Is Sinox FX safe?

Business

License

Is Sinox FX Safe or Scam?

Introduction

Sinox FX is a relatively new player in the forex market, claiming to provide a range of trading services including forex, commodities, and cryptocurrencies. Established in 2021, the broker positions itself as a competitive option for traders looking for high leverage and various trading instruments. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it crucial for traders to assess the legitimacy and safety of brokers like Sinox FX. This article aims to provide a comprehensive evaluation of Sinox FX, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. To arrive at a well-rounded conclusion, we have analyzed multiple sources, including user reviews, regulatory databases, and expert opinions.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safety net for traders, ensuring that their funds are protected and that the broker adheres to industry standards. Unfortunately, Sinox FX operates without any recognized regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation raises significant concerns regarding the safety of traders' funds. Legitimate brokers are typically registered with regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. A search for Sinox FX in these databases reveals no records, indicating that the broker is unregulated. This lack of oversight is compounded by the fact that unregulated brokers can operate with little accountability, making it challenging for traders to seek redress in case of issues.

Company Background Investigation

Sinox FX claims to have been established in 2016, but its domain was registered in April 2021, raising questions about its actual history. The broker is registered in the United Kingdom, but this registration does not equate to being regulated. Furthermore, while the company claims to have a presence in the UAE, it lacks verification from the Central Bank of the UAE.

The management team of Sinox FX is another area of concern. Information about the team is scant, and there are no publicly available details regarding their professional backgrounds or experience in the financial sector. This lack of transparency can be alarming for potential investors, as a knowledgeable and experienced management team is often a hallmark of a trustworthy broker. The absence of detailed company information further diminishes the credibility of Sinox FX.

Trading Conditions Analysis

Sinox FX offers a variety of trading accounts and claims to provide competitive trading conditions. However, the overall fee structure appears to be less favorable compared to industry standards.

| Fee Type | Sinox FX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.5 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Sinox FX are notably higher than those of many regulated brokers, which can significantly impact trading profitability. Additionally, the lack of a clear commission structure raises questions about hidden fees that may not be disclosed upfront. Traders should be cautious of brokers that do not provide transparent information regarding their fees, as this can lead to unexpected costs.

Client Fund Safety

When considering whether Sinox FX is safe, the protection of client funds is paramount. The broker does not appear to have any measures in place for fund segregation, which is a common practice among regulated brokers to ensure that client funds are kept separate from the company's operating funds. Moreover, there is no indication that Sinox FX participates in any investor compensation schemes, which would provide additional protection to traders in the event of broker insolvency.

The absence of negative balance protection further exacerbates the risks associated with trading through Sinox FX. This policy is crucial for preventing traders from losing more money than they initially deposited, particularly in volatile markets. Without such protections, traders could face significant financial liabilities.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. A review of user experiences with Sinox FX reveals a troubling pattern of complaints, particularly regarding withdrawal issues. Many users have reported being unable to withdraw their funds after making deposits, leading to allegations of the broker being a scam.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Average |

In one notable case, a trader reported being unable to withdraw an initial deposit of $1,900 after several months, despite having made profits. Such experiences highlight the potential risks of trading with an unregulated broker like Sinox FX. The company's customer support has also been criticized for being unresponsive, further aggravating the situation for affected clients.

Platform and Trade Execution

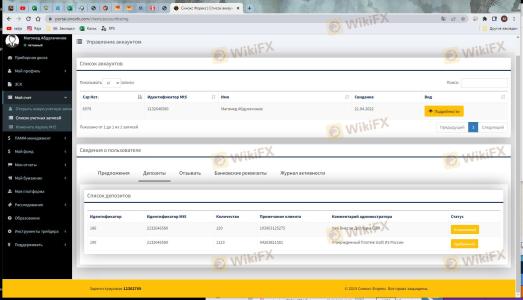

The trading platform offered by Sinox FX is MetaTrader 5 (MT5), which is known for its robust features and user-friendly interface. However, the overall performance and reliability of the platform remain in question due to the broker's lack of regulatory oversight. Issues such as slippage, order rejections, and execution delays can occur without accountability.

Traders have reported instances of slippage and rejected orders, which can be detrimental to trading strategies, especially in fast-moving markets. The lack of transparency regarding the execution quality raises concerns about potential platform manipulation, a risk that traders should consider seriously.

Risk Assessment

Using Sinox FX comes with a high level of risk due to its unregulated status and the numerous complaints from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | No fund protection measures |

| Operational Risk | Medium | Reports of withdrawal issues |

To mitigate these risks, traders are advised to conduct thorough research before investing and to consider using well-regulated brokers that offer strong protections for client funds.

Conclusion and Recommendations

In summary, the evidence suggests that Sinox FX is not a safe trading option. The lack of regulation, coupled with numerous complaints regarding withdrawal issues and the absence of client fund protection measures, raises significant red flags. Traders should exercise extreme caution when considering this broker.

For traders seeking safety and reliability, it is advisable to opt for well-regulated brokers that provide transparent fee structures and robust client protections. Some reputable alternatives include brokers regulated by the FCA or ASIC, which offer better security for client funds and a more trustworthy trading environment. Always prioritize safety and conduct thorough due diligence before committing funds to any trading platform.

Is Sinox FX a scam, or is it legit?

The latest exposure and evaluation content of Sinox FX brokers.

Sinox FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sinox FX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.