Executive Summary

Titan Capital Markets is a new forex broker in the trading world. This titan capital markets review shows a broker that gets attention, but not always for good reasons, with 644 reviews on Trustpilot and a low WikiFX rating of 1.41 out of 10.

The company started in 2021 and offers forex and CFD trading with over 30 currency pairs through its own Titan Webtrader platform. It targets investors who want forex and CFD trading, especially those looking for tight spreads and learning materials. But the rules and oversight around this broker are unclear, with no specific regulatory authorities or license numbers shown in public records.

The platform offers multiple forex pairs, educational resources to help traders learn, and claims to have competitive prices. User experiences are very different though, with some traders happy while others worry about the platform's safety and service quality. This mix of feedback, plus the lack of clear regulation, means traders should be very careful before choosing Titan Capital Markets.

Important Notice

Traders thinking about Titan Capital Markets should be extra careful about the broker's regulatory status. The regulatory information for this broker is unclear, with no specific authorities or license numbers available in public records.

This lack of clear oversight may create risks for traders, especially regarding fund protection and solving disputes. This review uses publicly available information and user feedback from sources like Trustpilot and WikiFX.

The trading experience and service quality may be very different from what we present here, and potential users should do their own research before investing. Market conditions, platform performance, and broker policies may change without notice, which could affect how accurate this assessment is over time.

Rating Framework

Broker Overview

Titan Capital Markets started trading in 2021. As a young brokerage firm, the company has not built the strong reputation that comes with more established brokers.

The company focuses on providing forex and CFD trading services to regular investors, targeting traders who want access to currency markets with competitive pricing. However, the broker's short history and limited public information about its structure raise questions about its stability and commitment to traders.

This titan capital markets review finds that while the broker tries to serve retail traders, its recent start means it lacks the track record that many experienced traders want when choosing a broker. Titan Capital Markets works mainly through its own Titan Webtrader platform, which is different from brokers that offer standard platforms like MetaTrader 4 or 5.

The broker focuses on forex trading with over 30 currency pairs, though the specific range of CFD instruments is less clear in available information. The lack of detailed regulatory information in public records is a major concern for traders who want regulatory oversight and fund protection.

Regulatory Status: Available information does not show specific regulatory authorities overseeing Titan Capital Markets operations, creating uncertainty about compliance standards and trader protection measures.

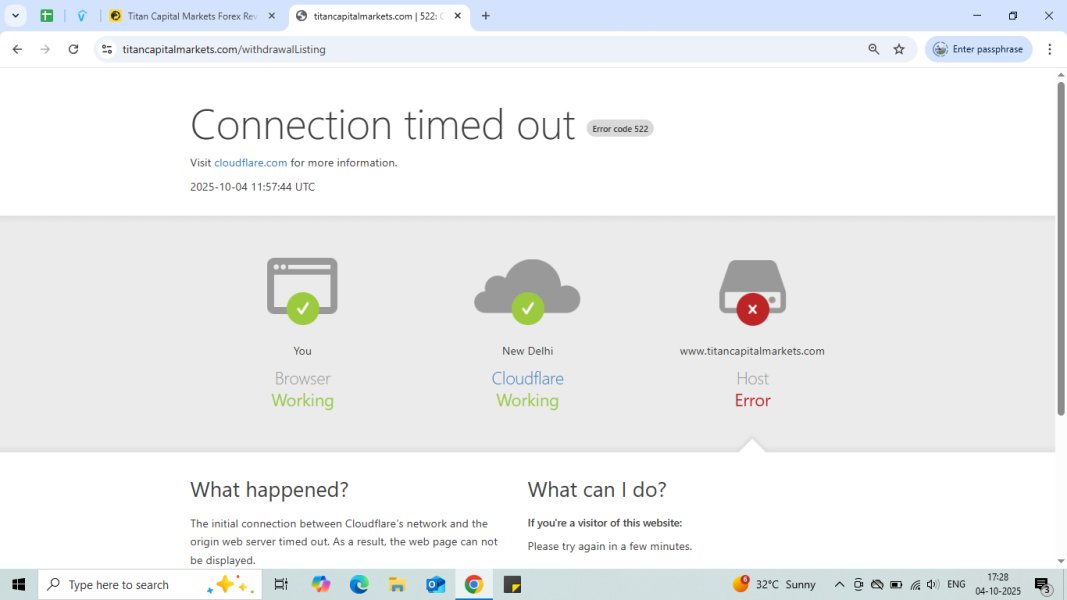

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and fees for deposits and withdrawals is not detailed in available documentation.

