Dominion Markets 2025 Review: Everything You Need to Know

Executive Summary

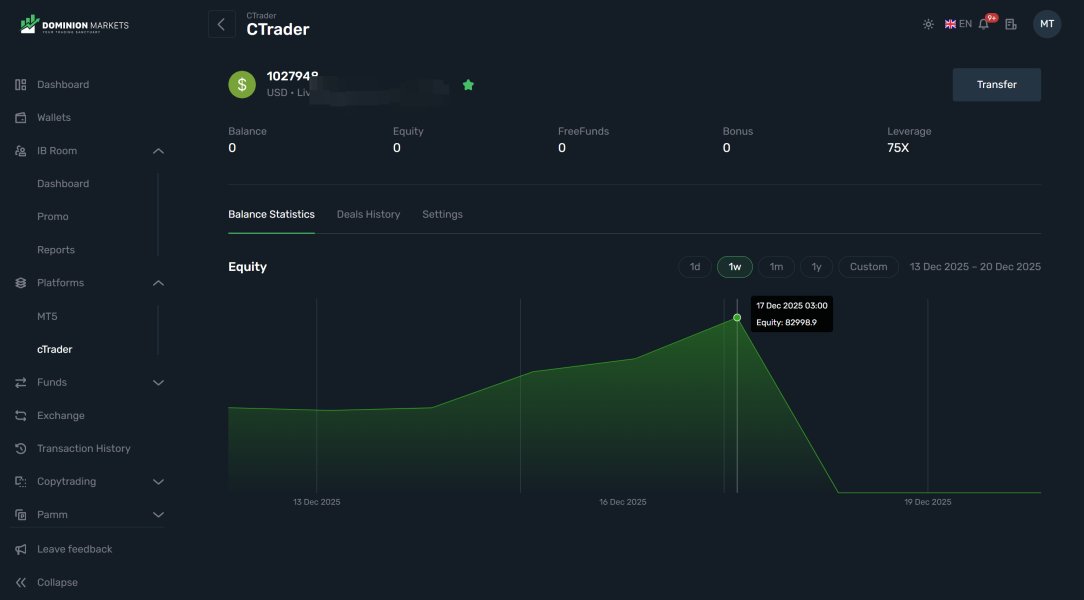

This comprehensive dominion markets review reveals a broker that has established itself as a noteworthy player in the competitive forex and crypto trading landscape since its 2020 launch. Dominion Markets operates from the United Arab Emirates. The company works as an ECN broker offering impressive leverage up to 1:500 and maintaining variable spreads with commissions starting from $7. The platform supports both MetaTrader 4 and MetaTrader 5, catering to traders seeking diverse asset exposure including forex, indices, stocks, commodities, cryptocurrencies, and precious metals.

User feedback consistently highlights the broker's exceptional customer service. They especially praise the deposit and withdrawal support, earning them a stellar 5-star rating from long-term clients. The minimum deposit requirement of $100 makes the platform accessible to intermediate and advanced traders, especially those interested in cryptocurrency and forex markets. According to user testimonials, Dominion Markets demonstrates genuine care for their trading community, with one veteran trader noting, "I've been with Dominion Markets almost since their launch, and I'm happy to say they continue to show they truly care about their traders."

The broker positions itself as "the first Crypto Forex broker that provides incentives to traders to perform better in the markets." This targets sophisticated traders who value both traditional forex opportunities and emerging cryptocurrency markets. While educational resources and detailed market analysis tools appear limited in available information, the platform's core trading infrastructure and customer support excellence make it a compelling choice for experienced traders seeking reliable execution and responsive service.

Important Notices

As an offshore broker headquartered in the United Arab Emirates, Dominion Markets may present varying regulatory frameworks and service offerings across different jurisdictions. Traders should know that offshore brokers typically operate under different regulatory standards compared to major financial centers. This may affect investor protection measures and dispute resolution processes.

This review is compiled based on publicly available information, user feedback from multiple platforms including Trustpilot, and comprehensive analysis from industry sources including TradingBrokers.com and TheForexGeek.com. The broker operates under the regulation of INTERNATIONAL BROKERAGE and CLEARING HOUSE with license number T2023340. Potential clients should conduct their own due diligence and consider their local regulatory requirements before opening an account.

