Ambit Capital 2025 Review: Everything You Need to Know

Executive Summary

This ambit capital review shows a troubling picture of a financial services firm that has lost respect in the investment community. The company has operated for 26 years since starting in 1997 and has employee satisfaction ratings of 4.1 out of 5, but Ambit Capital has been blacklisted by the British Columbia Securities Commission (BCSC), which creates serious red flags for potential investors. Ashok Wadhwa founded the company and still leads it today. The firm works mainly in investment banking, asset management, and equity research services. However, regulatory warnings and many more customer complaints have badly hurt its reputation.

The firm keeps running operations in multiple regions including India, where it works as a stockbroking company with 2 branches and 11 authorized persons. The growing regulatory concerns and user feedback about high fees and limited access make it right only for investors who can handle very high risks. The company does not share clear information about specific trading conditions, platform offerings, and customer support systems, which makes the concerns about this brokerage even worse.

Important Notice

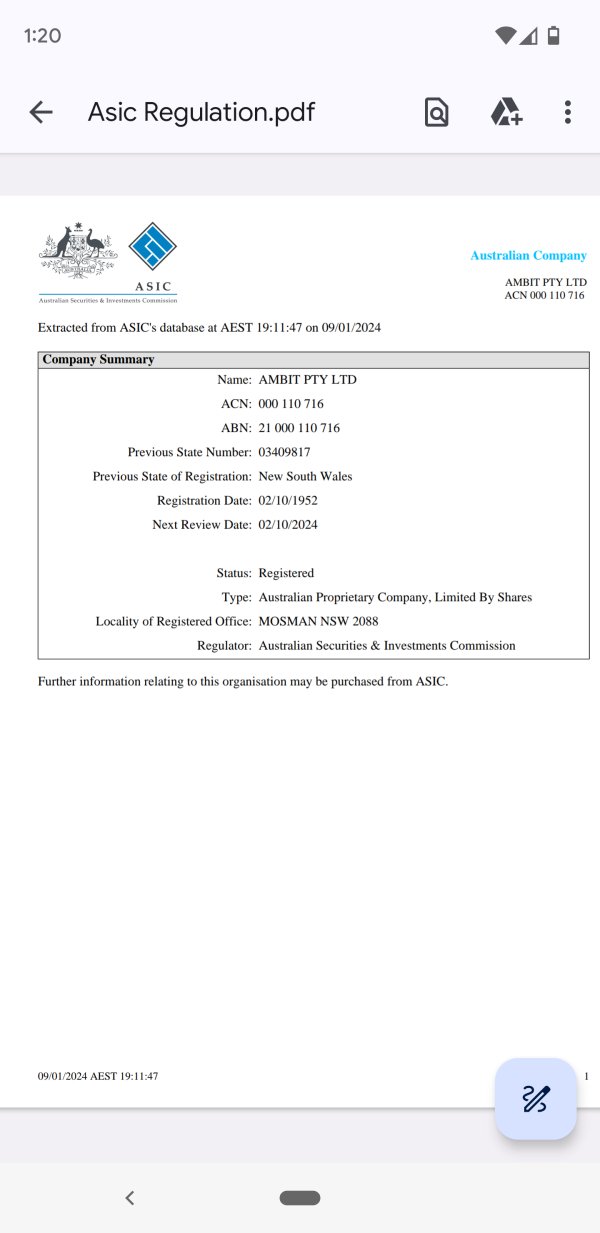

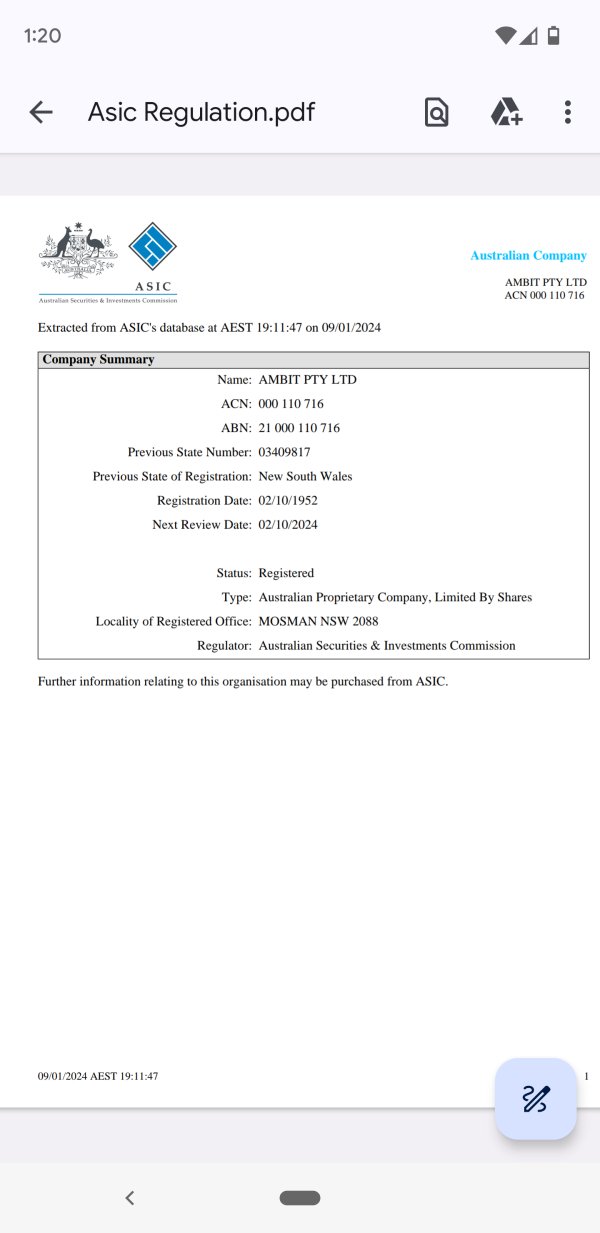

Regional Entity Differences: Ambit Capital operates across multiple jurisdictions and has received warnings from regulatory authorities in various regions. The British Columbia Securities Commission has blacklisted this entity. Investors should be very careful when thinking about any trading activities with this broker. Different regional entities may operate under varying regulatory frameworks. The safety and legitimacy of services may differ significantly between jurisdictions.

