Is PWC safe?

Pros

Cons

Is PWC Safe or Scam?

Introduction

PWC, short for PricewaterhouseCoopers Investment Services (Cyprus) Ltd, is a brokerage firm that has been operating in the forex market since its establishment in 2018. Positioned primarily in Cyprus, PWC aims to provide a range of trading services to clients across various regions, including Germany, the United Kingdom, and India. However, as the forex market is rife with potential risks and scams, it is crucial for traders to conduct thorough evaluations of brokers before engaging in trading activities. This article investigates the safety and legitimacy of PWC by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The findings are based on a review of multiple credible sources, including broker reviews and regulatory disclosures.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and safety for traders. PWC is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a recognized regulatory authority in the European Union. The importance of regulation lies in the protection it offers to traders, ensuring that brokers adhere to strict operational standards and maintain transparency in their dealings. Below is a summary of PWC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 351/17 | Cyprus | Verified |

The CySEC license indicates that PWC is subject to the regulatory framework that governs financial institutions in Cyprus. However, it is essential to note that some reviews have raised concerns about PWC's compliance with the regulatory requirements, suggesting a lower-than-average score on platforms like WikiFX, where it received a score of 3.34 out of 10. This score raises questions about the broker's operational transparency and adherence to regulatory standards. Overall, while PWC is regulated, the quality and effectiveness of its regulation warrant careful consideration by potential traders.

Company Background Investigation

PWC was founded in 2018 and has since positioned itself within the competitive landscape of forex brokers. The company's ownership structure is tied to its parent organization, which is known for its extensive experience in the financial services sector. The management team at PWC comprises professionals with backgrounds in finance and investment, contributing to the firm's operational capabilities. However, the relatively short history of the company may raise concerns for traders who prefer established brokers with a long track record of performance.

In terms of transparency, PWC provides various contact channels, including social media platforms and a customer service hotline. However, the broker's overall information disclosure practices have been criticized for lacking depth, particularly regarding its financial health and business operations. Traders should assess whether the available information meets their expectations for transparency. In summary, while PWC has a solid foundation and management team, its brief history and limited disclosures may be a red flag for some traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to assess their potential profitability. PWC's fee structure includes spreads and commissions that are competitive within the market. However, some reviews indicate that traders may encounter unexpected fees, leading to concerns about the broker's overall pricing transparency. Below is a comparison of PWC's core trading costs with industry averages:

| Fee Type | PWC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | Variable | 0.1% |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

The variable spreads indicate that traders may face fluctuating costs depending on market conditions. While PWC's spreads are competitive, the variability may lead to higher costs during volatile trading periods. Furthermore, the lack of a clear commission structure may confuse traders, especially those who prefer fixed fees. Overall, potential traders should carefully review PWC's fee structure to ensure it aligns with their trading strategies and expectations.

Customer Fund Safety

The safety of customer funds is a critical aspect of evaluating any broker. PWC claims to implement measures to safeguard client funds, including the separation of client accounts from the company's operational funds. This practice is crucial as it ensures that even in the event of the broker facing financial difficulties, clients' funds remain protected. Additionally, PWC is expected to adhere to the investor protection schemes mandated by CySEC, which typically include compensation funds for clients in case of broker insolvency.

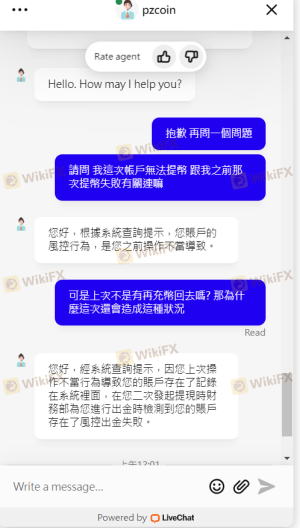

However, concerns have been raised regarding PWC's historical performance in safeguarding funds. Some reviews suggest that there have been instances where traders faced difficulties in withdrawing their funds, raising questions about the broker's reliability. Traders should be aware of these potential issues and assess PWC's track record in fund security before making any commitments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. PWC has received mixed reviews from its users, with some praising its customer service and trading platform, while others have reported issues related to fund withdrawals and delayed responses from support staff. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Support Issues | Medium | Moderate Response |

| Platform Stability | Low | Generally Positive |

One notable case involved a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and dissatisfaction with PWC's customer service. This incident highlights the importance of evaluating a broker's responsiveness and reliability in handling customer issues. Overall, while PWC has its strengths, potential traders should be cautious and consider feedback from existing users before proceeding.

Platform and Execution

The trading platform's performance is crucial for a seamless trading experience. PWC offers a proprietary trading platform that has received positive feedback for its user-friendly interface and functionality. However, some reviews indicate that traders have experienced issues related to order execution, including slippage and rejected orders. These factors can significantly impact a trader's profitability and overall experience.

Traders should consider the execution quality and any potential signs of manipulation. In a highly competitive market, brokers must provide transparent and efficient order execution to maintain trust with their clients. Therefore, it is essential for potential users to assess PWC's platform performance through demo accounts or by gathering feedback from current users.

Risk Assessment

Using PWC as a forex broker comes with inherent risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with trading with PWC:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews on regulatory adherence |

| Fund Security | High | Historical issues with withdrawals |

| Customer Support | Medium | Inconsistent response times |

To mitigate these risks, traders should conduct thorough due diligence, including reading reviews and seeking alternative brokers with stronger reputations. It is also advisable to start with smaller investments to test the waters before committing larger sums.

Conclusion and Recommendations

In conclusion, the question of whether PWC is safe or a scam remains complex. While the broker is regulated by CySEC, concerns about its compliance history, customer feedback, and fund security practices warrant caution. Traders should be particularly vigilant regarding withdrawal processes and the overall transparency of the broker's operations. For those considering PWC, it may be wise to explore alternative brokers with stronger reputations and proven track records in customer service and fund safety. Ultimately, thorough research and a cautious approach are essential when engaging with any forex broker, including PWC.

Is PWC a scam, or is it legit?

The latest exposure and evaluation content of PWC brokers.

PWC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PWC latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.