FX Corp 2025 Review: Everything You Need to Know

Executive Summary

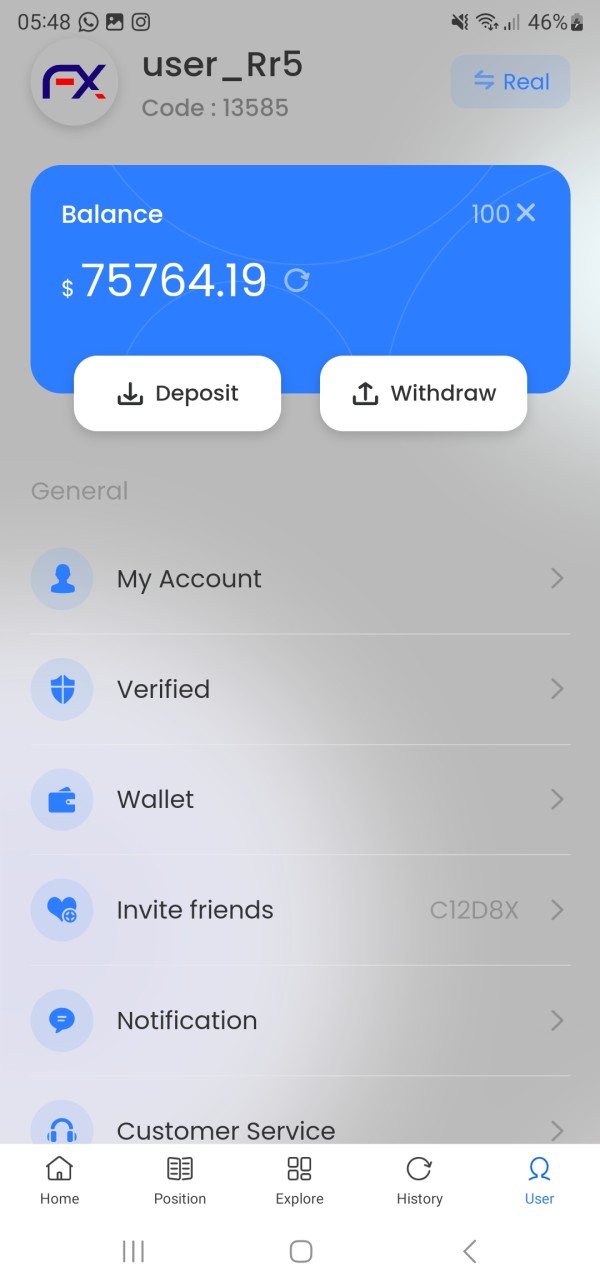

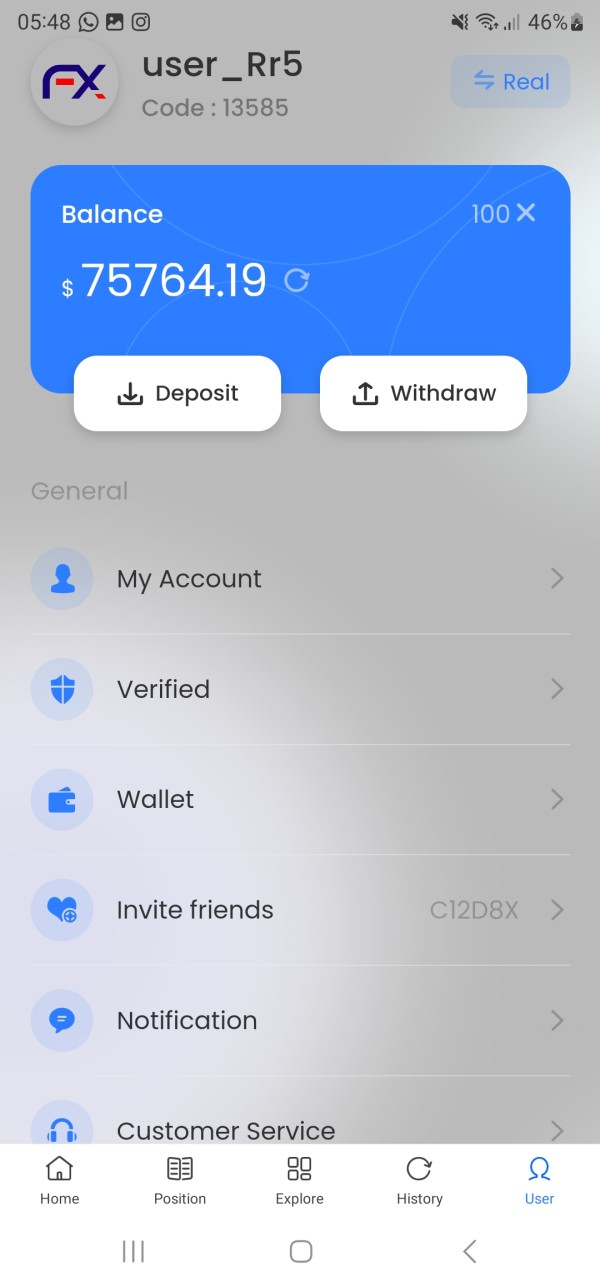

This comprehensive fx corp review examines a brokerage firm that presents a complex picture for potential traders. FX Corp has gotten attention in the trading community, though not always for good reasons. According to multiple industry sources and user feedback, the company shows certain strengths in customer service delivery, with users often praising their support team's knowledge and responsiveness.

However, this fx corp review must address major concerns that overshadow these positive aspects. Various financial watchdog organizations and scam recovery platforms have raised red flags about FX Corp's operations. The broker has been linked with questionable activities including forex scams, cryptocurrency fraud, and binary options scams, which seriously hurts its credibility in the trading community.

The primary user base that might find FX Corp appealing consists of traders who value responsive customer support and quick help with their trading questions. However, potential clients must carefully weigh the documented customer service benefits against the major trust and safety concerns that have emerged from multiple independent sources.

Based on available evidence from consumer review platforms and industry analysis, FX Corp operates in a regulatory gray area that demands extreme caution from prospective traders.

Important Notice

This evaluation is based on publicly available information, customer feedback, and industry reputation analysis gathered from various online sources and review platforms. Traders should note that specific regulatory information and cross-jurisdictional entity differences for FX Corp were not clearly detailed in available documentation.