Minimum Deposit Requirements: The broker has not clearly stated minimum deposit amounts for different account types in publicly available information.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in current documentation.

Trading Assets: The platform provides access to more than 30 foreign exchange trading pairs, though the complete list of available instruments and CFD offerings requires direct verification with the broker.

Cost Structure: While Titan Capital Markets claims to offer competitive spreads and low commission rates, specific data about spreads, overnight fees, and commission structures is not provided in available materials. This titan capital markets review notes that traders should request detailed pricing information directly from the broker.

Leverage Ratios: Information about maximum leverage levels available to traders is not specified in current documentation.

Platform Options: The broker only offers its own Titan Webtrader platform, without access to industry-standard trading platforms.

Geographic Restrictions: Specific information about regional limitations or restricted territories is not detailed in available sources.

Customer Support Languages: The range of languages supported by customer service teams is not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Titan Capital Markets has major information gaps about account structure and conditions. The broker has not provided clear details about different account types, their features, or the specific benefits of each tier.

This lack of transparency makes it hard for potential traders to understand what they can expect from their trading relationship with the platform. The absence of specific minimum deposit information is a major concern for traders who need to plan their initial investment.

Most reputable brokers clearly outline their deposit requirements across different account types, allowing traders to select options that match their financial capabilities. The account opening process details are similarly unclear, leaving potential clients uncertain about verification requirements, documentation needs, and approval timeframes.

Special account features that many traders consider essential, such as Islamic accounts for Shariah-compliant trading, are not mentioned in available documentation. This titan capital markets review finds that the broker's approach to account information disclosure falls short of industry standards, where comprehensive account details are typically provided upfront to help informed decision-making.

User feedback about account conditions is notably sparse, suggesting that either few traders have opened accounts or that account-related experiences are not generating much discussion. When compared to established brokers that provide detailed account comparison charts, fee schedules, and clear terms of service, Titan Capital Markets' approach appears inadequate for serious traders who require comprehensive information before committing funds.

The trading tools and resources offered by Titan Capital Markets center around their own Titan Webtrader platform. While having a custom-built platform can allow for unique features and tailored functionality, it also means traders cannot access the familiar interfaces and advanced tools available through industry-standard platforms like MetaTrader 4 or 5, which many experienced traders prefer.

Educational resources appear to be a focus area for the broker, with materials designed to support trader skill development. However, the depth, quality, and comprehensiveness of these educational offerings are not detailed in available information.

Effective educational resources typically include market analysis, trading tutorials, webinars, and comprehensive guides covering both basic and advanced trading concepts. The absence of information about research and analysis tools represents a significant gap in the broker's offering.

Professional traders typically require access to market research, technical analysis tools, economic calendars, and real-time market data to make informed trading decisions. Without clear information about these capabilities, traders cannot assess whether the platform meets their analytical needs.

Automated trading support, including Expert Advisors or algorithmic trading capabilities, is not mentioned in available documentation. This limitation could significantly impact traders who rely on automated strategies or those who wish to implement systematic trading approaches.

The platform's technical capabilities regarding charting tools, indicators, and analysis features remain unclear, making it difficult for traders to evaluate whether the tools meet their technical analysis requirements.

Customer Service and Support Analysis (Score: 5/10)

Customer service quality emerges as a significant concern based on available user feedback. Notable negative reviews affect the overall perception of Titan Capital Markets' support capabilities.

The presence of negative feedback in user reviews suggests that some clients have experienced difficulties with customer service interactions, though specific details about response times, issue resolution effectiveness, and support quality vary among user reports. The availability of customer service channels is not clearly documented, leaving uncertainty about whether clients can access support through multiple communication methods such as live chat, telephone, email, or ticket systems.

Response time expectations are similarly unclear, which is problematic since timely support is crucial in the fast-paced trading environment where technical issues or account problems can impact trading opportunities. Service quality consistency appears to be an issue based on the mixed nature of user feedback.

While some users may have satisfactory experiences, the presence of negative reviews suggests that service levels may be inconsistent or that certain types of issues are not being resolved effectively. This variability in service quality can create uncertainty for traders who need reliable support.

Multilingual support capabilities are not specified in available documentation, which could limit accessibility for international traders who prefer to communicate in their native languages. The absence of clear information about customer service hours, regional support availability, and escalation procedures further complicates the assessment of the broker's commitment to customer support excellence.