Review Methodology: This evaluation is based on publicly available information, regulatory warnings, user feedback, and official documentation from relevant financial authorities. The company shares limited information about specific trading conditions and services. Some assessments are based on available data and user reports.

Rating Framework

Broker Overview

Ambit Capital started in 1997 under founder Ashok Wadhwa's leadership. The company brings 26 years of experience to the financial services industry. The firm has its headquarters in India and positions itself as a comprehensive financial services provider. It focuses mainly on investment banking, asset management, and equity research services. Over its operational history, the firm has introduced various flexible Portfolio Management Services (PMS) strategies designed to accommodate diverse investment goals and risk appetites across different market segments.

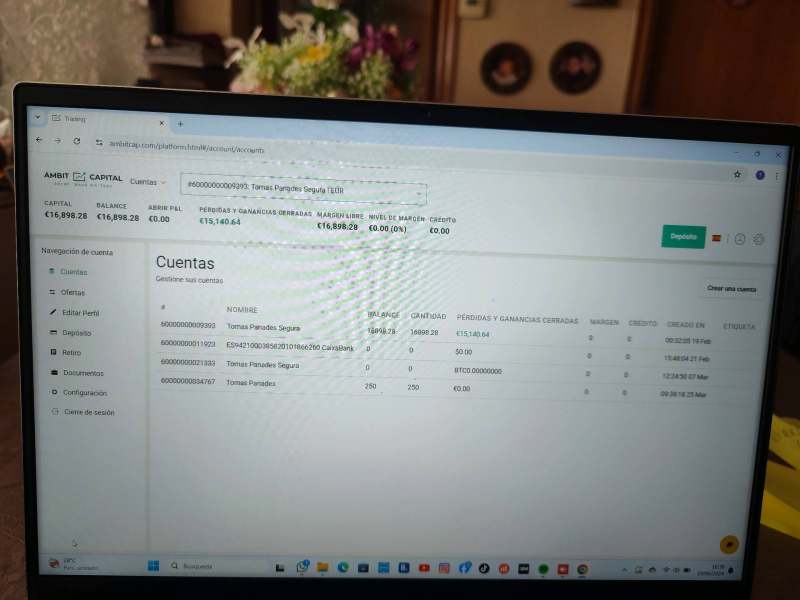

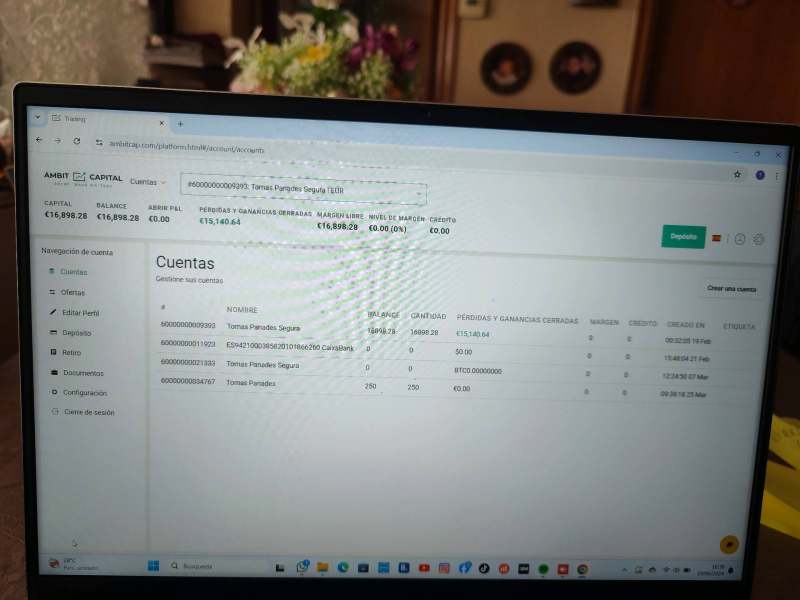

The company operates as one of the stockbroking entities in India. It maintains 2 branches and employs 11 authorized persons who function as stock brokers. According to available information, Ambit Capital also works with 3 remisiers to expand its service reach. The specific details about trading platforms, available asset classes, and comprehensive service offerings remain unclear from publicly available documentation.

