Triumph FX 2025 Review: Everything You Need to Know

Summary: Triumph FX, also known as TFXI, presents a mixed bag of reviews, with some users praising its trading conditions while others raise concerns about withdrawal issues and regulatory compliance. Key features include a low minimum deposit and the use of the popular MetaTrader 4 platform, yet its reputation is marred by allegations of being a potential scam, particularly in Asian markets.

Note: It is essential to understand that Triumph FX operates through different entities across regions, which can affect the level of regulatory protection and service quality. This review aims to provide a balanced overview based on various sources to ensure fairness and accuracy.

Ratings Overview

We rate brokers based on user feedback, regulatory standing, and overall service quality.

Broker Overview

Founded in 2009, Triumph FX operates as a brokerage firm offering trading services primarily in forex and precious metals. The broker utilizes the MetaTrader 4 platform, which is widely recognized for its robust features and user-friendly interface. Triumph FX is regulated by the Cyprus Securities and Exchange Commission (CySEC) and has additional oversight from the Financial Services Authority (FSA) of Seychelles. However, the broker's operations are also linked to a Vanuatu entity, which raises concerns about regulatory rigor and investor protection.

Detailed Analysis

Regulatory Geography

Triumph FX operates in different jurisdictions, primarily targeting clients in Europe and Asia. The CySEC regulation offers a layer of protection for European clients, while the FSA in Seychelles provides a more lenient regulatory environment. In contrast, the Vanuatu entity has faced scrutiny and had its license revoked, leading to concerns about its legitimacy and operational practices.