Our assessment methodology incorporates user testimonials, industry reports, and third-party evaluation platforms to provide a balanced perspective. However, potential clients are strongly advised to conduct independent due diligence and verify all regulatory claims before engaging with any brokerage services.

Rating Framework

Broker Overview

FX Corp operates in the competitive online trading space. However, comprehensive details about its founding year, corporate structure, and business model remain unclear from publicly available sources. The company has established a presence in the forex and potentially broader financial trading markets, though specific information about its corporate background and operational history is limited in current documentation.

According to industry sources, FX Corp positions itself as a trading service provider. However, the exact nature of its business operations and corporate governance structure requires further clarification. The company appears to focus on forex trading services, though the full scope of its offerings and operational framework needs more detailed examination.

The regulatory status and licensing information for FX Corp remain unclear in available sources. This fx corp review finds that specific details about primary regulatory authorities, compliance frameworks, and jurisdictional oversight are not clearly documented. The trading platform types, asset categories, and technological infrastructure details also require additional verification from official company sources.

Without clear regulatory information and transparent operational details, potential clients face significant uncertainty about the company's legitimacy and operational standards in the highly regulated financial services industry.

Regulatory Jurisdiction: Specific regulatory oversight and licensing details for FX Corp are not clearly documented in available sources, raising immediate concerns about compliance and legal operating status.

