Victoria Capital 2025 Review: Everything You Need to Know

Executive Summary

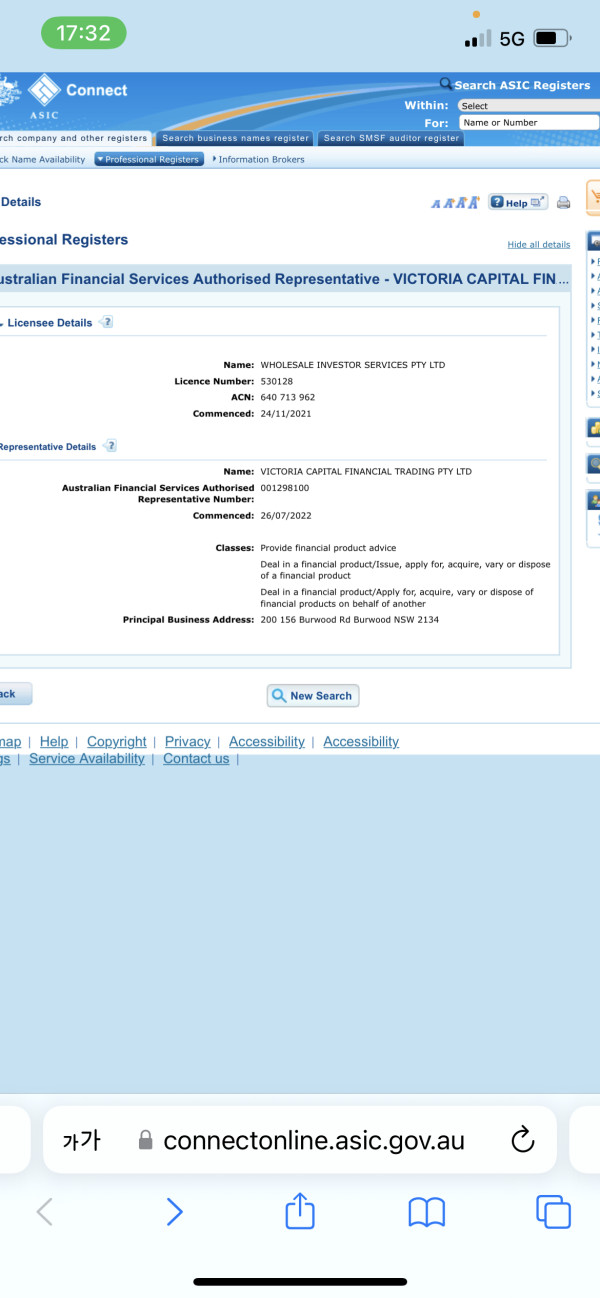

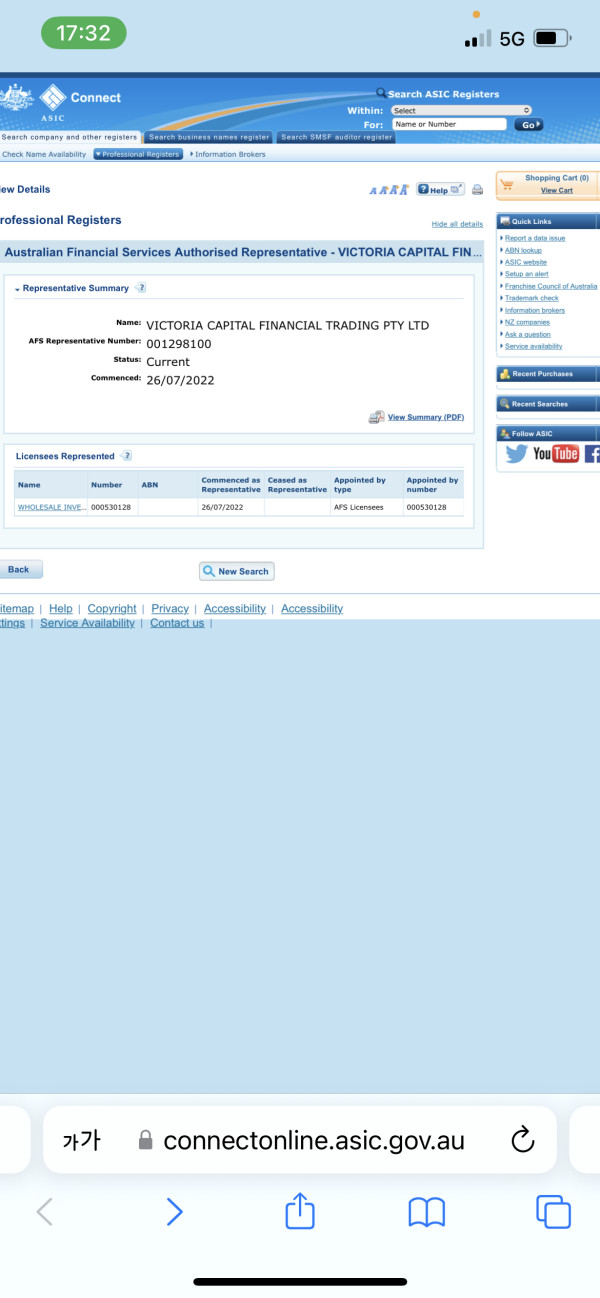

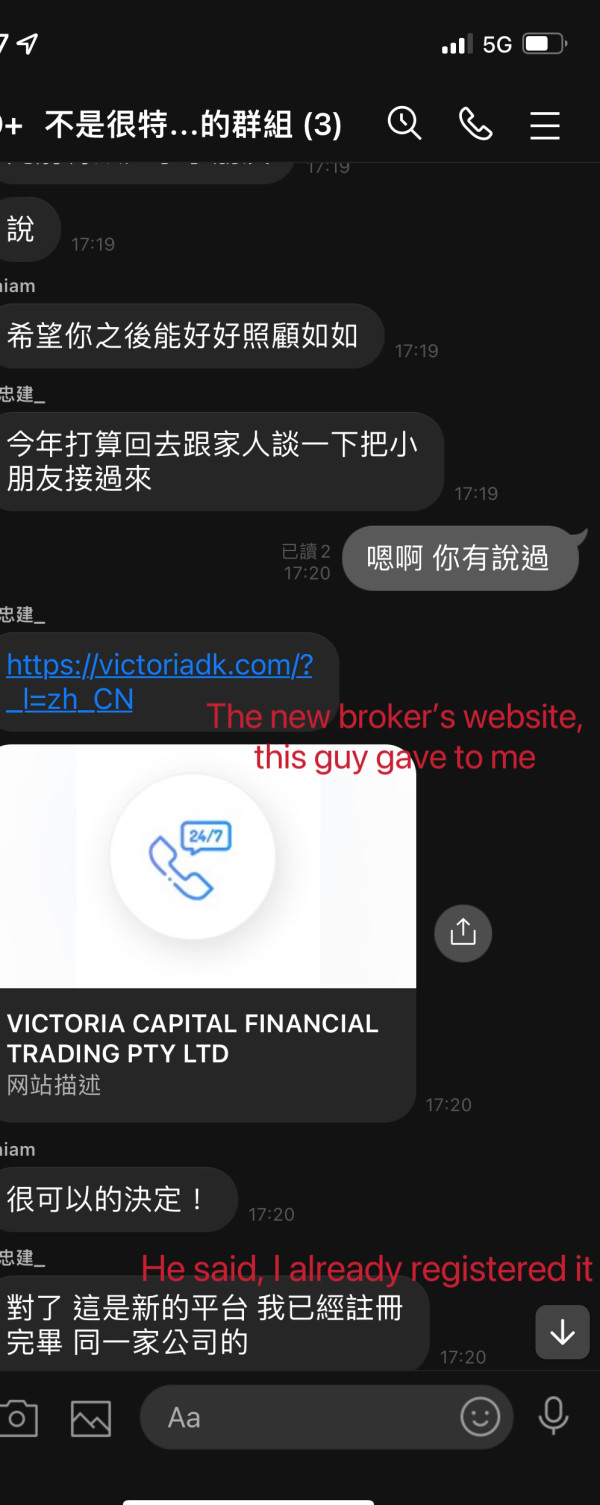

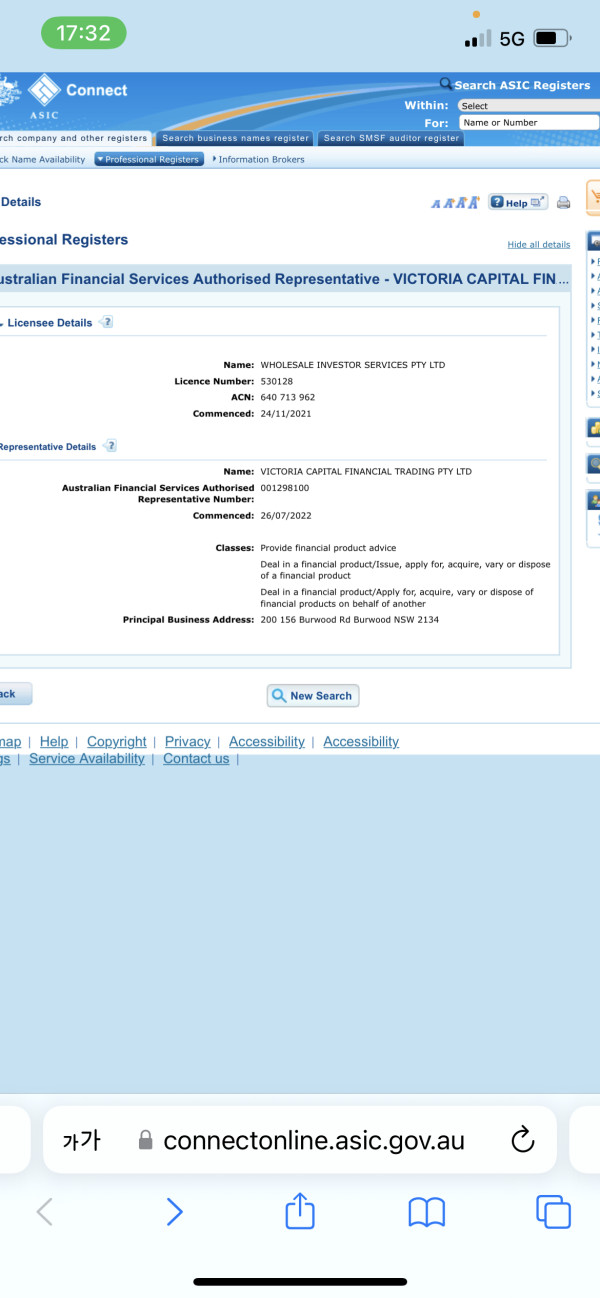

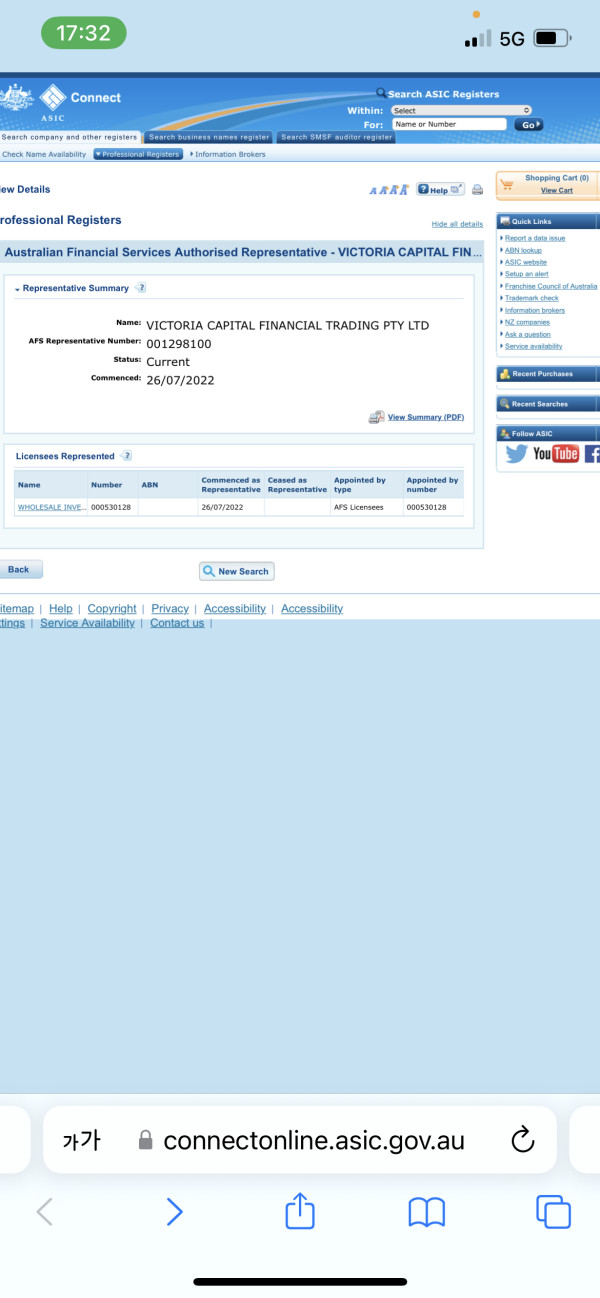

This comprehensive victoria capital review reveals significant concerns about this Australian-based forex broker. Traders should carefully consider these issues before opening an account. Victoria Capital was established in 2022 and operates without valid regulatory oversight, which immediately raises red flags for potential investors seeking a secure trading environment.

WikiFX assessments gave Victoria Capital an alarmingly low score of 1.40 out of 10. This score reflects serious deficiencies in multiple operational areas. Perhaps more concerning is the substantial volume of user complaints, with 26 formal grievances filed against the broker in just the past three months.

This pattern of negative feedback suggests systemic issues with the broker's service delivery and client satisfaction. The broker primarily targets retail forex traders seeking access to currency markets, but the lack of proper regulatory protection creates substantial risks for client funds and trading activities. Without oversight from recognized financial authorities, traders have limited recourse in case of disputes or operational problems.

Victoria Capital claims to offer forex trading services. However, the absence of transparent operational details, combined with poor user ratings and regulatory gaps, makes this broker unsuitable for most traders, particularly those prioritizing capital safety and reliable service quality.

