Tokyo 2025 Review: Everything You Need to Know

Executive Summary

Tokyo stands as one of the most significant financial hubs in the global forex trading landscape. The city offers traders a unique blend of traditional Japanese business culture and cutting-edge financial technology that sets it apart from other markets. Based on available information, Tokyo's financial district provides an active trading environment with sophisticated infrastructure. However, specific broker details remain limited in publicly available sources, making comprehensive analysis challenging for potential traders.

The city's financial sector is characterized by its strong regulatory framework and technological advancement. This makes it an attractive destination for serious traders seeking professional trading conditions in the Asian markets. This tokyo review examines the available information about Tokyo-based financial services. Though comprehensive broker-specific data requires further investigation, the general landscape appears robust and well-regulated.

The trading environment in Tokyo is particularly suited for institutional traders and those seeking exposure to Asian market hours. The city serves as a gateway to Japan's robust financial markets, offering unique opportunities for international traders. With its strategic location and advanced infrastructure, Tokyo continues to play a crucial role in global financial markets.

Important Notice

Due to limited specific regulatory and operational information available in public sources, this review focuses on general characteristics of Tokyo's financial trading environment. Different regulatory jurisdictions may apply varying legal frameworks and trading conditions. These variations could significantly impact trader experiences and outcomes in ways that are difficult to predict without specific information.

This evaluation is based on publicly available information about Tokyo's financial sector and general market observations. Potential traders should conduct thorough due diligence and verify specific regulatory status, trading conditions, and operational details directly with any financial service providers. The importance of this verification cannot be overstated, as trading conditions can change rapidly in dynamic markets. The lack of detailed broker-specific information in available sources necessitates careful verification of all trading terms and conditions before making any investment decisions.

Rating Framework

Broker Overview

Tokyo's financial services sector operates within one of the world's most sophisticated regulatory environments. However, specific establishment dates and company backgrounds for individual brokers require direct verification from the companies themselves. According to available information from Tokai Tokyo Financial Holdings documentation, the financial landscape in Tokyo has evolved significantly over recent decades.

Holding companies established as recently as 2009 demonstrate the dynamic nature of the sector. The business models employed by Tokyo-based financial institutions typically emphasize regulatory compliance and technological innovation, reflecting Japan's commitment to maintaining high standards. These standards help protect both domestic and international clients while fostering innovation in financial services.

The trading infrastructure in Tokyo benefits from Japan's advanced technological capabilities and robust regulatory oversight. While specific details about trading platforms, asset classes, and regulatory specifics are not comprehensively detailed in available public sources, the general framework suggests a focus on institutional-grade services. This tokyo review indicates that the financial ecosystem in Tokyo is designed to serve both domestic and international clients effectively. Though specific operational details require direct inquiry with individual service providers to ensure accuracy and current relevance, the overall environment appears well-structured for professional trading activities.

Regulatory Jurisdiction: Specific regulatory details are not comprehensively outlined in available sources. Japan's financial sector operates under strict oversight from multiple regulatory bodies that ensure market integrity.