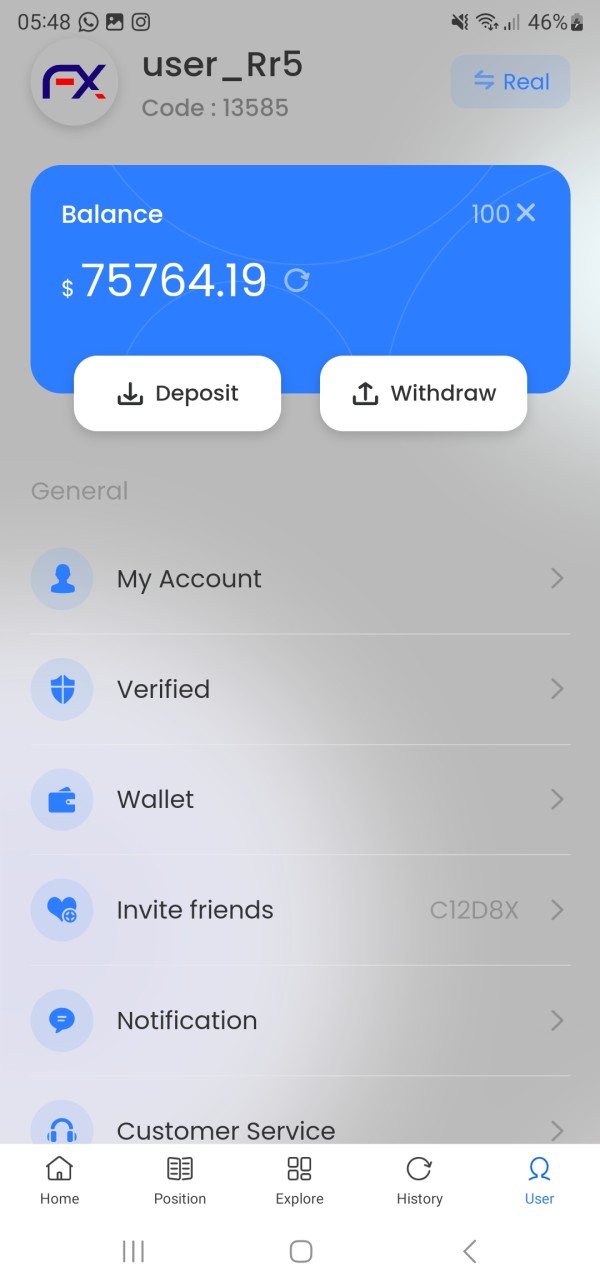

Deposit and Withdrawal Methods: The available payment processing options, supported currencies, and transaction methods have not been detailed in accessible documentation.

Minimum Deposit Requirements: Specific minimum funding requirements for account opening and maintenance are not specified in current sources.

Bonus and Promotional Offers: Information about welcome bonuses, trading incentives, or promotional campaigns is not available in reviewed materials.

Available Trading Assets: The range of tradeable instruments, including forex pairs, commodities, indices, or cryptocurrencies, requires clarification from official sources.

