Sinox FX 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex trading, Sinox FX emerges as a broker that has garnered mixed reviews from the trading community. Established in 2016 and operating under the claims of being registered in the UK and UAE, this broker offers a variety of trading options and high leverage. However, the lack of regulatory oversight raises significant concerns among potential traders. This review aims to provide a comprehensive overview of Sinox FX, highlighting both its advantages and drawbacks based on user experiences and expert opinions.

Note: It's essential to consider that Sinox FX operates under different entities across regions, which may impact its regulatory status and user experiences. Therefore, conducting thorough research and understanding the implications of trading with an unregulated broker is crucial.

Ratings Overview

We evaluate brokers based on multiple criteria, including user feedback, expert analysis, and factual data.

Broker Overview

Sinox FX is a forex broker that has been active since 2016, offering its services primarily through the MetaTrader 5 (MT5) trading platform. The broker claims to provide access to a wide range of financial instruments, including forex, cryptocurrencies, stocks, commodities, and indices. Despite its claims of being registered in the UK, Sinox FX does not hold a legitimate brokerage license, which raises concerns about its trustworthiness and operational security.

Detailed Section

Regulatory Status

Sinox FX operates without proper regulatory oversight, which is a significant red flag for potential traders. While it claims to be registered in the UK, a search of the Financial Conduct Authority (FCA) database reveals that it is not listed as an authorized broker. Similarly, its presence in the UAE lacks clarity regarding regulatory compliance. This absence of regulation means that traders are not afforded the protections that come with dealing with licensed brokers, making it a risky choice for investment.

