Is FXBV safe?

Pros

Cons

Is Fxbv Safe or Scam?

Introduction

Fxbv is a forex broker that has emerged in the crowded online trading market, claiming to provide a unique trading experience with a variety of currency pairs and financial instruments. As the forex market continues to attract traders worldwide, it is crucial for investors to carefully evaluate the legitimacy and safety of brokers like Fxbv, especially given the prevalence of scams in the industry. This article aims to investigate whether Fxbv is a safe trading platform or a potential scam, utilizing a comprehensive approach that includes regulatory status, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant indicators of its legitimacy. Fxbv claims to be regulated by the Australian Securities and Investments Commission (ASIC), a reputable authority known for its stringent oversight of financial services. However, upon further investigation, it has been revealed that Fxbv is not listed under ASIC's registered brokers, raising serious concerns about its claims. The lack of a valid regulatory framework can expose traders to significant risks, including the potential loss of funds without any recourse.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unverified |

The absence of regulatory oversight is alarming, as it means that Fxbv operates without the protections that regulated brokers must adhere to. This lack of regulation not only jeopardizes the safety of client funds but also raises questions about the broker's operational transparency and ethical practices. Therefore, it is essential for traders to consider this aspect seriously when asking the question, "Is Fxbv safe?"

Company Background Investigation

Fxbv's history and ownership structure are crucial elements in assessing its credibility. The broker claims to operate out of Australia, but there is a lack of verifiable information regarding its founding members, management team, and operational history. This opacity is a significant red flag, as reputable brokers typically provide detailed information about their leadership and corporate governance.

Moreover, the company's website has been reported as being inactive or for sale, which further casts doubt on its stability and reliability. Transparency is vital in the financial industry, and the inability to find credible information about Fxbv's background raises concerns about its legitimacy. Traders must be vigilant and conduct thorough research before entrusting their funds to such brokers.

Trading Conditions Analysis

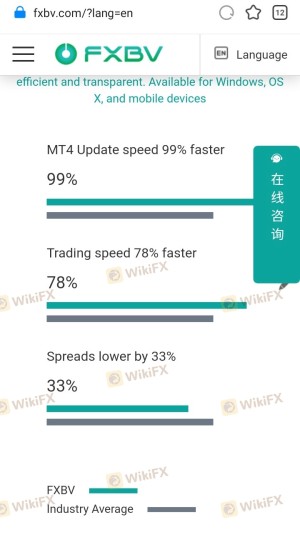

When assessing whether Fxbv is safe, it is also important to consider its trading conditions, including fees and spreads. Fxbv advertises an attractive trading environment with low spreads and high leverage, but the actual costs incurred by traders can be significantly higher than advertised due to hidden fees or unfavorable trading conditions.

| Fee Type | Fxbv | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1.0 - 1.5 pips |

| Commission Model | Unclear | Varies by broker |

| Overnight Interest Range | Unspecified | Varies by broker |

The lack of clarity regarding fees and commissions is concerning. Traders have reported unexpected costs and difficulties in withdrawing funds, which can be indicative of a scam. Such practices undermine the trust that is essential in any trading relationship. Therefore, it is imperative for traders to carefully evaluate the fee structure before engaging with Fxbv.

Customer Funds Safety

The safety of customer funds is a critical factor when determining if Fxbv is safe. Regulated brokers are required to implement stringent measures to protect client funds, including segregated accounts and investor protection schemes. However, Fxbv's lack of regulation raises significant concerns about its ability to safeguard client deposits.

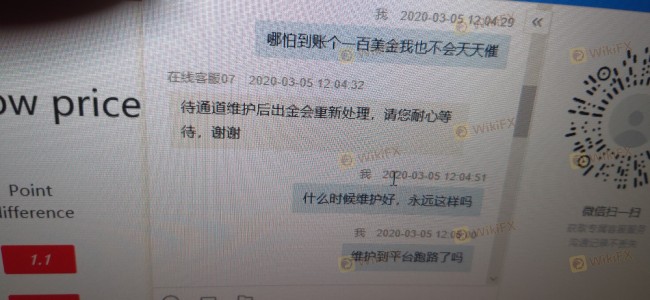

There are no clear policies regarding fund segregation or negative balance protection, which means that traders could potentially lose more than they invest. Historical complaints from users indicate that many have experienced difficulties in withdrawing their funds, suggesting that the broker may not have adequate measures in place to ensure the security of client assets.

Customer Experience and Complaints

Customer feedback is a valuable resource when assessing the trustworthiness of a broker. Reviews and complaints about Fxbv paint a troubling picture, with numerous users reporting issues related to withdrawals, account closures, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Account Closure | High | No clear explanation |

| Customer Service Complaints | Medium | Inadequate support |

Typical cases involve traders being unable to access their funds or facing excessive fees when attempting to withdraw. Such patterns are common in fraudulent schemes, and they should serve as a warning sign for potential investors. The overwhelming negative sentiment surrounding Fxbv raises the question of whether it is indeed a scam.

Platform and Trade Execution

Fxbv claims to offer a user-friendly trading platform with advanced features. However, the actual performance of the platform, including order execution speed and reliability, remains questionable. Many users have reported issues with slippage and order rejections, which are critical factors that can impact trading outcomes.

Furthermore, there are concerns about the platform's security, as any vulnerabilities could expose traders to potential manipulation or cyber threats. A reliable trading environment should prioritize both performance and security, and the reports surrounding Fxbv suggest that it may fall short in these areas.

Risk Assessment

Using Fxbv involves several risks that traders must be aware of. The lack of regulation, coupled with customer complaints and operational opacity, indicates a high-risk environment for trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes traders to loss. |

| Financial Risk | High | Potential loss of funds without recourse. |

| Operational Risk | Medium | Issues with platform performance and support. |

To mitigate these risks, traders should consider using established, regulated brokers that offer transparency and robust customer support. It is essential to prioritize safety over potential high returns, especially in an environment as volatile as forex trading.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Fxbv is not a safe trading platform. Its unregulated status, lack of transparency, and numerous customer complaints raise significant concerns about its legitimacy. Traders should approach Fxbv with caution and consider alternative options that offer better security and regulatory oversight.

For those looking for reliable trading platforms, it is advisable to explore brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Always conduct thorough research and due diligence before committing funds to any trading platform, as this is crucial in ensuring a safe trading experience. Ultimately, the question "Is Fxbv safe?" can be answered with a resounding no, and traders are encouraged to seek safer alternatives.

Is FXBV a scam, or is it legit?

The latest exposure and evaluation content of FXBV brokers.

FXBV Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXBV latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.