Important Notice

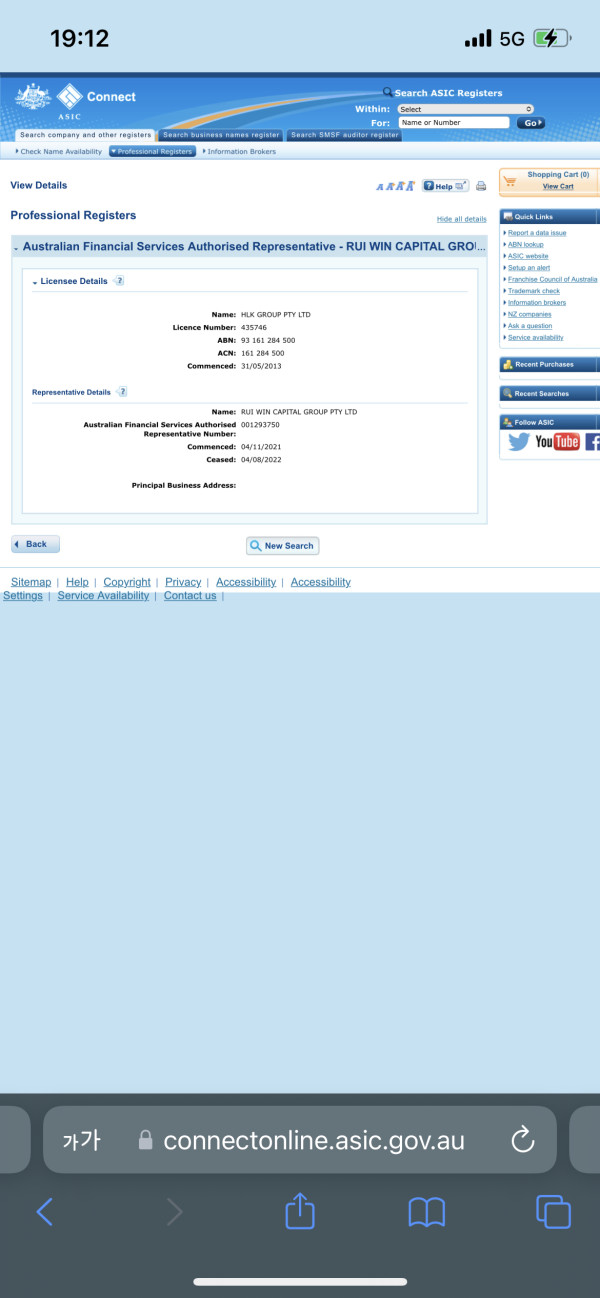

This victoria capital review is based on available public information and user feedback collected through various financial oversight platforms. Traders should be aware that Victoria Capital operates from Australia but lacks authorization from recognized financial regulatory bodies, including ASIC.

Our evaluation methodology incorporates user complaint data, regulatory status verification, and available operational information. However, due to the broker's limited transparency and regulatory gaps, comprehensive assessment of all service aspects remains challenging. Potential clients should exercise extreme caution and consider these limitations when making trading decisions.

Rating Framework

Broker Overview

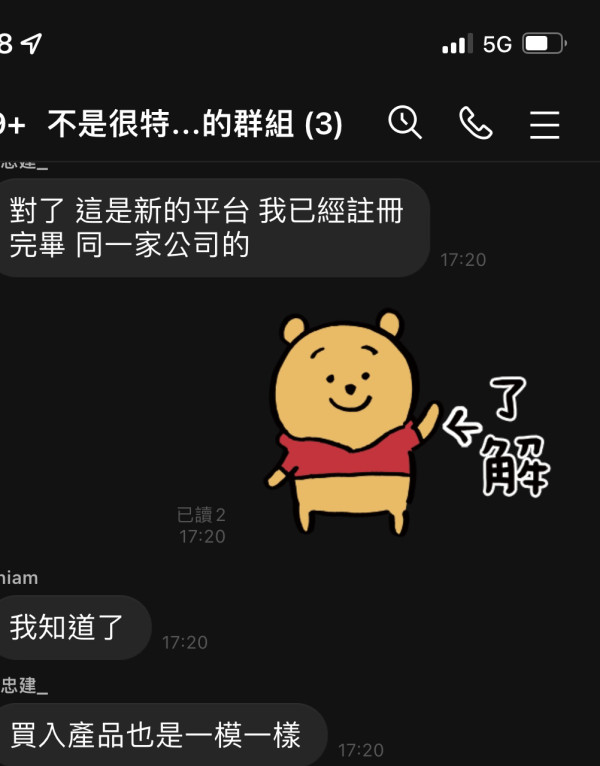

Victoria Capital emerged in the forex trading landscape in 2022. The company positioned itself as a service provider for retail currency traders in Australia and potentially other markets. Despite its relatively recent establishment, the broker has attracted attention primarily due to negative user experiences rather than positive market reception.

The company's business model centers around providing access to foreign exchange markets. However, specific details about their operational structure, technology infrastructure, and service offerings remain notably unclear. This lack of transparency is particularly concerning given the broker's short operational history and absence of regulatory oversight.

Victoria Capital operates from Australia and functions in a jurisdiction known for stringent financial regulations. Yet the broker appears to operate outside the established regulatory framework. This situation creates a significant disconnect between market expectations and actual operational standards, contributing to the negative assessment reflected in this victoria capital review.

The broker's target demographic appears to be individual traders seeking forex market access. However, the combination of regulatory gaps and poor user feedback suggests that Victoria Capital has struggled to meet basic industry standards for service quality and client protection.

Regulatory Status: Victoria Capital operates without valid regulation from recognized financial authorities. This absence of oversight represents a critical risk factor for potential clients, as regulatory protection typically provides essential safeguards for trader funds and dispute resolution mechanisms.

Asset Coverage: The broker focuses primarily on forex trading. However, specific currency pairs and market access details are not comprehensively documented in available materials. This limited transparency makes it difficult for traders to assess whether the broker's offerings align with their trading strategies.

Minimum Deposit Requirements: Specific information regarding minimum deposit amounts and account funding requirements is not clearly detailed in available documentation. This creates uncertainty for potential clients planning their initial investments.

Trading Platforms: Information about the trading platforms offered by Victoria Capital is not comprehensively available. This makes it impossible to evaluate the technological capabilities and user interface quality that traders can expect.

Leverage and Trading Conditions: Details about leverage ratios, spread structures, and other critical trading conditions are not transparently disclosed. This hinders traders' ability to assess the competitiveness of the broker's offerings.

Payment Methods: Specific information about deposit and withdrawal methods, processing times, and associated fees is not readily available. This creates uncertainty about fund management processes.

This victoria capital review highlights the concerning lack of operational transparency that characterizes this broker's public presence.

Account Conditions Analysis

The evaluation of Victoria Capital's account conditions presents significant challenges due to limited available information about their account structures and terms. Based on accessible data, the broker appears to offer basic forex trading accounts, but specific details about account types, minimum balance requirements, and associated benefits remain unclear.

Potential clients cannot make informed decisions about which account type might suit their trading needs without comprehensive documentation of account terms and conditions. This lack of transparency is particularly problematic for traders who require specific features such as Islamic accounts for religious compliance or professional accounts with enhanced leverage options.

The absence of clear information about account opening procedures, verification requirements, and ongoing maintenance conditions suggests either poor communication practices or deliberate opacity in the broker's operations. Industry-standard brokers typically provide detailed account specifications to help traders understand exactly what they can expect from different account tiers.

The high volume of user complaints may partly stem from unclear account terms that lead to misunderstandings between the broker and clients. When traders don't fully understand their account conditions, disputes about fees, restrictions, or service levels become more likely.

This victoria capital review must note that the lack of transparent account information represents a significant red flag for potential clients seeking a reliable trading partner.

Victoria Capital's offering of trading tools and educational resources cannot be comprehensively evaluated due to insufficient publicly available information. This lack of transparency regarding analytical tools, research materials, and educational content represents a significant concern for traders who rely on such resources for informed decision-making.

Modern forex brokers typically provide extensive libraries of market analysis, economic calendars, technical indicators, and educational materials to support their clients' trading activities. The absence of clear information about Victoria Capital's tool suite suggests either a limited offering or poor communication about available resources.

Traders may find themselves at a disadvantage when attempting to make informed trading decisions without access to quality research and analysis tools. This situation is particularly problematic for newer traders who depend on educational resources to develop their skills and market understanding.

The broker's failure to clearly communicate their tools and resources offering may contribute to user dissatisfaction. Traders often discover limitations only after opening accounts. This discovery process can lead to frustration and complaints, potentially contributing to the high complaint volume documented in various feedback platforms.

Professional traders typically require sophisticated analytical tools, automated trading capabilities, and comprehensive market data to execute their strategies effectively. The uncertainty surrounding Victoria Capital's tool offerings makes it difficult for such traders to assess whether the broker can meet their operational requirements.