Ambit capital review sources show that the company is now under regulatory scrutiny despite its established presence in the Indian financial market. The British Columbia Securities Commission (BCSC) serves as the primary regulatory authority that has issued warnings against the firm, resulting in its blacklisting status. This regulatory action has significantly impacted the company's credibility. It has raised serious questions about its operational compliance and customer protection measures.

Regulatory Regions: Ambit Capital operates under the oversight of the British Columbia Securities Commission (BCSC), which has placed the company on its blacklist due to regulatory concerns and compliance issues.

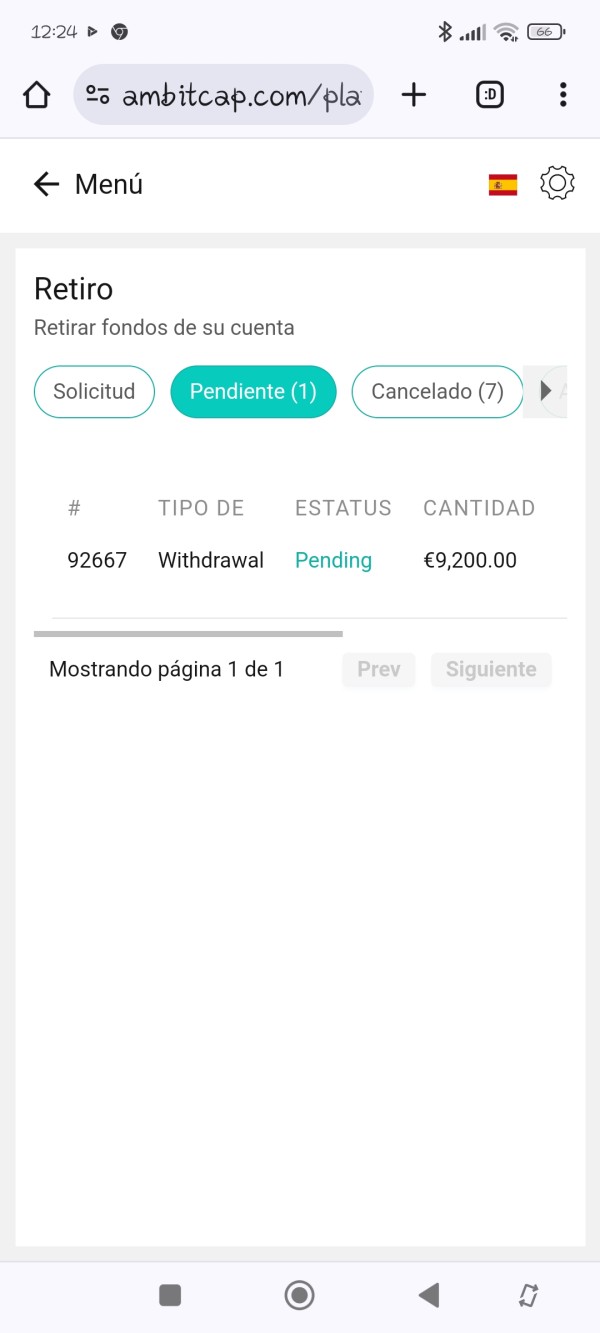

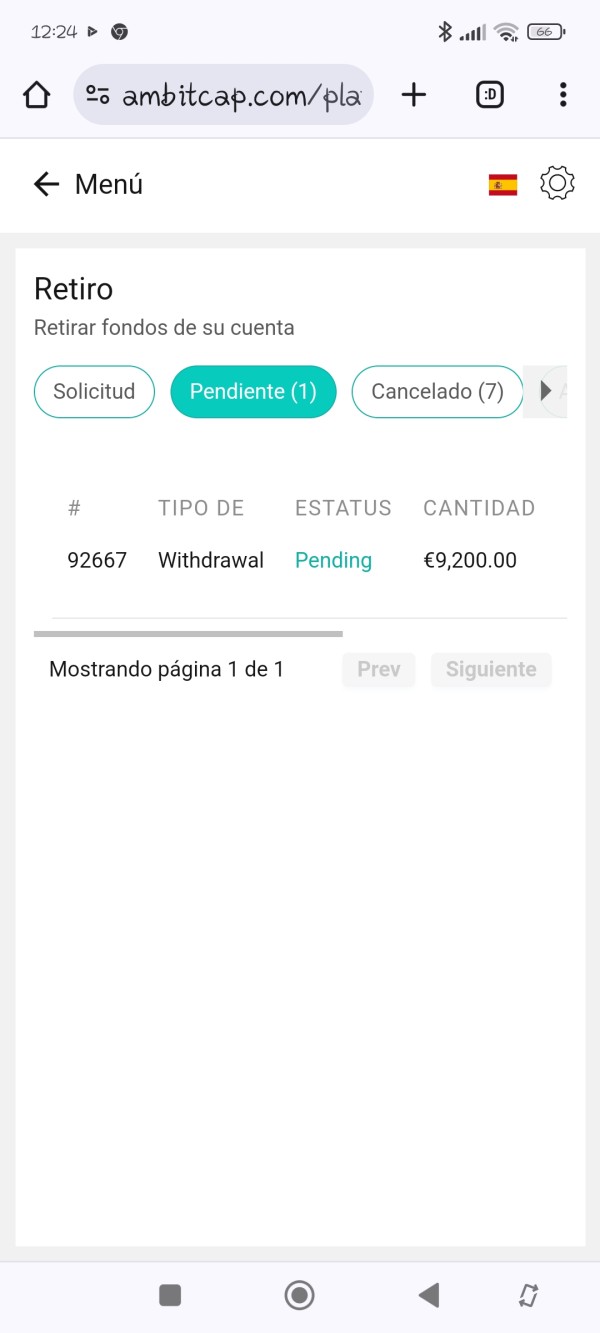

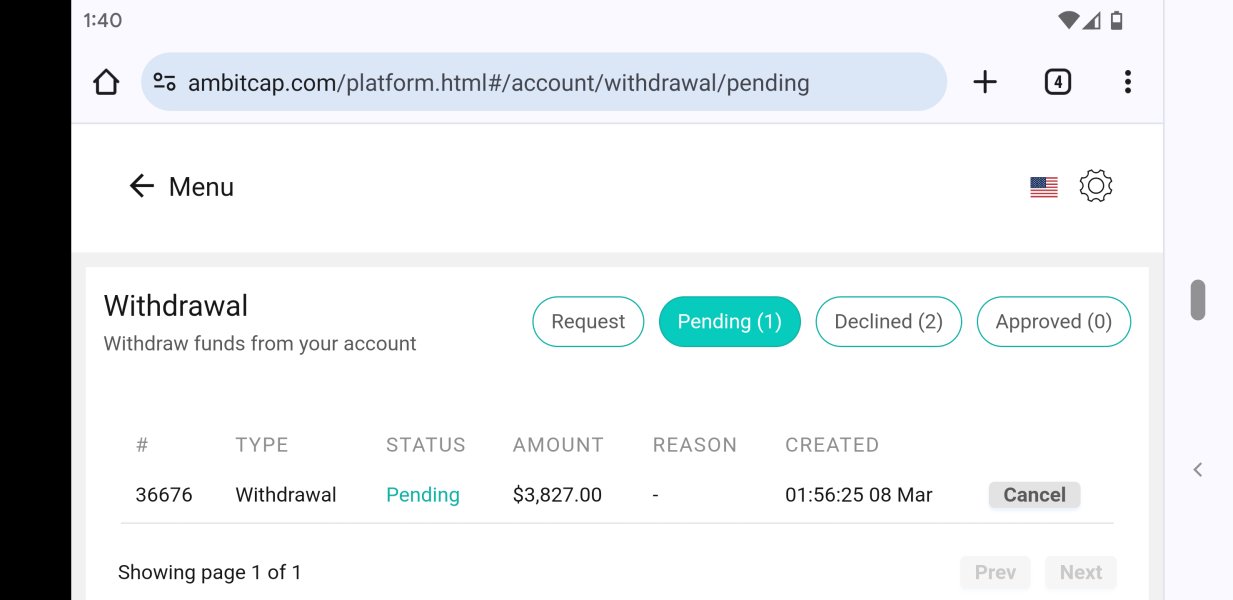

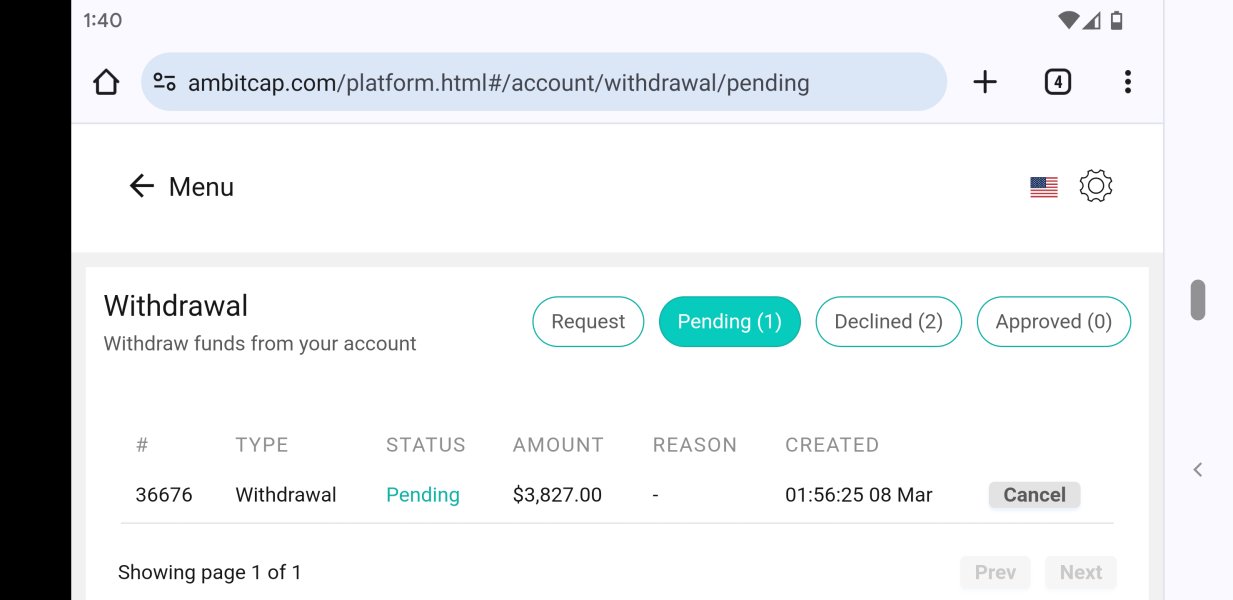

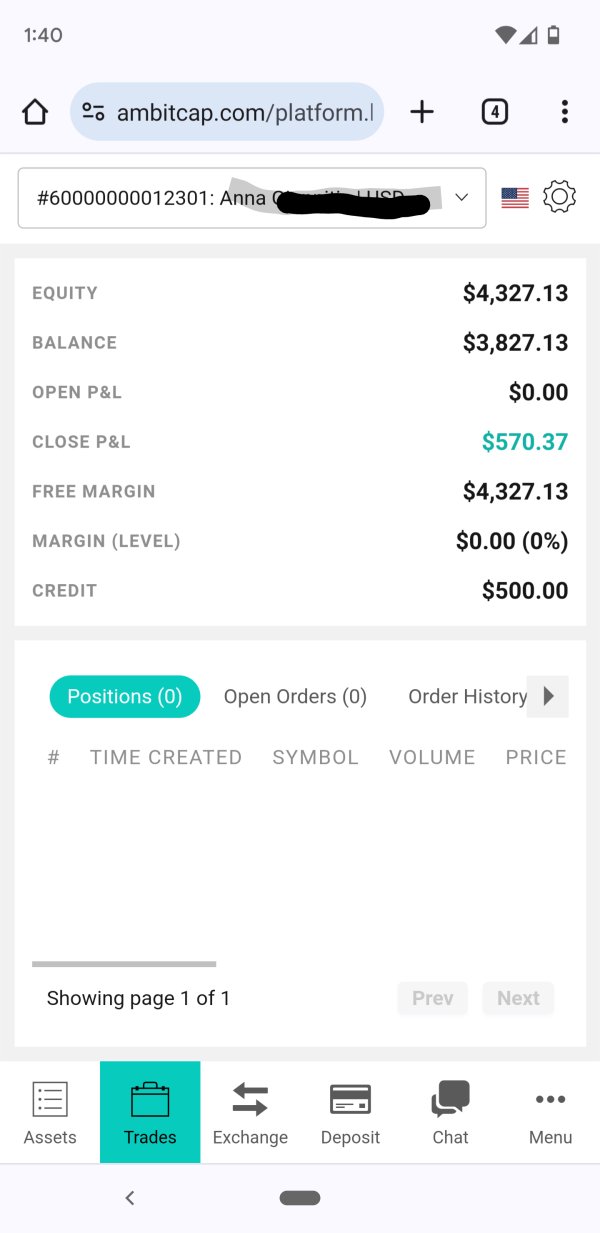

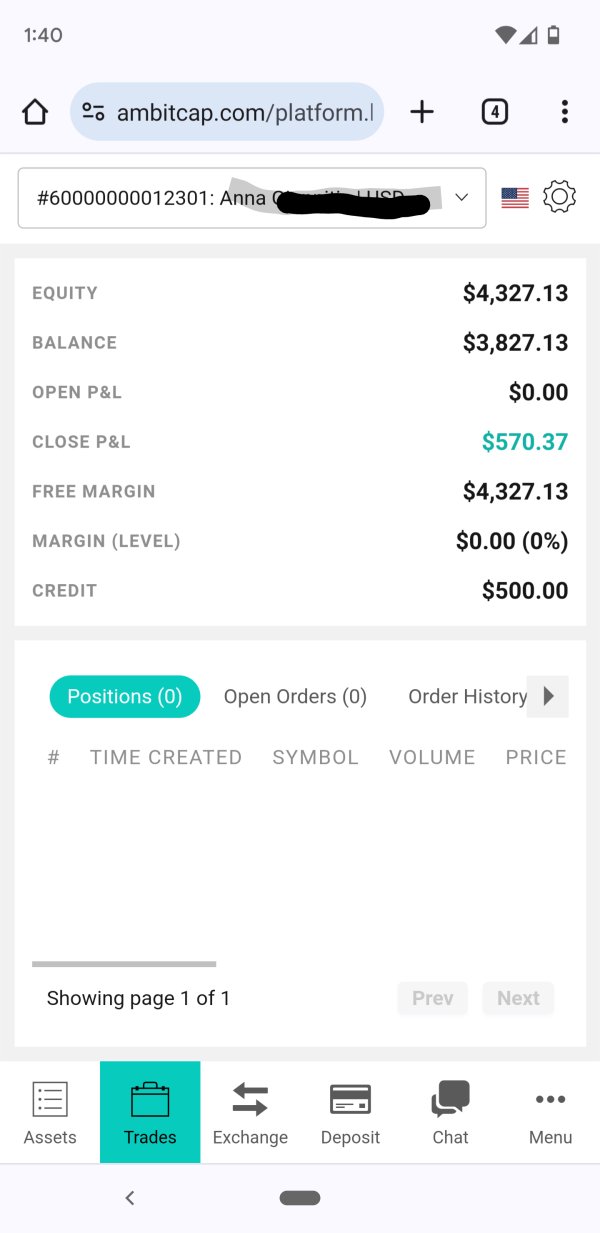

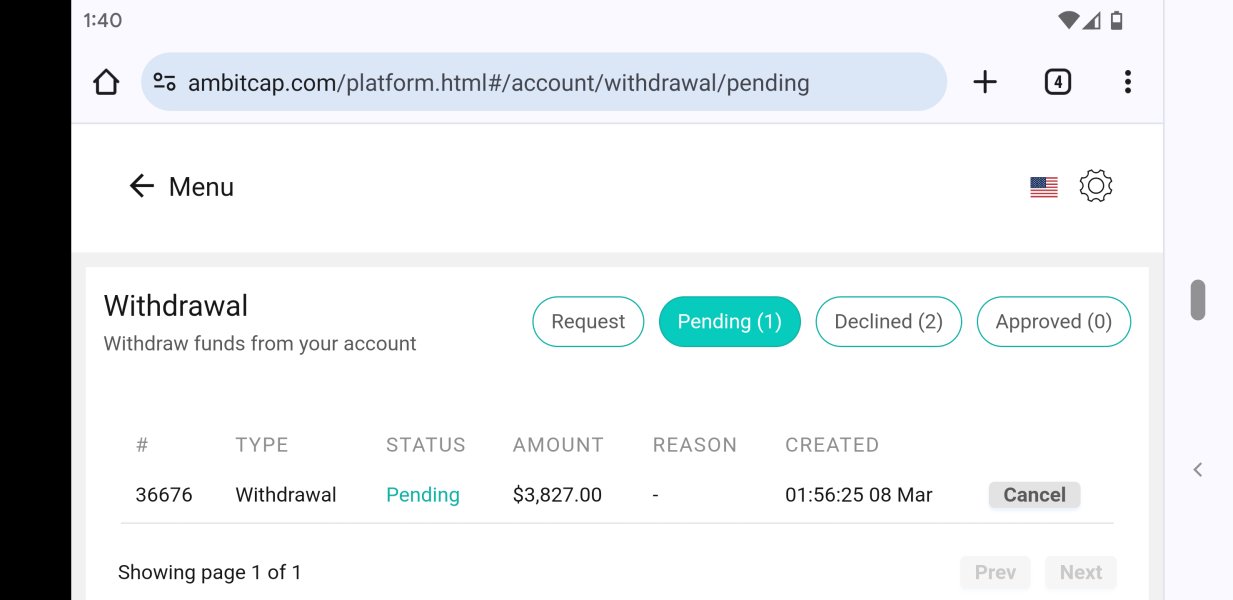

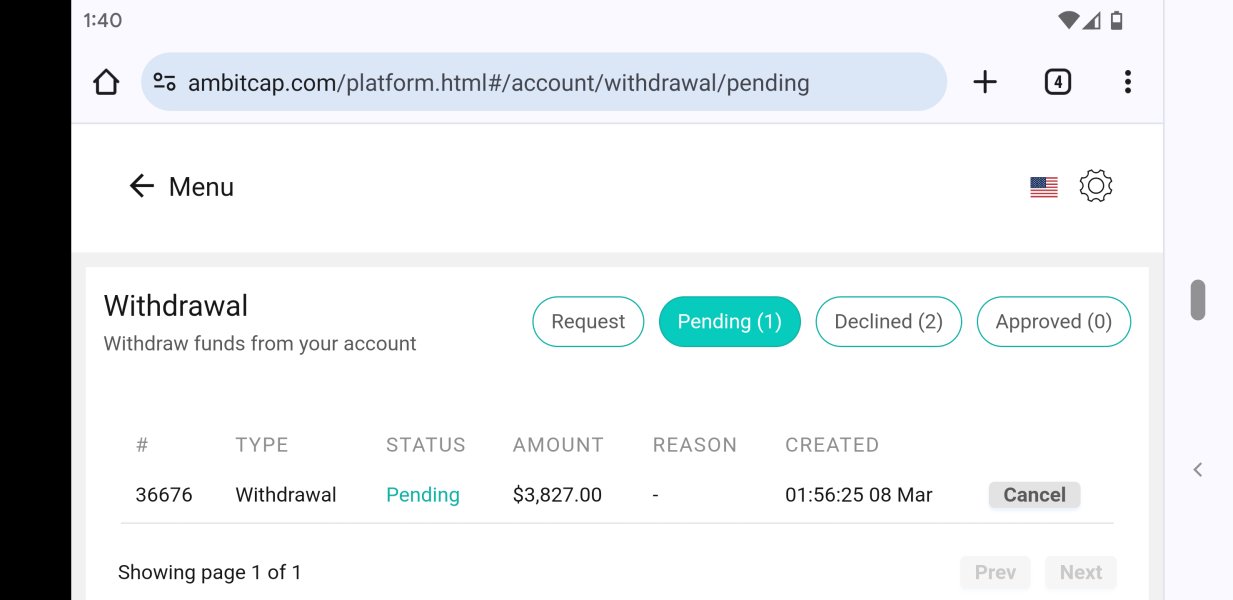

Deposit and Withdrawal Methods: Available documentation does not detail specific information about deposit and withdrawal methods. This creates uncertainty for potential clients about funding options.

Minimum Deposit Requirements: No specific minimum deposit amounts are disclosed in available sources, making it difficult for traders to assess entry-level requirements.