Trading Experience Analysis (Score: 5/10)

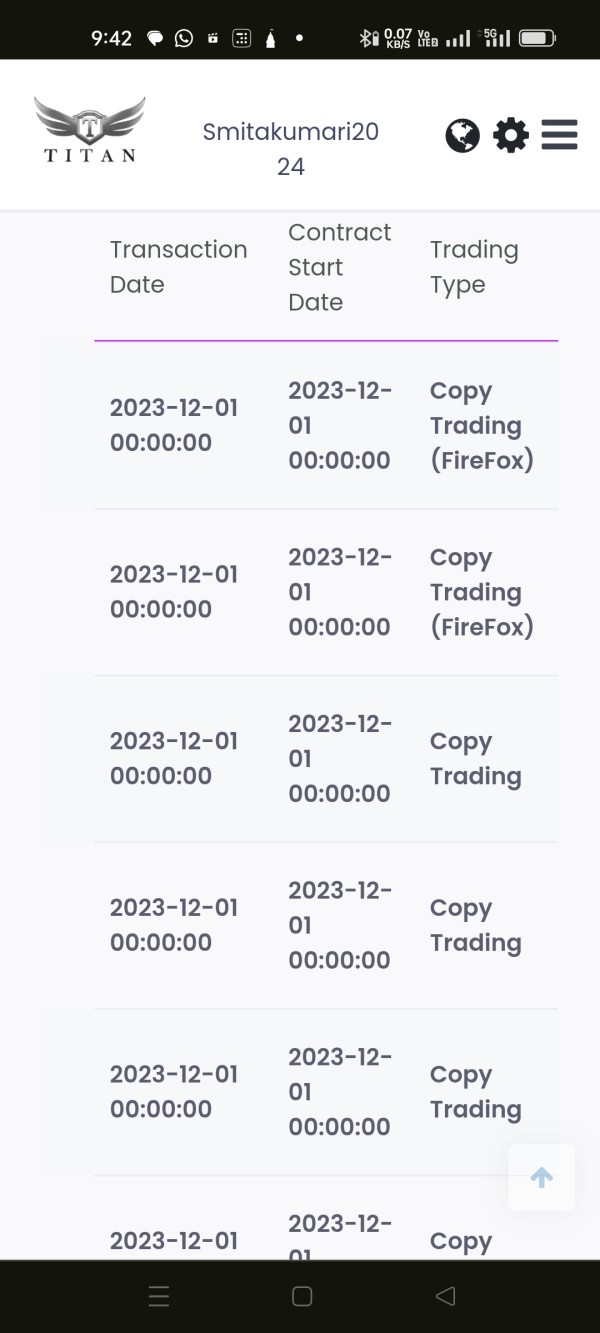

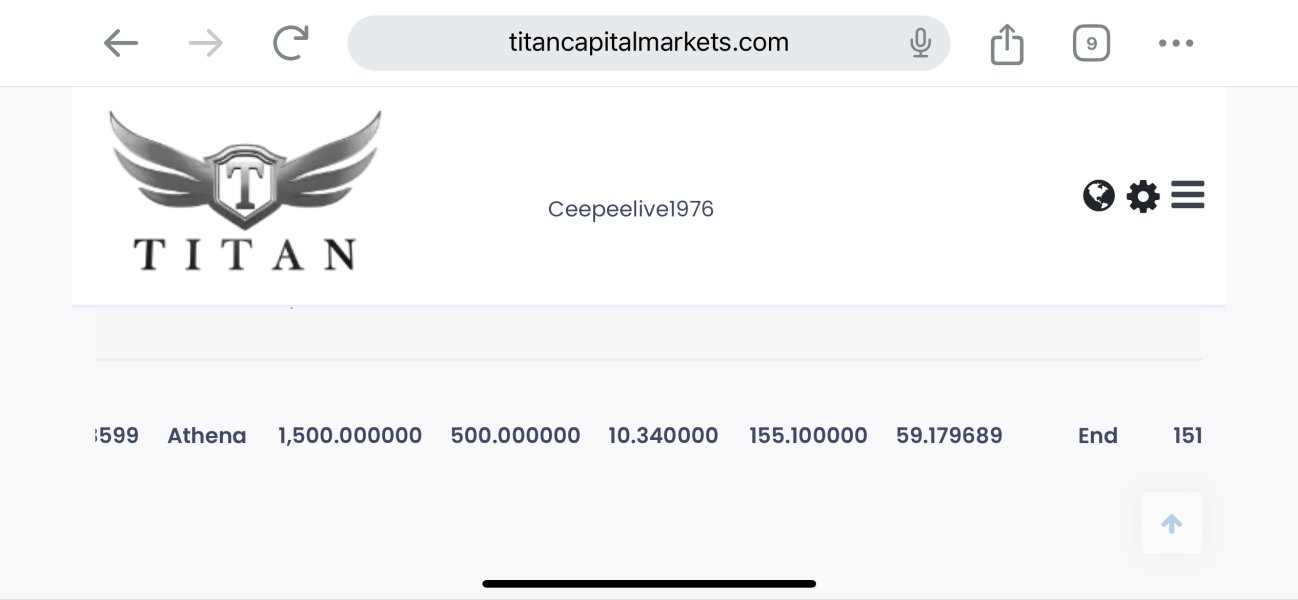

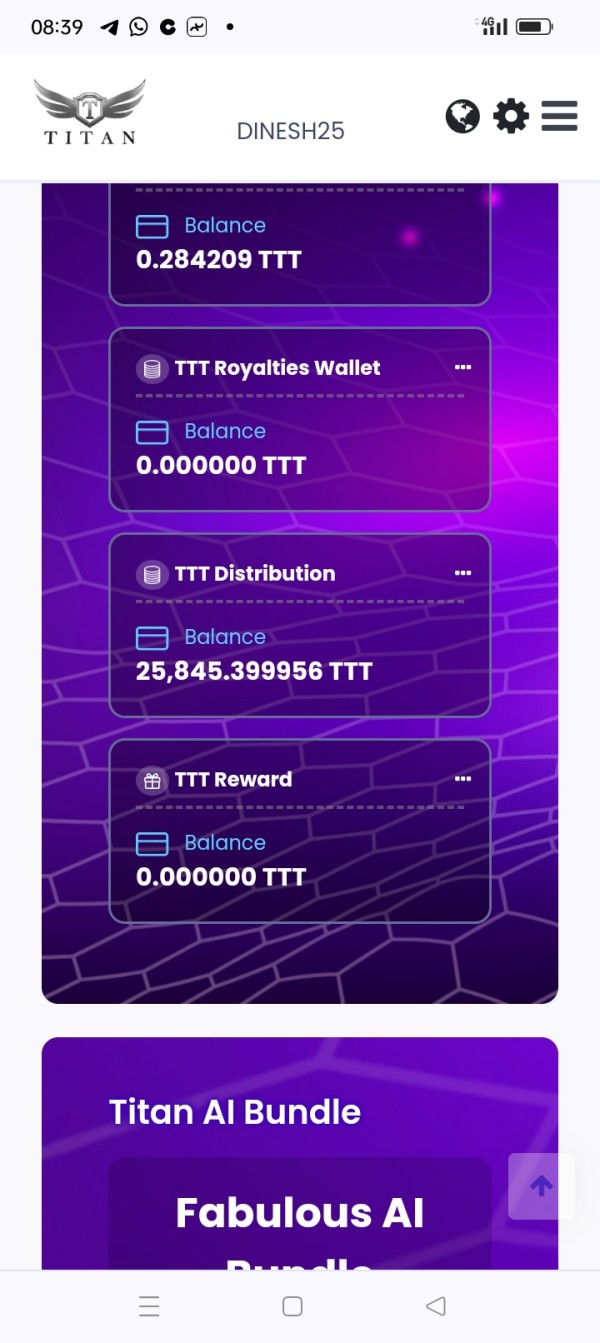

The trading experience provided by Titan Capital Markets presents mixed signals based on available user feedback and platform information. User satisfaction with the platform's performance appears inconsistent, with some traders expressing concerns about various aspects of their trading experience.

The proprietary Titan Webtrader platform's stability and performance characteristics are not well-documented, creating uncertainty about its reliability during different market conditions. Order execution quality represents a critical component of trading experience, yet specific information about execution speeds, slippage rates, and fill quality is not provided in available documentation.

Some user feedback suggests concerns about trading execution, though detailed analysis of execution statistics or independent performance testing results are not available to verify these claims. Platform functionality completeness cannot be thoroughly assessed due to limited information about the Titan Webtrader's features, tools, and capabilities.

Traders typically require comprehensive charting tools, multiple order types, risk management features, and real-time market data access. Without detailed platform specifications, potential users cannot determine whether the platform meets their trading requirements.