Customer Service and Support Analysis

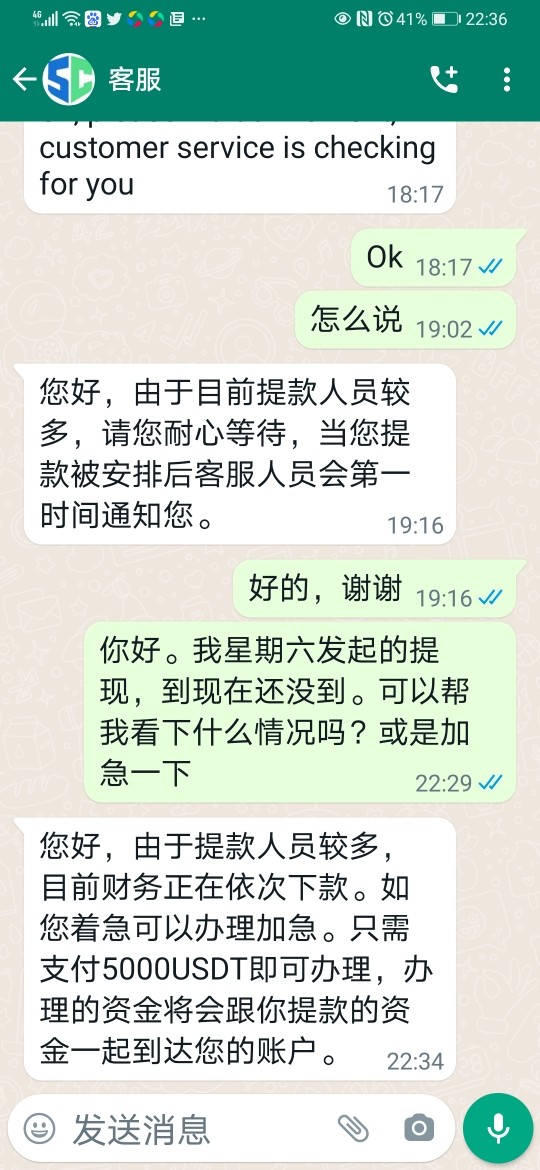

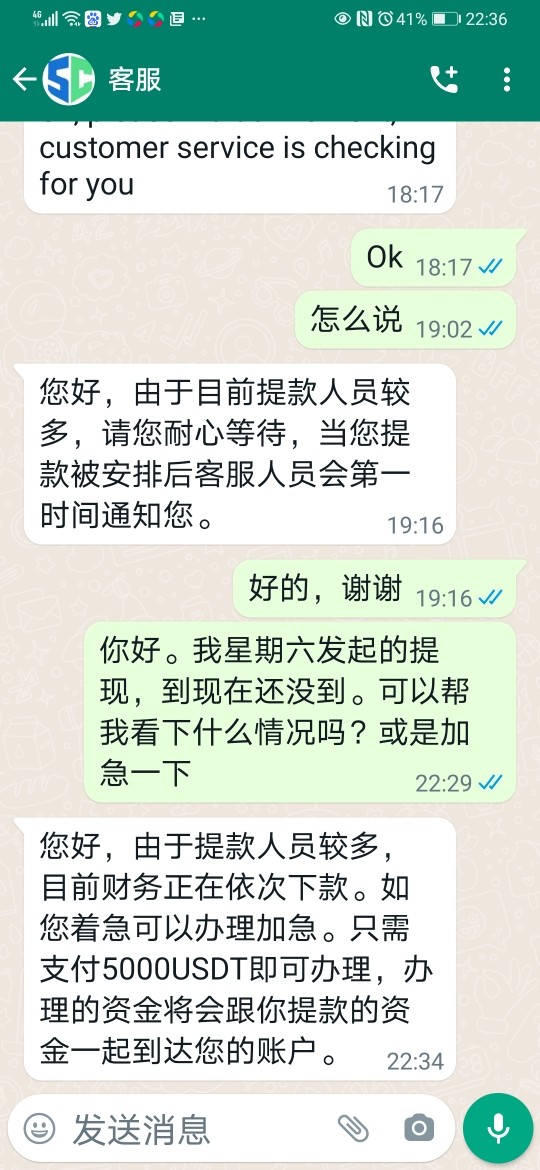

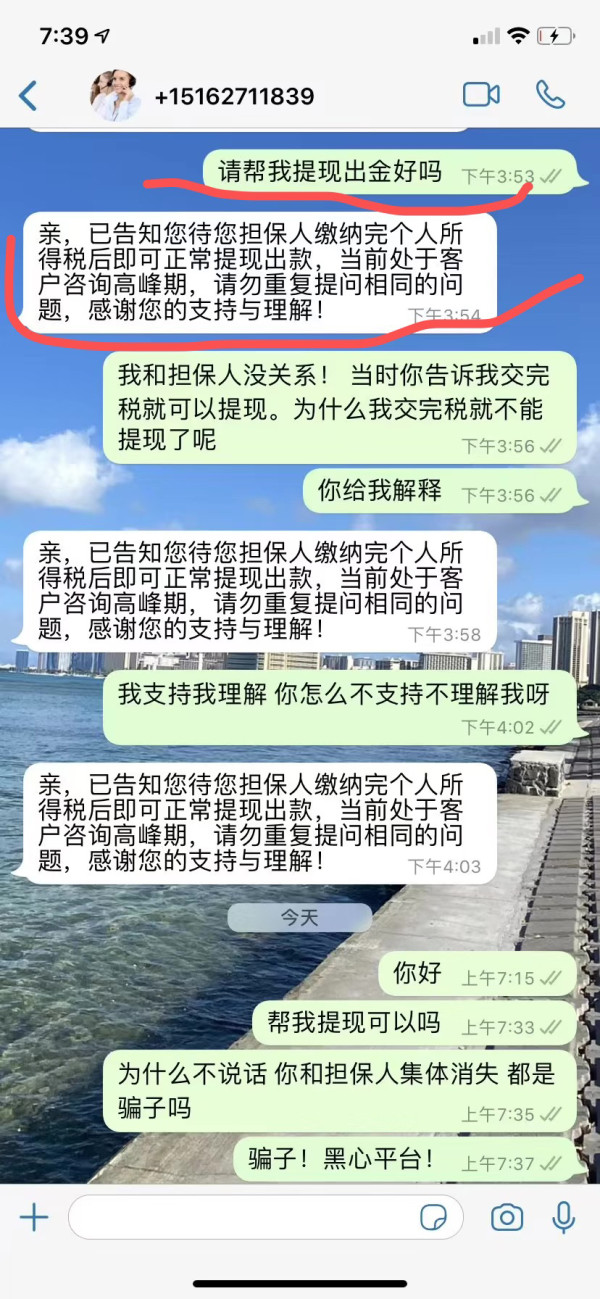

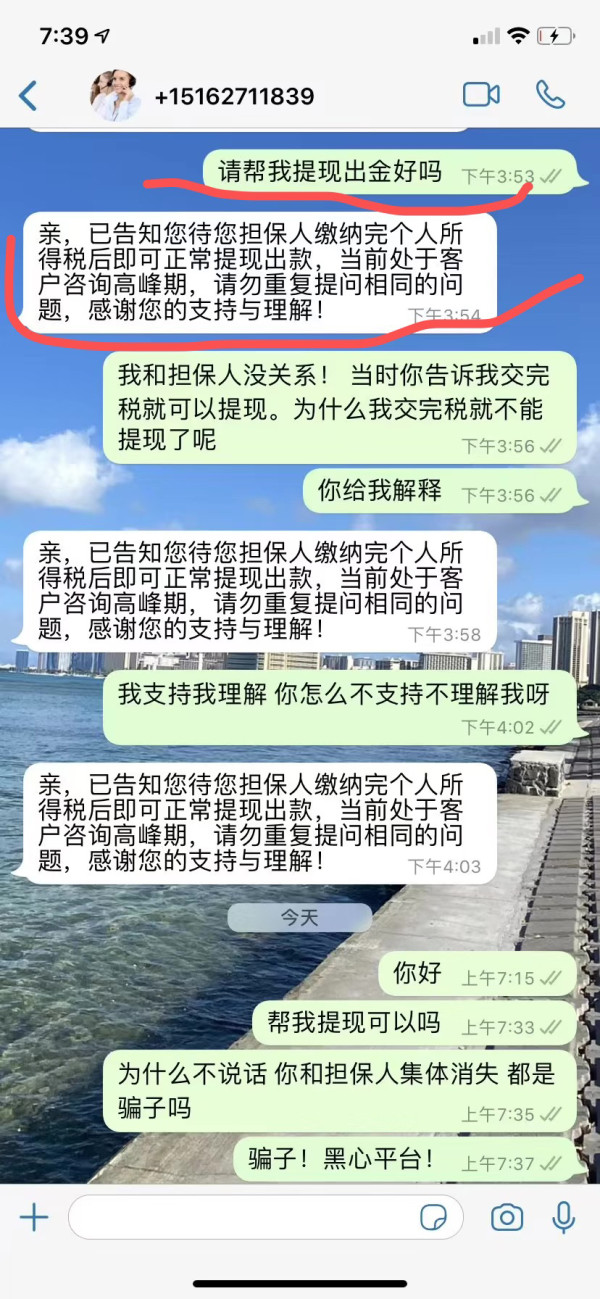

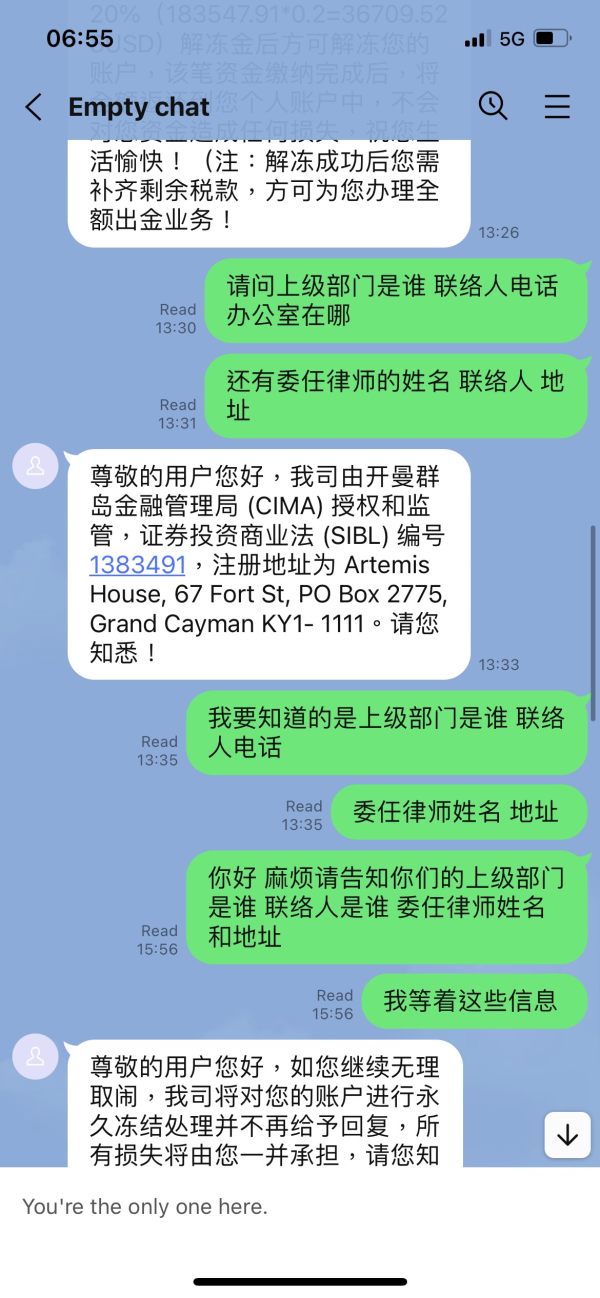

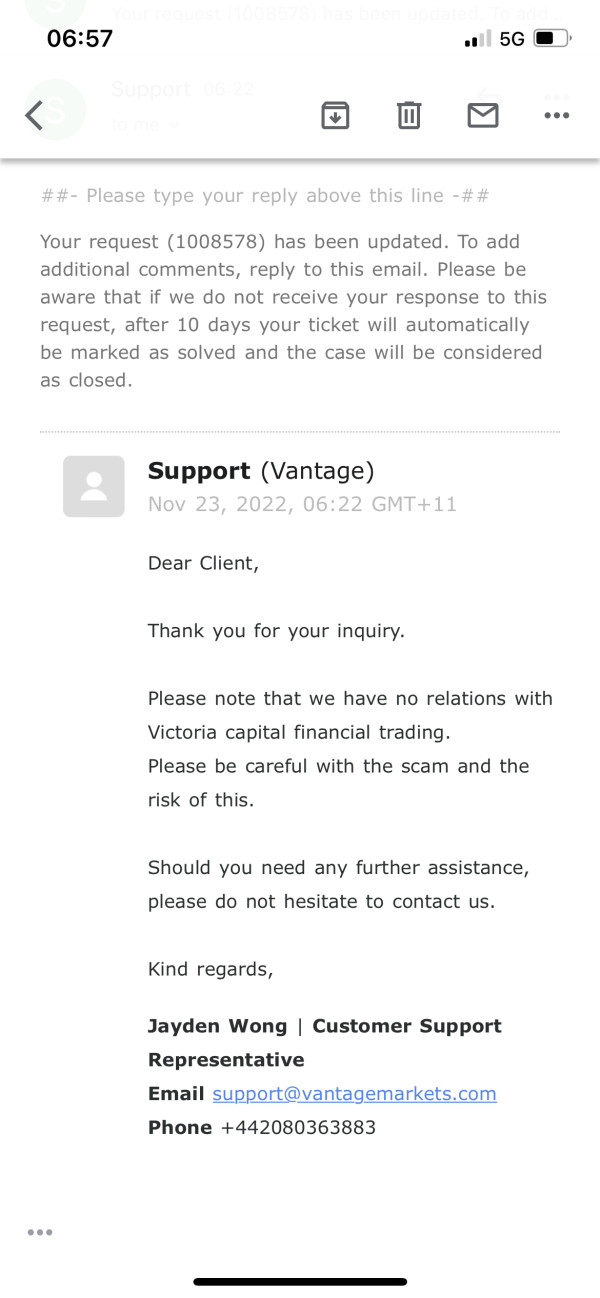

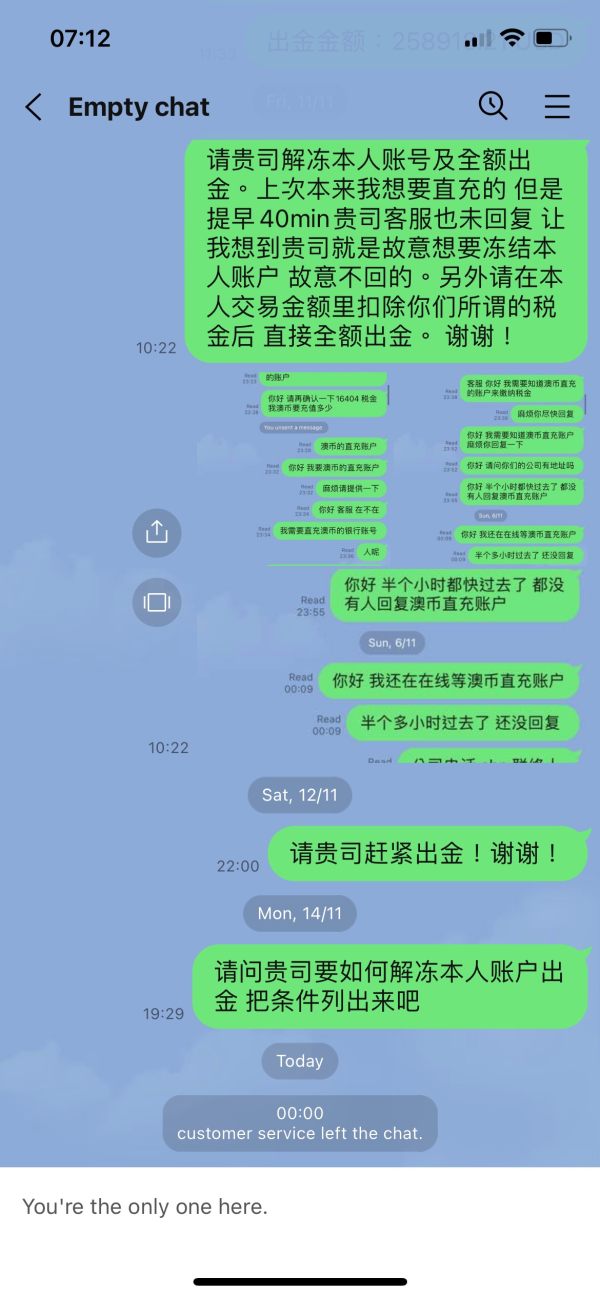

Customer service quality appears to be a significant weakness for Victoria Capital. This is evidenced by the substantial number of complaints filed against the broker. With 26 formal complaints registered in just three months, the broker demonstrates concerning patterns in client relationship management and support service delivery.

Effective customer support is crucial in forex trading, where technical issues, account problems, or market-related questions require prompt and knowledgeable responses. The high complaint volume suggests that Victoria Capital may lack adequate support infrastructure or properly trained personnel to handle client inquiries effectively.

Potential clients cannot assess whether the broker provides adequate assistance when problems arise without detailed information about support channels, response times, or service quality metrics. This uncertainty is particularly concerning given the documented history of user complaints.

