Yunikon FX 2025 Review: Everything You Need to Know

Yunikon FX has garnered mixed reviews in the forex trading community, with many users expressing skepticism about its legitimacy. While it offers a low minimum deposit and a range of trading instruments, concerns about its regulatory status and customer service persist. This review will delve into various aspects of Yunikon FX, including user experiences, expert opinions, and key features to help you make an informed decision.

Note: It is important to highlight that Yunikon FX operates across various regions, and the lack of robust regulatory oversight in certain jurisdictions raises significant concerns about user safety and fund protection.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding the broker's offerings and performance.

Broker Overview

Founded in 2022, Yunikon FX operates under the name Yuni Kon Financial Ltd and is registered in Saint Vincent and the Grenadines. The broker primarily offers trading through its proprietary platform, Yunikon FX Trader, which is based on the widely-used MetaTrader 4 (MT4) interface. Traders can access a variety of instruments, including forex pairs, commodities, and CFDs on stocks. However, Yunikon FX lacks regulation from major financial authorities, which raises concerns about its reliability.

Detailed Breakdown

Regulatory Status and Geographic Reach

Yunikon FX is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, but it does not hold a valid license from any significant regulatory body such as the FCA, ASIC, or CFTC. This lack of regulation is a critical red flag for potential investors, as it means that clients do not have the same protections as they would with a regulated broker. Additionally, Yunikon FX has been flagged by various financial authorities, including the Securities Commission of Malaysia, for operating without necessary licenses.

