Is Royal Tungsten safe?

Business

License

Is Royal Tungsten a Scam?

Introduction

Royal Tungsten is a forex broker that has recently garnered attention in the trading community. Positioned as a platform that offers a wide array of financial instruments, including forex, commodities, and cryptocurrencies, it claims to provide traders with competitive trading conditions and a user-friendly interface. However, the influx of negative reviews and allegations of fraudulent practices has raised significant concerns among potential investors. As such, traders must exercise caution and thoroughly evaluate the legitimacy of such brokers before committing their funds. This article aims to assess the safety and reliability of Royal Tungsten by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we utilized a comprehensive framework that includes a review of regulatory information, company history, customer feedback, and an evaluation of trading conditions. By synthesizing data from multiple sources, including user reviews and expert analyses, we aim to provide a balanced perspective on whether Royal Tungsten is safe or a potential scam.

Regulation and Legitimacy

One of the most critical aspects to consider when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Unfortunately, Royal Tungsten's regulatory standing is troubling. The broker claims to be licensed by the Australian Securities and Investments Commission (ASIC), but our research indicates that its license expired in October 2022, leaving it unregulated and devoid of any legitimate oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001296969 | Australia | Expired (October 2022) |

The absence of a valid regulatory license raises alarms about the safety of funds deposited with Royal Tungsten. The lack of oversight implies that traders have little recourse in the event of disputes or financial mismanagement. Moreover, the broker's claims of being regulated appear misleading, as they do not provide any verifiable evidence of compliance with regulatory standards. This lack of transparency is a significant red flag, leading to the conclusion that Royal Tungsten is not safe for traders.

Company Background Investigation

Royal Tungsten Limited, the entity behind the trading platform, claims to operate out of Melbourne, Australia. However, there is scant information available regarding its ownership structure and management team. The company was reportedly established in 2022, which raises questions about its experience and reliability in the highly competitive forex market.

The absence of publicly available information about the management team further exacerbates concerns regarding transparency. A reputable broker typically provides details about its executives, including their qualifications and industry experience. However, Royal Tungsten's website lacks this critical information, leaving potential investors in the dark about who is managing their funds.

Additionally, the company's operational history appears to be minimal, with many reviews indicating that it has not established a solid reputation within the trading community. The combination of a relatively new company, lack of transparency, and expired regulatory status suggests that Royal Tungsten is not safe for potential investors.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer, including fees, spreads, and overall cost structure. Royal Tungsten claims to provide competitive trading conditions, including low spreads and no commissions. However, numerous customer complaints indicate that the reality is far from this marketing rhetoric.