All information presented reflects the broker's status as of 2024-2025 and may be subject to changes in terms, conditions, and regulatory status. Traders are advised to verify current information directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Established in 2020, Dominion Markets has quickly positioned itself as a specialized ECN broker operating from the United Arab Emirates. The company distinguishes itself by combining traditional forex trading with cryptocurrency opportunities. It markets itself as "the first Crypto Forex broker that provides incentives to traders to perform better in the markets." This unique positioning reflects the broker's commitment to serving the evolving needs of modern traders who seek exposure to both established and emerging financial markets.

The broker's business model centers on providing institutional-grade trading conditions through advanced technology infrastructure while maintaining accessibility for individual traders. According to TradingBrokers.com, Dominion Markets operates as an ECN broker, which typically means tighter spreads and direct market access, though with variable spreads that reflect real market conditions. The company's relatively recent establishment in 2020 positions it as a newer entrant that has rapidly gained traction in competitive markets.

Dominion Markets supports comprehensive trading through MetaTrader 4 and MetaTrader 5 platforms. These platforms accommodate diverse trading styles from scalping to long-term position trading. The asset portfolio spans six major categories: forex pairs, global indices, individual stocks, commodities, cryptocurrencies, and precious metals. This diversification strategy appeals to traders seeking portfolio variety within a single brokerage relationship. The broker operates under regulation from INTERNATIONAL BROKERAGE and CLEARING HOUSE with license number T2023340, providing a regulatory framework for its operations while maintaining the flexibility typical of offshore brokers.

Regulatory Status: Dominion Markets operates under the supervision of INTERNATIONAL BROKERAGE and CLEARING HOUSE, holding license number T2023340. This offshore regulatory framework provides operational oversight while offering the flexibility characteristic of UAE-based financial services providers.

