Cudrania Capital 2025 Review: Everything You Need to Know

Executive Summary

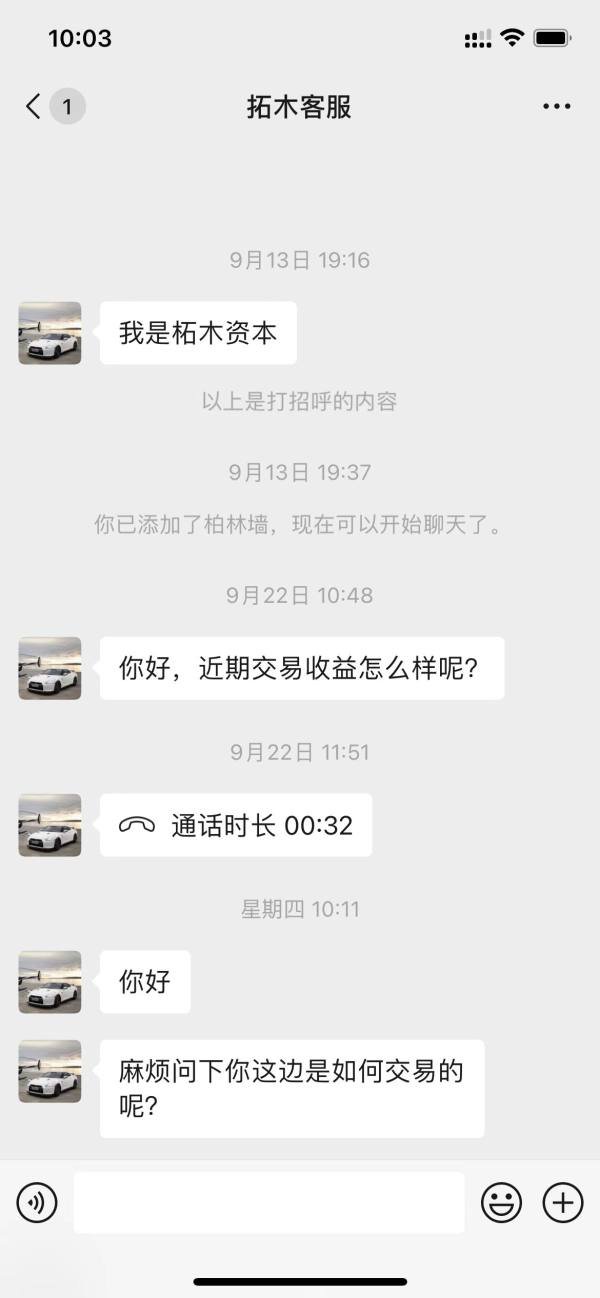

This cudrania capital review shows a broker that raises big concerns for potential traders. Cudrania Capital started in 2022 and claims to be an international online broker operating under the Cudrania Group with alleged operations centers across multiple global cities including Dallas, Sydney, Singapore, Hong Kong, Dubai, and Kuala Lumpur. Our investigation reveals critical red flags that traders must consider.

The broker offers what appears to be a simple account opening process and multiple account types. This might appeal to traders seeking quick market access. However, these surface-level conveniences are overshadowed by serious regulatory and safety concerns that cannot be ignored. According to WikiFX evaluation, Cudrania Capital receives an extremely low rating and has been flagged with scam warnings. This indicates substantial risks for potential clients.

This broker appears to target traders with higher risk tolerance. Even risk-seeking investors should exercise extreme caution given the unregulated nature of the platform and multiple warning signals from industry watchdogs.

Important Disclaimers

Regional Entity Variations: Cudrania Capital claims to maintain operational centers in multiple international financial hubs including Dallas, Sydney, Singapore, Hong Kong, Dubai, and Kuala Lumpur. However, no clear regulatory information has been identified for any of these claimed locations. Verification of these operational centers remains unconfirmed through official regulatory channels.

Review Methodology: This evaluation is based exclusively on publicly available information and user feedback collected from various industry sources. This assessment does not include direct trading experience with the platform. All conclusions are drawn from external data sources and regulatory database searches.

Overall Rating Framework

Broker Overview

Cudrania Capital emerged in the forex brokerage landscape in 2022. The company positions itself as an international online broker under the broader Cudrania Group umbrella. The company presents itself as a global financial services provider, claiming to offer brokerage services for various financial products through multiple international locations. Despite these claims of international presence, the company's actual headquarters and primary operational base remain unclear.