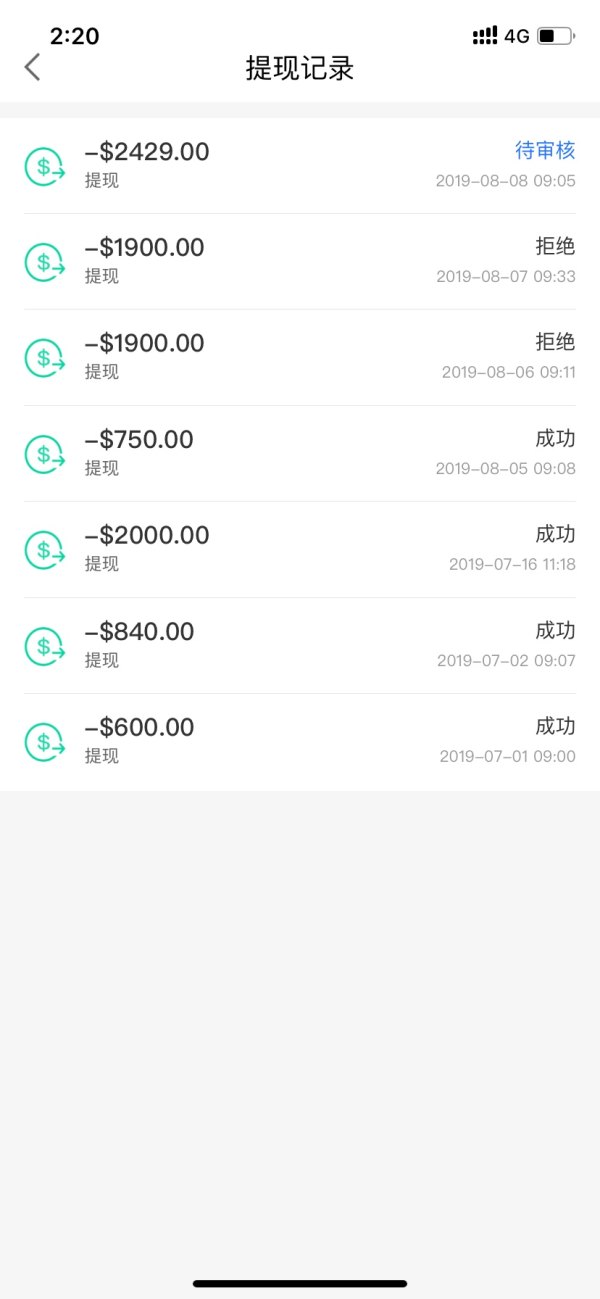

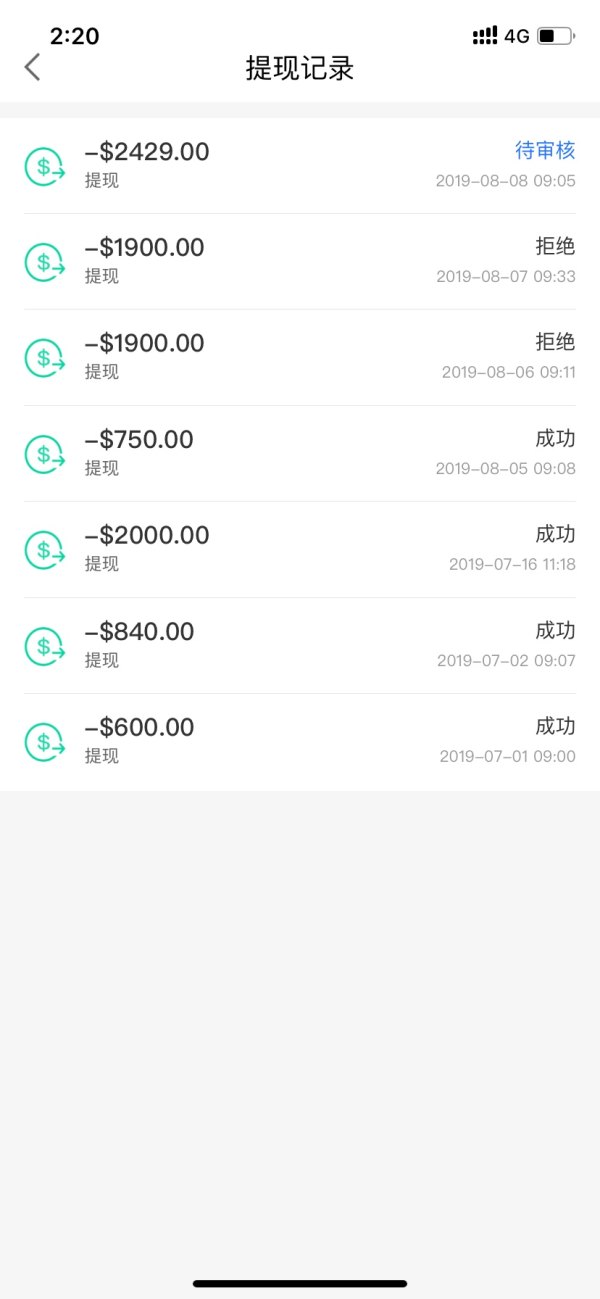

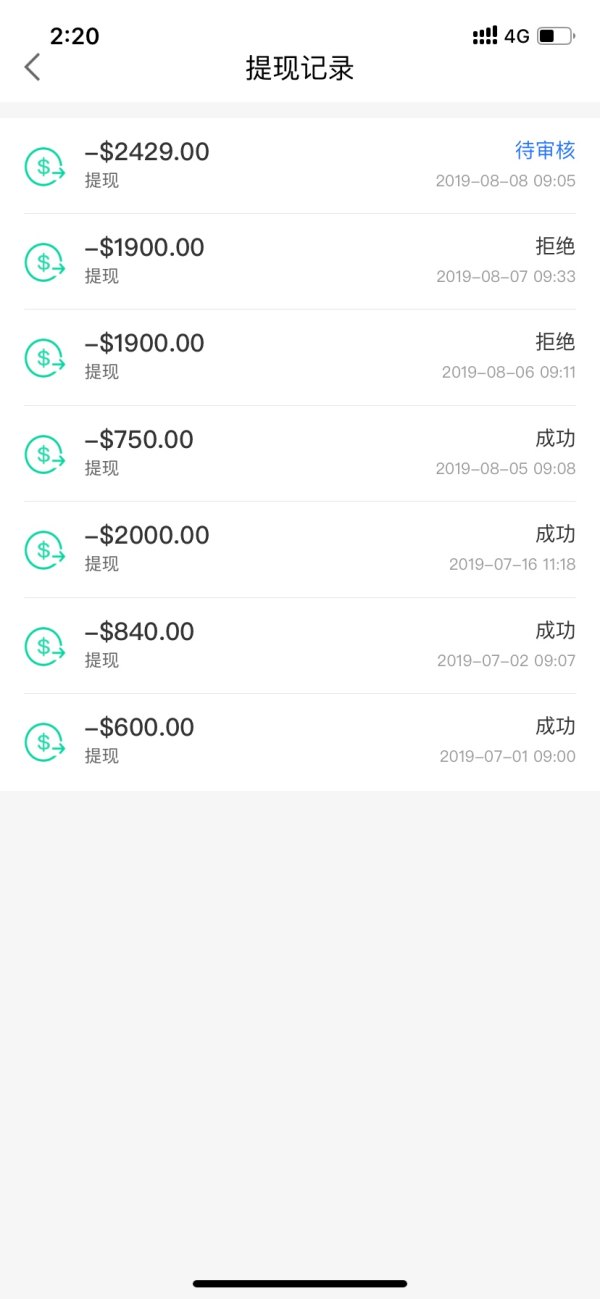

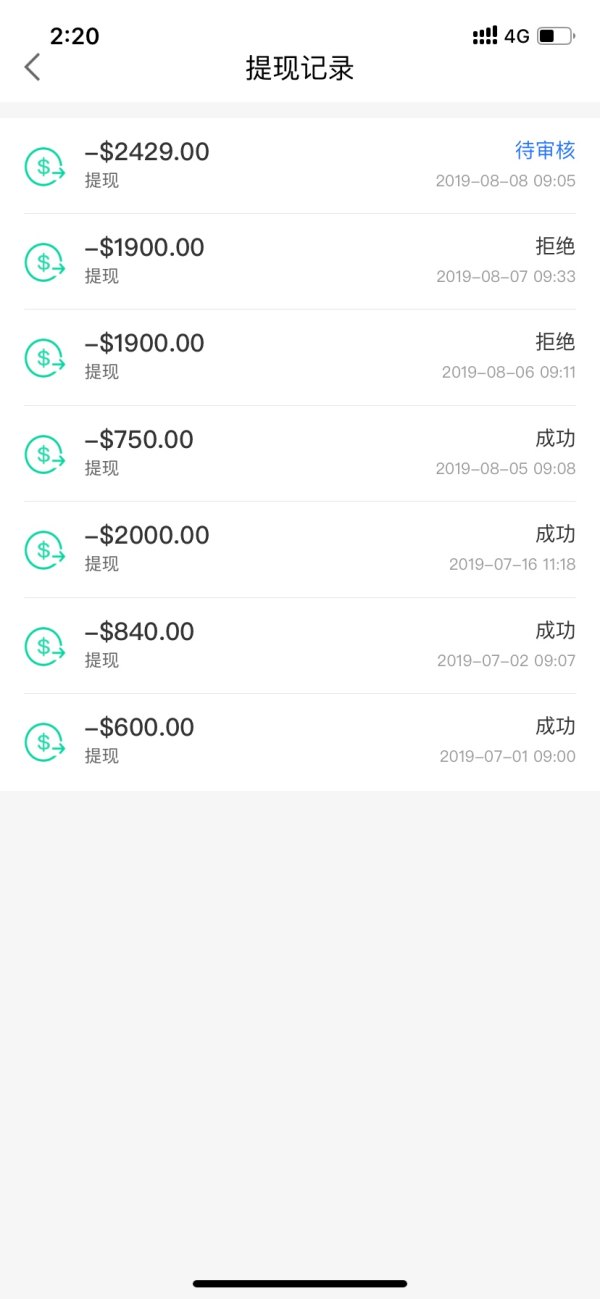

Deposit and Withdrawal Methods: Detailed information about payment processing methods is not specified in reviewed materials. Direct verification with service providers is necessary to understand available options and processing times.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available public documentation. These requirements can vary significantly between different service providers and account types.

