Is Titan Capital Markets safe?

Pros

Cons

Is Titan Capital Markets A Scam?

Introduction

Titan Capital Markets is a relatively new player in the forex trading industry, having been established in 2021. It positions itself as a broker offering various trading services, including forex and CFDs, through its proprietary platform. Given the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The forex market is rife with potential risks, including scams and unregulated brokers, which can lead to significant financial losses. Therefore, a thorough evaluation of Titan Capital Markets is essential to determine its legitimacy and reliability. This article employs a comprehensive investigative approach, analyzing regulatory compliance, company background, trading conditions, client experiences, and overall risk factors associated with Titan Capital Markets.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical aspect that can significantly affect a trader's experience and security. Titan Capital Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, many sources indicate that the broker's ASIC license has been revoked and that it operates outside the scope of its regulatory permissions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 089 386 569 | Australia | Revoked |

| FINTRAC | M22889075 | Canada | Active |

The quality of regulation is paramount, as it ensures that brokers adhere to stringent guidelines aimed at protecting traders. ASIC is known for its rigorous enforcement of regulations, while FINTRAC primarily focuses on anti-money laundering efforts. However, the revocation of Titan Capital Markets' ASIC license raises serious concerns about its operational legitimacy. Furthermore, the lack of transparency regarding its current regulatory status suggests that potential clients should approach this broker with caution.

Company Background Investigation

Titan Capital Markets was founded in 2021 and claims to be based in Australia. However, its ownership structure and management team remain somewhat opaque, with limited publicly available information. The lack of transparency concerning the company's history and the absence of a well-defined management team raises red flags. Effective management and a clear ownership structure are crucial for building trust in a brokerage firm.

The broker's website provides minimal insights into its operational history or the qualifications of its leadership, which could indicate a lack of professionalism or experience in the financial services sector. Furthermore, the absence of information about its financial backing or partnerships with reputable financial institutions may contribute to skepticism regarding its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by Titan Capital Markets is essential for evaluating its overall value proposition. The broker claims to provide competitive spreads and low commissions; however, specific details about these costs are often vague or missing.

| Cost Type | Titan Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 0.6 - 1.0 pips |

| Commission Model | Not Specified | Varies (0 - 10 USD) |

| Overnight Interest Range | Not Specified | Varies (0.5% - 5%) |

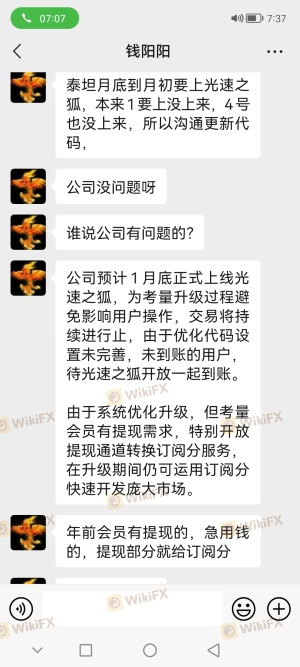

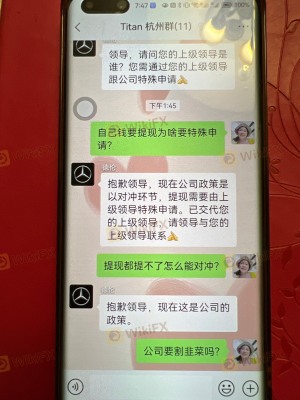

The lack of clarity regarding trading costs can be concerning for traders, as hidden fees or unfavorable conditions can significantly impact profitability. Moreover, numerous complaints have been reported regarding withdrawal issues and unexpected fees, which further complicates the assessment of Titan Capital Markets' trading conditions.