The broker's business model appears to focus on providing online trading services for forex and potentially other financial instruments. This follows a common pattern seen among newer market entrants. However, unlike established brokers, Cudrania Capital lacks the regulatory foundation that typically supports legitimate international brokerage operations. This cudrania capital review reveals that the company has not secured registration with major regulatory bodies including the Financial Conduct Authority, Australian Securities and Investments Commission, Monetary Authority of Singapore, or other primary financial regulators in their claimed operational jurisdictions.

The absence of proper regulatory oversight represents a fundamental concern for potential clients. Legitimate forex brokers typically maintain clear regulatory status in their primary operational markets. This regulatory gap significantly impacts the broker's credibility and raises questions about client fund protection and operational transparency.

Regulatory Status: Comprehensive searches across major regulatory databases including LFSA, DFSA, ASIC, HK SFC, and MAS have yielded no matching results for Cudrania Capital. This indicates the broker operates without oversight from these key financial authorities.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees is not detailed in available public documentation. This creates uncertainty about transactional procedures.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit amounts for their various account types. This makes it difficult for potential clients to assess initial investment requirements.

Promotional Offers: No specific bonus structures or promotional campaigns are detailed in available information sources. This may reflect the broker's current operational status.

Tradable Assets: Based on the broker's positioning as a forex-focused platform, services likely include currency pairs and potentially CFDs on various underlying assets. Specific instrument offerings require direct verification.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains undisclosed in public documentation. This prevents accurate cost analysis for potential clients.

Leverage Ratios: Maximum leverage offerings and any regional variations in leverage limits are not specified in available materials. This represents another transparency concern.

Platform Options: The specific trading platforms supported by Cudrania Capital, whether proprietary or third-party solutions like MetaTrader, are not clearly identified in current documentation. This lack of clarity makes platform evaluation impossible.

Geographic Restrictions: Specific countries or regions where services are restricted or prohibited are not detailed in available information. Potential clients cannot determine service availability in their jurisdiction.

Customer Support Languages: The range of languages supported by customer service teams remains unspecified in current public materials. This creates uncertainty about communication capabilities.

This cudrania capital review highlights significant information gaps that potential clients should consider when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis

The account structure offered by Cudrania Capital presents a mixed picture with concerning gaps in transparency. According to available information, the broker provides three distinct account types. Detailed specifications for each tier remain largely undisclosed. This lack of detailed account information creates uncertainty for potential traders attempting to understand the differences between available options and select the most appropriate account for their trading style and capital requirements.

User feedback suggests that the account opening process is relatively straightforward. This could be considered a positive aspect for traders seeking quick market access. However, this simplicity may come at the cost of proper due diligence and client verification procedures that legitimate brokers typically implement. The absence of detailed minimum deposit requirements across different account tiers makes it impossible for potential clients to accurately plan their initial investment.

The lack of information regarding account-specific features such as Islamic account availability, premium account benefits, or professional trader accommodations further diminishes the overall account offering quality. When compared to regulated brokers that provide comprehensive account documentation, Cudrania Capital's opacity regarding account conditions represents a significant disadvantage.

This cudrania capital review emphasizes that while account opening convenience may appeal to some traders, the lack of transparency regarding account terms and conditions should raise concerns about the broker's operational standards and client protection measures.

The trading tools and resources landscape at Cudrania Capital presents significant concerns for traders who rely on comprehensive analytical and educational support. Available information reveals a notable absence of detailed descriptions regarding trading tools, market analysis resources, or educational materials. Modern traders typically expect these from their brokers.

Professional trading tools such as advanced charting packages, technical indicators, automated trading system support, and real-time market analysis appear to be either unavailable or insufficiently documented. This gap is particularly concerning for active traders who depend on sophisticated analytical tools to make informed trading decisions and manage risk effectively.

Educational resources serve as crucial support for developing traders but are not mentioned in available documentation. Legitimate brokers typically provide comprehensive learning materials including webinars, tutorials, market analysis, and trading guides to help clients improve their trading skills and market understanding.

The absence of detailed information about research and analysis resources suggests that traders would need to rely on external sources for market insights and analytical support. User feedback indicates general dissatisfaction with the tools and resources available. Specific details about shortcomings are limited in available reviews.

For traders considering this platform, the lack of comprehensive tool documentation and educational support represents a significant limitation that could impact trading success and skill development.

