Sealark 2025 Review: Everything You Need to Know

Summary: The overall assessment of Sealark as a forex broker is concerning, with a low rating of 0.6 out of 5 stars from various reviews. Key issues include a lack of regulatory oversight, poor customer support, and a questionable reputation among users. However, the broker does offer enticing cashback incentives and a rebate program, which may attract some traders.

Note: It's important to recognize that Sealark operates under various entities across different regions, which can complicate regulatory oversight. This review aims to present a fair and accurate analysis of the broker based on available data.

Rating Overview

How We Rated the Broker: Ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding the broker's operations.

Broker Overview

Founded in 2007, Sealark operates as an online forex broker under the name Sealark Group. The broker is based in London, UK, and primarily offers trading through the popular MetaTrader 4 (MT4) platform. Sealark provides access to various financial instruments, primarily focusing on forex trading. However, it is crucial to note that Sealark lacks regulation from major financial authorities, which raises significant concerns regarding its trustworthiness and operational practices.

Detailed Analysis

-

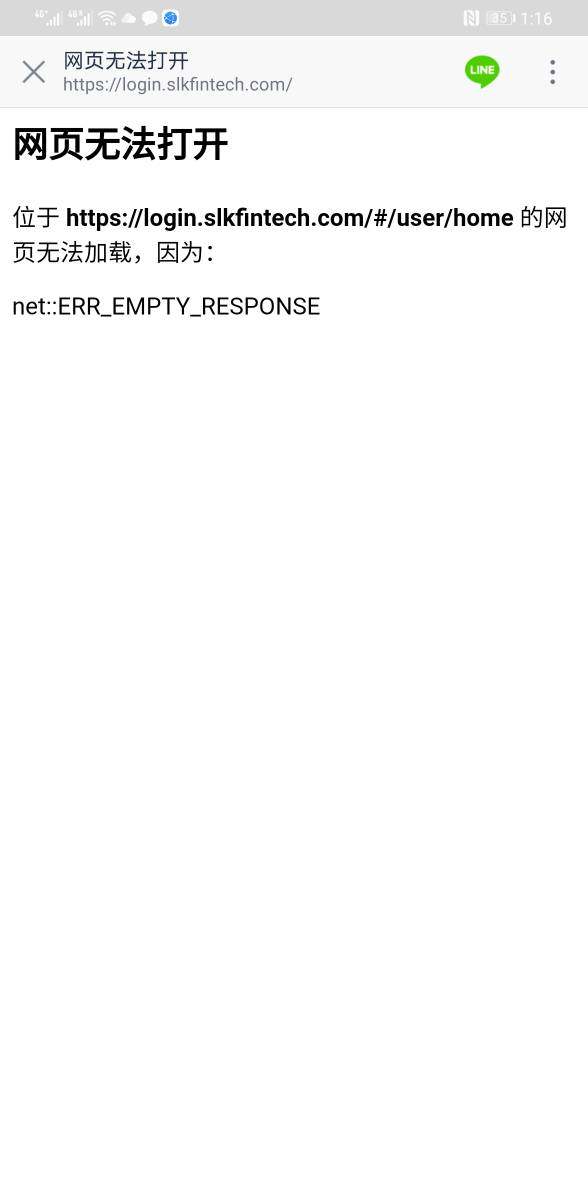

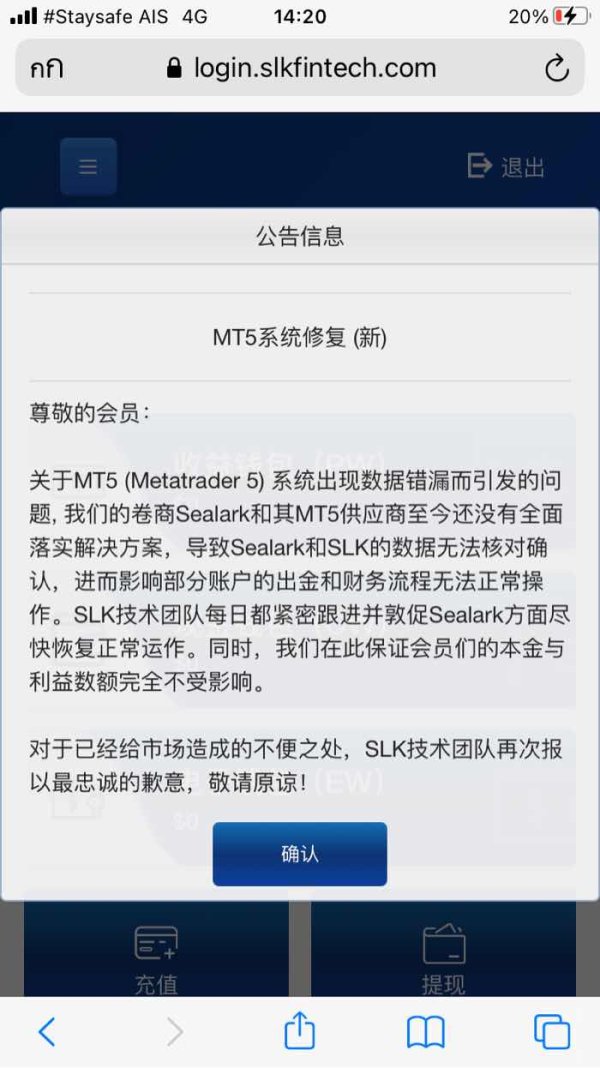

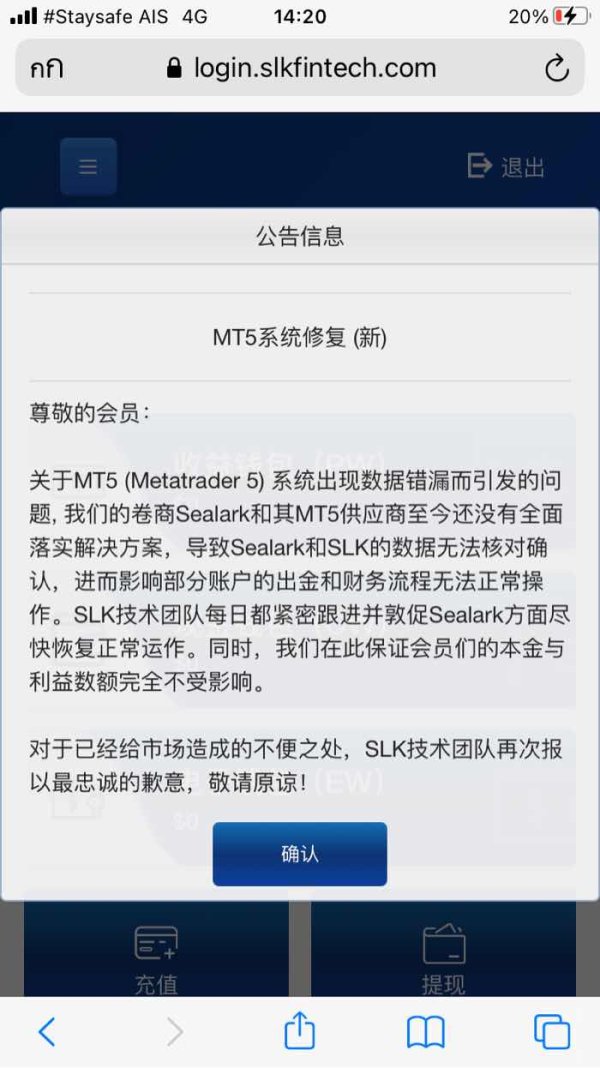

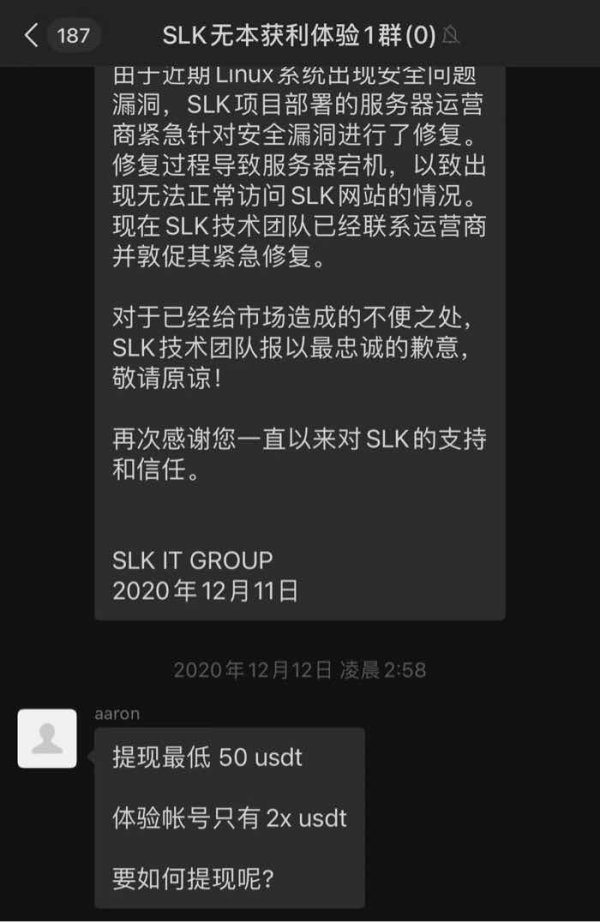

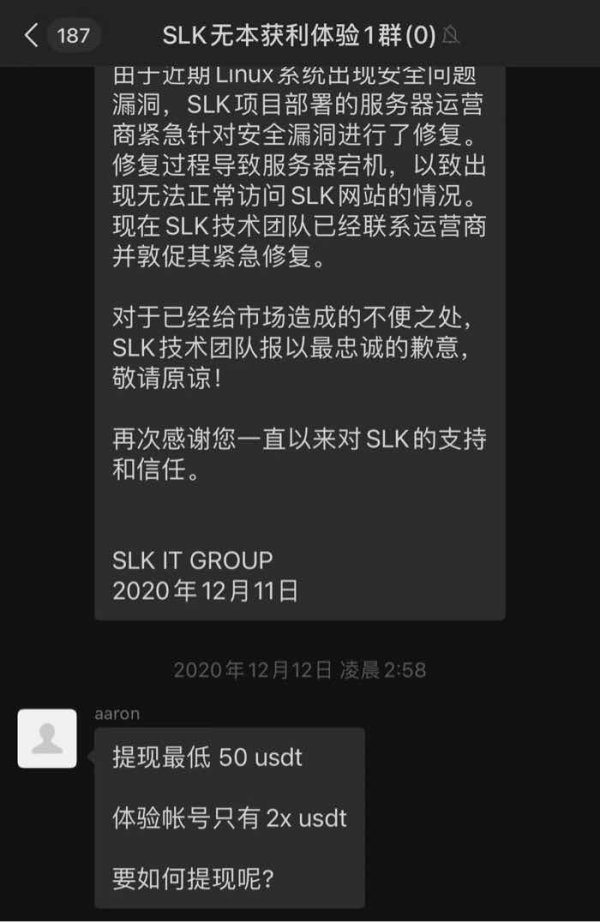

Regulated Geographic Regions: Sealark is unregulated and does not hold licenses from significant financial institutions such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This lack of regulation poses a risk for traders, as it limits their ability to seek recourse in case of disputes.

Deposit/Withdrawal Currencies: The broker does not specify the currencies accepted for deposits and withdrawals, which can be a drawback for traders looking for clarity in this area.

Minimum Deposit: Information regarding the minimum deposit requirement is inconsistent across sources, with some indicating it to be as low as $0. This could be appealing for beginner traders but may also indicate a lack of serious commitment from the broker.