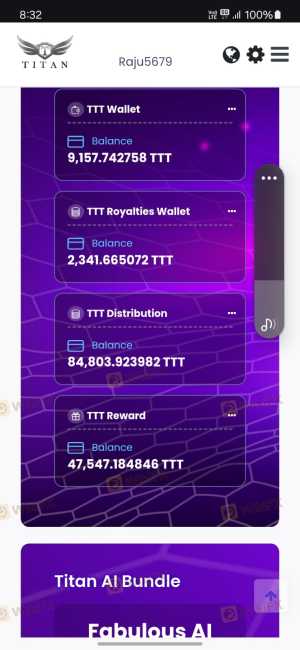

Client Fund Security

The security of client funds is a non-negotiable aspect of any reputable brokerage. Titan Capital Markets asserts that it employs various measures to ensure the safety of traders' funds, including segregated accounts and investor protection policies. However, the absence of detailed information on these measures raises questions about their effectiveness.

Traders should always look for brokers that provide clear information regarding fund segregation, investor compensation schemes, and negative balance protection. The lack of evidence supporting Titan Capital Markets' claims of fund safety may leave clients vulnerable to potential financial risks.

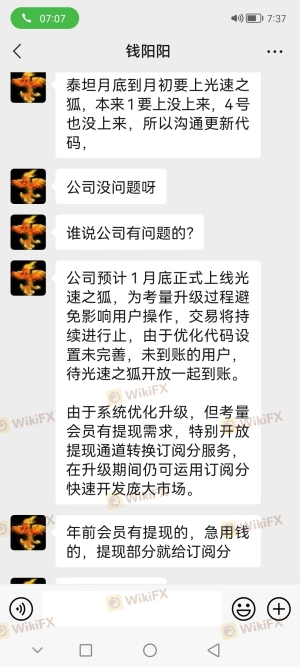

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. An analysis of user reviews reveals a concerning pattern of complaints about Titan Capital Markets. Many users report issues related to account access, withdrawal delays, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Lockouts | High | Poor |

| Customer Support Delay | Medium | Moderate |

For instance, one user reported their account being locked without explanation, preventing them from accessing their funds. Such experiences reflect poorly on the broker's operational integrity and customer support capabilities. The consistency of these complaints suggests that potential clients should carefully consider these factors before engaging with Titan Capital Markets.

Platform and Trade Execution

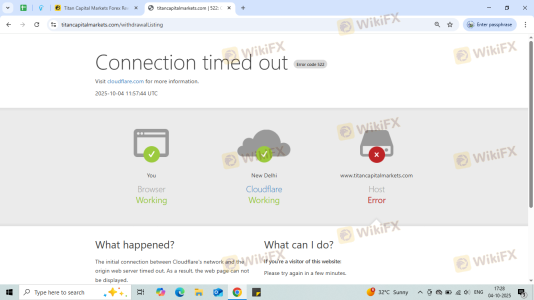

The performance of a broker's trading platform is vital for a seamless trading experience. Titan Capital Markets offers its proprietary trading platform, Titan WebTrader. While the platform is designed to be user-friendly, there are concerns regarding its execution quality. Reports of slippage, order rejections, and system outages have been noted, which can hinder trading performance.

Moreover, the absence of industry-standard platforms like MetaTrader 4 or 5 may deter experienced traders who prefer those platforms for their advanced features and reliability. The lack of transparency regarding execution metrics raises questions about the broker's overall trading environment.

Risk Assessment

Using Titan Capital Markets comes with inherent risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Revoked ASIC license |

| Financial Risk | Medium | Complaints about fund withdrawals |

| Operational Risk | High | Platform performance issues |

Given these risks, it's advisable for traders to conduct thorough due diligence and consider alternative brokers with a proven track record and robust regulatory oversight.

Conclusion and Recommendations

In summary, the evidence suggests that Titan Capital Markets may not be a trustworthy brokerage option. The revocation of its ASIC license, combined with numerous customer complaints and a lack of transparency, raises significant concerns about its legitimacy and operational practices.

For traders seeking reliable forex brokers, it is recommended to consider established firms with strong regulatory frameworks, transparent trading conditions, and positive customer feedback. Some reputable alternatives include brokers like IG, OANDA, and Forex.com, which have demonstrated a commitment to regulatory compliance and customer service excellence.

Ultimately, while Titan Capital Markets presents itself as a viable trading option, the risks and uncertainties associated with it warrant caution. Traders should prioritize their financial security and conduct comprehensive research before committing to any trading platform.

Is Titan Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Titan Capital Markets brokers.

Titan Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Titan Capital Markets latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.