Bonus Promotions: Available documentation does not provide information about specific bonus promotions or incentive programs offered by the broker.

Tradeable Assets: Current documentation does not include detailed information about specific tradeable asset classes and instruments. This limits understanding of the broker's market offerings.

Cost Structure: Available sources do not disclose specific details about spreads, commissions, and other trading costs. User feedback suggests high fee structures that may impact trading profitability.

Leverage Ratios: Information about available leverage ratios and margin requirements is not specified in current documentation.

Platform Options: Available sources do not provide specific trading platform choices and technological infrastructure details. This creates uncertainty about the ambit capital review trading environment.

Regional Restrictions: Available documentation does not clearly outline specific geographical limitations and restricted territories.

Customer Service Languages: Available sources do not detail information about supported languages for customer service.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Ambit Capital remain largely hidden due to insufficient public disclosure of essential trading parameters. The company does not provide clear information about account types, their specific features, or the requirements for different service levels, according to ambit capital review sources. This lack of transparency creates significant challenges for potential clients attempting to evaluate whether the broker's account structures align with their trading needs and investment objectives.

The absence of clearly stated minimum deposit requirements makes the assessment process even more complicated. Traders cannot properly plan their initial investment or understand the financial commitment required to access different service tiers without this fundamental information. Available sources do not detail the account opening process and required documentation, creating uncertainty about the onboarding experience and timeline.

User feedback consistently points to high fees and limited accessibility as major concerns. This suggests that even if account types are available, they may not offer competitive conditions compared to industry standards. The lack of information about special account features, such as Islamic accounts or professional trading accounts, indicates either limited offerings or poor communication of available services. The account conditions receive a low rating that reflects both transparency issues and potentially unfavorable terms given these significant information gaps and negative user feedback.