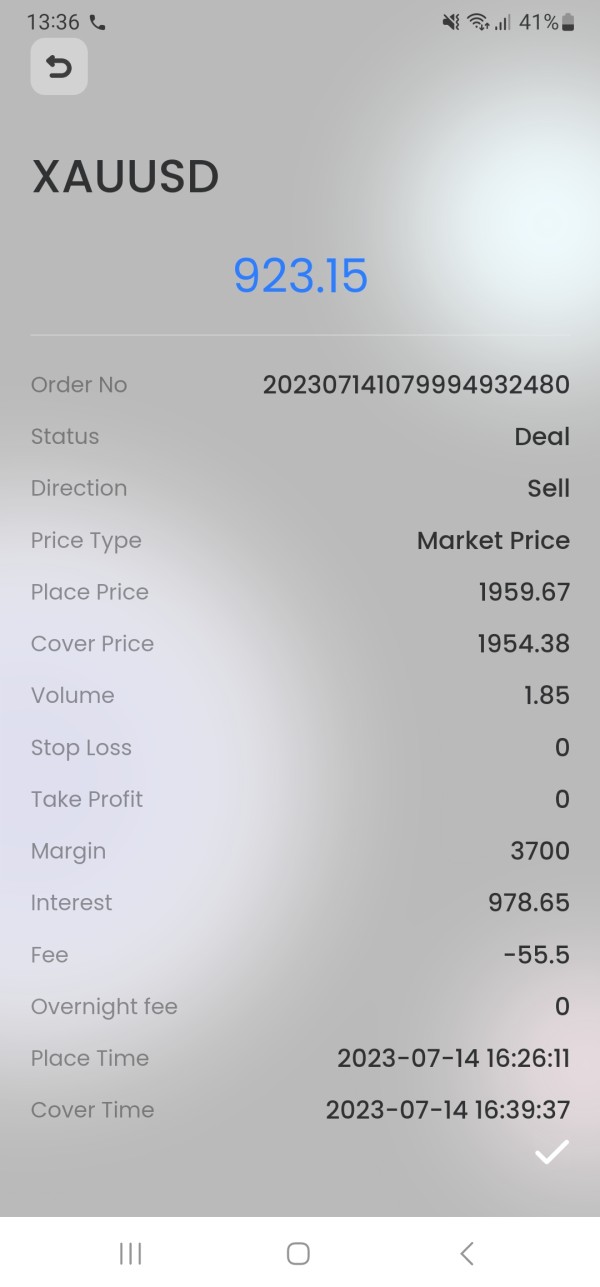

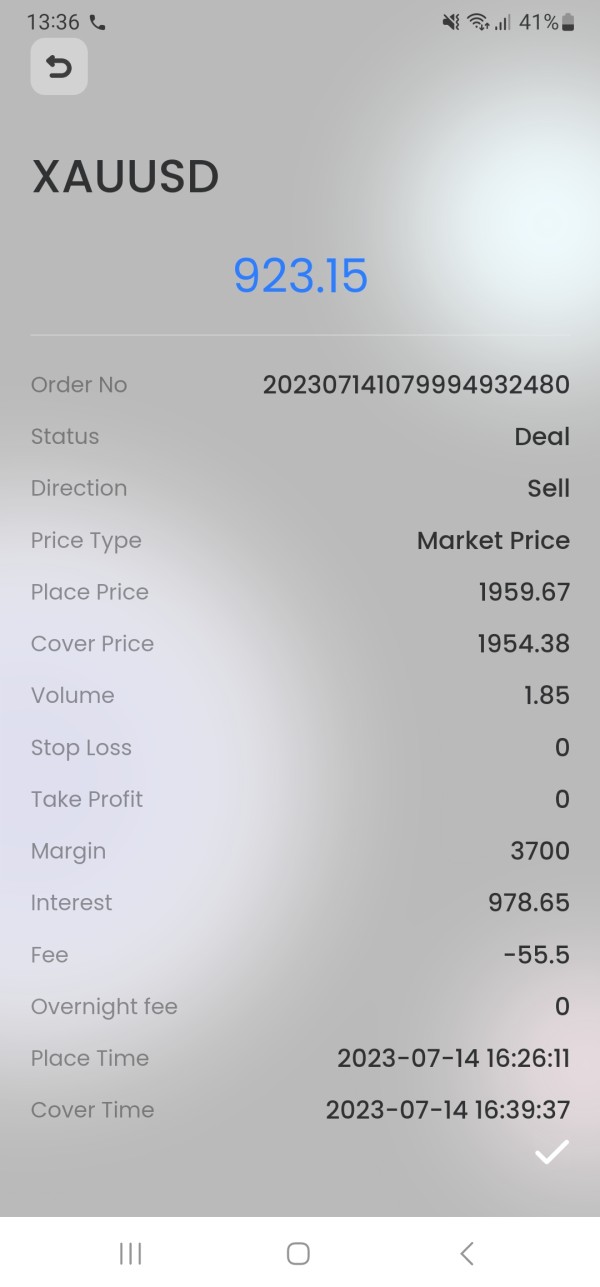

Cost Structure and Fees: Detailed information about spreads, commissions, overnight fees, and withdrawal charges is not comprehensively documented, making cost comparison difficult for potential clients.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available documentation.

Platform Options: Specific trading platform software, mobile applications, and technological features require verification from official company sources.

Geographic Restrictions: Regional availability and service limitations are not clearly outlined in accessible materials.

Customer Service Languages: Multilingual support options and communication channels need clarification.

This fx corp review emphasizes that the lack of transparent, easily accessible information about these fundamental aspects raises significant concerns about the broker's operational transparency and regulatory compliance.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of FX Corp's account conditions faces major limitations due to insufficient publicly available information. Standard account features such as account types, tier structures, and specific trading conditions are not comprehensively documented in accessible sources. This lack of transparency represents a major concern for potential traders who require clear understanding of trading terms.

Minimum deposit requirements, which are crucial for trader decision-making, remain unspecified in current documentation. The absence of clear account opening procedures and verification processes further complicates the assessment. Professional trading features such as Islamic accounts, VIP services, or institutional offerings cannot be evaluated due to information gaps.

The unavailability of detailed account condition information significantly impacts this fx corp review, as traders typically require comprehensive understanding of fees, restrictions, and account features before committing funds. This information deficit aligns with broader transparency concerns identified across multiple evaluation criteria.

Without access to official account documentation or verified user experiences regarding specific account features, potential clients face uncertainty about fundamental trading conditions and service parameters.

The assessment of FX Corp's trading tools and educational resources encounters major limitations due to inadequate information availability. Standard industry offerings such as technical analysis tools, economic calendars, market research, and trading signals cannot be properly evaluated without comprehensive platform documentation.

Educational resources, which are essential for trader development, including webinars, tutorials, market analysis, and trading guides, are not detailed in available sources. The absence of information about automated trading support, API access, or third-party integration capabilities further limits the assessment.

Research and analysis resources, typically including market commentary, economic forecasts, and technical analysis reports, require verification from official company materials. The quality and comprehensiveness of these tools directly impact trading success and user satisfaction.

Without detailed information about platform capabilities, analytical tools, and educational support systems, traders cannot make informed decisions about the broker's suitability for their trading strategies and skill development needs.

