Is StockPCL safe?

Business

License

Is StockPCL Safe or Scam?

Introduction

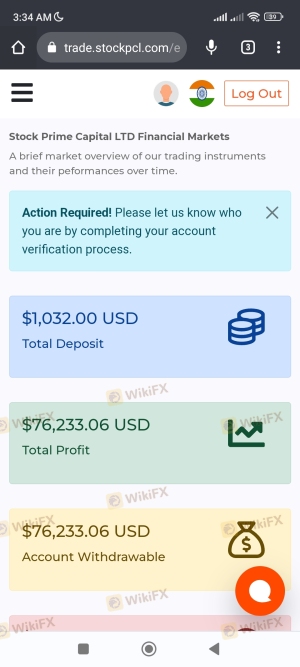

StockPCL is a relatively new entrant in the forex market, positioning itself as an online trading platform that offers access to various financial instruments, including forex, commodities, and indices. As the trading landscape continues to evolve, it becomes increasingly essential for traders to thoroughly evaluate the legitimacy and safety of brokers like StockPCL. The potential for financial loss due to scams and unregulated platforms is significant, making it imperative for investors to conduct diligent research before committing their funds. This article aims to provide a comprehensive analysis of StockPCL, assessing its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on a review of multiple reputable sources, including regulatory databases, customer feedback, and industry reports.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards of conduct and financial practices. Unfortunately, StockPCL is reported to be an unregulated broker, which raises significant concerns about the safety of client funds.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that StockPCL does not operate under the oversight of any recognized financial authority, such as the UK's Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC). This lack of oversight can expose traders to various risks, including the potential for fraud and mismanagement of funds. Additionally, unregulated brokers often lack transparency regarding their operations, making it challenging for clients to seek recourse in the event of disputes or issues. Overall, the regulatory quality associated with StockPCL is concerning, and potential investors should exercise extreme caution when considering this platform.

Company Background Investigation

StockPCL was established in 2022, claiming to be based in the United Kingdom. However, information about its ownership structure and management team is scarce, which raises red flags regarding the company's transparency. A credible broker should provide clear details about its leadership, including the backgrounds and qualifications of key executives. Unfortunately, the lack of publicly available information about StockPCL's management team makes it difficult to assess their expertise and commitment to ethical trading practices.

Moreover, the company's website does not offer adequate disclosures about its operational history or financial health. This opacity is concerning, as it prevents potential clients from making informed decisions about engaging with the broker. In the world of online trading, transparency is crucial, and the absence of such information may indicate underlying issues. Therefore, the lack of a clear company background and ownership structure further diminishes StockPCL's credibility and raises questions about its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is essential. StockPCL claims to provide competitive trading fees, including low spreads and no commissions on certain trades. However, the details surrounding these conditions are not consistently reported across various reviews.

| Fee Type | StockPCL | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.0 pips | 1.0-2.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | N/A | 0.5%-1.5% |

While the advertised spreads of 0.0 pips may seem attractive, traders should be wary of hidden fees or unfavorable trading conditions that might not be immediately apparent. Many unregulated brokers employ deceptive practices, such as high withdrawal fees or unfavorable exchange rates, that can erode profits. Furthermore, the lack of a clear commission structure or overnight interest rates raises concerns about the transparency of StockPCL's fee model. Traders should be cautious and ensure they fully understand the cost implications before committing to this broker.

Customer Funds Safety

The safety of customer funds is a paramount concern when selecting a broker. StockPCL's lack of regulation is a significant warning sign, as it means there are no legal protections in place to safeguard client funds. Regulated brokers are typically required to segregate client funds from their own operational capital, providing an additional layer of security. However, without regulatory oversight, StockPCL may not adhere to such practices.

Additionally, there is no information available regarding investor protection measures, such as negative balance protection or compensation schemes for clients in the event of insolvency. The absence of these safeguards increases the risk of financial loss for traders using StockPCL. Historical data on previous fund security issues or disputes involving StockPCL is also lacking, which further complicates the assessment of its safety. As a result, potential investors should approach StockPCL with caution, as their funds may be at significant risk.

Customer Experience and Complaints

Customer feedback is a crucial element in evaluating a broker's reliability. Reviews of StockPCL indicate a mixed experience among users, with several complaints highlighting issues related to withdrawal difficulties and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Misleading Promotions | High | Unresponsive |

Common complaints include reports of clients facing obstacles when attempting to withdraw their funds, with some users claiming that their requests were ignored or met with excessive fees. Additionally, the quality of customer support has been criticized, with many users reporting long response times and unhelpful assistance. Such complaints are significant indicators of a broker's operational integrity and can be a critical factor in determining whether StockPCL is a safe platform.

One notable case involved a trader who reported being unable to withdraw their funds for several weeks, despite multiple attempts to contact customer support. This situation exemplifies the potential risks associated with using an unregulated broker like StockPCL, where clients may find themselves without recourse in the event of disputes.

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a positive trading experience. StockPCL offers a web-based trading platform, which allows users to access their accounts from anywhere with an internet connection. However, reports regarding the platform's stability and order execution quality are mixed.

Traders have noted instances of slippage during high-volatility periods, which can significantly impact trading outcomes. Moreover, concerns about order rejection rates have been raised, with some users reporting that their trades were not executed as expected. Such issues can be detrimental to a trader's success and may indicate underlying problems with the platform's infrastructure.

Additionally, any signs of platform manipulation should be taken seriously, as they can signal unethical practices by the broker. The overall user experience on StockPCL's platform appears to vary widely, with some users expressing satisfaction while others report significant frustrations. This inconsistency further complicates the assessment of whether StockPCL is a safe trading environment.

Risk Assessment

Engaging with StockPCL presents several risks that potential traders should carefully consider. The lack of regulation, combined with customer complaints and issues related to fund safety, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Platform stability concerns |

| Customer Service Risk | High | Poor response to complaints |

To mitigate these risks, traders should consider using regulated brokers with established reputations and transparent practices. It's advisable to conduct thorough research and read user reviews before committing to any trading platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that StockPCL raises several red flags that warrant caution. The lack of regulation, combined with numerous customer complaints and concerns about fund safety, indicates that StockPCL may not be a safe platform for trading. Potential investors should be particularly wary of the risks associated with unregulated brokers, as they often lack the necessary protections to safeguard client funds.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. Brokers such as OANDA, IG, or Forex.com are examples of platforms that offer robust regulatory oversight and a proven track record of customer satisfaction. Ultimately, the decision to engage with StockPCL should be made with careful consideration of the associated risks and the potential for financial loss. Always prioritize safety and due diligence when navigating the forex trading landscape.

Is StockPCL a scam, or is it legit?

The latest exposure and evaluation content of StockPCL brokers.

StockPCL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

StockPCL latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.