Ambit Capital's tools and resources portfolio appears limited to traditional financial services rather than comprehensive trading infrastructure. The company focuses mainly on investment banking, asset management, and equity research services, which suggests a more institutional approach rather than retail trading support. The lack of detailed information about specific trading tools, analytical software, or platform capabilities raises concerns about the technological infrastructure available to clients.

The absence of information about research and analysis resources is particularly troubling for a firm that claims expertise in equity research. The company mentions research services as part of its offerings, but no details are provided about the depth, frequency, or quality of research reports, market analysis, or investment insights available to clients. This gap significantly impacts the value proposition for traders who rely on comprehensive market intelligence for decision-making.

Available documentation does not mention educational resources, which are crucial for trader development and platform familiarity. The lack of automated trading support, algorithmic trading tools, or advanced charting capabilities further limits the platform's appeal to modern traders who expect sophisticated technological solutions. User feedback suggests that clients find the available tools and resources inadequate. This contributes to the overall dissatisfaction with the service quality and supports the relatively low rating in this category.

Customer Service and Support Analysis (Score: 4/10)

Customer service and support capabilities at Ambit Capital appear to be significantly compromised based on available feedback and the lack of detailed service information. The company does not provide clear information about available customer service channels. This makes it difficult for potential clients to understand how they can access support when needed. This communication gap is particularly concerning given the complexity of financial services and the importance of reliable customer assistance.

Available documentation does not specify response times for customer inquiries, and there is no information about service level agreements or guaranteed response standards. User feedback consistently highlights high fees and limited accessibility as primary concerns, suggesting that when customers do receive service, they may face cost barriers or restricted access to support resources. The significant increase in customer complaints has notably damaged the company's reputation. This indicates systemic issues with service quality and client satisfaction.