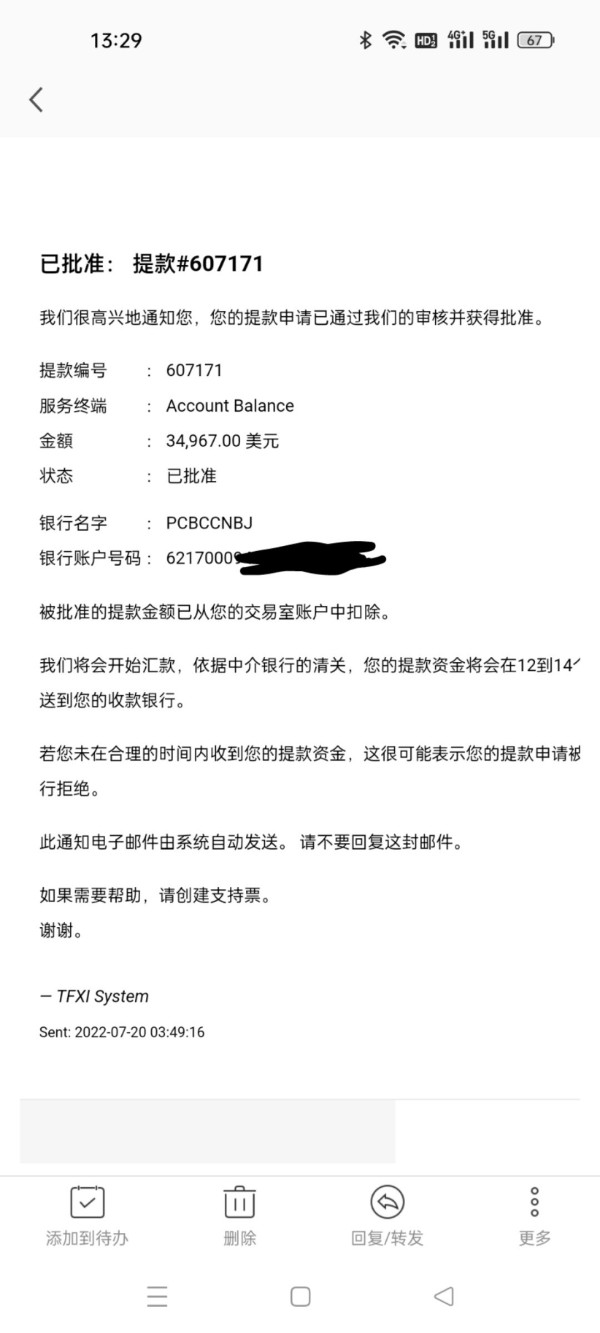

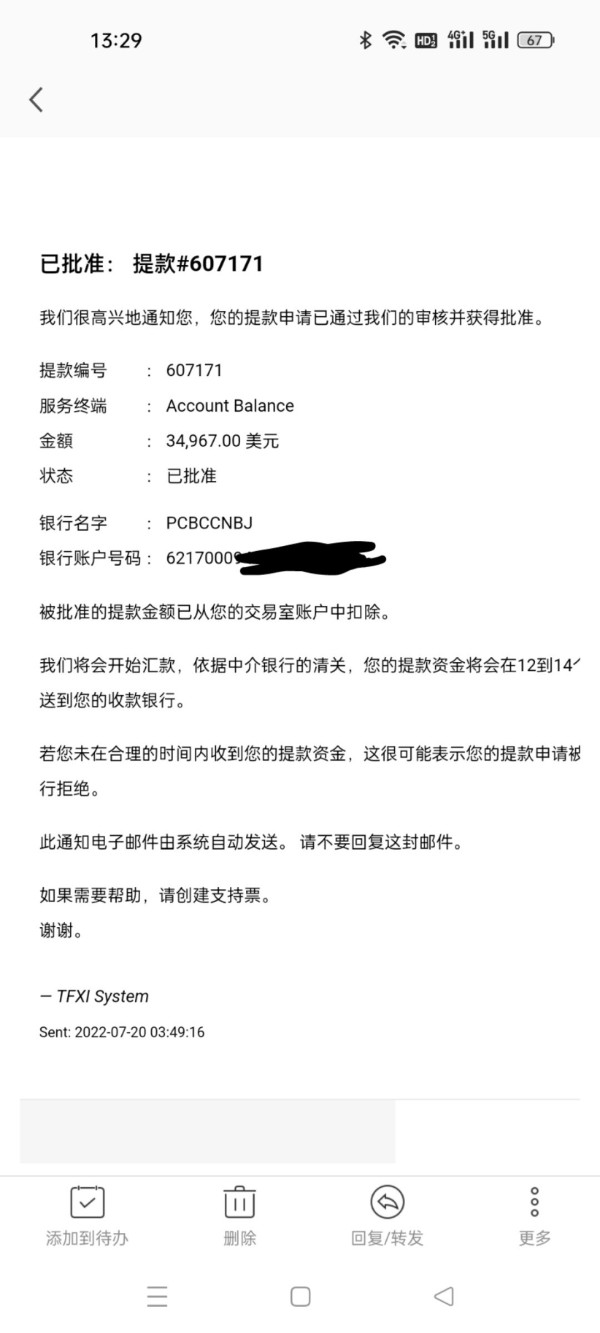

Deposit/Withdrawal Currencies

Triumph FX supports deposits and withdrawals in multiple currencies, including USD, EUR, and GBP. The broker accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets like Neteller and Skrill. However, withdrawal fees can be significant, with charges ranging from $25 to $75, depending on the method used, which has drawn criticism from users.

Minimum Deposit

The minimum deposit requirement for opening an account with Triumph FX is set at a competitive $100, making it accessible for beginner traders. However, higher-tier accounts require larger initial investments, which may limit options for some traders.

While Triumph FX does not offer extensive bonuses, it has introduced a 5% welcome bonus for new clients in its international division. However, this promotion is not available to clients in the EU, which limits its appeal.

Tradable Asset Classes

The broker provides access to over 60 currency pairs and a limited selection of precious metals, including gold and silver. However, the absence of stocks, commodities, or cryptocurrencies may deter traders seeking a more diverse trading portfolio.

Costs (Spreads, Fees, Commissions)

Triumph FX has relatively competitive spreads, starting from 1.6 pips on standard accounts and 0.5 pips on VIP accounts. However, users have reported inconsistencies in spread execution, particularly during volatile market conditions. Furthermore, the broker charges commissions on certain account types, which can add to trading costs.

Leverage

Triumph FX offers leverage up to 1:500 for professional clients, while retail clients are limited to 1:30 due to regulatory restrictions. This high leverage can amplify both potential gains and losses, necessitating prudent risk management.

The primary trading platform offered by Triumph FX is MetaTrader 4 (MT4), available on desktop and mobile devices. While MT4 is a well-established platform, some users have expressed a desire for more modern alternatives like MetaTrader 5 (MT5).

Restricted Regions

Triumph FX does not accept clients from several countries, including the United States, due to regulatory restrictions. Additionally, the broker has faced warnings from various Asian regulators, further complicating its reputation in those markets.

Available Customer Service Languages

Customer support at Triumph FX is somewhat limited, with services available primarily in English. The absence of a dedicated support system, such as live chat or a comprehensive FAQ section, has been a point of contention among users.

Repeated Ratings Overview

Detailed Breakdown

- Account Conditions (6.0): Triumph FX offers various account types with a low minimum deposit but lacks competitive features for standard accounts.

- Tools and Resources (4.0): Limited educational resources and market analysis tools hinder traders' ability to make informed decisions.

- Customer Service (3.0): Slow response times and limited support options have frustrated users, leading to negative experiences.

- Trading Experience (5.0): While the MT4 platform provides a solid trading experience, users have reported issues with spread execution and withdrawal processes.

- Trustworthiness (4.0): Regulatory concerns, particularly regarding its offshore operations, have raised questions about the broker's integrity.

- User Experience (5.0): Mixed reviews highlight both positive trading experiences and significant frustrations with customer support and withdrawal issues.

In conclusion, the Triumph FX review presents a broker with potential but also significant risks. While it offers accessible trading conditions and a popular platform, concerns about regulatory compliance, user experiences, and withdrawal issues necessitate careful consideration. Prospective traders should conduct thorough research and consider alternative brokers with stronger reputations and regulatory oversight.