The absence of clear communication about available support languages, operating hours, and contact methods further complicates the customer service picture. International traders need assurance that they can receive assistance in their preferred language during appropriate time zones.

Poor customer service can significantly impact trading experiences, particularly when urgent issues arise during active market periods. Traders who cannot quickly resolve technical problems or account issues may face financial losses, contributing to the negative feedback patterns observed with this broker.

Trading Experience Analysis

Evaluating Victoria Capital's trading experience proves challenging due to limited available information about platform performance, execution quality, and overall trading conditions. However, the substantial user complaint volume suggests that traders have encountered significant issues with their trading experiences.

Platform stability and execution speed are critical factors that directly impact trading profitability and user satisfaction. Traders cannot assess whether the broker provides reliable platform performance during various market conditions without comprehensive data about Victoria Capital's technological infrastructure.

Order execution quality, including slippage rates, requote frequency, and fill speeds, significantly affects trading outcomes. The absence of transparent performance metrics makes it impossible for potential clients to evaluate whether Victoria Capital can deliver competitive execution standards.

Mobile trading capabilities have become essential for modern forex traders who need market access while away from their computers. The lack of clear information about Victoria Capital's mobile trading solutions creates uncertainty about platform accessibility and functionality.

The high complaint volume may partly reflect trading experience issues, such as platform outages, execution problems, or unexpected trading restrictions. These technical and operational challenges can severely impact trader profitability and satisfaction levels.

This victoria capital review must emphasize that without reliable trading infrastructure and transparent performance metrics, traders face significant risks to their trading success and account security.

Trust and Safety Analysis

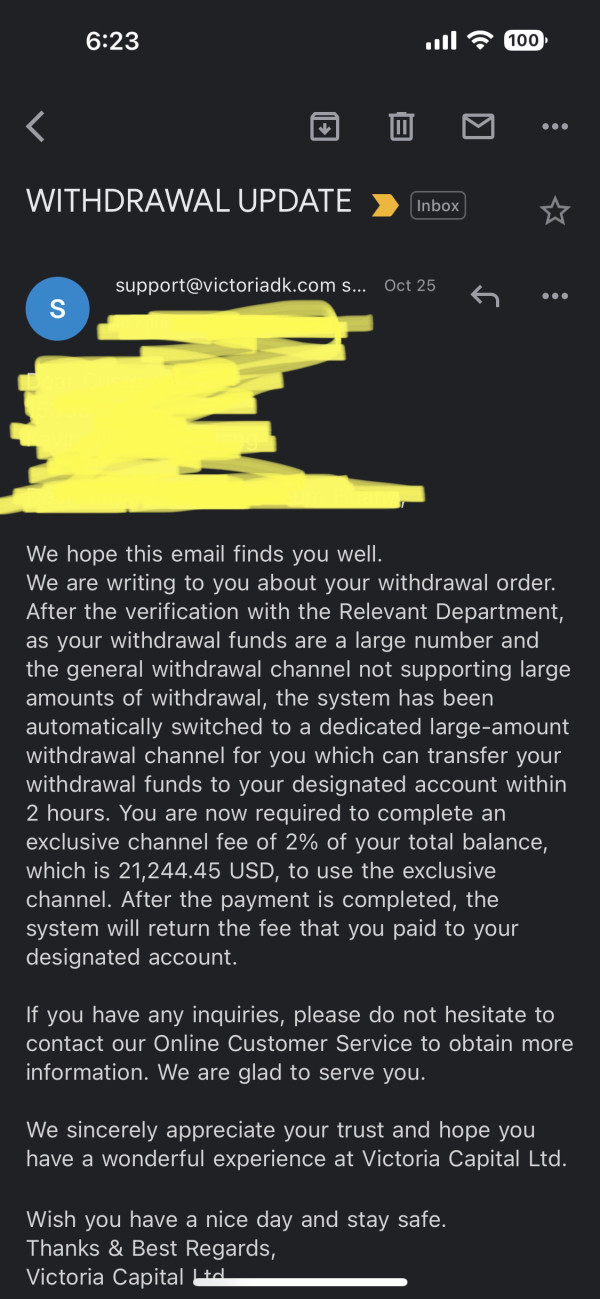

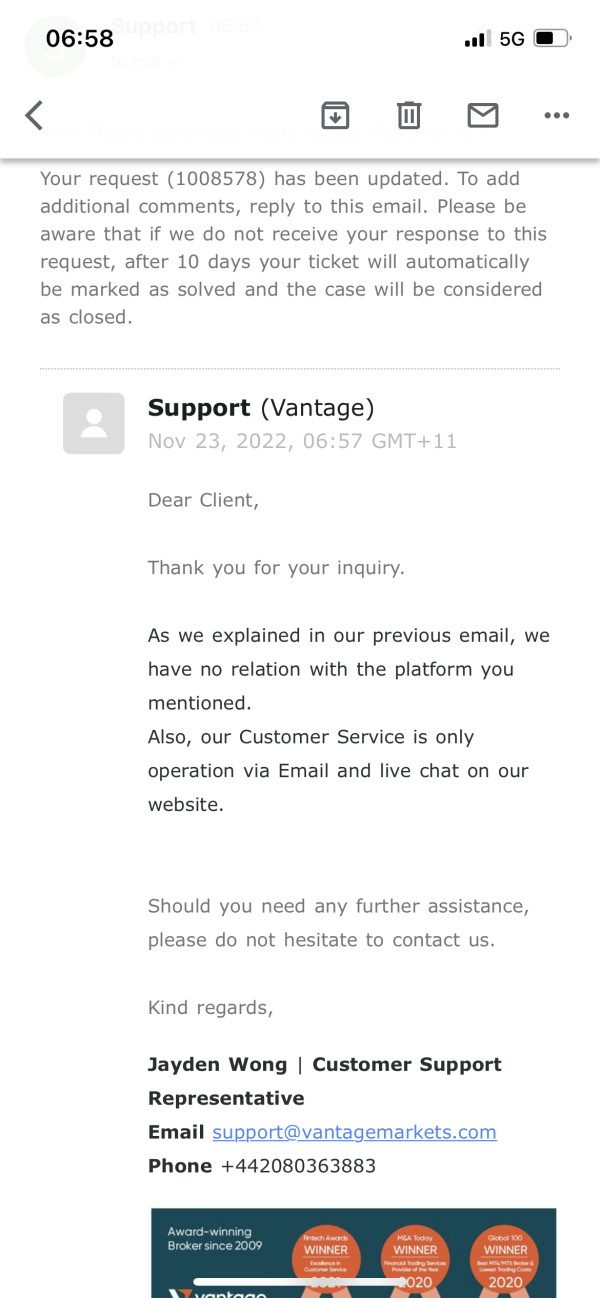

Trust and safety represent the most critical concerns in this victoria capital review. Victoria Capital receives extremely poor ratings across multiple assessment criteria. The broker's operation without valid regulatory oversight creates fundamental risks for client fund security and legal protection.