Mobile trading experience details are not provided in available information, which is significant since many modern traders require robust mobile trading capabilities. The absence of information about mobile app availability, features, and performance limits traders' ability to assess whether they can effectively manage their positions while away from desktop computers.

This titan capital markets review notes that trading environment factors such as spread stability, liquidity provision, and market depth are not adequately documented for proper evaluation.

Trust and Safety Analysis (Score: 3/10)

Trust and safety concerns represent the most significant challenges facing Titan Capital Markets. Multiple factors contribute to a low confidence rating.

The absence of clear regulatory authority information and specific license numbers creates substantial uncertainty about the broker's compliance with financial services regulations. Regulatory oversight provides essential protections for traders, including fund segregation requirements, dispute resolution mechanisms, and operational standards.

The WikiFX rating of 1.41 out of 10 represents a severe red flag for potential traders, as this rating suggests significant concerns about the broker's operations, reliability, or legitimacy. WikiFX ratings are based on various factors including regulatory status, user feedback, and operational analysis, and such a low score indicates substantial issues that traders should carefully consider.

User warnings about potential fraudulent activity represent perhaps the most concerning aspect of the trust assessment. When traders publicly warn others about possible scam activities, it indicates serious problems with the broker's operations or business practices.

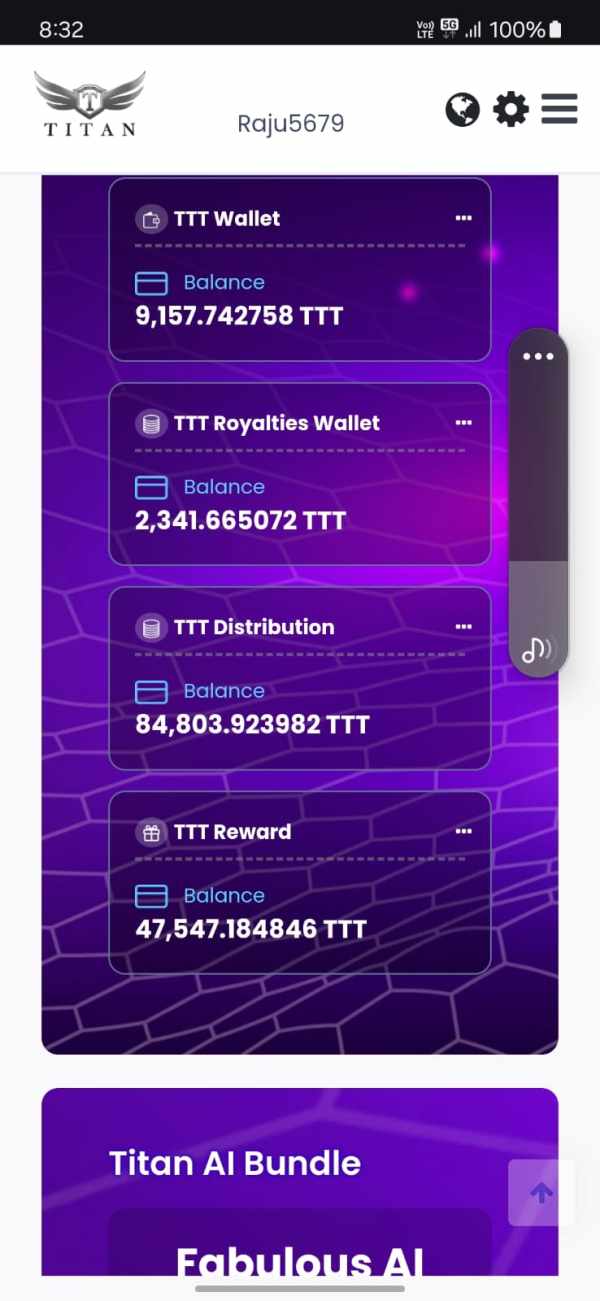

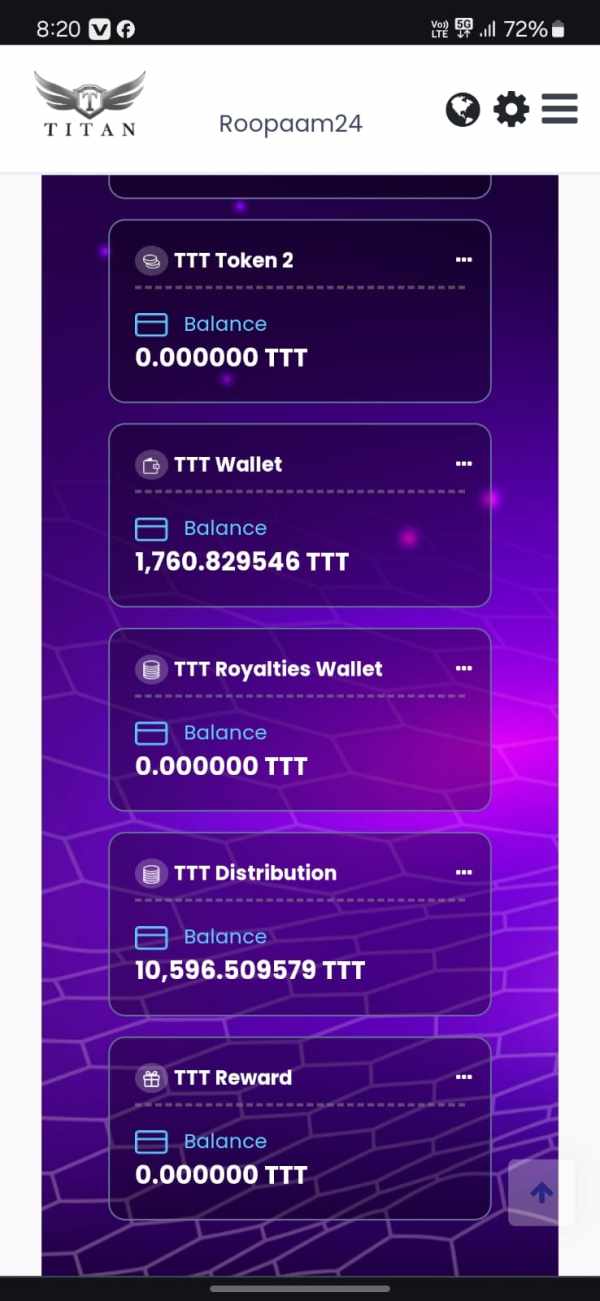

These warnings should be taken seriously by anyone considering engaging with the platform. Fund security measures are not clearly documented, leaving uncertainty about how client funds are protected, whether they are segregated from company operating funds, and what insurance or compensation schemes might protect traders in case of broker insolvency.

The lack of transparent information about corporate structure, financial reporting, and management team further compounds trust concerns.

User Experience Analysis (Score: 4/10)

User experience assessment reveals significant disparities in trader satisfaction. Feedback ranges from neutral to highly negative.

The variation in user reviews suggests that experiences with Titan Capital Markets may depend on specific circumstances, trading styles, or individual interactions with the platform. However, the presence of multiple cautionary recommendations from users indicates systemic issues that affect user satisfaction.