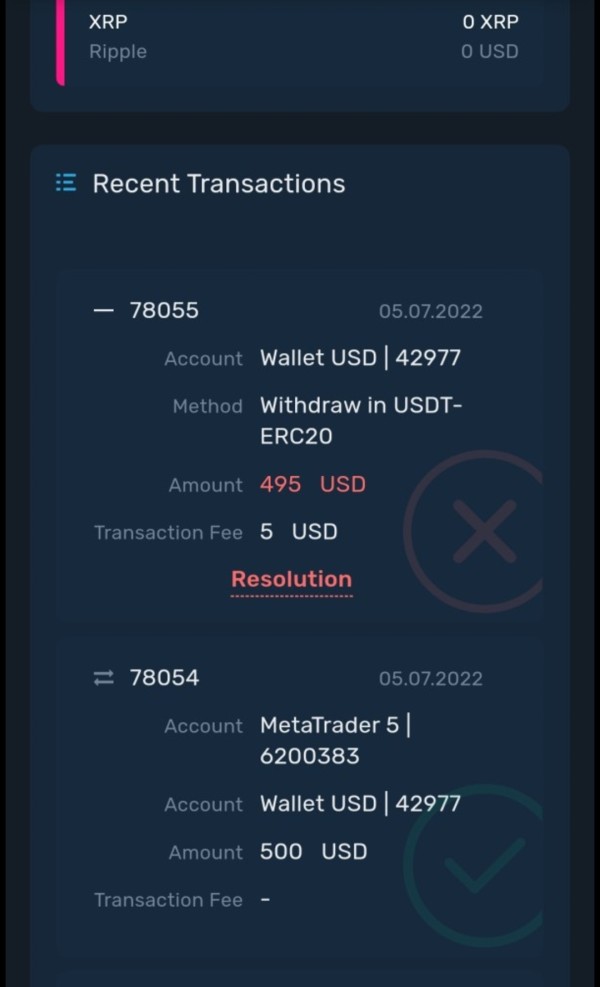

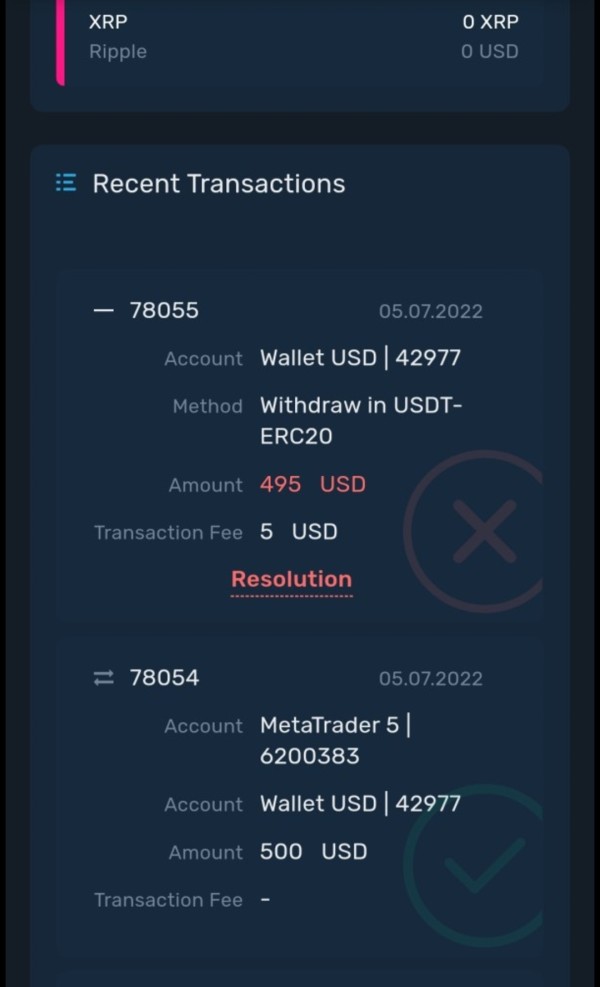

Deposit and Withdrawal Methods: The broker supports multiple funding channels including bank transfers, credit/debit cards, and e-wallets. User feedback consistently praises the speed of deposit processing. One client noted successful instant deposit assistance from the support team after an initial decline. Withdrawal processes are similarly streamlined, though specific processing times for different methods are not detailed in available information.

Minimum Deposit Requirements: Dominion Markets maintains an accessible $100 minimum deposit threshold. This positions the broker competitively within industry standards while remaining approachable for intermediate-level traders seeking professional trading conditions.

Promotional Offers: Specific bonus and promotional information is not detailed in available sources. However, the company's self-description as providing "incentives to traders to perform better" suggests some form of performance-based rewards system may be available.

Tradeable Assets: The platform offers comprehensive market access across forex pairs, global indices, individual stocks, commodities, cryptocurrencies, and precious metals. This broad asset coverage enables portfolio diversification and supports various trading strategies within a single platform environment.

Cost Structure: Trading costs feature variable spreads reflecting real market conditions, with commission charges beginning at $7. This commission-based model typically indicates ECN execution, where traders pay explicit commissions but benefit from tighter spreads and direct market access.

Leverage Options: Maximum leverage reaches 1:500. This provides significant capital efficiency for qualified traders while requiring appropriate risk management given the amplified exposure potential.

Platform Selection: Both MetaTrader 4 and MetaTrader 5 are supported, offering traders choice between the established MT4 environment and the enhanced features of MT5. MT5 includes additional timeframes, order types, and built-in economic calendar functionality.

Geographic Restrictions: Available information does not specify particular geographic limitations. However, as an offshore broker, services may vary by jurisdiction based on local regulatory requirements.

Customer Service Languages: Specific language support details are not provided in current sources. The international nature of the operation suggests multi-language capabilities.

This dominion markets review reveals a broker focused on combining traditional and cryptocurrency markets while maintaining professional trading standards through established platform technology and responsive customer support.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Dominion Markets demonstrates competitive account structuring that balances accessibility with professional trading standards. The $100 minimum deposit requirement positions the broker favorably within industry benchmarks. It makes quality trading conditions available without excessive capital requirements. According to TradingBrokers.com, the broker offers multiple account types designed to accommodate varying trader preferences and capital levels, though specific account tier details are not extensively documented in available sources.