Customer Service and Support Analysis

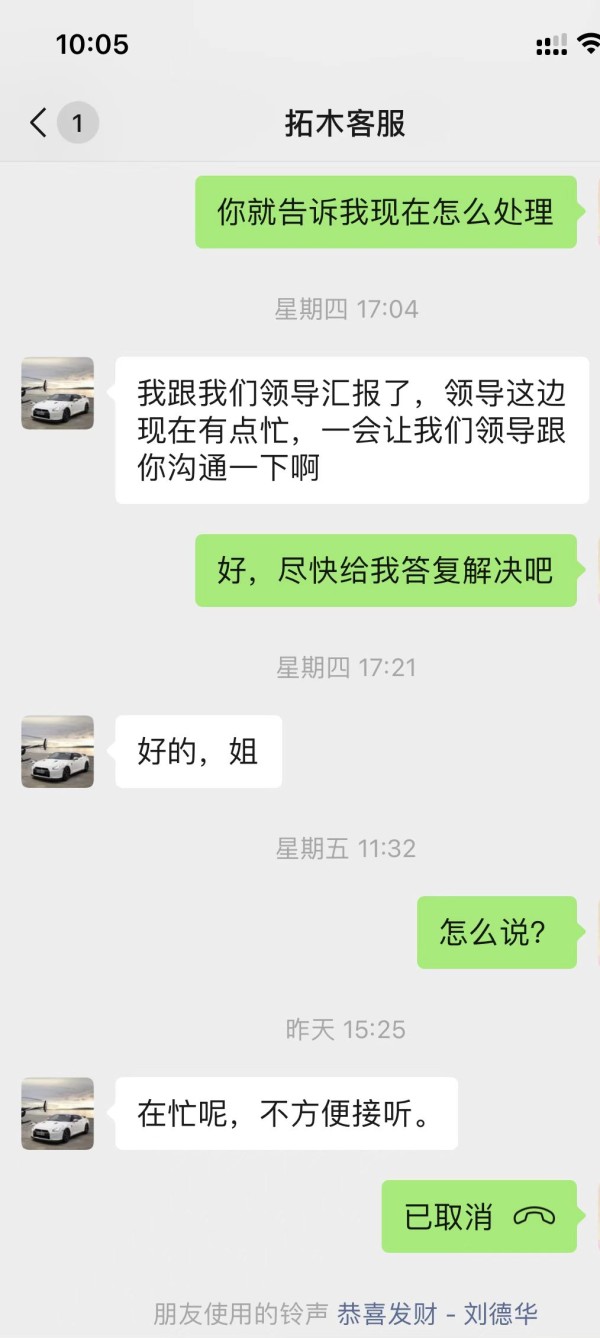

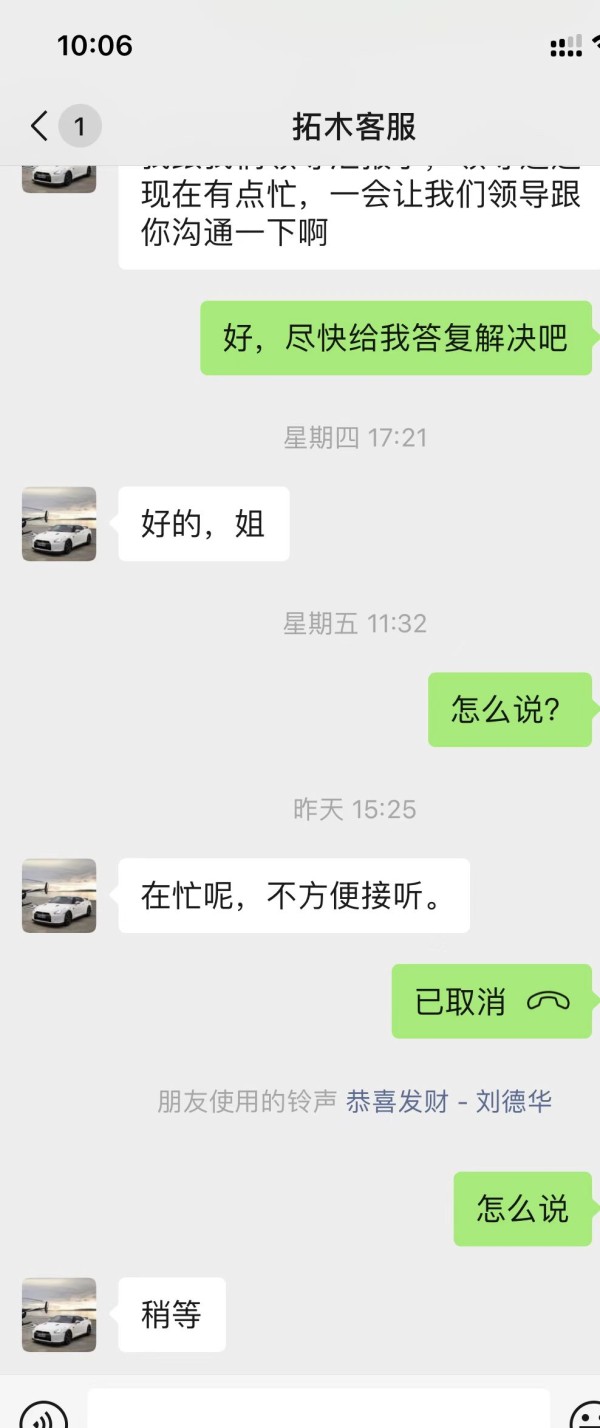

Customer service quality and accessibility represent critical factors in broker evaluation. Cudrania Capital's support infrastructure raises several concerns based on available information. The broker has not clearly documented their customer service channels, availability hours, or response time commitments. This creates uncertainty about support accessibility when clients require assistance.

Multi-language support capabilities are essential for international brokers serving diverse client bases but remain unspecified in current documentation. This gap is particularly concerning given the broker's claims of international operations across multiple time zones and linguistic regions.

Response time expectations and service level agreements are not publicly documented. This makes it impossible for potential clients to understand what level of support they can expect during critical trading situations or account-related issues. Professional traders often require rapid response times for technical issues or urgent account matters, and the lack of clear service commitments represents a significant concern.

User feedback regarding customer service experiences appears predominantly negative. Specific details about service quality, problem resolution effectiveness, or support team competency are limited in available reviews. The absence of documented escalation procedures or complaint resolution processes further compounds concerns about service quality.

Without clear documentation of support channels, availability, and service standards, traders face uncertainty about receiving adequate assistance when needed. This represents a significant operational risk for active trading accounts.

Trading Experience Analysis

The trading experience evaluation reveals significant gaps in platform information and user feedback. These are essential for assessing execution quality and overall trading environment. Critical technical specifications including platform stability, execution speed, and order processing reliability are not documented in available materials. This creates uncertainty about the actual trading environment quality.