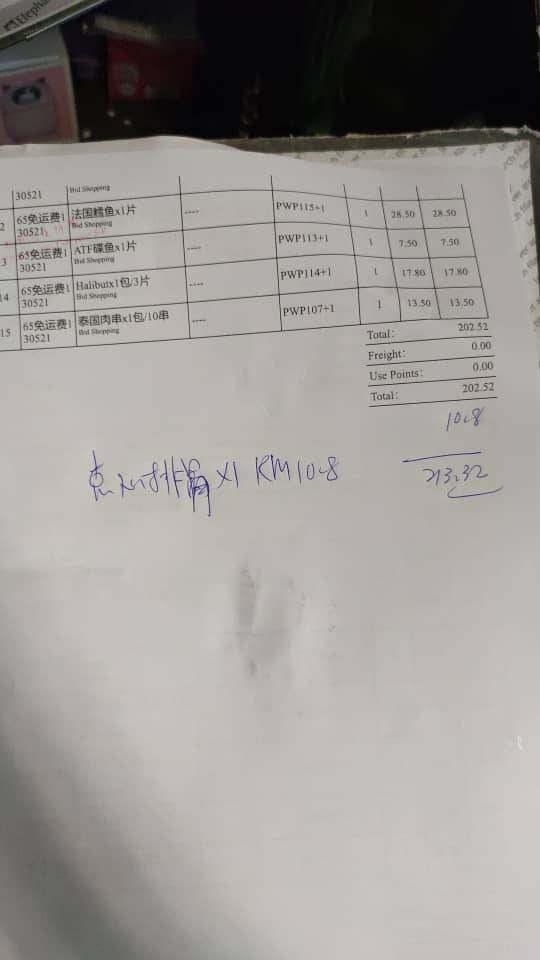

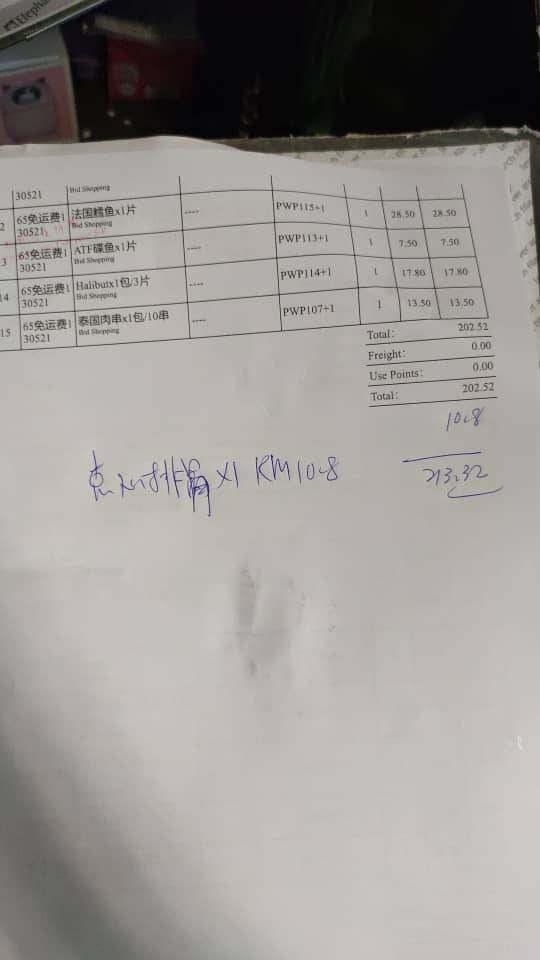

Bonuses/Promotions: Sealark promotes a cashback program that offers traders rebates on their trades. This feature is marketed as a way to lower trading costs, but it is essential to consider the overall trustworthiness of the broker before engaging with such promotions.

Tradable Asset Classes: While primarily focused on forex, the specifics of other tradable asset classes remain unclear. This lack of transparency can deter potential clients.

