Is TOKYO safe?

Pros

Cons

Is Tokyo Safe or a Scam?

Introduction

Tokyo, a prominent player in the global forex market, has attracted a diverse range of traders seeking to capitalize on currency fluctuations. As with any investment opportunity, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of forex brokers. The forex market is rife with potential pitfalls, including scams and unregulated brokers that can jeopardize investors' funds. This article aims to provide an objective assessment of whether Tokyo is a safe option for traders or if it presents significant risks that warrant concern. Our investigation is based on a comprehensive analysis of regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a cornerstone of any financial institution's credibility. Tokyo's regulatory status is crucial for potential investors to understand, as it directly impacts their safety and the legitimacy of the trading conditions offered.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | N/A | Japan | Not Verified |

The FSA is the primary regulatory body overseeing financial institutions in Japan, including forex brokers. However, it is important to note that Tokyo has been reported to operate without a valid license, raising red flags about its operations. The absence of verification from a reputable regulatory authority suggests that traders may be exposed to significant risks, including the potential for fraud and mismanagement of funds.

The quality of regulation is paramount; brokers regulated by top-tier authorities are generally required to adhere to strict operational standards, ensuring transparency and protecting client interests. Historical compliance records of Tokyo indicate a lack of oversight, which could potentially lead to disputes and loss of funds for investors.

Company Background Investigation

Understanding the company behind a forex broker is essential in evaluating its trustworthiness. Tokyo's history and ownership structure reveal a relatively short operational timeline, having been in business for less than a year. This limited experience raises concerns regarding its stability and ability to navigate market fluctuations.

The management team of Tokyo has not been adequately disclosed, leaving potential investors in the dark about their qualifications and expertise. A transparent company is often characterized by a well-documented management team with relevant industry experience. Unfortunately, the lack of information about the leadership at Tokyo further exacerbates concerns regarding its legitimacy.

Moreover, the level of transparency regarding operational practices and financial disclosures is critical. A reputable broker will provide comprehensive information about its operations, including financial health, trading conditions, and risk management practices. In Tokyo's case, the absence of such information is a significant warning sign for potential investors.

Trading Conditions Analysis

An evaluation of trading conditions is vital for understanding the overall cost of trading with a broker. Tokyo's fee structure has raised concerns among traders, particularly regarding hidden fees and unfavorable trading conditions.

| Fee Type | Tokyo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Average |

| Commission Structure | Unclear | Standard |

| Overnight Interest Range | High | Low |

The overall cost of trading with Tokyo appears to be higher than the industry average, indicating a potentially uncompetitive offering. Traders have reported unexpected fees that could significantly impact profitability. Such practices are commonly associated with less reputable brokers, making it essential for traders to approach Tokyo with caution.

In addition, the unclear commission structure may lead to confusion and dissatisfaction among clients, as they may not fully grasp the costs associated with their trades. A transparent fee structure is crucial for maintaining trust and ensuring that traders can accurately assess their potential returns.

Client Fund Safety

The safety of client funds is a paramount concern for any forex trader. An analysis of Tokyo's safety measures reveals several alarming issues. The broker reportedly does not implement strict fund segregation policies, which could put clients' investments at risk in the event of financial difficulties.

Furthermore, the absence of investor protection mechanisms, such as those provided by regulatory bodies, raises significant concerns about the security of client funds. Traders should be wary of brokers that do not offer robust measures to protect their investments, as this could lead to catastrophic losses.

Historical incidents involving Tokyo have raised additional alarms regarding fund safety. Reports of clients struggling to withdraw funds and facing unexplained account freezes have surfaced, indicating potential mismanagement and a lack of accountability.

Client Experience and Complaints

Customer feedback is a critical component in assessing the overall reliability of a broker. An analysis of client experiences with Tokyo reveals a pattern of dissatisfaction among traders. Common complaints include difficulties in withdrawing funds, lack of responsive customer service, and issues related to the execution of trades.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Execution Problems | High | Unresolved |

Two notable cases illustrate these concerns:

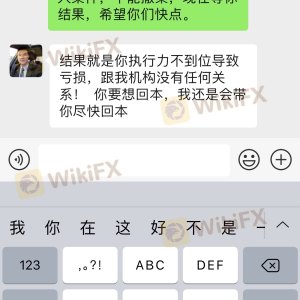

Case of Mr. Lu: A trader reported successful initial withdrawals, only to face repeated denials for subsequent requests. This pattern is often indicative of a broker attempting to lure clients into investing more before restricting access to their funds.

Case of Ms. Chen: Another trader voiced frustration over unresponsive customer service when attempting to resolve issues related to trade execution, which further compounded her dissatisfaction with the broker.

These complaints highlight significant issues that could impact a trader's experience and overall trust in Tokyo as a reliable forex broker.

Platform and Execution

The trading platform's performance is crucial for a positive trading experience. Tokyo's platform has been reported to experience frequent outages and lag, which can hinder traders' ability to execute trades effectively.

Additionally, there have been indications of slippage and high rejection rates for orders, further complicating the trading experience. Such issues can lead to significant losses, especially for traders employing high-frequency strategies.

Risk Assessment

When considering whether to trade with Tokyo, it is essential to evaluate the comprehensive risks involved.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and licensing |

| Fund Safety Risk | High | No segregation or protection measures |

| Execution Risk | Medium | Platform instability and order issues |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Tokyo. Seeking alternative brokers with strong regulatory oversight and positive client reviews is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tokyo presents significant risks for potential traders. The lack of regulatory oversight, unresolved client complaints, and questionable trading conditions point to a broker that may not be safe for trading.

For traders considering engaging with Tokyo, it is crucial to remain vigilant and consider alternative, more reputable options in the forex market. Brokers with established regulatory frameworks, transparent practices, and positive client feedback should be prioritized to ensure a safer trading environment.

Ultimately, the question remains: Is Tokyo safe? Based on the current findings, prospective traders should approach with caution and prioritize their financial security.

Is TOKYO a scam, or is it legit?

The latest exposure and evaluation content of TOKYO brokers.

TOKYO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOKYO latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.