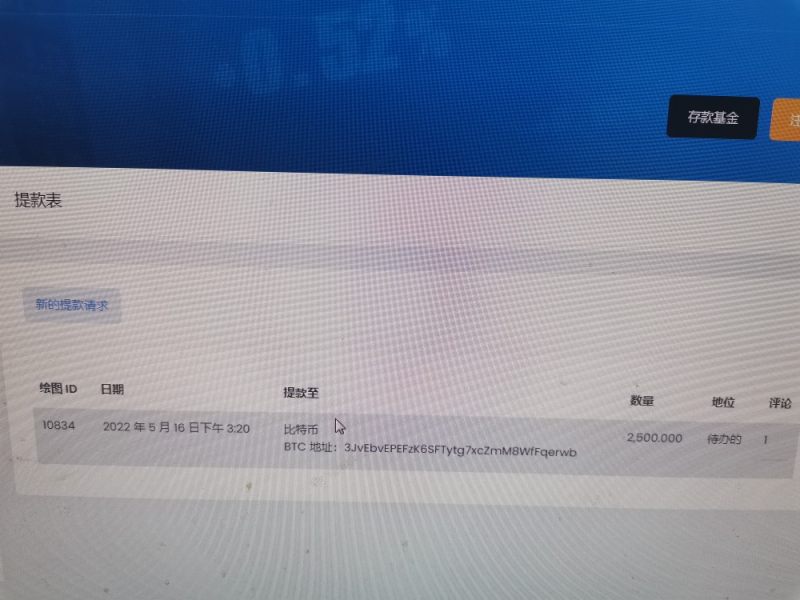

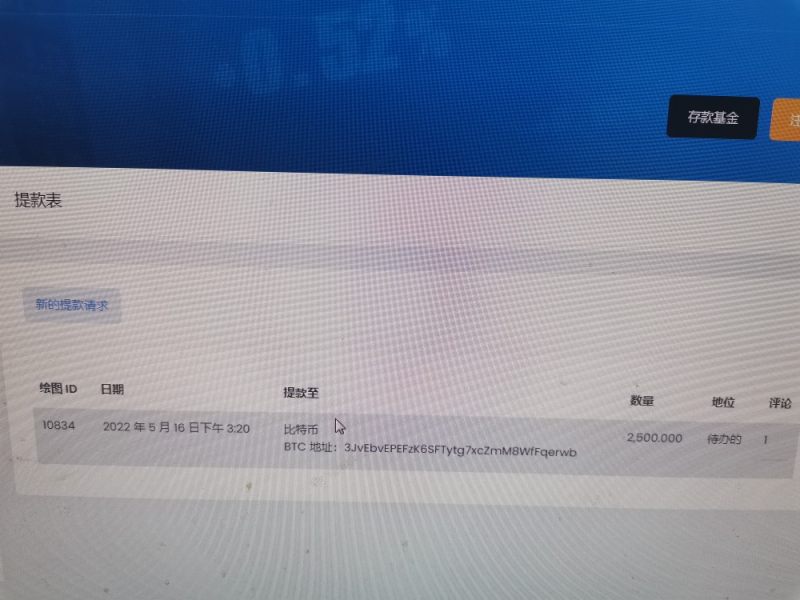

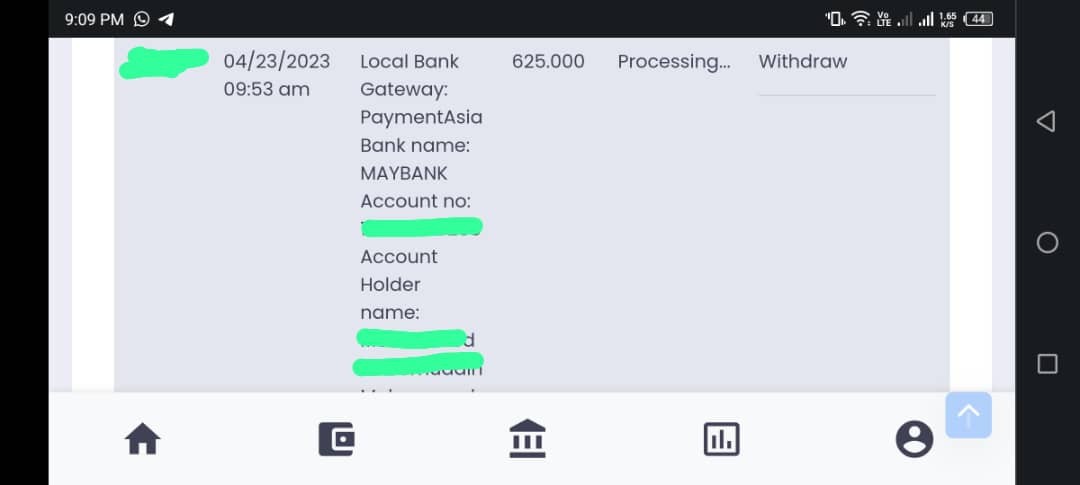

Deposit and Withdrawal Options

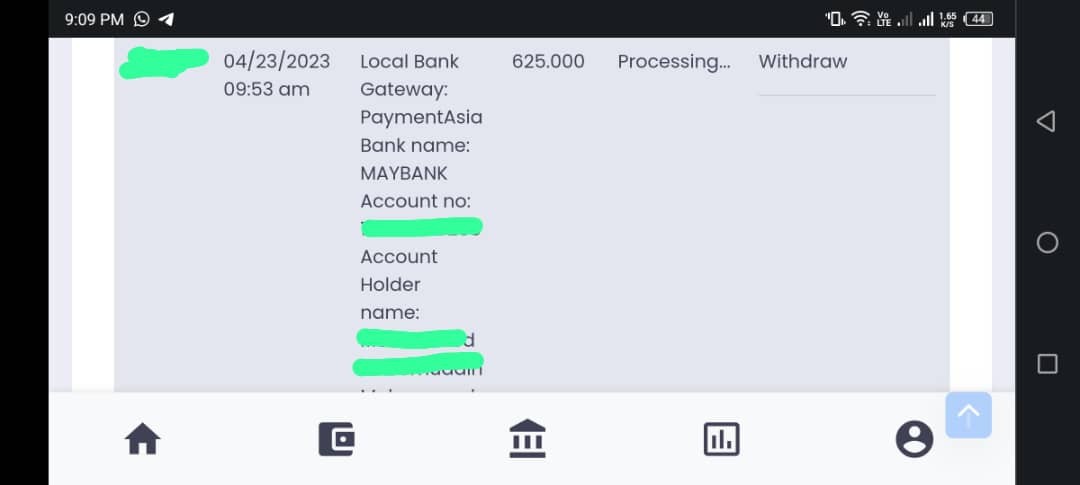

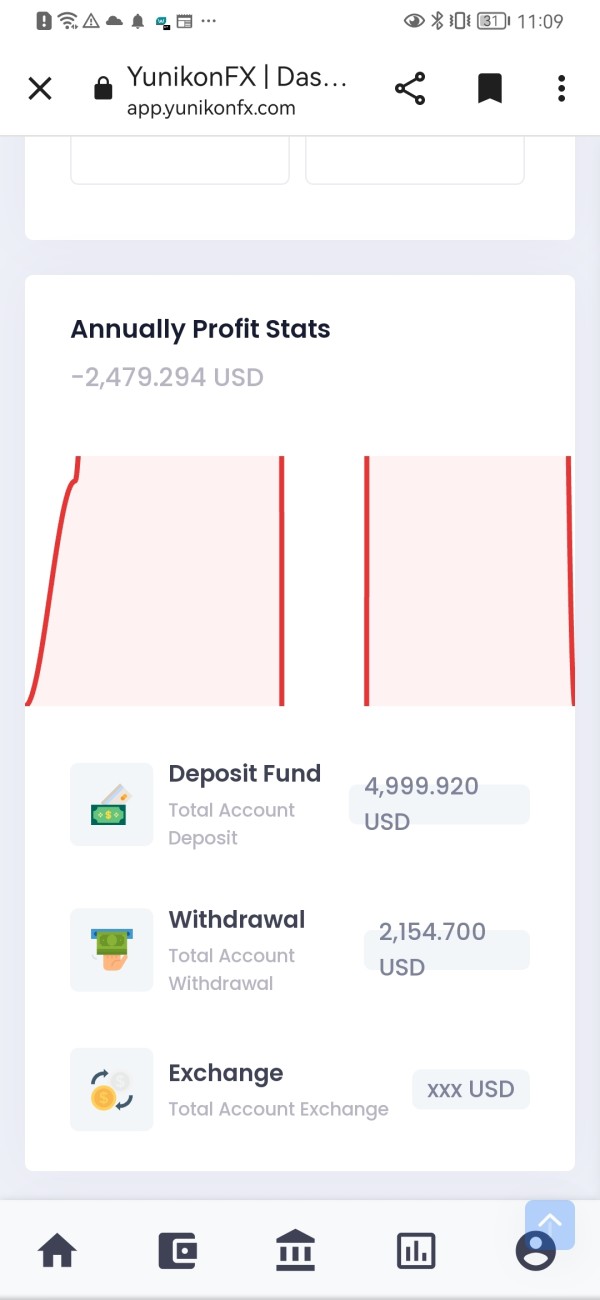

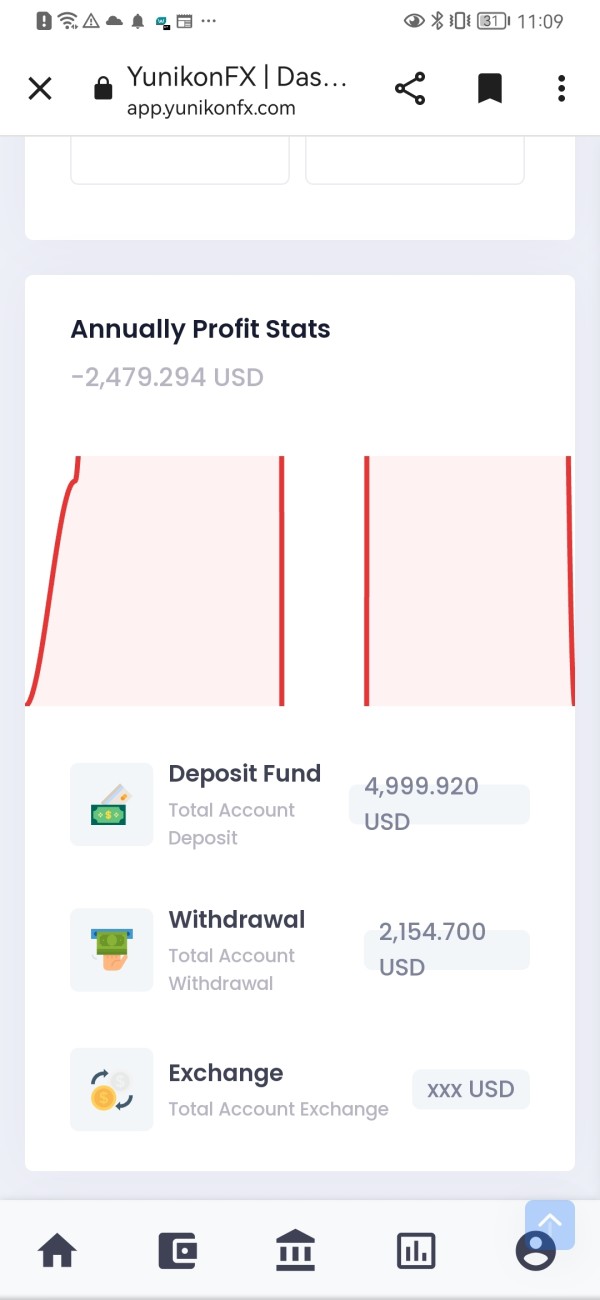

The broker offers a minimum deposit requirement of $10 for self-trading accounts and $20 for auto-trading accounts. Yunikon FX accepts deposits via local bank transfers in specific regions (Malaysia, Vietnam, Indonesia, and Thailand) and cryptocurrencies. However, the withdrawal process has been criticized for being slow, with reports of users facing delays in accessing their funds.

While Yunikon FX markets various promotions, user feedback suggests that the terms and conditions surrounding these offers are often unclear. Many users have reported that the bonus structures can be misleading, leading to complications when attempting to withdraw funds.