Order execution quality includes factors such as slippage rates, requote frequency, and fill rates during volatile market conditions but lacks documentation or user reporting. These technical aspects are fundamental to successful trading, particularly for strategies that rely on precise entry and exit timing or during high-impact news events when market volatility increases.

Platform functionality assessments are hampered by the lack of detailed information about trading interface features, order types supported, risk management tools, and mobile trading capabilities. Modern traders expect comprehensive platform functionality including advanced order types, one-click trading options, and sophisticated risk management features.

Mobile trading experience has become essential for active traders who need market access while away from their primary trading stations. The quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality remain unknown.

User feedback regarding trading experience quality is notably absent from available reviews. This prevents assessment of real-world platform performance and trader satisfaction levels. This cudrania capital review emphasizes that the lack of platform documentation and user experience feedback represents a significant concern for potential clients evaluating trading environment quality.

Trustworthiness Analysis

Trustworthiness evaluation reveals the most concerning aspects of Cudrania Capital's operations. Multiple red flags exist that potential clients must carefully consider. The broker's failure to secure registration with any major financial regulatory authority represents a fundamental trust issue. This impacts all aspects of client protection and operational oversight.

Regulatory verification attempts across primary financial authorities including FCA, ASIC, MAS, DFSA, and HK SFC have yielded no matching results. This occurs despite the broker's claims of operations in jurisdictions covered by these regulators. This regulatory absence means clients lack the protections typically provided by financial authorities, including compensation schemes, operational oversight, and dispute resolution mechanisms.

Fund security measures are not documented or verifiable given the unregulated status. Legitimate brokers implement these through segregated account structures, regulatory capital requirements, and client money protection schemes. This creates significant risk for client deposits and trading capital.