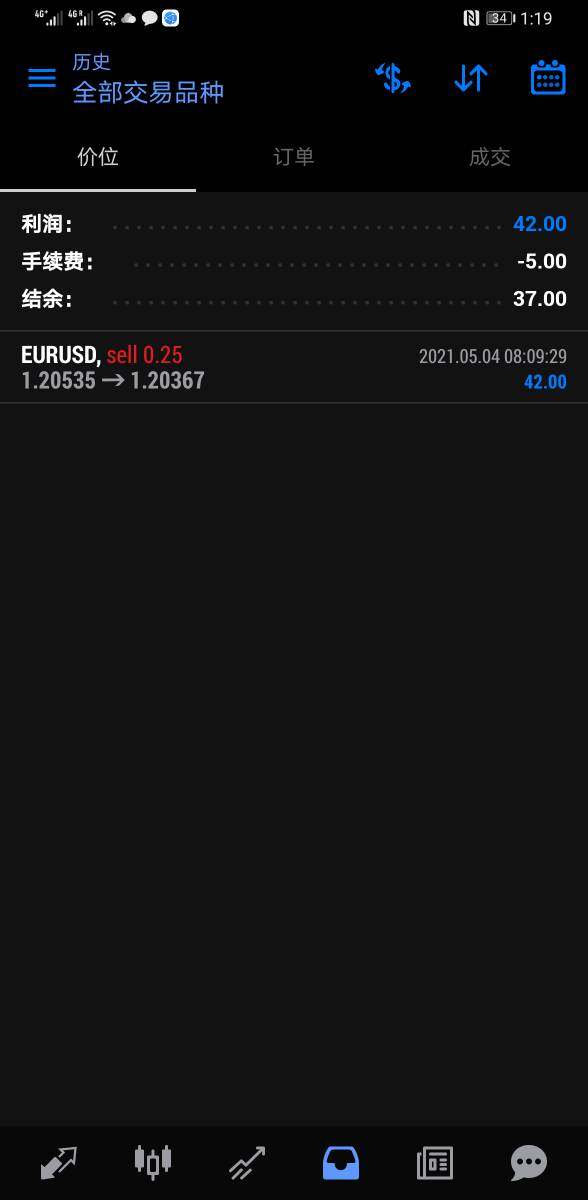

Costs (Spreads, Fees, Commissions): The broker's cost structure is not well-defined in the sources reviewed, which may lead to unexpected charges for traders. This lack of clarity can be detrimental to user experience.

Leverage: Information on leverage options is sparse, which is a critical aspect for many traders. High leverage can amplify both profits and losses, making it an essential factor to consider.

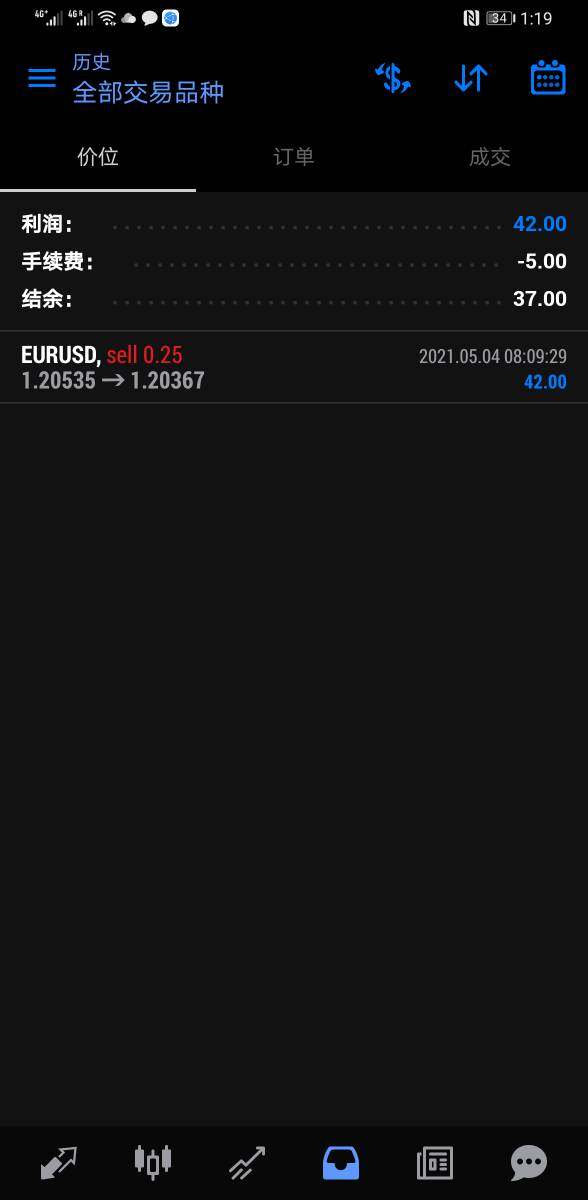

Allowed Trading Platforms: Sealark primarily utilizes the MT4 platform, a widely recognized and user-friendly trading environment. However, the absence of newer platforms like MT5 may limit options for some traders.

Restricted Regions: The broker does not provide clear information about regions where its services are restricted, which is vital for compliance and user awareness.

Available Customer Support Languages: Customer support appears to be limited, with no clear indication of the languages supported. This could pose challenges for non-English speaking traders seeking assistance.

Rating Recap

Detailed Breakdown

-

Account Conditions (2/10): The lack of regulatory oversight and unclear minimum deposit requirements significantly impact the broker's account conditions. While a low minimum deposit may attract new traders, the absence of a robust regulatory framework raises serious concerns.

Tools and Resources (3/10): Sealark offers basic tools primarily through the MT4 platform. However, the lack of advanced trading resources and educational materials may leave traders wanting more.