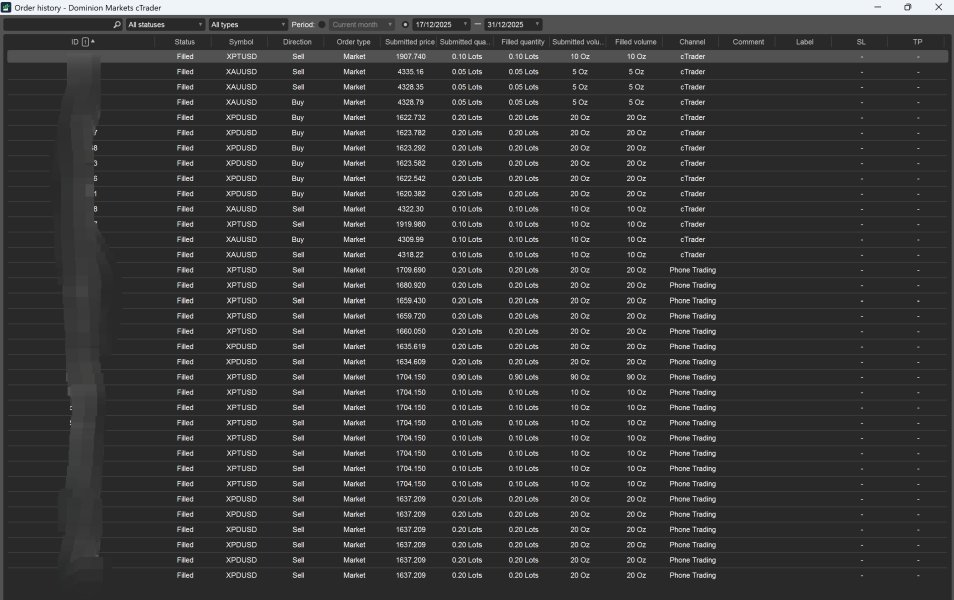

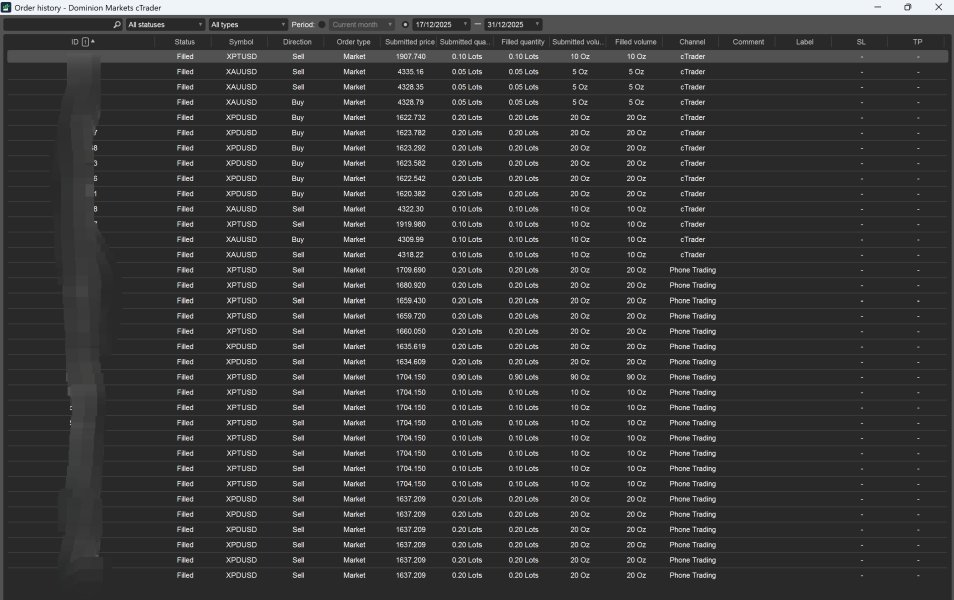

The commission structure beginning at $7 reflects the broker's ECN model, where traders pay explicit commissions in exchange for tighter spreads and direct market access. This transparent cost structure appeals to experienced traders who prefer predictable commission costs rather than wider spreads that embed broker margins. User feedback indicates streamlined account opening processes, with clients reporting satisfactory onboarding experiences and efficient verification procedures.

Account funding flexibility through bank transfers, credit/debit cards, and e-wallets provides practical convenience for international clients. The absence of detailed information regarding Islamic accounts or other specialized account features represents a potential limitation for traders requiring specific religious compliance or unique trading conditions. Overall, the account conditions framework supports serious trading activity while maintaining reasonable accessibility thresholds.

