraud. Therefore, it is prudent to approach ExtrendCap with caution, as its regulatory status suggests a potential scam.

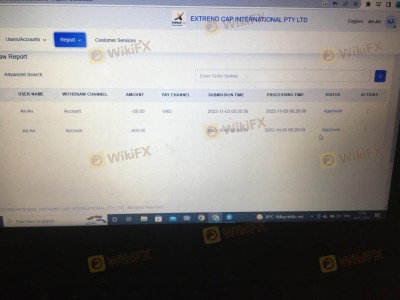

Company Background Investigation

ExtrendCap is operated by Extrend Cap International Pty Ltd, a company that has not established a long-standing presence in the forex industry. The company's domain was registered recently, which raises questions about its credibility and experience. A detailed analysis of the management team reveals a lack of transparency regarding their qualifications and professional backgrounds. This opacity contributes to the overall suspicion surrounding ExtrendCap.

The absence of clear information about the company's ownership structure and management team may indicate a deliberate effort to obscure its true nature. Reliable brokers typically provide detailed information about their management and operational history, fostering trust among potential clients. In contrast, the lack of such transparency with ExtrendCap suggests that it may not be a trustworthy broker. This lack of information further fuels concerns regarding its safety for traders, reinforcing the question: Is ExtrendCap safe?

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. ExtrendCap provides a range of trading instruments and claims to offer competitive spreads. However, the overall fee structure and any unusual or problematic policies warrant close examination.

| Fee Type | ExtrendCap | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While ExtrendCap advertises low spreads, the lack of transparency regarding commission structures and overnight interest rates raises red flags. Traders should be cautious of hidden fees or charges that could significantly impact their profitability. The absence of clear information about these costs is concerning and may suggest that traders could face unexpected expenses. This ambiguity further complicates the question of whether ExtrendCap is safe for trading.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. ExtrendCap claims to implement various security measures, but the absence of regulatory oversight raises concerns about the efficacy of these protections.

Traders should inquire about the broker's policies on fund segregation, investor protection, and negative balance protection. A reputable broker typically segregates client funds from operational funds, ensuring that traders' money is protected even in the event of the broker's insolvency. Additionally, negative balance protection is crucial, as it prevents traders from losing more than their initial investment.

However, the lack of clear information regarding these safety measures with ExtrendCap raises significant concerns. Historical issues related to fund security, such as withdrawal difficulties and allegations of fraud, further exacerbate these worries. Therefore, traders must carefully consider whether ExtrendCap is safe for their investments.

Customer Experience and Complaints

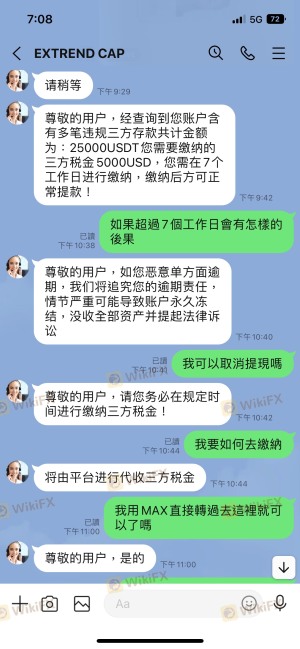

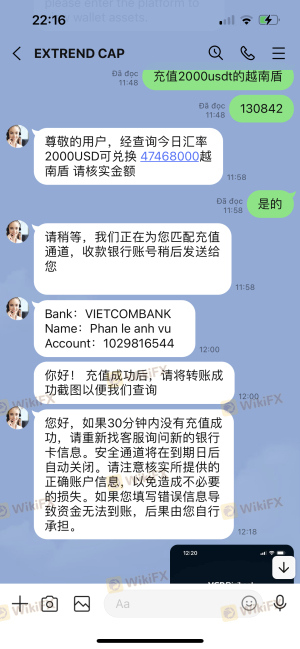

Customer feedback plays a vital role in assessing the reliability of a broker. A thorough analysis of user experiences with ExtrendCap reveals a troubling trend of complaints, particularly regarding withdrawal issues. Many users report difficulties in accessing their funds, with some alleging that the broker imposes unreasonable conditions for withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Transparency Concerns | Medium | Poor |

| Customer Support Complaints | High | Poor |

Common complaints include demands for additional payments or taxes before processing withdrawals, a tactic often employed by fraudulent brokers. These complaints indicate a troubling pattern that raises serious questions about the broker's integrity. For instance, one user reported being unable to withdraw their funds without paying a so-called "tax," a common scam tactic. Such experiences highlight the importance of conducting thorough research before engaging with a broker like ExtrendCap. The question remains: Is ExtrendCap safe?

Platform and Trade Execution

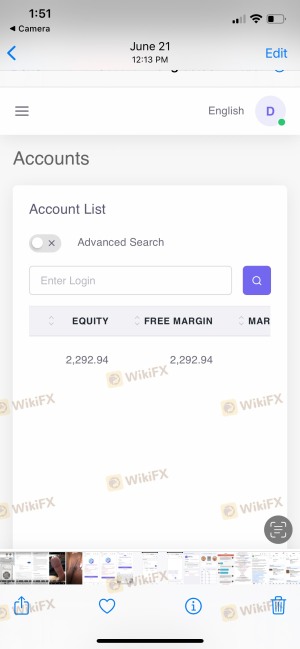

The performance of a trading platform is crucial for a positive trading experience. ExtrendCap claims to offer a reliable trading platform, but user feedback suggests otherwise. Many traders report issues related to order execution, slippage, and rejected orders, which can significantly impact trading outcomes.

A reliable platform should ensure quick and efficient order execution, minimizing slippage and maximizing the likelihood of order fulfillment. However, reports of manipulation or poor execution practices at ExtrendCap raise concerns about the platform's reliability. Such issues can lead to significant financial losses for traders, further complicating the question of whether ExtrendCap is safe for trading.

Risk Assessment

Engaging with a broker like ExtrendCap involves various risks that traders must consider. The lack of regulation, combined with a history of customer complaints and withdrawal issues, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Reports of withdrawal difficulties. |

| Operational Risk | Medium | Complaints about platform performance. |

To mitigate these risks, traders should consider alternative regulated brokers with established reputations and transparent practices. Engaging with a well-regulated broker can provide a layer of protection against potential fraud and operational issues.

Conclusion and Recommendations

In conclusion, the evidence suggests that ExtrendCap exhibits several characteristics commonly associated with fraudulent brokers. Its lack of regulatory oversight, coupled with numerous customer complaints regarding withdrawal issues and transparency concerns, raises significant alarms about its legitimacy. Therefore, it is crucial for traders to approach ExtrendCap with caution and skepticism.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers such as [Insert Trusted Broker Names] offer the necessary protections and transparency that traders need to feel confident in their investments. Ultimately, the question remains: Is ExtrendCap safe? The evidence suggests otherwise, and caution is warranted.

Is ExtrendCap a scam, or is it legit?

The latest exposure and evaluation content of ExtrendCap brokers.

ExtrendCap Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ExtrendCap latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.