Customer Service and Support Analysis

Customer service represents the strongest aspect of FX Corp based on available user feedback. Multiple sources indicate that users have experienced positive interactions with the support team, describing them as knowledgeable, responsive, and readily available to address trading-related queries and technical issues.

User testimonials suggest that FX Corp's customer support staff demonstrate professional competency and problem-solving capabilities. The support team appears to provide timely responses to user inquiries, which is crucial for active traders who require immediate assistance during market hours.

However, specific details about support channels, operating hours, multilingual capabilities, and response time metrics are not comprehensively documented. The availability of phone support, live chat, email assistance, and emergency contact options requires clarification from official sources.

Despite positive user feedback regarding support quality, the overall customer service evaluation must consider the broader context of trust and safety concerns that affect the company's reputation. While individual support interactions may be satisfactory, systemic issues related to company credibility impact the overall service experience assessment.

Trading Experience Analysis

The evaluation of FX Corp's trading experience faces major challenges due to limited available information about platform performance, execution quality, and user interface design. Critical factors such as order execution speed, slippage rates, and platform stability cannot be assessed without comprehensive user data and performance metrics.

Platform functionality, including charting capabilities, order types, and mobile trading experience, requires verification from actual user experiences and official platform demonstrations. The absence of detailed technical specifications and performance benchmarks limits the ability to compare FX Corp's trading environment with industry standards.

User feedback specifically related to trading execution, platform reliability, and overall trading satisfaction is not comprehensively documented in available sources. This information gap prevents accurate assessment of the practical trading experience that clients can expect.

The fx corp review cannot provide definitive conclusions about trading experience quality without access to verified user testimonials, platform performance data, and detailed technical specifications from official company sources.

