Is AMBER safe?

Pros

Cons

Is Amber Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, choosing a reliable broker is crucial for traders looking to maximize their investments. Amber, a broker that has emerged in recent years, claims to offer a range of trading services. However, the question remains: Is Amber safe? This article aims to provide a comprehensive analysis of Amber's legitimacy, regulatory status, and overall safety for traders.

Given the prevalence of scams in the forex industry, it is essential for traders to exercise caution and conduct thorough due diligence before engaging with any broker. This investigation will utilize a structured framework that examines regulatory compliance, company background, trading conditions, customer experiences, and risk assessments. By scrutinizing these aspects, we aim to determine whether Amber can be deemed a safe trading partner or if it poses significant risks to its users.

Regulatory Status and Legitimacy

The regulatory status of a forex broker is a key indicator of its reliability and safety. A broker operating under strict regulations is generally considered to have a higher level of accountability and transparency. Unfortunately, Amber has been flagged for its lack of regulation, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Amber has not provided any valid regulatory information, which is a major red flag for potential investors. The absence of oversight from reputable regulatory authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) indicates that Amber operates in a high-risk environment. Traders should be particularly wary, as unregulated brokers often lack the necessary consumer protections, leading to potential financial losses.

The quality of regulation is paramount, as it ensures that brokers adhere to strict operational standards. Ambers lack of regulatory oversight suggests that it may not be committed to safeguarding client funds or maintaining ethical trading practices. Therefore, the question Is Amber safe? is met with skepticism based on its regulatory standing.

Company Background Investigation

To further understand Ambers legitimacy, it is important to delve into its company background, including its history, ownership structure, and transparency. Unfortunately, the information available about Amber is quite limited. The company appears to operate anonymously, with no clear details regarding its founding date, ownership, or management team.

The lack of transparency raises concerns about the brokers accountability. A legitimate broker typically provides information about its founders and management team, allowing traders to assess their qualifications and experience. However, in Amber's case, this information is either absent or difficult to verify. As a result, potential clients may find it challenging to gauge the broker's reliability and operational integrity.

Moreover, the absence of a physical office location further complicates matters. Legitimate brokers usually have a registered office where clients can seek assistance or resolution for their concerns. Amber's failure to provide such information contributes to the perception that it may not be a trustworthy entity.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall safety and reliability. In the case of Amber, the available information on its fees and trading costs is concerning. The broker's fee structure appears to be opaque, with traders reporting unexpected charges and difficulties in withdrawing funds.

| Fee Type | Amber | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Model | None | Varies |

| Overnight Interest Range | Unclear | Standard |

Traders have reported that the spreads on major currency pairs are significantly higher than the industry average, which can erode potential profits. Additionally, the commission structure is ambiguous, leaving traders uncertain about the costs associated with their trades. Such discrepancies can indicate that Amber may not be operating in the best interests of its clients.

Moreover, traders have expressed frustration regarding withdrawal processes, with many claiming that their requests were ignored or delayed for extended periods. This raises red flags about the broker's commitment to client satisfaction and financial integrity. When assessing whether Amber is safe, these troubling trading conditions cannot be overlooked.

Customer Fund Security

The security of client funds is a critical aspect of any forex broker's operations. In the case of Amber, there are significant concerns regarding its fund protection measures. A reputable broker typically employs stringent security protocols, such as segregating client funds from company operational funds and offering investor protection schemes.

However, Amber has not publicly disclosed any such measures. The lack of information about fund segregation and investor protection raises alarms about the safety of traders' investments. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial deposits, exposing them to significant financial risk.

Historical issues related to fund security have also been reported, with numerous complaints from clients who have faced challenges in accessing their funds. Such incidents further illustrate the potential dangers associated with trading with Amber. As traders continue to ask themselves Is Amber safe?, the answer leans towards caution due to these unresolved security concerns.

Customer Experience and Complaints

Examining customer feedback is essential for understanding a broker's reputation and reliability. In the case of Amber, numerous negative reviews have surfaced, highlighting a pattern of complaints that raise serious concerns about the broker's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

| Trading Conditions | High | Ignored |

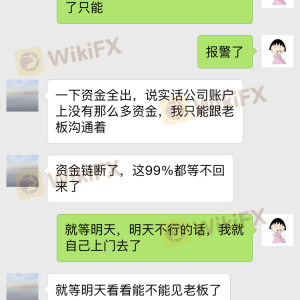

Many users have reported severe difficulties in withdrawing their funds, with some claiming that their requests were either denied or ignored altogether. The company's response to these complaints has been largely inadequate, leading to frustration among clients. Furthermore, issues related to customer service have been frequently mentioned, with users feeling neglected and unsupported.

One notable case involved a trader who successfully grew their account but was unable to withdraw their profits due to unexplained restrictions imposed by the broker. This experience is indicative of a broader pattern of behavior that raises questions about Amber's integrity and commitment to its clients. As such, the question Is Amber safe? becomes increasingly pertinent, as potential clients weigh the risks of engaging with such a broker.

Platform and Execution Quality

The trading platform and execution quality are crucial factors for any forex trader. A reliable broker should provide a stable and user-friendly platform that facilitates smooth trading experiences. However, in the case of Amber, there are indications that the platform may not meet these expectations.

Traders have reported issues with order execution, including instances of slippage and rejected orders. Such problems can severely impact trading performance and profitability. Additionally, the platform's overall performance has been criticized for being less stable compared to industry standards, which could lead to further complications during trading sessions.

The lack of transparency regarding the platform's features and functionalities further complicates matters. Traders need to be able to trust that the platform they are using is secure and efficient. Without clear information about the platform's capabilities, potential clients may be hesitant to engage with Amber, leading to the question Is Amber safe? remaining unanswered.

Risk Assessment

Assessing the overall risk associated with trading with Amber is essential for potential clients. Given the various concerns outlined in this analysis, it is crucial to summarize the key risk areas that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about accountability. |

| Fund Security Risk | High | Absence of fund protection measures increases financial risk. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues indicate potential problems. |

| Trading Conditions Risk | Medium | Opaque fee structure and high spreads can erode profits. |

In light of these risks, traders should approach Amber with caution. It is advisable to consider alternative brokers that are regulated and have a proven track record of safety and reliability.

Conclusion and Recommendations

In conclusion, the investigation into Amber reveals multiple red flags that suggest it may not be a safe trading option for forex traders. The lack of regulation, transparency issues, and numerous complaints regarding customer experiences raise serious concerns about the broker's legitimacy and commitment to client safety.

For traders seeking a reliable and secure trading environment, it is recommended to consider well-regulated alternatives with strong reputations. Brokers with oversight from reputable regulatory bodies, transparent fee structures, and positive client feedback should be prioritized. As the forex market continues to grow, ensuring the safety of investments remains paramount, and traders must remain vigilant in their broker selection process. Thus, the question Is Amber safe? can be answered with a resounding no, urging potential clients to seek safer trading options.

Is AMBER a scam, or is it legit?

The latest exposure and evaluation content of AMBER brokers.

AMBER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMBER latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.