Bonuses and Promotions: Information regarding promotional offers and bonus structures is not detailed in accessible sources. Traders should inquire directly about current promotional offerings and their terms and conditions.

Tradeable Assets: Comprehensive asset listings are not provided in the reviewed materials. Tokyo's position suggests broad market access across multiple asset classes including forex, equities, and commodities.

Cost Structure: Detailed fee schedules and cost breakdowns are not specified in available public information. Direct inquiry with service providers is essential to understand the complete cost structure and any potential hidden fees.

Leverage Ratios: Specific leverage offerings are not mentioned in the sources reviewed. Leverage availability may be subject to regulatory restrictions and individual account qualifications.

Platform Options: Detailed platform specifications are not outlined in available materials. Most major financial centers offer multiple platform options to suit different trading styles and preferences.

Geographic Restrictions: Specific regional limitations are not detailed in accessible documentation. These restrictions can change based on regulatory developments and international agreements.

Customer Support Languages: Language support details are not specified in reviewed sources. In an international financial center like Tokyo, multilingual support would typically be expected but should be confirmed directly.

This tokyo review highlights the need for direct verification of operational details with specific service providers. Potential clients should prepare comprehensive questions about all aspects of service delivery before making any commitments.

Detailed Rating Analysis

Account Conditions Analysis

The account structure and conditions offered by Tokyo-based financial services require direct verification. Specific details are not comprehensively outlined in available public sources, making it difficult to provide definitive guidance. Based on the general framework of Japan's financial sector, account offerings likely emphasize regulatory compliance and sophisticated features suitable for professional traders.

The account opening process in Japan typically involves stringent verification procedures. These procedures reflect the country's commitment to financial transparency and anti-money laundering protocols that protect both institutions and clients. Documentation requirements may be more extensive than in some other jurisdictions, but this thoroughness helps ensure market integrity.

Minimum deposit requirements and account tier structures are not specified in the reviewed materials. This indicates that potential clients must engage directly with service providers for accurate information about available account types. Special account features, including Islamic finance-compliant options, would need to be confirmed through direct inquiry with individual providers.

The regulatory environment in Japan suggests that account conditions are likely structured to meet high compliance standards. However, specific terms and conditions require individual verification to ensure they meet trader needs and expectations. This tokyo review emphasizes the importance of obtaining current and detailed account information directly from service providers before making any commitments.

The trading tools and resources available through Tokyo's financial sector likely reflect Japan's reputation for technological innovation. However, specific details are not outlined in available public documentation, making comprehensive assessment challenging. The general technological infrastructure in Tokyo suggests access to sophisticated trading platforms and analytical resources, consistent with the city's position as a major financial hub.

Research and analysis capabilities would be expected to meet institutional standards. Though specific offerings require direct verification, the competitive nature of Tokyo's financial sector suggests robust analytical tools. Market data feeds, charting capabilities, and research reports would typically be available to support informed trading decisions.

Educational resources and training materials are not detailed in the reviewed sources. This indicates that potential users should inquire directly about available learning opportunities and skill development programs. Automated trading support and algorithmic trading capabilities would likely be available given Tokyo's technological advancement, but specific features and compatibility details are not specified in accessible materials.

The absence of detailed tool specifications in public sources underscores the need for direct engagement with service providers. Traders should evaluate available resources and their capabilities through hands-on demonstrations and trial periods when possible.

Customer Service and Support Analysis

Customer service standards and support structures for Tokyo-based financial services are not detailed in available public sources. However, Japan's business culture typically emphasizes high-quality customer relations and attention to detail. Response times, service quality metrics, and available communication channels require direct verification with individual service providers to ensure they meet specific needs.

The multilingual capabilities that might be expected in an international financial center like Tokyo are not specifically outlined in reviewed materials. Given the international nature of financial markets, support in multiple languages would be expected but should be confirmed directly. Operating hours and availability schedules for customer support are not mentioned in accessible documentation, necessitating direct inquiry for accurate information.