Interface design and usability information for the Titan Webtrader platform is not detailed in available documentation, making it difficult to assess whether the platform provides an intuitive and efficient trading environment. User interface quality significantly impacts trading effectiveness, particularly for active traders who require quick access to positions, market information, and trading tools.

Registration and account verification processes are not clearly outlined, creating uncertainty about onboarding experience quality and timeframes. Efficient account opening procedures are essential for positive initial user experiences, and unclear processes can create frustration and delays for new clients.

Fund operation experiences, including deposit and withdrawal processes, are not well-documented in user feedback or broker information. The efficiency, reliability, and cost-effectiveness of money movement processes significantly impact overall user satisfaction.

Common user complaints appear to focus on customer service interactions and trading experience issues, suggesting that the broker may need to address fundamental operational aspects to improve user satisfaction. The recommendation from some users to exercise caution when investing indicates serious concerns about the platform's reliability and safety for retail traders.

Conclusion

This comprehensive titan capital markets review reveals a broker that presents significant challenges and concerns for potential traders. While Titan Capital Markets offers access to over 30 forex trading pairs and provides educational resources, these positive aspects are overshadowed by substantial issues including unclear regulatory status, poor WikiFX ratings, and mixed user feedback that includes serious warnings about the platform's legitimacy.

The broker may appeal to traders seeking educational resources and claimed competitive pricing, but the lack of transparent regulatory oversight and the presence of user fraud warnings make it unsuitable for traders who prioritize safety and reliability. The absence of detailed information about account conditions, trading costs, and platform capabilities further complicates the decision-making process for potential clients.

Given the low trust ratings, regulatory uncertainty, and negative user feedback, this review recommends extreme caution for anyone considering Titan Capital Markets. Traders would be better served by selecting established, well-regulated brokers with transparent operations and positive user track records.