The absence of information about multilingual support capabilities limits the broker's appeal to international clients. Unclear customer service hours create uncertainty about when assistance is available. Problem resolution processes and escalation procedures are not documented, leaving clients uncertain about how issues will be addressed. The mounting complaints and regulatory warnings suggest that existing customer service frameworks are inadequate for addressing client concerns effectively. This results in the moderate but concerning rating that reflects both service limitations and negative client experiences.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by Ambit Capital remains largely undefined due to insufficient information about platform capabilities, execution quality, and technological infrastructure. Available documentation does not specify the types of trading platforms used, their stability, or execution speeds. This creates significant uncertainty about the actual trading environment that clients can expect. This lack of transparency is particularly problematic in an industry where platform performance directly impacts trading outcomes and client satisfaction.

Available sources do not address order execution quality, which is fundamental to trading success. Potential clients cannot assess whether the broker can meet their trading requirements without information about execution speeds, slippage rates, or order fill reliability. The absence of details about platform functionality, including charting tools, order types, and risk management features, further complicates the evaluation of the trading experience.

Available documentation does not mention mobile trading capabilities, which are essential for modern traders who require flexibility and mobility. The overall trading environment remains unclear, with no information about market access, liquidity providers, or trading conditions during different market sessions. Ambit capital review feedback from users does not provide specific insights into trading experience quality. This suggests either limited user engagement or poor communication of platform capabilities. The combination of information gaps and lack of positive user feedback regarding trading experience supports the low rating in this critical category.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents the most critical concern for Ambit Capital, as the company has been blacklisted by the British Columbia Securities Commission (BCSC). This represents a severe regulatory action that significantly undermines client confidence. This blacklisting indicates serious compliance failures or regulatory violations that pose substantial risks to client funds and trading activities. Such regulatory actions are not taken lightly and typically result from significant breaches of financial regulations or client protection standards.

The company's regulatory status creates immediate safety concerns, as blacklisted entities often face restrictions on operations and may have limited client protection measures in place. Available information does not detail specific fund safety measures, segregation of client accounts, or insurance protections. These are fundamental requirements for trustworthy financial service providers. The lack of transparency regarding these critical safety elements further compounds the trust deficit created by the regulatory warnings.

Company transparency is severely compromised, with limited disclosure of operational details, financial conditions, or compliance measures. The industry reputation has been significantly damaged by the combination of regulatory warnings and increasing customer complaints. This creates a negative feedback loop that further erodes trust. Third-party evaluations consistently highlight the safety concerns and regulatory issues, while user trust feedback indicates negative experiences and concerns about fund security. The regulatory verification confirms the serious nature of the compliance issues. This supports the very low trustworthiness rating that reflects the substantial risks associated with this broker.

User Experience Analysis (Score: 4/10)

User experience at Ambit Capital presents a complex picture with contrasting internal and external perspectives. Employee satisfaction ratings of 4.1 out of 5 suggest a positive internal culture and work environment. This internal satisfaction has not translated into positive client experiences or market reputation. The disconnect between employee satisfaction and client experience indicates potential issues with service delivery, communication, or alignment between internal operations and client-facing services.

Overall user satisfaction appears to be significantly impacted by the mounting negative feedback and regulatory concerns that have damaged the company's reputation. The lack of detailed information about platform interface design and usability creates uncertainty about the actual user experience when interacting with the company's services. Available documentation does not detail registration and verification processes, making it difficult to assess the onboarding experience and user journey efficiency.

Available sources do not specifically address fund operation experiences, though user complaints about high fees and limited accessibility suggest that financial interactions may be problematic. Common user complaints consistently focus on cost-related issues and service accessibility. This indicates systematic problems with the value proposition and service delivery model. The user profile analysis suggests that the service may only be suitable for investors with exceptionally high risk tolerance, significantly limiting its market appeal. Potential improvements should focus on cost reduction, accessibility enhancement, and transparency improvements to address the fundamental concerns that have led to the current negative reputation and user experience challenges based on user feedback.

Conclusion

This comprehensive ambit capital review reveals a financial services firm facing significant challenges that substantially outweigh any potential benefits. Ambit Capital has 26 years of industry experience and relatively high employee satisfaction ratings, but the company's blacklisting by the British Columbia Securities Commission and mounting customer complaints create an unacceptable risk profile for most investors. The lack of transparency regarding essential trading conditions, platform capabilities, and safety measures further compounds these concerns.

The broker is not recommended for ordinary retail investors due to the serious regulatory warnings and safety concerns. Only investors with exceptionally high risk tolerance and specific requirements for the limited services offered should consider this broker, and even then, extreme caution is advised. The primary advantages of high employee satisfaction and extensive industry experience are significantly overshadowed by regulatory blacklisting, increasing customer complaints, lack of transparency, and unclear service offerings. These factors make this broker unsuitable for most trading and investment needs.