Is LEOM safe?

Pros

Cons

Is Leom Safe or Scam?

Introduction

Leom Market, a relatively new entrant in the forex trading landscape, has garnered attention for its promise of high leverage and a user-friendly trading platform. Established in 2022 and claiming to operate globally, Leom positions itself as a broker catering to traders seeking opportunities in forex and CFDs. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially in an industry notorious for scams and fraudulent activities. Traders must ensure that their chosen broker is legitimate, regulated, and transparent in its operations. This article aims to provide an objective analysis of Leom Market, assessing its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on multiple sources, including user reviews and regulatory reports, offering a comprehensive view of whether Leom is safe or a potential scam.

Regulation and Legitimacy

When evaluating a forex broker, regulatory compliance is paramount. A regulated broker is subject to strict oversight, which typically includes requirements for capital reserves, transparency, and investor protection. Unfortunately, Leom Market is unregulated, lacking any valid license from recognized financial authorities. This absence of regulation raises significant concerns about the safety of funds and the broker's operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The lack of regulatory oversight means that traders have no recourse in case of disputes or issues with fund withdrawals. High-risk brokers often operate without regulation to evade compliance with industry standards, making them more likely to engage in fraudulent practices. The absence of a regulatory body overseeing Leom Market means that traders are essentially operating in a high-risk environment where their investments could be at stake.

Company Background Investigation

Leom Market's company profile raises several red flags. Established in 2022, the broker's history is minimal, and there is little information available about its ownership structure or management team. This lack of transparency is concerning, as reputable brokers typically provide clear details about their corporate structure and key personnel.

The absence of publicly available information regarding the management team further complicates the assessment of Leom's credibility. A broker's management team should ideally have a proven track record in the financial services industry, but in the case of Leom, this information is either missing or unreliable. Consequently, traders are left with little insight into the expertise and qualifications of those running the brokerage.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall appeal and safety. Leom Market claims to offer competitive trading conditions, including high leverage of up to 1:500. However, the lack of transparency regarding spreads, commissions, and other fees raises concerns about the overall cost of trading with this broker.

| Fee Type | Leom Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information about trading costs can lead to unexpected expenses for traders. Moreover, high leverage, while attractive, significantly increases the risk of substantial losses. Traders should approach such offers with caution, especially from unregulated brokers like Leom Market, as the potential for financial loss is heightened.

Customer Funds Safety

The safety of customer funds is a critical aspect of any brokerage evaluation. Regulated brokers are required to implement measures such as segregating client funds from their own and participating in compensation schemes to protect investors. Unfortunately, Leom Market does not provide any assurances regarding fund safety or investor protection.

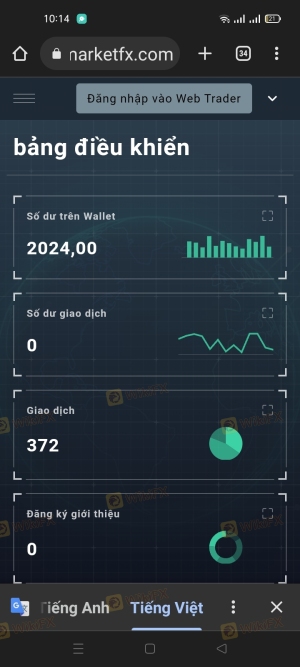

Given its unregulated status, there are no guarantees that customer funds are secure. Reports of withdrawal issues and complaints from users suggest that there may be serious concerns about the broker's ability to safeguard client assets.

Customer Experience and Complaints

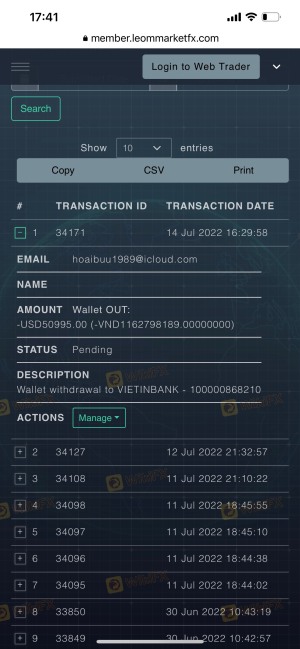

The customer experience at Leom Market has been largely negative, with numerous complaints surfacing from users who have faced challenges with withdrawals and account management. Common complaints include difficulty in accessing funds, lack of customer support, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support Access | High | Unavailable |

Several users have reported being unable to withdraw their funds after making deposits, a common tactic employed by fraudulent brokers to retain client money. In some cases, clients have claimed that they were pressured into making additional deposits under the guise of "unlocking" their funds. This pattern of behavior is a significant indicator that Leom Market may not be a safe option for traders.

Platform and Execution

The trading platform offered by Leom Market is based on the widely used MetaTrader 4 (MT4), which is known for its reliability and user-friendly interface. However, the overall execution quality, including slippage and order rejection rates, is a critical factor that can impact trading success.

User feedback indicates that there are concerns regarding the execution of trades, with some clients reporting issues with slippage and delayed order processing. Such problems can severely affect a trader's ability to execute strategies effectively, further questioning whether Leom is safe for trading.

Risk Assessment

Trading with Leom Market presents several risks that potential investors should consider. The unregulated status of the broker, combined with the lack of transparency and numerous complaints, indicates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | High | Issues with withdrawals and support |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker, especially those lacking regulation. It is crucial to prioritize transparency and regulatory compliance when selecting a trading partner.

Conclusion and Recommendations

In conclusion, the evidence gathered strongly suggests that Leom Market is not a safe option for traders. The lack of regulation, transparency issues, and numerous customer complaints raise significant concerns about the broker's legitimacy. Traders should exercise extreme caution and consider alternative options that offer regulatory oversight and a proven track record of reliability.

For those looking for safer trading alternatives, reputable brokers with established regulatory credentials should be prioritized. Options such as IC Markets, FXCM, and RoboForex are examples of brokers that provide a more secure trading environment with transparent practices and robust customer support. Always remember, when it comes to trading, safety should be your top priority.

Is LEOM a scam, or is it legit?

The latest exposure and evaluation content of LEOM brokers.

LEOM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LEOM latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.