Is Vault Markets safe?

Pros

Cons

Is Vault Markets A Scam?

Introduction

Vault Markets is a relatively new player in the forex trading scene, having been established in 2021. It positions itself as a broker that caters primarily to the African market, offering a wide array of trading instruments including forex, commodities, indices, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the risk of scams and fraudulent activities is prevalent. This article aims to provide an objective analysis of Vault Markets, evaluating its legitimacy, regulatory status, trading conditions, and customer experiences. The investigation is based on a comprehensive review of multiple sources, including customer feedback, regulatory records, and expert analyses.

Regulation and Legitimacy

The regulatory framework under which a broker operates is crucial for ensuring the safety and security of client funds. Vault Markets claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. However, the quality of this regulation is a point of contention. Below is a summary of the regulatory information pertaining to Vault Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 51478 | South Africa | Verified |

While the FSCA is recognized, it is considered a tier-2 regulator, which means it does not enforce as stringent compliance standards as tier-1 regulators like the FCA in the UK or ASIC in Australia. Furthermore, there are concerns regarding the legitimacy of the parent company, 1st Fintech Capital (Pty) Ltd., and its connections to other entities that lack proper regulatory oversight. This raises questions about the overall safety of trading with Vault Markets, particularly concerning the protection of investor funds.

Company Background Investigation

Vault Markets is owned and operated by 1st Fintech Capital (Pty) Ltd., which has been in operation since 2021. The company claims to have a management team with over 40 years of combined trading experience, but the lack of transparency regarding their professional backgrounds raises concerns. The company's history is relatively short, and there is limited information available about its operational practices.

In terms of transparency, Vault Markets has been criticized for not providing clear information about its ownership structure and operational details. This lack of clarity can be a red flag for potential investors, as a reputable broker should offer comprehensive information about its management and operational practices. Overall, the opacity surrounding Vault Markets' corporate structure and management team contributes to the skepticism regarding its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is essential. Vault Markets offers a variety of account types, each with different fee structures. However, the overall fee transparency is lacking, which can lead to confusion for traders. Below is a comparison of core trading costs associated with Vault Markets:

| Fee Type | Vault Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 1 pip | From 0.5 pips |

| Commission Model | Not specified | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The spread offered by Vault Markets starts from 1 pip, which is competitive but not the lowest in the industry. Additionally, the lack of clarity regarding commission structures and overnight interest can be concerning for traders. Many users have reported unexpected fees and charges, which can significantly affect trading profitability. Therefore, potential traders should be cautious and fully understand the fee structure before committing to any trades.

Client Funds Security

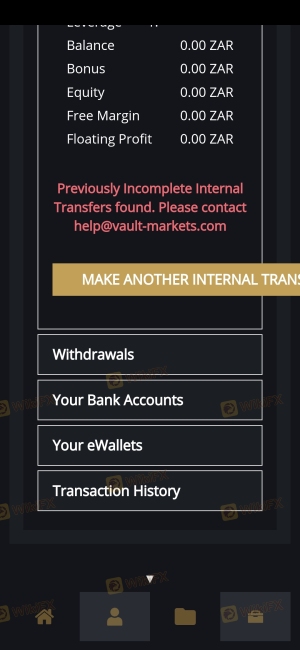

The safety of client funds is a paramount concern for any trader. Vault Markets claims to implement several security measures, including segregated accounts to keep client funds separate from company funds. However, the absence of an investor protection scheme raises concerns about the safety of deposits in the event of broker insolvency.

Moreover, Vault Markets offers negative balance protection, which ensures that traders cannot lose more than their initial investment. While this is a positive aspect, the overall security measures appear to be insufficient when compared to brokers regulated by tier-1 authorities. Historical complaints about withdrawal issues and fund accessibility further highlight potential risks associated with trading through Vault Markets.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Vault Markets reveal a mixed bag of experiences, with many users expressing dissatisfaction with the company's customer service and withdrawal processes. Below is a summary of common complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Support | Medium | Slow response times |

| Misleading Information | High | Unaddressed |

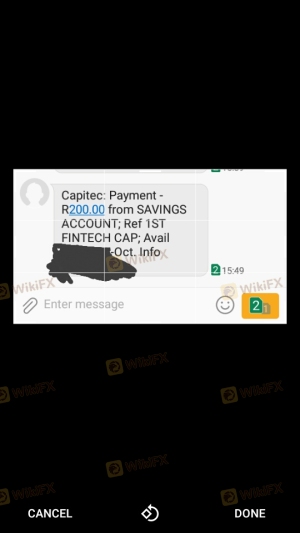

Common complaints include delayed withdrawals, unresponsive customer service, and discrepancies between advertised and actual trading conditions. For instance, some users have reported significant delays in accessing their funds, which can be detrimental to traders relying on timely withdrawals. These issues highlight the need for potential clients to approach Vault Markets with caution.

Platform and Trade Execution

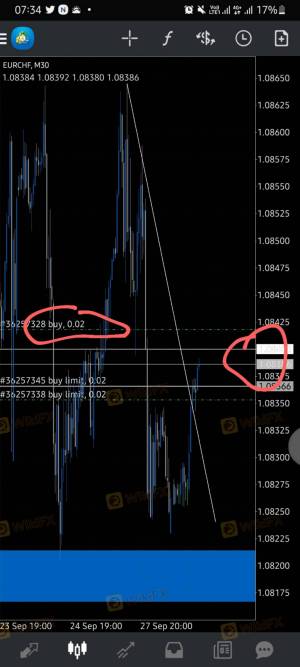

The trading platform offered by Vault Markets is primarily MetaTrader 4 (MT4), which is widely recognized for its user-friendly interface and robust features. However, the absence of a demo account limits the ability of new traders to familiarize themselves with the platform before committing real funds.

In terms of trade execution, users have reported varying experiences, with some noting issues with slippage and order rejections during volatile market conditions. These problems can impact trading outcomes and raise concerns about the broker's execution quality. Overall, while the platform offers essential trading tools, the lack of a demo account and reports of execution issues may deter potential clients.

Risk Assessment

Using Vault Markets comes with an inherent level of risk, particularly due to its regulatory status and customer feedback. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of tier-1 regulation and oversight |

| Financial Risk | Medium | Potential for hidden fees and charges |

| Operational Risk | High | Issues with withdrawal and customer service |

Given these risks, traders should exercise caution when considering Vault Markets as their trading platform. It is advisable to start with small investments to assess the broker's performance and reliability.

Conclusion and Recommendations

In conclusion, while Vault Markets presents itself as a legitimate trading platform, various red flags raise concerns about its safety and reliability. The lack of strong regulatory oversight, combined with numerous customer complaints regarding withdrawal issues and transparency, suggests that traders should approach this broker with caution.

For traders seeking a more secure and regulated trading environment, it may be wise to consider alternatives such as brokers regulated by tier-1 authorities like FCA or ASIC. These brokers typically offer better protection for client funds and a more transparent trading experience. Overall, the findings suggest that while Vault Markets may offer competitive trading conditions, the potential risks associated with its operations warrant careful consideration before proceeding.

In summary, is Vault Markets safe? The answer is not straightforward, and traders should conduct thorough research and consider their risk tolerance before engaging with this broker.

Is Vault Markets a scam, or is it legit?

The latest exposure and evaluation content of Vault Markets brokers.

Vault Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vault Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.