Is Cudrania Capital safe?

Business

License

Is Cudrania Capital Safe or a Scam?

Introduction

Cudrania Capital positions itself as an emerging player in the forex market, claiming to provide a wide range of trading services and investment opportunities. As with any financial service provider, it is crucial for traders to perform due diligence before engaging with a broker. The forex market is rife with both legitimate and fraudulent entities, making it essential for traders to assess the trustworthiness of brokers like Cudrania Capital. This article aims to analyze whether Cudrania Capital is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and potential risks.

Regulation and Legitimacy

Understanding the regulatory status of a broker is paramount for assessing its safety. Cudrania Capital operates as an offshore broker and is not regulated by any prominent financial authorities. This lack of regulation raises significant red flags, as it means that traders may have limited recourse in case of disputes or issues regarding fund security. Below is a summary of the regulatory information for Cudrania Capital:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Offshore | Not Verified |

The absence of regulation from reputable authorities such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC) indicates that Cudrania Capital may not adhere to industry standards for investor protection. Historically, unregulated brokers have been associated with fraudulent activities, making it imperative for traders to be cautious. Therefore, is Cudrania Capital safe? Given its offshore status and lack of regulation, it is advisable to approach this broker with skepticism.

Company Background Investigation

Cudrania Capital claims to be part of the Cudrania Group, with operational centers in various global cities, including Dallas, Sydney, Singapore, and Dubai. However, the lack of transparency regarding its ownership structure and management team raises concerns. There is minimal information available about the individuals behind the company, and the website does not provide details about their experience or qualifications. This absence of information can be a warning sign, as reputable brokers typically disclose their management team's credentials and company history.

Moreover, the companys commitment to customer safety is stated on its website, but without independent verification, these claims remain unsubstantiated. The lack of transparency in its operations and the potential for undisclosed ownership structures make it difficult to ascertain the true nature of Cudrania Capital. Therefore, when considering whether Cudrania Capital is safe, the lack of clarity in its company background raises significant concerns.

Trading Conditions Analysis

Cudrania Capital offers a variety of trading accounts and claims to provide competitive trading conditions, including low spreads and flexible leverage. However, the overall fee structure and any unusual policies warrant scrutiny. Below is a comparison of the key trading costs associated with Cudrania Capital:

| Fee Type | Cudrania Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | Varies by account | Standard fees |

| Overnight Interest Range | Varies | Varies |

While the broker advertises low spreads, the lack of clarity regarding the commission structure and overnight interest rates can lead to unexpected costs for traders. Furthermore, if traders encounter issues withdrawing funds, they may find themselves facing additional charges that were not disclosed upfront. This ambiguity raises questions about the broker's commitment to transparency and fairness. Hence, it is crucial for traders to carefully evaluate these conditions to determine if Cudrania Capital is safe for their investment needs.

Customer Funds Security

The safety of customer funds is a critical aspect of any brokerage. Cudrania Capital claims to implement measures to safeguard client assets, such as segregating client funds from operational funds. However, the effectiveness of these measures cannot be independently verified. The broker does not provide clear information on whether it offers investor protection schemes or negative balance protection, which are essential for ensuring that traders do not lose more than their initial investment.

Additionally, the broker's offshore status may limit the legal protections available to clients, making it difficult to recover funds in case of disputes. Past incidents involving offshore brokers have shown that clients often struggle to retrieve their money when issues arise. Therefore, when assessing whether Cudrania Capital is safe, the lack of robust fund security measures is a significant concern.

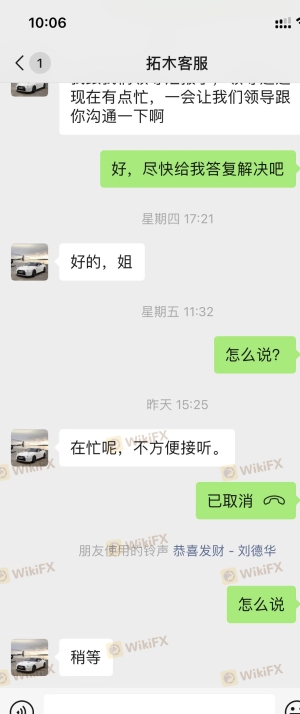

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, Cudrania Capital has received a number of negative reviews from traders, highlighting issues such as difficulty withdrawing funds, aggressive sales tactics, and lack of customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Aggressive Sales Practices | Medium | Average |

| Customer Support Availability | High | Poor |

Many traders have reported being pressured to deposit more funds, and when attempting to withdraw, they encountered various obstacles. This pattern of complaints raises serious concerns about the broker's practices and its commitment to client satisfaction. Therefore, when evaluating if Cudrania Capital is safe, the negative experiences reported by clients cannot be overlooked.

Platform and Execution

The trading platform offered by Cudrania Capital is designed to facilitate a range of trading activities. However, the quality of execution, including order fulfillment and slippage, is crucial for a positive trading experience. Reports from users indicate that there may be issues with order execution and potential slippage during volatile market conditions. Additionally, there is little information available regarding any measures in place to prevent order manipulation or rejection.

Given these concerns, traders should be cautious when considering Cudrania Capital as their broker. Issues with execution can significantly impact trading performance and profitability, leading to further doubts about whether Cudrania Capital is safe for traders.

Risk Assessment

The overall risk associated with trading through Cudrania Capital is concerning. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of investor protection measures. |

| Customer Service Risk | Medium | Poor feedback on support responsiveness. |

| Execution Risk | High | Reports of slippage and order issues. |

To mitigate these risks, traders should consider using smaller amounts when trading with Cudrania Capital, if they choose to engage with this broker at all. Additionally, it may be wise to seek out brokers with established regulatory oversight and a proven track record.

Conclusion and Recommendations

After a thorough investigation into Cudrania Capital, the evidence suggests that this broker exhibits several characteristics commonly associated with scams. The lack of regulation, transparency issues, and numerous customer complaints raise serious concerns about the safety of trading with this broker. Therefore, it is prudent for traders to exercise caution and consider alternative options.

If you are looking for reliable and regulated brokers, it is advisable to explore options that are licensed by reputable authorities such as the FCA, ASIC, or CySEC. These brokers not only provide a safer trading environment but also offer better customer support and fund security measures. In conclusion, given the findings, Cudrania Capital may not be safe for traders, and caution is strongly recommended when considering engaging with this broker.

Is Cudrania Capital a scam, or is it legit?

The latest exposure and evaluation content of Cudrania Capital brokers.

Cudrania Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cudrania Capital latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.