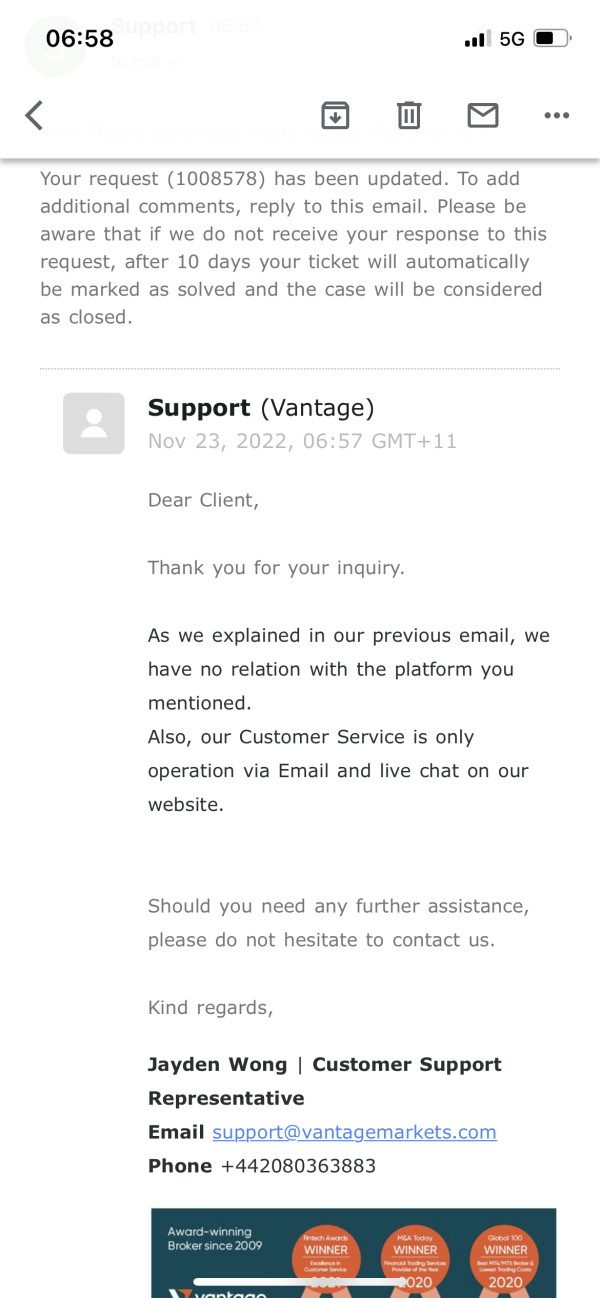

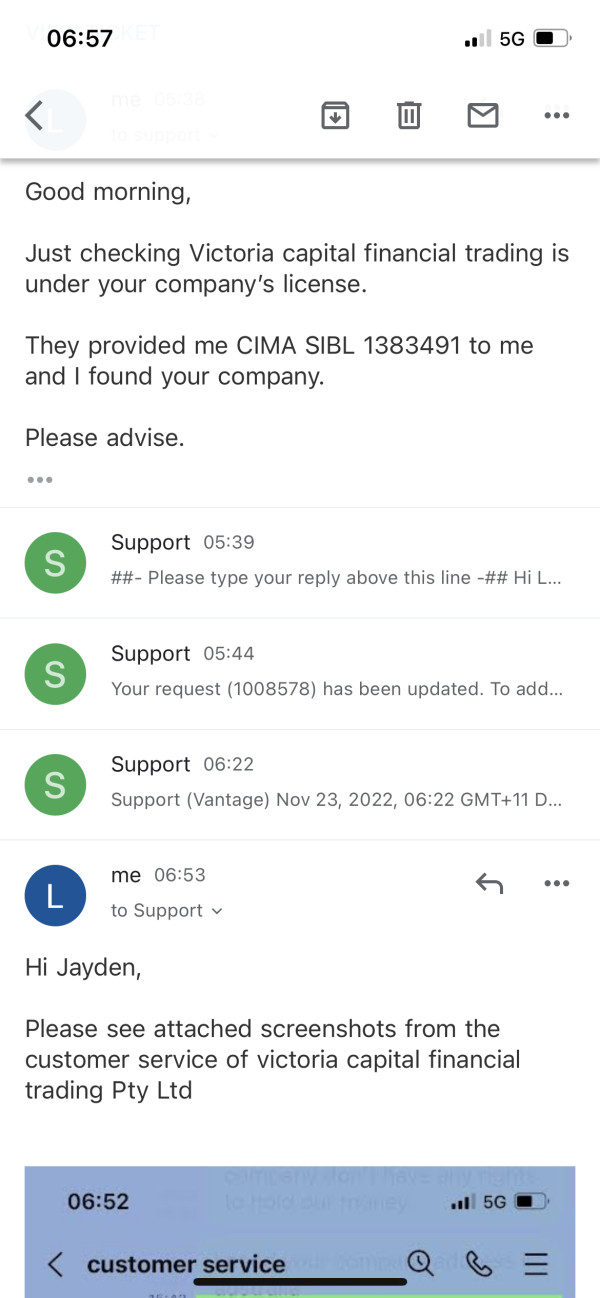

Regulatory authorization provides essential safeguards including segregated client funds, compensation schemes, and formal dispute resolution mechanisms. Victoria Capital's lack of proper regulation means traders have limited recourse if problems arise with their accounts or funds.

The WikiFX score of 1.40 out of 10 reflects serious deficiencies in operational standards, transparency, and client protection measures. This exceptionally low rating places Victoria Capital among the least trustworthy brokers in the industry, indicating substantial risks for potential clients.

The pattern of 26 complaints in just three months suggests systemic issues with the broker's operations, client treatment, or service delivery. This complaint frequency is particularly concerning given the broker's relatively recent establishment and presumably limited client base.

Clients cannot verify whether Victoria Capital maintains segregated client accounts, adequate capital reserves, or appropriate risk management procedures without proper regulatory oversight. These fundamental protections are essential for broker trustworthiness and client security.

The combination of regulatory gaps, poor industry ratings, and high complaint volumes creates a compelling case against trusting Victoria Capital with trading funds or personal financial information.

