Regarding the legitimacy of JinDao forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is JinDao safe?

Pros

Cons

Is JinDao markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RevokedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

金道貴金屬有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

copm.gwghk.comExpiration Time:

--Address of Licensed Institution:

九龍佐敦上海街42-46號忠和商業大廈5樓505室Phone Number of Licensed Institution:

(852) 37199399/(852)Licensed Institution Certified Documents:

Is JinDao Safe or Scam?

Introduction

JinDao is a forex broker based in Hong Kong that has emerged in recent years, primarily focusing on trading forex, metals, and energy commodities. As the forex market continues to grow, traders are increasingly looking for reliable brokers to facilitate their trading activities. However, with the proliferation of online trading platforms, it is crucial for traders to carefully assess the legitimacy and safety of these brokers before investing their hard-earned money. This article aims to provide a comprehensive evaluation of JinDao, analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and inherent risks. The findings are based on various online sources, including reviews and regulatory databases, to ensure a balanced and objective assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and legitimacy. JinDao operates as an unregulated entity, which raises significant concerns regarding investor protection and compliance with industry standards. The lack of regulation means that traders may not have access to the same level of oversight and recourse that regulated brokers provide. Below is a summary of JinDao's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | License No. 074 | Hong Kong | Unsubscribed |

The Chinese Gold & Silver Exchange Society holds a license for JinDao; however, it is currently classified as "unsubscribed," indicating that the broker's license may not be active or compliant with regulatory requirements. This status poses inherent risks to traders, as it suggests that the broker may not adhere to necessary operational standards. The absence of a robust regulatory framework can lead to issues such as fund mismanagement and a lack of transparency, making it essential for traders to approach JinDao with caution.

Company Background Investigation

JinDao was established in Hong Kong within the past 5 to 10 years, positioning itself as a specialist in trading forex, precious metals, and energy commodities. The company has not provided extensive information regarding its ownership structure or management team, which can be a red flag for potential investors. Without clear insights into the backgrounds of key personnel, it is challenging to assess the firm's credibility and operational expertise.

The management teams experience in the financial sector is crucial for ensuring effective risk management and compliance with trading regulations. However, JinDao's lack of transparency regarding its leadership may raise concerns about its operational integrity. The company's website is currently inaccessible, further complicating efforts to verify its claims and gather essential information about its services. This lack of accessibility can create distrust among potential clients, leading them to question the broker's reliability.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential for assessing overall value. JinDao offers competitive trading conditions, with a minimum deposit requirement of $100 and leverage up to 1:400. However, the broker's fee structure raises some concerns. Below is a comparison of JinDao's core trading costs:

| Fee Type | JinDao | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.8 pips | 1.0 - 2.0 pips |

| Commission Model | Varies by account type | Typically $5 - $10 per lot |

| Overnight Interest Range | Varies | Typically 2% - 5% |

While JinDao's spreads starting from 0.8 pips may seem attractive, traders should be aware of the additional fees that may apply. For example, JinDao imposes a 3% fee on credit card deposits and a $10 withdrawal fee for bank transfers. Moreover, an inactivity fee of $50 per month after six months of no trading activity can deter infrequent traders. These fees can significantly impact a trader's overall profitability, making it essential to consider all costs associated with trading on this platform.

Customer Fund Security

The safety of customer funds is paramount when choosing a forex broker. JinDao claims to implement various security measures; however, the absence of regulation raises questions about the effectiveness of these measures. Traders must consider whether their funds are held in segregated accounts, which can protect them from potential broker insolvency. Additionally, it is crucial to evaluate whether JinDao offers negative balance protection, which can prevent traders from losing more than their initial investment.

Unfortunately, there is limited information available regarding JinDao's specific fund security policies. The lack of transparency in this area may expose traders to heightened risks, particularly in the event of financial difficulties faced by the broker. Historical incidents of fund mismanagement or security breaches can further exacerbate these concerns, reinforcing the need for traders to exercise caution when dealing with unregulated brokers like JinDao.

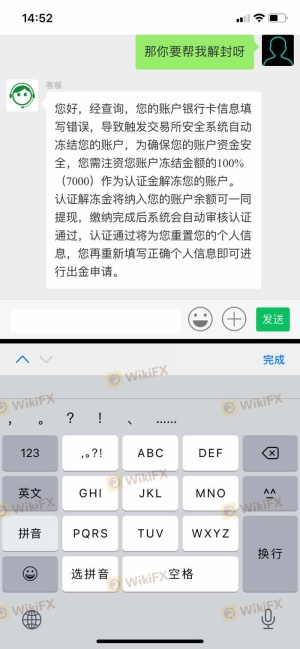

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational practices and overall reliability. Reviews of JinDao indicate a mix of experiences, with some users reporting satisfactory trading conditions while others express concerns about withdrawal issues and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Limited availability |

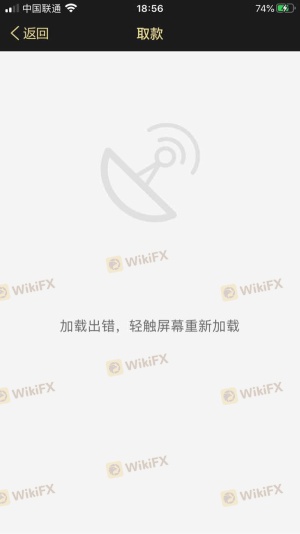

| Account Accessibility | High | Website currently inaccessible |

A notable case involved a trader who experienced difficulties withdrawing funds, leading to frustration and distrust in the broker's operations. The company's slow response to such complaints can reflect poorly on its customer service standards and overall commitment to client satisfaction. As traders evaluate whether JinDao is safe, they should consider these experiences and weigh the potential risks associated with engaging with this broker.

Platform and Trade Execution

A broker's trading platform is a critical component of the overall trading experience. JinDao primarily utilizes the MetaTrader 4 (MT4) platform, a widely recognized tool in the forex industry known for its user-friendly interface and robust analytical capabilities. However, the performance of the platform, including order execution quality, slippage, and rejection rates, is vital for traders seeking a seamless trading experience.

While MT4 is generally reliable, reports of slippage and order rejections have emerged among JinDao users, which can hinder trading performance and lead to unexpected losses. Additionally, the current inaccessibility of JinDao's website raises concerns about the platform's stability and reliability. Traders must be cautious when assessing the platform's performance, as any indications of manipulation or execution issues can significantly impact their trading outcomes.

Risk Assessment

Engaging with an unregulated broker like JinDao entails various risks that traders must carefully evaluate. Below is a risk scorecard summarizing key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks to investors. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Reports of slow response times and withdrawal issues. |

| Platform Stability Risk | High | Inaccessible website and potential execution issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with JinDao. Opening a small account to test the broker's services and responsiveness can provide valuable insights into its reliability. Additionally, traders should consider alternative brokers with established regulatory oversight and a proven track record of customer service.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that JinDao presents several red flags that warrant caution. The broker's unregulated status, coupled with its inaccessible website and mixed customer feedback, raises concerns about its legitimacy and overall safety. While JinDao may offer competitive trading conditions, the potential risks associated with engaging with this broker cannot be overlooked.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated and have a solid reputation in the industry. Brokers with established regulatory oversight and positive customer reviews can provide a safer trading environment. In light of the findings, it is crucial for traders to prioritize their safety and conduct thorough due diligence before deciding to invest with JinDao or any similar unregulated broker.

Is JinDao a scam, or is it legit?

The latest exposure and evaluation content of JinDao brokers.

JinDao Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JinDao latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.