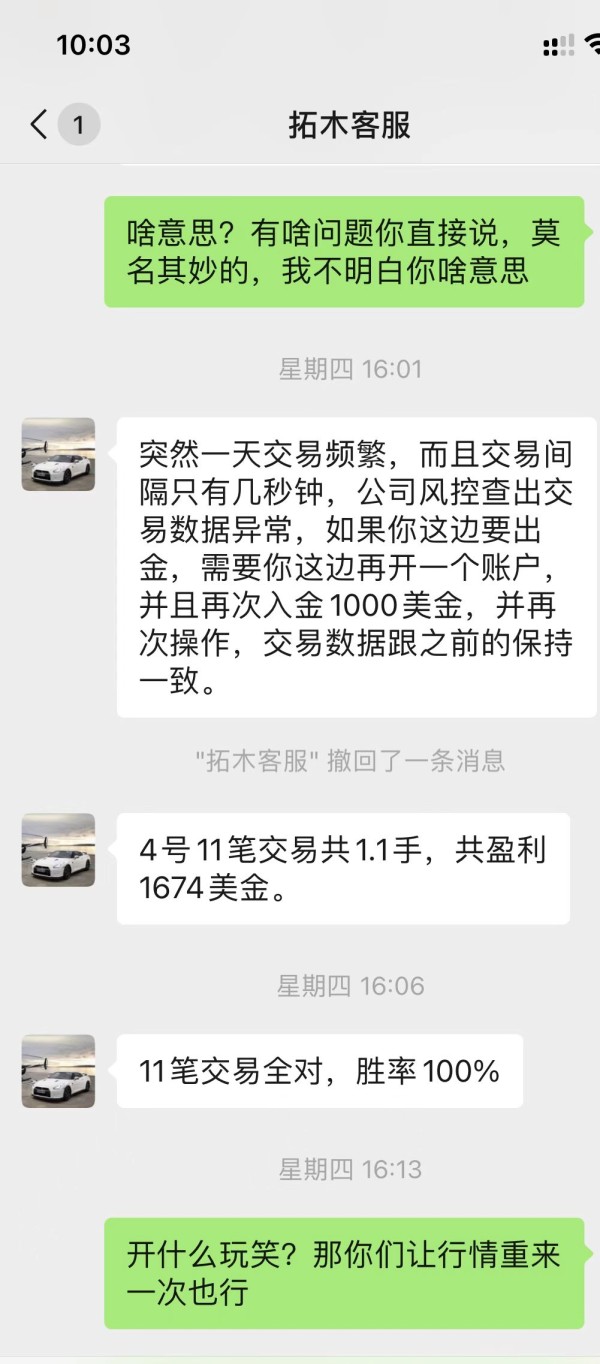

Company transparency issues extend beyond regulatory status to include unclear ownership structures, lack of detailed operational information, and absence of audited financial statements. Regulated brokers typically provide these. WikiFX evaluation has assigned an extremely low rating and flagged the broker with scam warnings, indicating serious concerns from industry monitoring services.

Third-party evaluations consistently highlight the risks associated with this broker. Multiple sources indicate potential scam operations. The combination of regulatory absence, negative industry ratings, and warning flags creates a trust profile that suggests extreme caution for potential clients.

User Experience Analysis

User experience evaluation based on available feedback reveals predominantly negative sentiment and concerning patterns. Potential clients should carefully consider these. Overall user satisfaction appears significantly below industry standards, with multiple indicators suggesting problematic experiences for traders who have engaged with the platform.

The account registration process receives some positive feedback for simplicity and speed. This may initially appeal to traders seeking quick market access. However, this convenience appears to be overshadowed by subsequent operational concerns and user experience issues that emerge during actual platform usage.

Interface design and usability assessments are limited by lack of detailed user feedback. Available information suggests that platform functionality may not meet modern trader expectations. The absence of positive user testimonials regarding platform features, trading tools, or overall satisfaction represents a concerning pattern for potential clients.

Funding and withdrawal experiences are critical components of broker evaluation but lack sufficient user documentation. This prevents assessment of processing efficiency, fee structures, or problem resolution. This information gap prevents accurate assessment of transactional user experience quality.

Common user complaints appear to center around safety and security concerns rather than specific platform functionality issues. This suggests that trust and regulatory concerns overshadow technical platform considerations. The user profile analysis indicates this platform is unsuitable for risk-averse traders and questionable even for those with higher risk tolerance.

Improvement recommendations would necessarily focus on fundamental regulatory compliance and transparency enhancement. These must be addressed before tackling user interface or functionality concerns.

Conclusion

This comprehensive cudrania capital review reveals a broker with significant operational and regulatory concerns. These substantially outweigh any potential benefits. Cudrania Capital's performance across all evaluation criteria indicates substantial risks for potential clients, with particularly concerning issues in regulatory compliance and user trustworthiness.

The broker is not recommended for ordinary retail investors, especially those with lower risk tolerance or limited experience with unregulated financial services. Even traders with higher risk acceptance should exercise extreme caution given the multiple warning signals and absence of regulatory protection. The primary advantage of simplified account opening is overshadowed by fundamental concerns about regulatory compliance, fund security, and operational transparency. These create unacceptable risk levels for most trading strategies and investment goals.