Trust and Safety Analysis

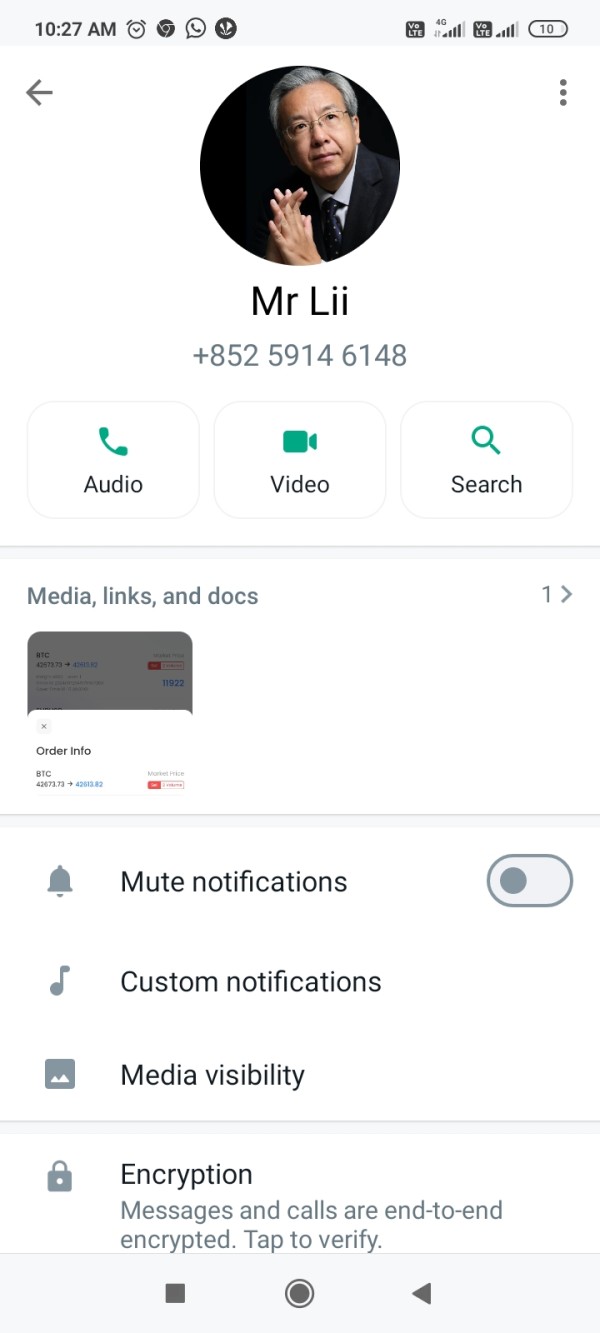

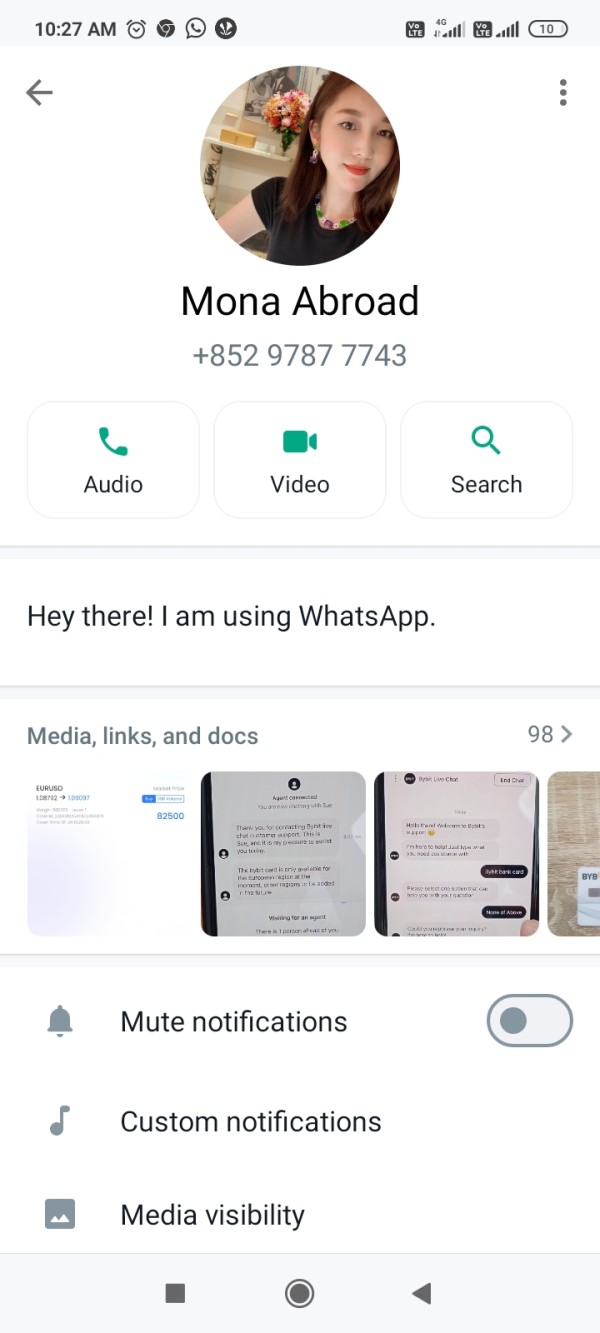

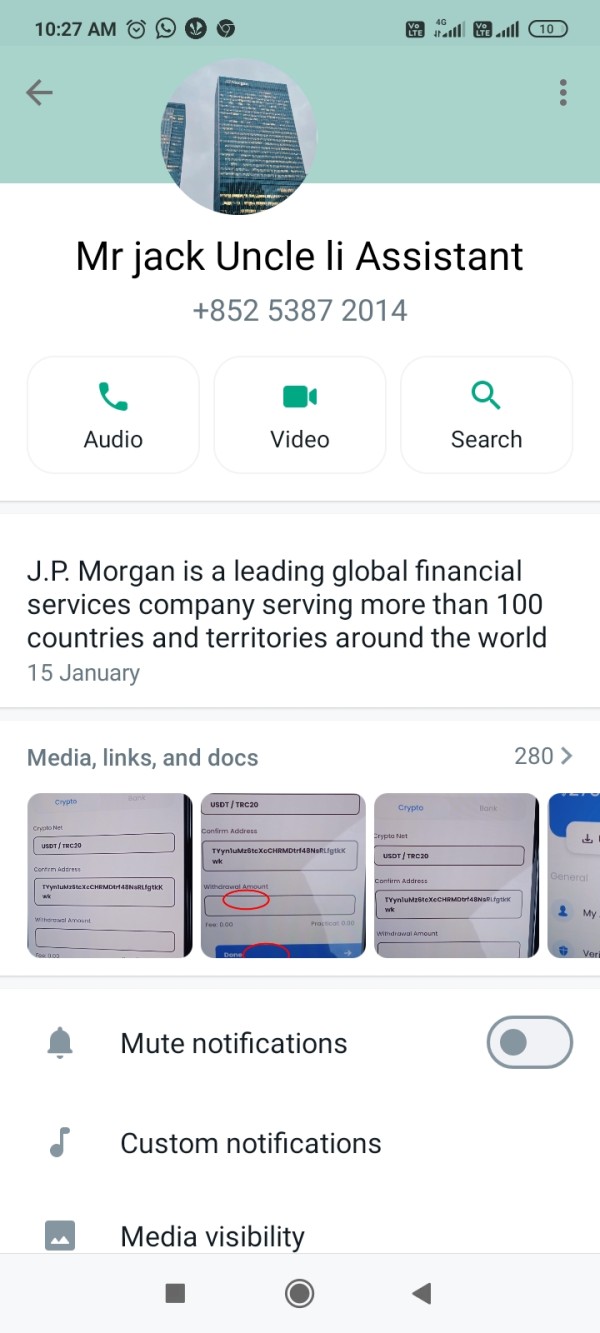

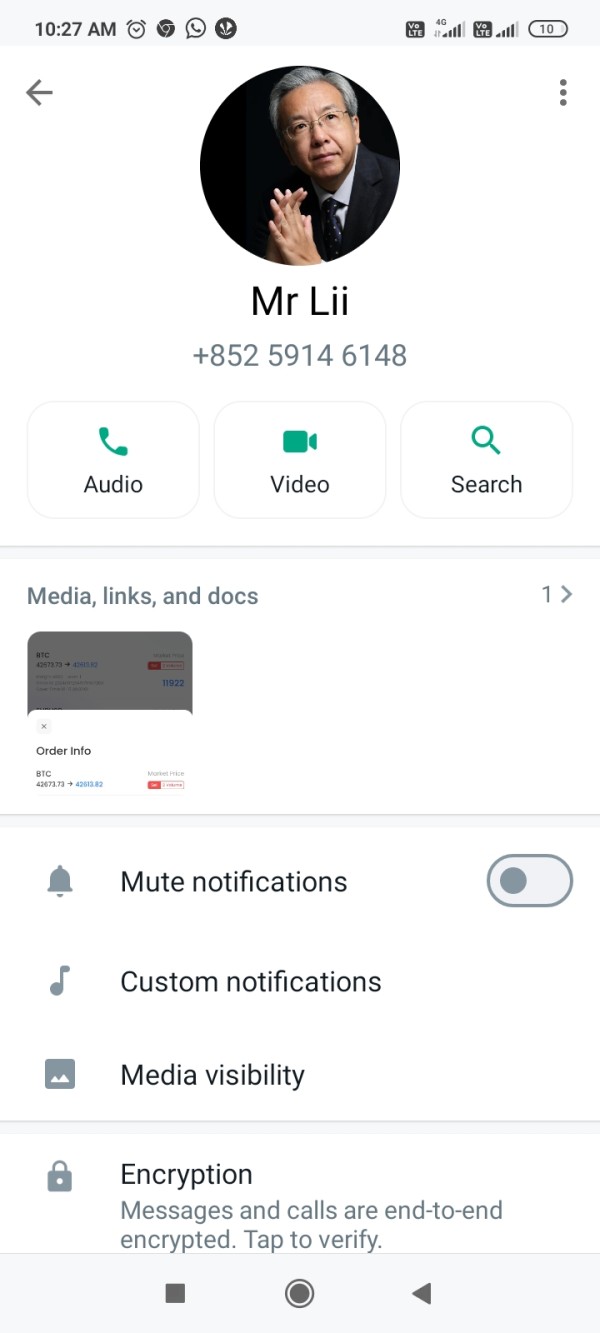

Trust and safety represent the most concerning aspects of FX Corp's operations based on available information from multiple independent sources. Various financial watchdog organizations and scam recovery platforms have identified FX Corp in connection with questionable activities, including forex scams, cryptocurrency fraud, and binary options scams.

The absence of clear regulatory information and transparent licensing details significantly undermines confidence in the company's legitimacy. Legitimate brokers typically provide comprehensive regulatory documentation and maintain transparent compliance frameworks, which appear to be lacking in FX Corp's case.

Multiple platforms have issued warnings about FX Corp, suggesting potential risks for traders considering their services. These warnings typically emerge from patterns of suspicious activity, user complaints, or regulatory concerns that affect trader safety and fund security.

The lack of verifiable regulatory oversight, combined with documented associations with suspicious activities, creates a high-risk environment for potential clients. Fund safety measures, segregated account protections, and dispute resolution mechanisms cannot be verified without proper regulatory documentation.

User Experience Analysis

User experience evaluation for FX Corp reveals mixed feedback with major concerns overshadowing positive customer service interactions. While some users report satisfactory support experiences, broader user sentiment reflects skepticism and concern about the company's operations and practices.