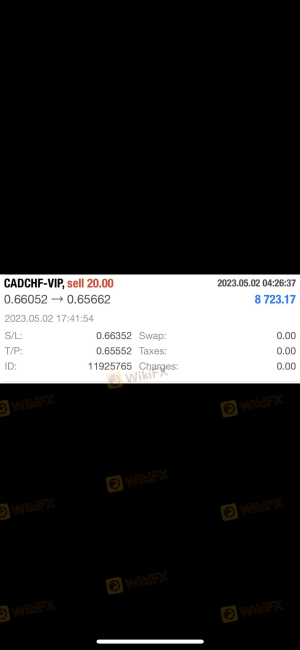

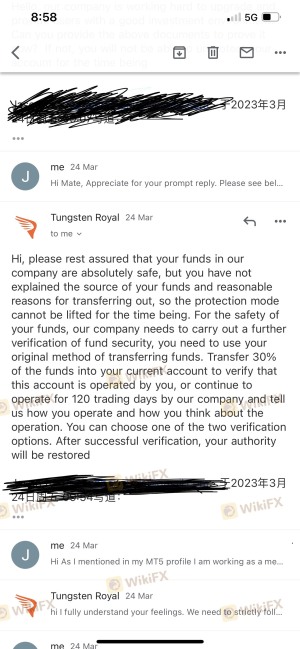

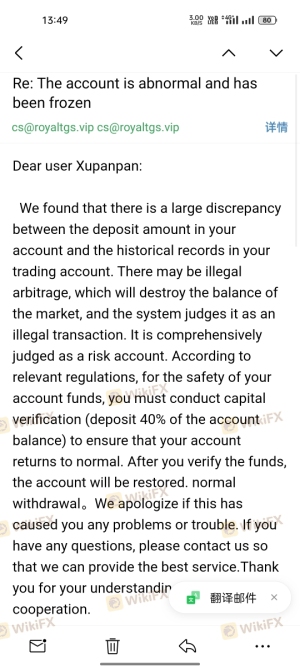

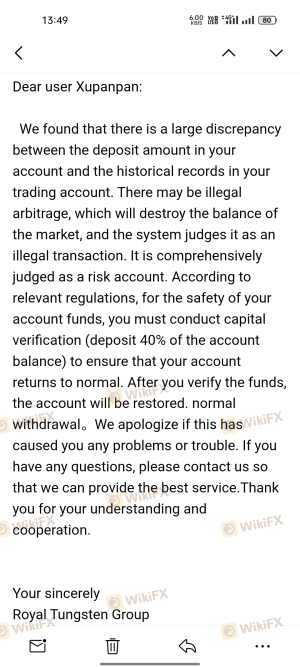

One of the most concerning aspects of Royal Tungsten's trading conditions is its withdrawal fees. Many users have reported being asked to pay exorbitant fees—ranging from 30% to 40%—before being allowed to withdraw their funds. This practice is not only unusual but also indicative of potential fraudulent behavior, as legitimate brokers typically do not impose such steep withdrawal fees.

| Fee Type | Royal Tungsten | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | Not disclosed | Typically 2-5% |

The above table illustrates the discrepancies between Royal Tungsten's advertised conditions and industry norms. The significant withdrawal fees and lack of transparency regarding overnight interest rates suggest that traders may face unexpected costs, further indicating that Royal Tungsten may not be safe for trading.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. A reputable broker typically employs robust security measures, such as segregated accounts and investor protection policies. Unfortunately, Royal Tungsten's lack of regulation means that it is not bound by any legal requirements to protect client funds.

There are no indications that Royal Tungsten uses segregated accounts to safeguard client deposits, which means that funds could potentially be misused or lost. Furthermore, the absence of investor protection policies raises concerns about the financial security of traders' investments. Historical complaints from users about difficulty withdrawing funds only amplify these concerns, leading to the conclusion that Royal Tungsten is not safe for investors looking to protect their capital.

Customer Experience and Complaints

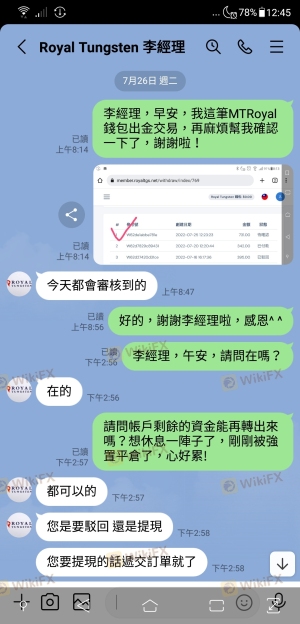

Customer feedback is a valuable tool in assessing a broker's reliability. Unfortunately, Royal Tungsten has received a plethora of negative reviews, with many users expressing frustration over their experiences. Common complaints include difficulty withdrawing funds, misleading information regarding fees, and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Fee Structures | Medium | Poor |

| Customer Support Responsiveness | High | Poor |

One notable case involved a user who attempted to withdraw funds only to be told they needed to pay a significant tax fee before processing their request. This pattern of requiring additional payments before allowing withdrawals is a common tactic employed by scam brokers, further reinforcing the notion that Royal Tungsten is not safe for traders.

Platform and Execution

The trading platform offered by Royal Tungsten is another critical aspect to consider. While the broker claims to provide a user-friendly interface, many users have reported issues with execution quality, including slippage and rejected orders. These problems can severely impact a trader's ability to execute strategies effectively, leading to potential losses.

Moreover, there are concerns about the platform's stability, with reports of frequent outages and maintenance issues. Such disruptions can hinder trading activities and result in missed opportunities, which is unacceptable for any serious trader. The combination of execution issues and possible platform manipulation raises further questions about whether Royal Tungsten is safe for trading.

Risk Assessment

Investing with Royal Tungsten comes with a host of risks that potential traders should be aware of. The lack of regulation, combined with numerous complaints about withdrawal difficulties and misleading fee structures, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No active regulation or oversight |

| Financial Risk | High | Potential loss of funds due to mismanagement |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, it is advisable for traders to conduct thorough research before investing with any broker. Additionally, diversifying investments and avoiding brokers with a history of complaints can help reduce the likelihood of financial loss.

Conclusion and Recommendations

In conclusion, the evidence suggests that Royal Tungsten is not safe for traders. The combination of an expired regulatory license, a lack of transparency, numerous customer complaints, and questionable trading conditions raises significant red flags. Potential investors should exercise extreme caution and consider alternative options.

For traders seeking reliable and regulated brokers, it is advisable to explore platforms with a solid reputation, transparent fee structures, and robust regulatory oversight. Brokers such as IG, OANDA, and Forex.com have established themselves as trustworthy options in the forex market. By prioritizing safety and reliability, traders can better protect their investments and achieve their trading goals.

Is Royal Tungsten a scam, or is it legit?

The latest exposure and evaluation content of Royal Tungsten brokers.

Royal Tungsten Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Royal Tungsten latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.