The dominion markets review data suggests that account management focuses on core functionality rather than extensive customization options. This may suit traders prioritizing execution quality over elaborate account features.

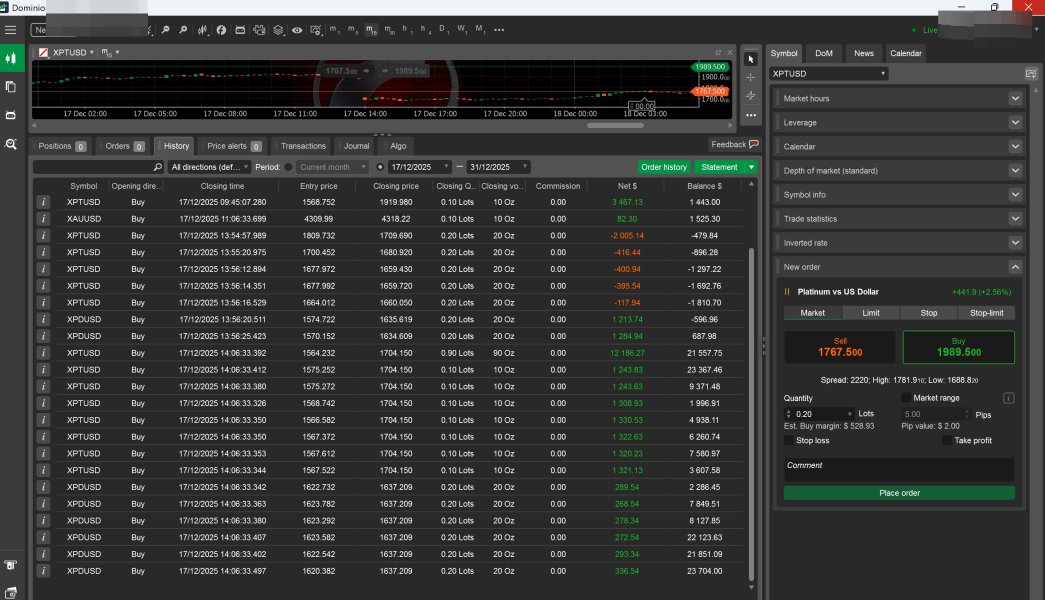

The broker's platform infrastructure centers on MetaTrader 4 and MetaTrader 5, providing traders with industry-standard tools that support comprehensive technical analysis and automated trading capabilities. MT4's proven reliability appeals to traditional forex traders. Meanwhile, MT5's enhanced features including additional timeframes, more order types, and improved backtesting capabilities serve advanced users seeking sophisticated analysis tools.

User feedback indicates platform stability and smooth operation, with traders reporting consistent performance during active trading sessions. The platforms support Expert Advisors (EAs) and signal services, enabling automated trading strategies and social trading participation. However, detailed information about proprietary research tools, market analysis resources, and educational materials is limited in available sources.

The absence of comprehensive educational resources represents a notable gap for traders seeking broker-provided learning materials and market insights. While the platform technology meets professional standards, the apparent lack of value-added research and educational content may disadvantage newer traders or those seeking ongoing market analysis support.

Platform performance appears reliable based on user experiences. However, specific technical performance metrics such as execution speeds or server uptime statistics are not detailed in current information sources.

Customer Service and Support Analysis (9/10)