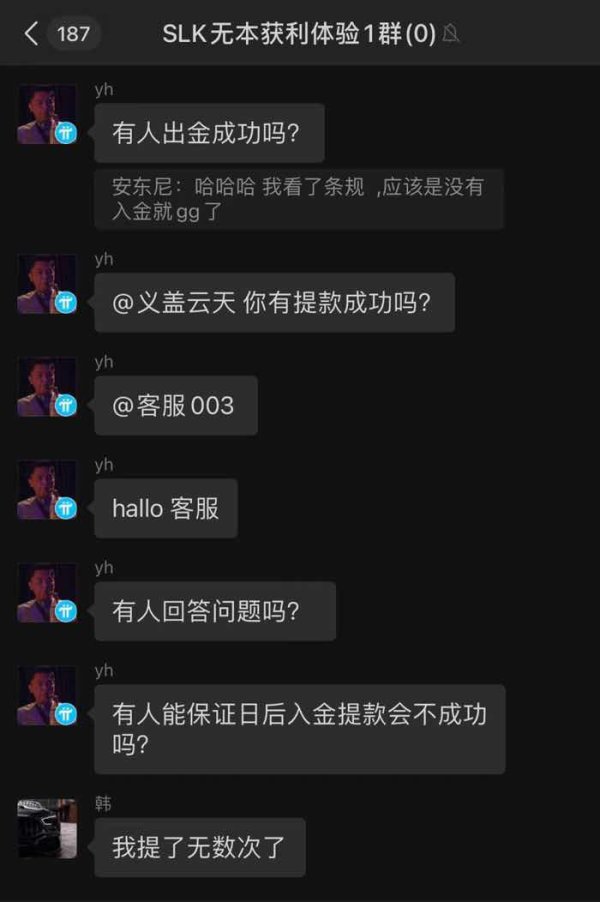

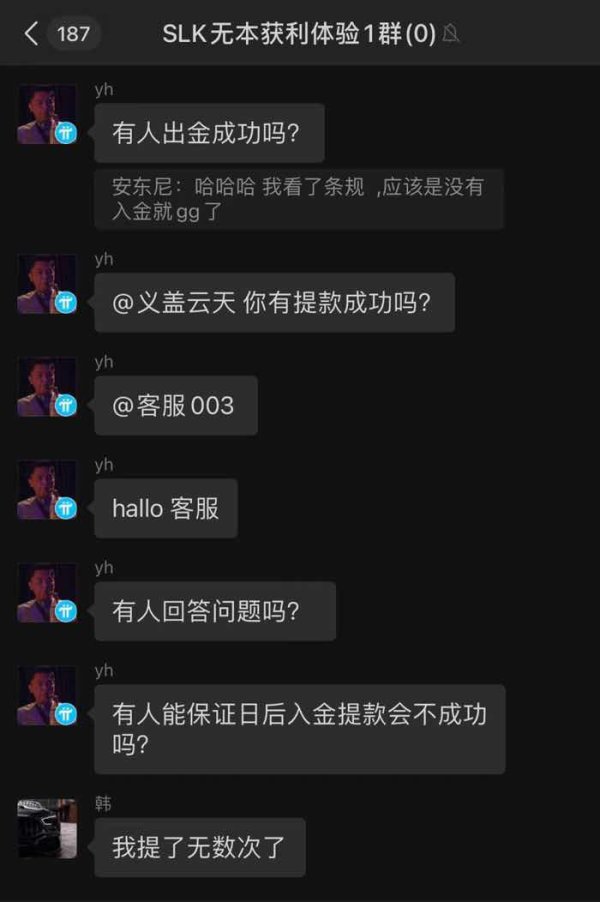

Customer Service and Support (1/10): User reviews consistently highlight poor customer service, with limited support channels available. This lack of responsiveness can lead to frustration, especially for traders requiring immediate assistance.

Trading Experience (4/10): Although the trading experience is facilitated by the MT4 platform, the overall lack of transparency regarding costs and account conditions detracts from a positive trading environment.

Trustworthiness (2/10): The absence of regulation and poor user feedback contribute to a low trust rating for Sealark. Potential traders should exercise caution and conduct thorough research before engaging with this broker.

User Experience (3/10): Overall user experience is marred by concerns over customer support and regulatory compliance. While the cashback program is a positive feature, it does not outweigh the potential risks associated with trading through an unregulated broker.

In conclusion, while Sealark offers certain attractive features such as cashback promotions, the overwhelming consensus from user reviews and expert opinions indicates significant risks associated with trading through this broker. Potential traders are advised to proceed with caution and consider other regulated options in the market.