Is VICTORIA CAPITAL safe?

Pros

Cons

Is Victoria Capital Safe or Scam?

Introduction

Victoria Capital is an online forex broker that claims to offer a variety of trading instruments, including forex, commodities, indices, and stocks. As the forex market continues to grow, the number of brokers available to traders has also increased, making it essential for potential investors to carefully evaluate the legitimacy and safety of any trading platform they consider. This article aims to provide an objective analysis of Victoria Capital, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on various sources, including reviews, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. Victoria Capital claims to be based in Australia and operates under the name Victoria Capital Financial Trading Pty Ltd. However, its regulatory status raises significant concerns. According to multiple sources, including WikiFX and BrokersView, Victoria Capital lacks valid regulation, with its previous Australian Financial Services (AFS) license having been revoked. This absence of oversight poses a substantial risk to traders, as unregulated brokers may engage in fraudulent practices without accountability.

| Regulating Authority | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| ASIC | 001298100 | Australia | Revoked |

The lack of a valid regulatory framework means that traders have little to no legal recourse in case of disputes or issues with fund withdrawals. The quality of regulation is vital for ensuring that brokers adhere to strict operational standards and protect client funds. Victoria Capital's history of regulatory non-compliance further exacerbates concerns about its legitimacy and reliability.

Company Background Investigation

Victoria Capital's company history is shrouded in ambiguity. The broker claims to have been established in Australia, but there are no verifiable records to support this assertion. The ownership structure is unclear, and the management team lacks transparency, with no detailed information available about their professional backgrounds or experience in the financial industry. This lack of transparency raises red flags regarding the broker's credibility and trustworthiness.

Additionally, the company has faced numerous complaints from users, with many alleging difficulties in withdrawing their funds. This pattern of behavior is often characteristic of fraudulent brokers, who may change their names or operational details to evade scrutiny. The absence of clear information about the company's operations and the lack of accountability further contribute to the skepticism surrounding Victoria Capital.

Trading Conditions Analysis

When evaluating whether Victoria Capital is safe, it's essential to consider its trading conditions. The broker offers a minimum deposit requirement of $250, which is relatively standard in the industry. However, the overall fee structure and trading costs remain unclear, with many users reporting unexpected charges and a lack of transparency regarding spreads and commissions.

| Fee Type | Victoria Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The absence of specific fee information is concerning, as it can lead to unexpected costs for traders. Moreover, the lack of clarity regarding trading conditions can be indicative of a broker that does not prioritize transparency or fair practices. Traders should be cautious when engaging with platforms that do not provide detailed information about their trading conditions.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Victoria Capital's approach to fund security raises significant issues. Reports indicate that the broker does not segregate client funds, which means that traders' money may not be protected in the event of the broker's insolvency. Furthermore, there is no indication of investor protection measures, such as insurance for deposits, which is a standard practice among regulated brokers.

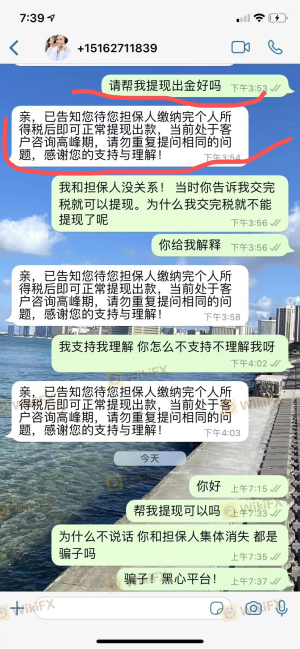

The broker's history of complaints regarding fund withdrawals is alarming. Many users have reported being unable to access their funds, often citing unreasonable withdrawal conditions or being asked to pay additional fees before they can withdraw their money. This pattern of behavior is a strong indicator that Victoria Capital may not prioritize the safety of its clients' funds.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing whether Victoria Capital is safe. Numerous complaints have surfaced, with users expressing frustration over withdrawal issues and lack of responsive customer support. The broker has received a significant number of negative reviews, indicating a pattern of dissatisfaction among its clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | Poor |

Common complaints include difficulties in withdrawing funds, slow response times from customer service, and a lack of transparency regarding fees and trading conditions. In many cases, users have reported that their accounts were frozen or that they were unable to communicate effectively with the broker. These issues highlight the potential risks associated with trading through Victoria Capital.

Platform and Trade Execution

The trading platform provided by Victoria Capital is reportedly based on the popular MetaTrader 5 (MT5) software, known for its reliability and advanced features. However, user experiences with the platform have been mixed, with some traders reporting issues related to order execution, including slippage and rejected orders.

While MT5 is generally considered a robust platform, the lack of oversight and potential manipulation of trading conditions by the broker raises concerns about the integrity of the trading environment. Traders should be cautious and consider the possibility of platform-related issues when assessing whether Victoria Capital is safe.

Risk Assessment

Engaging with Victoria Capital presents several risks that potential traders should be aware of. The absence of regulation, combined with numerous complaints and issues related to fund withdrawals, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Support Risk | Medium | Poor response times and support issues |

To mitigate these risks, traders are advised to conduct thorough research, avoid depositing large sums of money, and consider using regulated brokers with a proven track record of customer satisfaction and fund safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that Victoria Capital exhibits several red flags that indicate it may not be a safe trading environment. The lack of valid regulation, numerous complaints regarding fund withdrawals, and poor customer support raise significant concerns about the broker's legitimacy and reliability.

Traders should exercise caution when considering engagement with Victoria Capital and explore alternative options that offer better regulatory oversight and customer satisfaction. Recommended alternatives include established brokers that are regulated by reputable authorities, ensuring a safer trading experience.

Ultimately, the question of "Is Victoria Capital safe?" leans towards a negative response, and potential investors should prioritize their financial security by choosing regulated and trustworthy trading platforms.

Is VICTORIA CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of VICTORIA CAPITAL brokers.

VICTORIA CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VICTORIA CAPITAL latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.