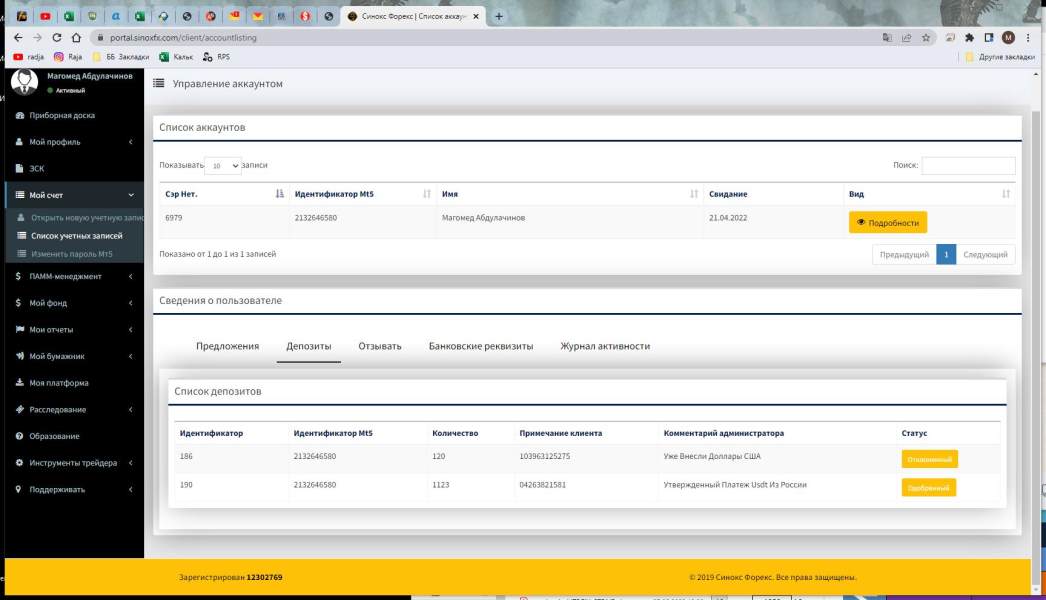

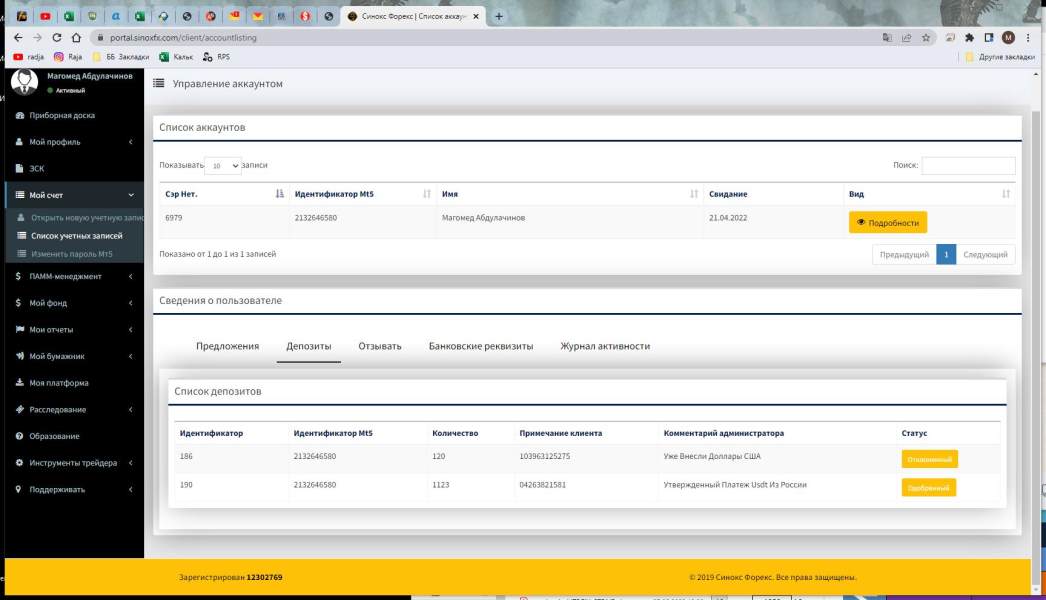

Deposit/Withdrawal Options

Sinox FX supports various deposit and withdrawal methods, including bank transfers, e-wallets like PayPal and Skrill, and cryptocurrencies. However, it is crucial to note that while the broker does not charge fees for deposits or withdrawals, external transaction fees may apply. The minimum deposit requirement varies by account type, starting as low as $50 for the Silver account, which is appealing for novice traders.

Unfortunately, Sinox FX does not offer any bonuses or promotions for new or existing clients, which is a common practice among many brokers to attract and retain traders. This lack of incentives could be a drawback for traders looking for additional value.

Trading Asset Classes

Sinox FX provides access to a diverse range of trading instruments, including over 60 currency pairs, various cryptocurrencies, commodities, indices, and stocks. This variety allows traders to diversify their portfolios and explore different market opportunities. However, the absence of cent accounts may deter novice traders who prefer to trade with minimal risk.

Costs (Spreads, Fees, Commissions)

The cost structure at Sinox FX varies by account type. Spreads start from 2.5 pips for the Silver account and can go as low as 0 pips for the Raw+ account, which requires a significant minimum deposit of $50,000. While the absence of withdrawal fees is a positive aspect, the overall cost structure may not be competitive compared to other regulated brokers.

Leverage

Sinox FX offers high leverage of up to 1:1000, which can attract more experienced traders looking to maximize their trading potential. However, this high leverage also increases the risk of significant losses, particularly for novice traders who may not fully understand the implications of using such leverage.

Restricted Regions

Sinox FX is not available to clients in certain regions, including the EU and UK, which further complicates its regulatory standing. Traders should ensure they are compliant with local laws before engaging with the broker.

Available Customer Support Languages

Sinox FX offers customer support primarily in English, with various channels of communication, including email and phone support. However, the absence of live chat can be a disadvantage for traders seeking immediate assistance.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: Sinox FX offers five account types, catering to both novice and experienced traders. However, the lack of cent accounts limits options for those looking to trade with minimal risk.

Tools and Resources: The broker provides basic tools and resources, but the absence of educational materials and advanced trading tools is a drawback for traders seeking to enhance their skills.

Customer Service & Support: While customer support is available through various channels, the lack of live chat and mixed reviews regarding response times can be a concern for traders needing immediate assistance.

Trading Experience: User experiences vary significantly, with some traders praising the execution speed and platform reliability, while others report issues with withdrawals and overall service quality.

Trustworthiness: With a low score of 1.5, the lack of regulation and numerous negative reviews significantly impact Sinox FX's reputation, making it a risky choice for traders.

User Experience: Overall user experience is mixed, with some traders appreciating the platform's functionality, while others express concerns over withdrawal processes and customer support.

In conclusion, while Sinox FX presents itself as an attractive option for traders due to its high leverage and diverse asset offerings, the significant lack of regulatory oversight and mixed user experiences raise serious concerns. Potential traders are advised to conduct thorough research and consider the risks before engaging with this broker.