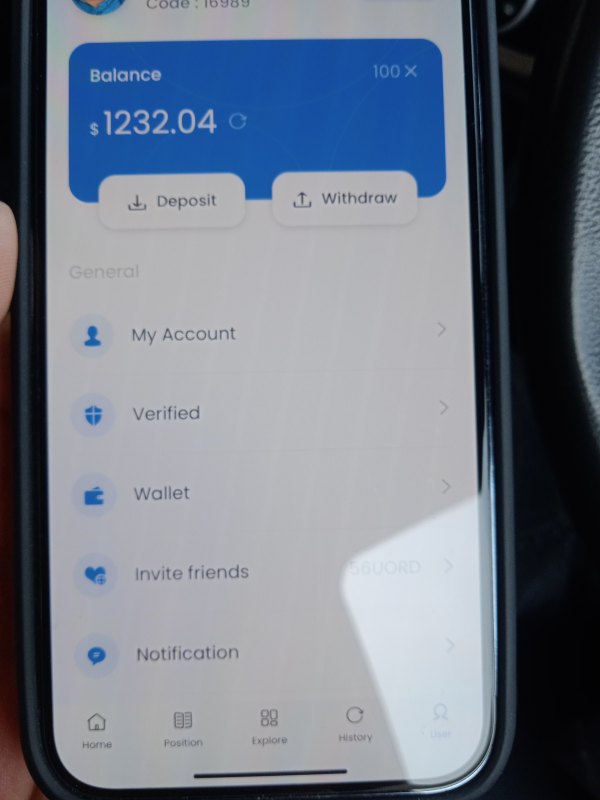

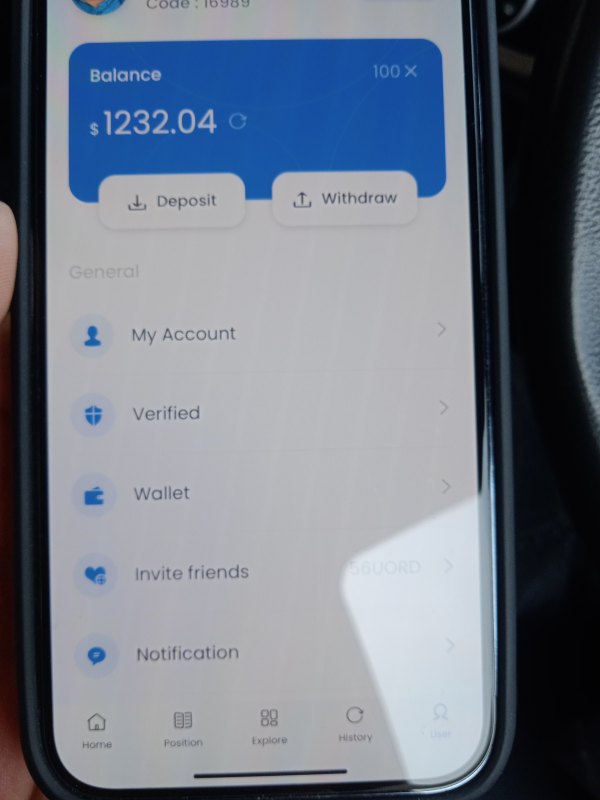

Withdrawal process concerns represent a recurring theme in available user feedback, with some individuals expressing doubts about the company's handling of fund withdrawal requests. These concerns are particularly significant in the trading industry, where reliable fund access is essential for client confidence.

The registration and account verification processes, platform usability, and overall user interface design cannot be comprehensively evaluated due to limited detailed user feedback in available sources. Navigation ease, feature accessibility, and mobile experience require additional user testimonials for proper assessment.

Common user complaints appear to center around trust-related issues rather than technical platform problems, suggesting that operational concerns overshadow potential positive aspects of the user interface and platform functionality. This pattern aligns with broader safety and trust concerns identified in multiple evaluation criteria.

Conclusion

This comprehensive fx corp review reveals a brokerage operation that presents major risks despite some positive aspects in customer service delivery. While user feedback indicates competent customer support with knowledgeable and responsive staff, these benefits are substantially overshadowed by serious trust and safety concerns.

FX Corp may appeal to traders who prioritize responsive customer support and require immediate assistance with trading queries. However, potential clients must carefully consider the documented associations with suspicious activities and the absence of clear regulatory oversight before engaging with their services.

The primary advantages include reportedly effective customer service interactions, while the major disadvantages encompass low trust scores due to fraud allegations, withdrawal concerns, and regulatory ambiguity. The lack of transparent operational information further complicates the decision-making process for potential clients.

Given the major safety concerns and regulatory uncertainties identified in this evaluation, traders are strongly advised to exercise extreme caution and conduct thorough independent research before considering FX Corp's services.