Is SEALARK safe?

Business

License

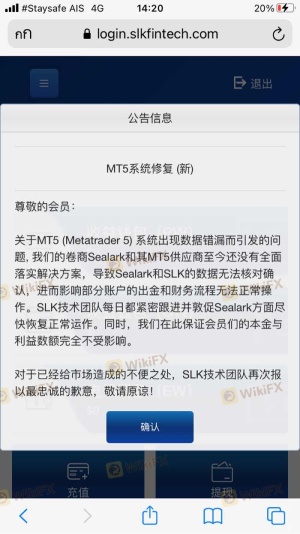

Is Sealark Safe or Scam?

Introduction

Sealark is a forex broker that has emerged in the competitive landscape of online trading, offering various financial instruments and trading platforms. However, the question of whether Sealark is a legitimate and safe trading option is crucial for potential investors. In an industry rife with scams and unregulated entities, traders must conduct thorough evaluations before committing their funds. This article employs a comprehensive assessment framework, examining regulatory status, company background, trading conditions, customer safety, user experiences, and risk factors to determine if Sealark is safe or if it presents potential risks to traders.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy. Sealark operates without any significant regulatory oversight, which raises red flags for potential traders. The absence of regulation means that traders have limited recourse in the event of disputes or issues with the broker. Below is a summary of Sealark's regulatory information:

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory license from recognized authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) indicates a significant risk associated with trading through Sealark. Historically, unregulated brokers have been linked to fraudulent activities, including the misappropriation of client funds and lack of transparency in trading practices. Therefore, the question "Is Sealark safe?" becomes increasingly pertinent given its unregulated status.

Company Background Investigation

Sealark's company background provides insight into its operational history and ownership structure. Established in the United Kingdom, Sealark claims to offer a range of forex and CFD trading services. However, the information available about its management team and corporate structure is limited. A thorough background check reveals that the company's transparency is questionable, with minimal details disclosed about its founders or key personnel.

The management team's qualifications and experience are vital in assessing the broker's reliability. A lack of clear information about the individuals behind Sealark raises concerns about their expertise and commitment to ethical trading practices. Furthermore, the opaque nature of the company's operations may lead to distrust among potential clients, as transparency is a cornerstone of a reputable trading environment.

Trading Conditions Analysis

When evaluating whether Sealark is safe, it is essential to analyze its trading conditions, including fees and spreads. Sealark's fee structure appears to be competitive; however, the absence of clear and detailed information about its costs is concerning. Below is a comparison of key trading costs associated with Sealark:

| Cost Type | Sealark | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low to Medium |

The trading fees at Sealark are reportedly higher than the industry average, which can significantly impact profitability for traders. The lack of a transparent commission model and potential hidden fees may further exacerbate concerns about the broker's trustworthiness. As traders assess whether "Is Sealark safe?", they should consider how these costs could affect their overall trading experience.

Client Fund Safety

One of the most critical aspects of any forex broker is the safety of client funds. Unfortunately, Sealark does not provide sufficient information about its fund security measures. Effective fund protection typically includes segregated accounts, investor compensation schemes, and negative balance protection. However, the absence of these assurances at Sealark raises significant concerns.

Traders should be wary of the risks associated with depositing funds in an unregulated broker. The lack of transparency regarding fund safety policies increases the likelihood of encountering issues when attempting to withdraw funds or resolve disputes. Given these factors, the question of "Is Sealark safe?" remains unanswered, as traders could face substantial risks regarding their investments.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a forex broker. Reviews of Sealark indicate a mixed bag of experiences, with numerous complaints regarding withdrawal difficulties and lack of responsive customer support. Common complaint types include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| Poor Customer Support | Medium | Inconsistent |

| Account Suspension | High | Unclear reasons |

Many users have reported challenges in accessing their funds, with some even alleging that their accounts were suspended without clear justification. These complaints highlight a troubling pattern that raises questions about the broker's operational integrity and customer service commitment. As potential traders ponder whether "Is Sealark safe?", these negative experiences should be taken seriously.

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Sealark offers a trading platform that claims to be user-friendly; however, reports of execution issues, including slippage and order rejections, have surfaced. Traders have expressed dissatisfaction with the platform's stability, which can lead to missed opportunities and financial losses.

Additionally, any signs of platform manipulation, such as excessive slippage during volatile market conditions, can further erode trust in the broker. As users evaluate whether "Is Sealark safe?", the quality of trade execution and platform reliability must be considered.

Risk Assessment

Using an unregulated broker like Sealark comes with inherent risks. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized bodies |

| Fund Safety Risk | High | Lack of transparency and protection |

| Customer Support Risk | Medium | Inconsistent responses to complaints |

| Trading Execution Risk | High | Reports of slippage and rejections |

Given these risks, it is advisable for traders to approach Sealark with caution. Seeking alternatives that are regulated and have a proven track record of reliability is a prudent strategy.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sealark may not be a safe option for forex trading. Its lack of regulatory oversight, questionable fund safety measures, and numerous customer complaints indicate potential risks that traders should carefully consider. For those wondering, "Is Sealark safe?" the answer leans towards caution.

Traders seeking reliable alternatives should consider reputable brokers that are regulated by recognized authorities, offer transparent fee structures, and maintain positive user reviews. Some recommended options include brokers that are well-established in the industry, with a strong commitment to customer service and fund protection. Ultimately, ensuring a safe trading environment is paramount for successful trading experiences.

Is SEALARK a scam, or is it legit?

The latest exposure and evaluation content of SEALARK brokers.

SEALARK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SEALARK latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.