User Experience Analysis

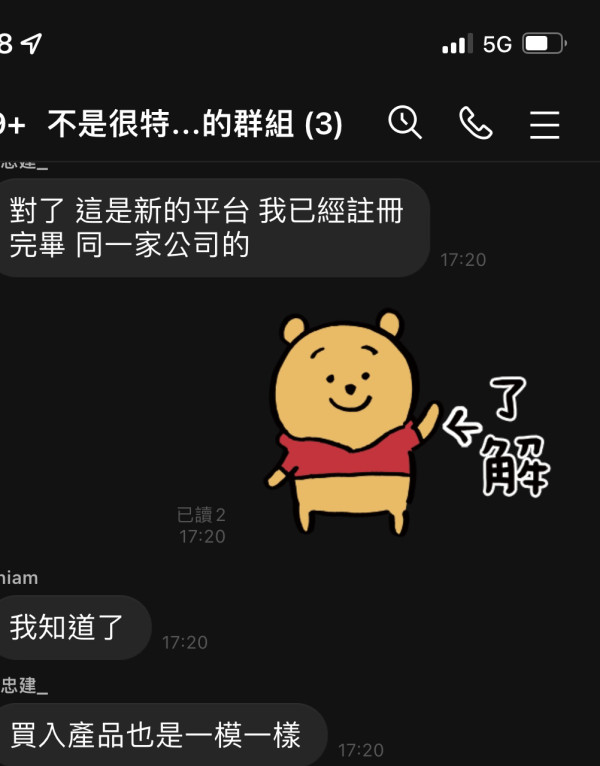

User experience with Victoria Capital appears significantly problematic. This is evidenced by the substantial complaint volume and poor industry ratings. The 26 complaints filed in three months suggest widespread dissatisfaction among the broker's client base, indicating systemic issues with service delivery.

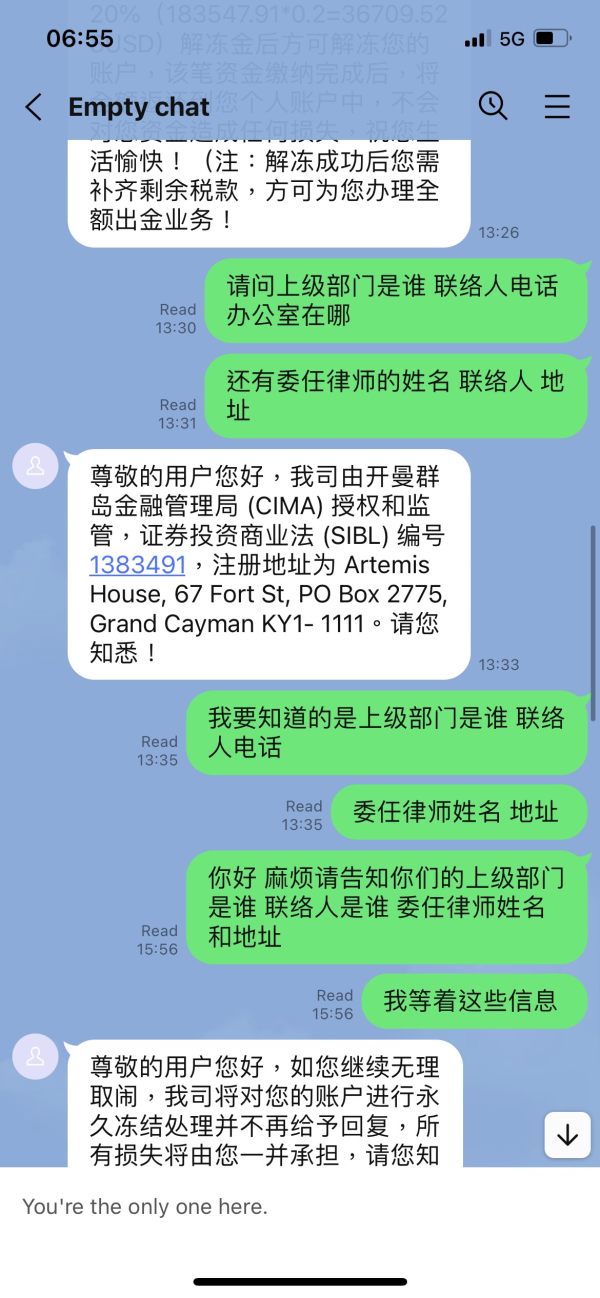

User feedback patterns typically reflect problems with account management, fund processing, platform functionality, or customer support responsiveness. The high complaint frequency suggests that Victoria Capital struggles across multiple operational areas that directly impact client satisfaction.

The broker's target demographic of forex traders seeking market access appears to be poorly served based on available feedback indicators. Traders require reliable platforms, transparent pricing, efficient fund processing, and responsive support - areas where Victoria Capital appears to underperform significantly.

Registration and account verification processes may contribute to user frustration if they are unclear, lengthy, or poorly communicated. The lack of transparent information about these procedures can create negative first impressions that set the tone for ongoing client relationships.

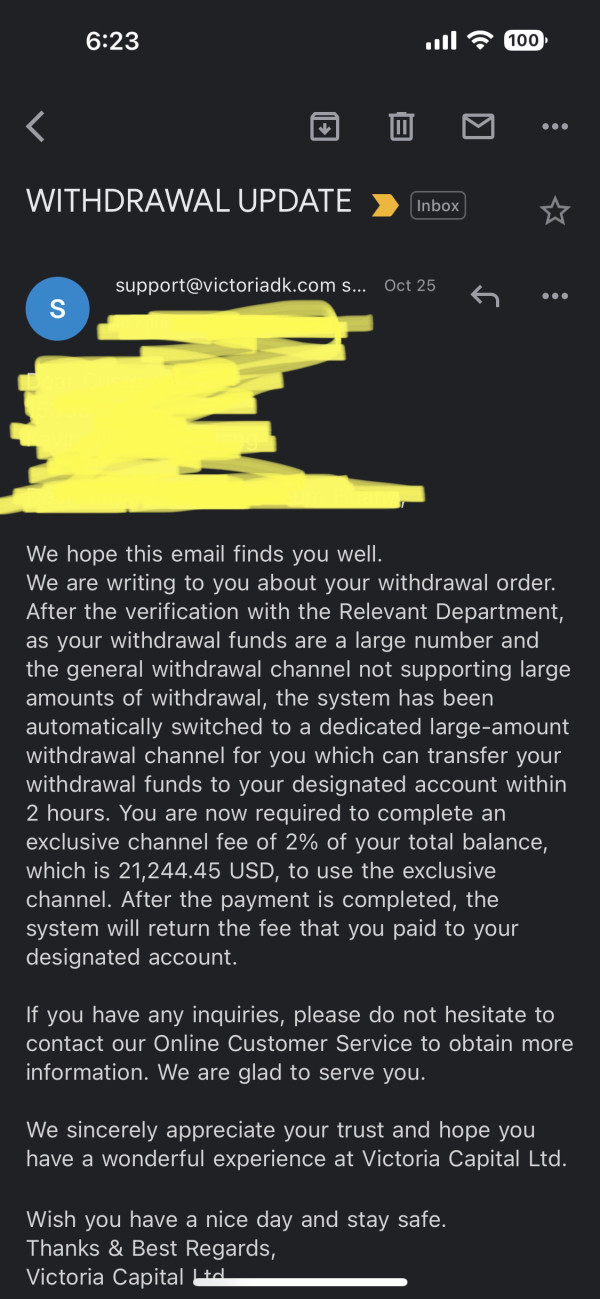

Fund management experiences, including deposit and withdrawal processes, often generate the most serious user complaints when they don't function smoothly. Problems with fund access can create significant stress and financial hardship for traders, potentially explaining some of the documented complaints.

The overall user experience picture suggests that Victoria Capital has fundamental operational challenges that prevent satisfactory service delivery to its client base.

Conclusion

This comprehensive victoria capital review reveals a broker that fails to meet basic industry standards for safety, transparency, and service quality. The combination of operating without valid regulation, receiving extremely poor industry ratings, and generating substantial user complaints creates a clear picture of a high-risk trading environment.

Victoria Capital is particularly unsuitable for risk-averse traders who prioritize capital safety and reliable service. The absence of regulatory protection means that traders have limited recourse if problems arise, while the documented complaint patterns suggest that issues are likely to occur.

The broker's main advantage appears to be its focus on forex trading services. However, this benefit is overshadowed by significant disadvantages including lack of regulatory oversight, poor transparency, high complaint volumes, and unclear operational standards. These factors combine to create an unacceptable risk profile for most retail traders seeking a reliable trading partner.