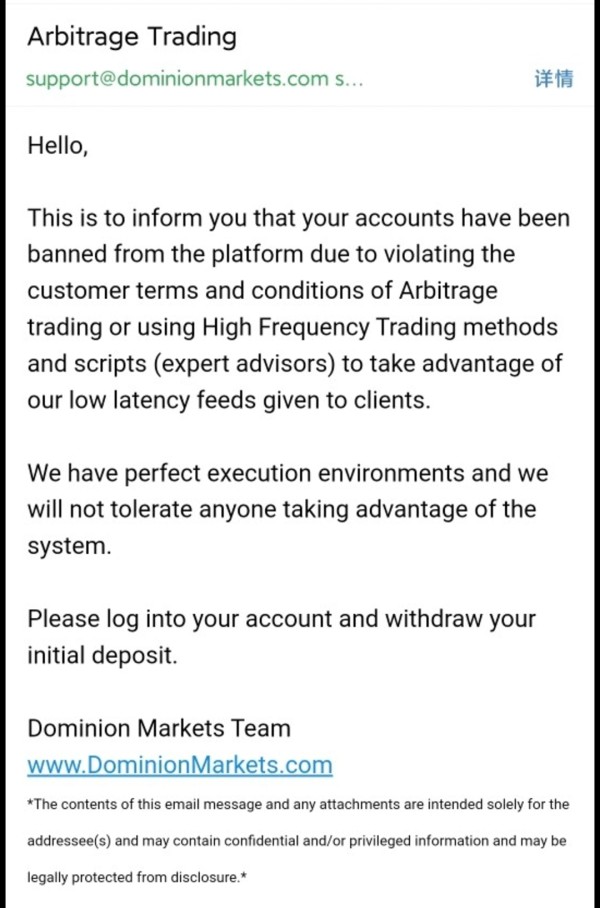

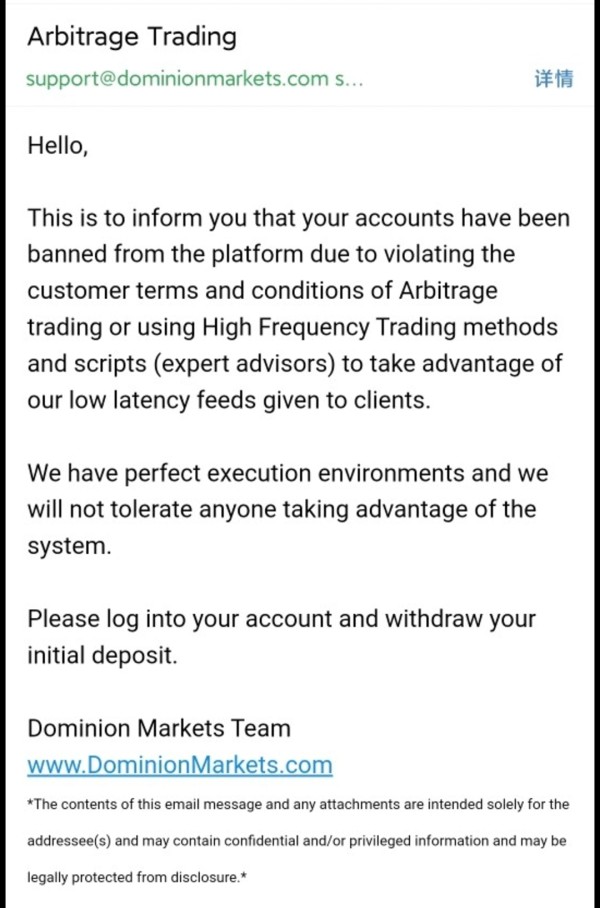

Dominion Markets receives exceptional ratings for customer service quality, with users consistently praising both responsiveness and problem-solving effectiveness. Trustpilot reviews highlight particular satisfaction with deposit and withdrawal support. This indicates that the broker prioritizes financial transaction assistance. One user testimonial specifically mentions successful resolution of a deposit decline, with support providing immediate assistance for instant deposit completion.

The customer service team demonstrates professional competency in addressing technical and account-related issues, contributing to the broker's 5-star user rating. Response times appear competitive, though specific service level agreements or guaranteed response timeframes are not detailed in available information. The support infrastructure appears designed to handle both routine inquiries and complex problem resolution effectively.

Long-term client relationships reflect positively on service consistency, with veteran users noting continued satisfaction over extended periods. The absence of specific information regarding support channel availability (phone, email, live chat) and operating hours represents a minor information gap. However, user experiences suggest adequate accessibility across multiple contact methods.

Multi-language support capabilities are not specifically documented. The international client base suggests appropriate language accommodation for diverse markets.

Trading Experience Analysis (8/10)

Trading execution quality receives positive user feedback, with clients reporting smooth platform operation and reliable order processing. The variable spread structure reflects real market conditions while the ECN model typically provides competitive pricing during active market hours. User testimonials indicate satisfaction with overall trading conditions, particularly regarding platform stability and execution reliability.

