Is SEVEN STAR FX safe?

Pros

Cons

Is Seven Star FX Safe or Scam?

Introduction

Seven Star FX is a forex broker that has been operating since 2004, positioning itself as a provider of various trading instruments including forex, commodities, indices, and cryptocurrencies. With the increasing popularity of online trading, it is crucial for traders to thoroughly evaluate brokers before committing their funds. The forex market is rife with both reputable and fraudulent entities, making due diligence essential for safeguarding investments. This article investigates Seven Star FX's legitimacy by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The assessment is based on a review of multiple sources, including regulatory filings, trader reviews, and expert analyses, to provide a comprehensive understanding of the broker's standing in the market.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. Seven Star FX claims to be registered with the Financial Services Authority of St. Vincent and the Grenadines (SVG FSA). However, this assertion has raised concerns among industry experts and traders alike, as the SVG FSA does not provide robust oversight for forex trading activities. Furthermore, several reviews indicate that the broker is unregulated, which poses significant risks to investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 23895 IBC 2016 | St. Vincent | Unverified |

The absence of a credible regulatory framework means that Seven Star FX is not subject to the stringent requirements that regulated brokers must adhere to, such as maintaining segregated accounts for client funds and ensuring transparency in operations. This lack of oversight raises red flags regarding the safety of client investments and the broker's operational integrity.

Company Background Investigation

Seven Star FX Ltd. claims to have been established in 2004, operating primarily out of St. Vincent and the Grenadines. However, the company's ownership structure and management team remain opaque, with minimal publicly available information. The lack of transparency about who runs the brokerage and their qualifications is concerning, as it raises questions about accountability and governance.

The company's historical claims of regulation have been called into question, and while it has attempted to present itself as a legitimate entity, the absence of verifiable information about its management team further complicates the assessment. A reputable broker typically provides detailed information about its leadership and operational history, which is crucial for building trust with clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital for assessing its competitiveness in the market. Seven Star FX offers a range of trading instruments with varying spreads and leverage options. However, the broker's fee structure has been criticized, particularly regarding hidden fees and non-competitive spreads.

| Fee Type | Seven Star FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.0 - 1.5 pips |

| Commission Structure | Variable | Low to none |

| Overnight Interest Range | Varies | Competitive |

The spreads offered by Seven Star FX are notably higher than the industry average, which could significantly impact trading profitability. Additionally, the broker's commission model lacks clarity, with reports of unexpected fees that could catch traders off guard. Such practices are often indicative of less reputable brokers.

Client Fund Safety

The safety of client funds is paramount in the forex trading landscape. Seven Star FX has been criticized for its lack of investor protection measures. The broker does not provide segregated accounts, which are essential for ensuring that client funds are kept separate from the company's operational funds. This lack of separation increases the risk of misuse of client funds and raises concerns about the broker's financial stability.

Moreover, there are no indications that Seven Star FX participates in any investor compensation schemes, which are crucial for protecting clients in the event of broker insolvency. Historical complaints about fund withdrawal issues further exacerbate concerns about the safety of funds held with this broker.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews for Seven Star FX reveal a mixed bag of experiences, with many traders expressing dissatisfaction regarding withdrawal processes and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Quality | Medium | Poor |

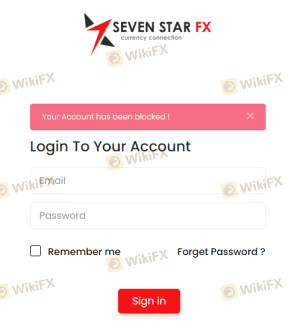

Common complaints include difficulties in withdrawing funds and unresponsive customer service. Some users have reported that their accounts were frozen or that they faced unreasonable verification requests, leading to frustration and financial loss. Such patterns of behavior are often associated with scam brokers, making it imperative for potential clients to approach with caution.

Platform and Trade Execution

The trading platform offered by Seven Star FX is MetaTrader 4 (MT4), a widely recognized platform known for its user-friendly interface and robust trading tools. However, issues have been reported regarding order execution quality, with some traders experiencing slippage and rejected orders.

The platform's performance is critical for traders, and any signs of manipulation or poor execution can severely impact trading outcomes. While MT4 is generally reliable, the broker's execution practices need to be scrutinized to ensure that traders receive fair treatment.

Risk Assessment

Engaging with Seven Star FX comes with inherent risks, particularly due to its unregulated status and questionable operational practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No credible regulation, increasing risk. |

| Fund Safety | High | Lack of segregation and investor protection. |

| Withdrawal Issues | Medium | Historical complaints about fund access. |

To mitigate risks, traders should consider using only regulated brokers and avoid those with a history of complaints. It is advisable to start with a minimal deposit and test the broker's withdrawal processes before committing larger amounts.

Conclusion and Recommendations

In conclusion, Seven Star FX raises significant concerns regarding its legitimacy and safety. The lack of credible regulation, coupled with reports of withdrawal issues and poor customer service, suggests that this broker may not be a trustworthy option for traders. While it offers a variety of trading instruments and utilizes a popular platform, the risks associated with trading through Seven Star FX are considerable.

For traders seeking reliable alternatives, it is recommended to consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC, which offer better investor protection and transparency. Brokers like eToro, IG, or Forex.com are examples of reputable entities that provide a safer trading environment. Always conduct thorough research and due diligence before engaging with any broker to ensure the safety of your investments.

Is SEVEN STAR FX a scam, or is it legit?

The latest exposure and evaluation content of SEVEN STAR FX brokers.

SEVEN STAR FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SEVEN STAR FX latest industry rating score is 2.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.