Problem resolution procedures and escalation processes would likely reflect Japanese business practices emphasizing thoroughness and attention to detail. However, specific protocols are not detailed in available sources, making it important to understand these processes before engaging services. The cultural emphasis on customer satisfaction in Japan suggests high service standards, but verification is essential.

The lack of comprehensive customer service information in public materials highlights the importance of evaluating support quality through direct interaction. Potential clients should test responsiveness and service quality during the evaluation process.

Trading Experience Analysis

The trading experience offered by Tokyo-based financial services likely benefits from Japan's advanced technological infrastructure. However, specific platform performance metrics are not detailed in available sources, making objective assessment difficult. Order execution quality and platform stability would be expected to meet high standards given Tokyo's position as a major financial center, but specific performance data requires direct verification.

Platform functionality and feature completeness are not comprehensively outlined in reviewed materials. Modern trading platforms typically offer advanced charting, multiple order types, and real-time market data, but specific capabilities should be evaluated directly. Mobile trading capabilities and cross-platform compatibility details are not specified in accessible documentation, indicating that potential users should evaluate these aspects through hands-on testing.

The trading environment in Tokyo would likely emphasize reliability and sophisticated features suitable for professional trading. However, specific characteristics require individual verification to ensure they align with trading strategies and preferences. Market access during Asian trading hours would be a particular advantage for traders focused on regional markets.

This tokyo review suggests that while the general framework appears robust, detailed trading experience evaluation requires hands-on assessment. Traders should request demo accounts or trial periods to evaluate platform performance and functionality before committing to live trading.

Trust and Reliability Analysis

The regulatory framework governing Tokyo's financial sector suggests high standards for trust and reliability. However, specific regulatory credentials for individual brokers are not detailed in available sources, making independent verification essential. Japan's financial oversight regime is generally recognized for its stringency, indicating that authorized service providers operate under comprehensive supervision.

Fund safety measures and client protection protocols would likely meet international standards. Though specific details require direct verification, Japan's regulatory environment typically includes investor protection mechanisms. Company transparency and disclosure practices are not specifically outlined in reviewed materials, necessitating direct evaluation of individual service providers.

Industry reputation and third-party validation information is not comprehensively available in accessible sources. Potential clients should research company backgrounds, regulatory history, and industry standing independently. The handling of negative events and dispute resolution procedures would likely reflect Japanese business practices emphasizing responsibility and thoroughness, though specific protocols are not detailed in available documentation.

Financial strength and operational stability should be evaluated through available financial statements and regulatory filings. This information may not be readily accessible in public sources but can often be obtained through direct inquiry or regulatory databases.

User Experience Analysis

Overall user satisfaction metrics and experience feedback are not detailed in available public sources. This indicates that potential users should seek current user testimonials and reviews directly from multiple sources. Interface design and usability characteristics are not specifically outlined in reviewed materials, though Tokyo's technological standards suggest sophisticated user experience design.

Registration and verification processes would likely reflect Japan's stringent compliance requirements. However, specific procedures require direct verification to understand documentation needs and processing timeframes. Fund operation experiences and transaction processing details are not specified in accessible documentation, making it important to understand these processes before beginning trading activities.

Common user concerns and feedback patterns are not outlined in available sources. This necessitates direct research into current user experiences through forums, review sites, and direct testimonials. The user profile most suitable for Tokyo-based services would likely include professional traders and those seeking exposure to Asian markets, though specific target demographics require individual service provider clarification.

Platform learning curves and onboarding support should be evaluated during the selection process. New users should understand available training resources and support during the initial learning period.

Conclusion

This tokyo review reveals that while Tokyo represents a significant financial hub with sophisticated infrastructure and regulatory oversight, specific operational details for individual brokers require direct verification. The general framework suggests a professional trading environment suitable for serious traders seeking high-quality financial services in the Asian markets. However, comprehensive evaluation necessitates direct engagement with service providers to understand specific terms, conditions, and capabilities.

The main advantages appear to include access to a major financial center with strong regulatory foundations and advanced technological infrastructure. The primary limitation is the lack of readily available detailed operational information in public sources, which requires additional research effort. Potential traders should prepare comprehensive due diligence processes and direct inquiries to fully evaluate available options in Tokyo's financial services sector.