Trading Instruments

Yunikon FX provides a selection of trading instruments, including major and minor forex pairs, commodities like gold and silver, and CFDs on various stocks and indices. However, the variety of assets is limited compared to other more established brokers. This lack of diversity may restrict trading strategies for users looking to diversify their portfolios.

Cost Structure

The spreads at Yunikon FX start from 0 pips, which can be appealing; however, users have reported higher-than-average fees on certain account types. The overall cost structure lacks transparency, and many users have expressed concerns about hidden fees, particularly related to withdrawals.

Leverage Options

Yunikon FX offers leverage ratios of up to 1:1000, which is significantly higher than many regulated brokers allow. While high leverage can amplify profits, it also increases the risk of substantial losses, making it a contentious feature for many traders.

Yunikon FX primarily utilizes its proprietary trading platform, which is based on the MetaTrader 4 framework. While MT4 is known for its user-friendly interface and extensive features, the fact that Yunikon FX does not offer MT5 or any mobile applications for iOS is a limitation that could deter potential users.

Restricted Regions

The broker appears to operate without clear restrictions on the countries it accepts clients from, including regions that are typically excluded by other brokers due to regulatory concerns. This ambiguity raises further questions about the broker's legitimacy and operational integrity.

Customer Support Languages

Yunikon FX claims to provide multilingual customer support, including English, Bahasa, and Chinese. However, user reviews indicate that the quality of customer service is subpar, with many clients reporting long response times and unhelpful interactions.

Conclusion

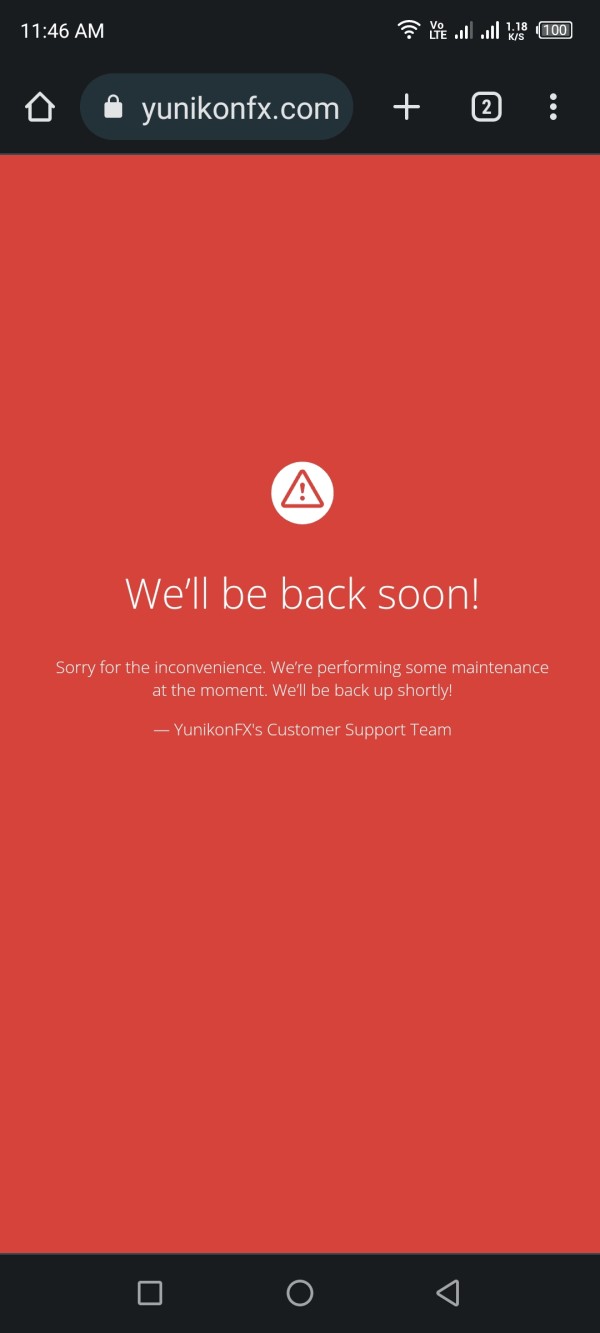

In summary, Yunikon FX presents several appealing features, such as a low minimum deposit and a range of trading instruments. However, the significant concerns regarding its regulatory status, customer service, and overall trustworthiness cannot be overlooked. Many users have reported negative experiences, including issues with withdrawals and poor support. Therefore, potential traders are advised to exercise caution and consider more reputable alternatives before engaging with Yunikon FX.

This Yunikon FX review highlights the critical factors to consider when evaluating this broker, emphasizing the importance of regulatory oversight and reliable customer support in ensuring a secure trading environment.