The 1:500 maximum leverage provides significant capital efficiency for qualified traders while requiring appropriate risk management protocols. Order execution appears prompt with minimal slippage reported in user feedback, though specific execution statistics or latency measurements are not provided in available sources. Platform functionality supports various trading strategies from scalping to position trading through comprehensive charting tools and technical indicators.

Mobile trading capabilities are not extensively detailed in current information, representing a potential consideration for traders requiring robust mobile platform functionality. The MT4 and MT5 infrastructure typically includes mobile applications. However, broker-specific mobile experience quality is not specifically addressed in user reviews.

Market access spans six asset categories, providing portfolio diversification opportunities within a single trading environment. The combination of traditional forex markets with cryptocurrency access appeals to traders seeking exposure to both established and emerging market segments.

This dominion markets review indicates that trading experience quality meets professional standards while maintaining user satisfaction across core execution and platform functionality metrics.

Trust and Security Analysis (7/10)

Dominion Markets operates under regulation from INTERNATIONAL BROKERAGE and CLEARING HOUSE with license number T2023340, providing regulatory oversight within an offshore framework. While this regulatory structure offers operational supervision, it may provide different investor protection levels compared to major financial center regulations such as FCA, ASIC, or CySEC oversight.

Client fund segregation practices are implemented according to available information, enhancing security by separating client deposits from operational business funds. This segregation provides additional protection in unlikely insolvency scenarios. However, specific details about segregation procedures and depository institutions are not extensively documented in current sources.

The broker's 2020 establishment means limited operational history for comprehensive track record evaluation, though available user feedback indicates positive experiences without significant security concerns or fund safety issues. The absence of detailed information regarding financial reporting, external audits, or industry awards represents areas where additional transparency would strengthen trust assessment.

User testimonials reflect confidence in fund security and withdrawal reliability, with clients expressing trust in the broker's financial practices. However, the offshore regulatory framework requires traders to understand potential differences in dispute resolution processes and investor compensation schemes compared to major regulated jurisdictions.

User Experience Analysis (8/10)

Overall user satisfaction reaches 5-star levels according to available feedback, indicating strong performance across key user experience metrics. The account opening process receives positive reviews for simplicity and efficiency. Users report straightforward onboarding and verification procedures. Interface design appears intuitive based on user feedback, contributing to positive platform adoption experiences.

Deposit and withdrawal operations generate particular user satisfaction, with clients praising both speed and support quality for financial transactions. The combination of responsive customer service and reliable platform performance creates positive user experiences that encourage long-term client relationships. One veteran user specifically notes continued satisfaction "almost since their launch," indicating consistent service quality over time.

The broker's focus on trader care appears genuine based on user testimonials, with clients feeling valued rather than merely processed. This relationship-focused approach differentiates Dominion Markets in competitive markets where user experience often determines client retention. However, the apparent lack of comprehensive educational resources may limit the experience for users seeking extensive learning materials and market analysis.

User demographics appear to favor intermediate and advanced traders, particularly those interested in cryptocurrency markets alongside traditional forex trading. The platform design and service approach seem optimized for experienced traders who prioritize execution quality and customer support over extensive educational content.

Conclusion

This comprehensive dominion markets review reveals a broker that has successfully established itself as a reliable trading partner since its 2020 launch, particularly excelling in customer service and trading execution quality. The combination of competitive account conditions, professional platform infrastructure, and exceptional client support creates a compelling offering for intermediate to advanced traders seeking quality trading conditions with responsive service.

The broker's specialization in combining traditional forex markets with cryptocurrency opportunities positions it uniquely for traders interested in both established and emerging market segments. The 1:500 leverage, variable spreads, and ECN execution model provide institutional-quality trading conditions. These features maintain accessibility through reasonable minimum deposit requirements.

Dominion Markets appears most suitable for experienced traders who prioritize execution quality, customer service excellence, and multi-asset trading capabilities over extensive educational resources and research tools. The offshore regulatory framework requires appropriate due diligence, though user experiences indicate reliable operations and fund security practices.

While areas such as educational content and detailed market analysis tools represent potential enhancement opportunities, the broker's core strengths in platform performance, customer support, and trading conditions create a solid foundation for serious trading activity in both traditional and cryptocurrency markets.