Is VRN Capitals safe?

Business

License

Is VRN Capitals A Scam?

Introduction

VRN Capitals is an online brokerage firm that positions itself in the competitive landscape of the forex market, offering a range of trading services for retail and professional traders alike. As the forex market continues to grow, the number of available brokers has surged, making it increasingly vital for traders to conduct thorough evaluations of these firms before committing their funds. This article aims to provide an objective analysis of VRN Capitals, discussing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a comprehensive review of multiple sources, including regulatory warnings, user feedback, and expert assessments.

Regulatory and Legality

The regulatory framework surrounding a brokerage is crucial as it establishes the credibility and safety of the trading environment. In the case of VRN Capitals, it is essential to note that the broker operates without any regulatory oversight from recognized financial authorities. The absence of regulation raises red flags regarding the safety of customer funds and the overall transparency of the brokerage.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a regulatory license means that VRN Capitals is not subject to the stringent compliance requirements that regulated brokers must adhere to. These regulations typically include measures for client fund protection, transparent pricing, and fair trading practices. Furthermore, the UK Financial Conduct Authority (FCA) has previously issued warnings against VRN Capitals, identifying it as providing financial services without proper authorization. This history of non-compliance and the absence of regulatory oversight contribute to the conclusion that IS VRN Capitals safe? The answer leans heavily towards "no," as traders are left vulnerable without the protections typically afforded by regulatory frameworks.

Company Background Investigation

VRN Capitals claims to be based in the United Kingdom, but there is a lack of verifiable information regarding its actual ownership and operational history. The company's website does not provide any details about its founders or management team, which raises concerns about its transparency. In an industry where trust is paramount, the absence of clear information regarding the company's background can be alarming for potential investors.

The management teams experience is another critical factor in assessing a broker's reliability. Unfortunately, without available information, it is challenging to evaluate the qualifications and expertise of the individuals behind VRN Capitals. This opacity can lead to uncertainties regarding the firm's operational integrity and decision-making processes. Given these factors, it is prudent to approach VRN Capitals with caution, as the lack of transparency raises further concerns about whether IS VRN Capitals safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. VRN Capitals presents a variety of account types with different deposit requirements and leverage options, which may initially appear attractive to potential traders. However, the overall fee structure and trading conditions warrant closer scrutiny.

| Fee Type | VRN Capitals | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1 pip | From 0.5 pips |

| Commission Model | No commission | Varies widely |

| Overnight Interest Rate | N/A | Generally ranges |

While the spreads offered by VRN Capitals start at 1 pip, which is relatively standard, the absence of a transparent commission model raises questions about hidden fees or unfavorable trading conditions. Traders should be wary of potential costs that may not be immediately apparent. Moreover, the lack of information regarding overnight interest rates and other charges can lead to unexpected expenses, making it essential for traders to fully understand the implications of trading with VRN Capitals.

Customer Fund Safety

The safety of customer funds is a paramount concern for any brokerage. VRN Capitals does not provide clear information regarding its fund protection measures, such as segregated accounts or investor compensation schemes. Without these measures, traders are at a higher risk of losing their funds in the event of financial instability or mismanagement by the broker.

The absence of negative balance protection policies further exacerbates this risk. Negative balance protection ensures that traders cannot lose more than their initial investment, providing a safety net in volatile market conditions. The lack of such protections raises significant concerns about whether IS VRN Capitals safe for managing customer funds. Historical data on fund security issues related to VRN Capitals is limited, but the absence of robust safety measures is alarming and should be a red flag for potential investors.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of VRN Capitals reveal a mixed bag of experiences, with numerous complaints highlighting issues such as difficulty in withdrawing funds, unresponsive customer service, and overall dissatisfaction with trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Transparency Concerns | High | Poor |

The most common complaints revolve around withdrawal difficulties, which can be a significant concern for traders. Delays in processing withdrawals can indicate potential financial instability or operational inefficiencies within the brokerage. Furthermore, the quality of customer service has been criticized, with many users reporting long response times or unhelpful interactions. These issues contribute to the perception that IS VRN Capitals safe for investors, as a brokerage that cannot effectively address customer concerns is inherently risky.

Platform and Trade Execution

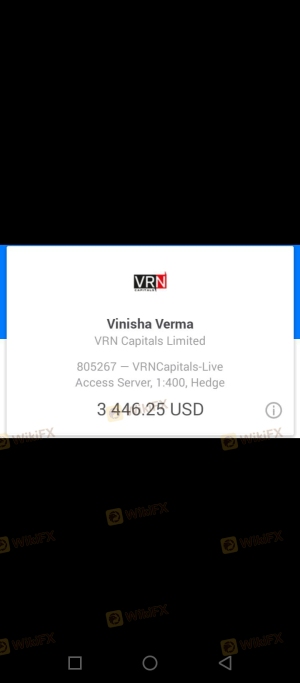

The trading platform's performance is critical for a positive trading experience. VRN Capitals offers popular platforms like MetaTrader 4 and MetaTrader 5, known for their robust features and user-friendly interfaces. However, the execution quality, including slippage and rejection rates, is equally important.

Traders have reported mixed experiences with execution speeds, with some noting instances of slippage during volatile market conditions. Such occurrences can significantly impact trading results, especially for those employing short-term strategies. Additionally, any signs of platform manipulation, such as frequent rejections of orders, should be taken seriously, as they can indicate unethical practices. Therefore, it is essential to consider whether IS VRN Capitals safe in terms of platform reliability and trade execution quality.

Risk Assessment

Using VRN Capitals presents several risks that traders should be aware of before opening an account. The lack of regulation, transparency issues, and customer complaints are significant factors that contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, potential traders should conduct thorough due diligence, consider using smaller amounts for initial trading, and be prepared for the possibility of difficulties in fund withdrawal. Additionally, seeking out brokers with established regulatory frameworks may provide a safer alternative.

Conclusion and Recommendations

In conclusion, the evidence suggests that IS VRN Capitals safe for trading is a question that leans towards a negative response. The absence of regulatory oversight, coupled with transparency issues and numerous customer complaints, raises significant concerns about the reliability and safety of this brokerage. Traders should exercise extreme caution when considering VRN Capitals as a trading option.

For those seeking to engage in forex trading, it is advisable to consider alternatives that are regulated by reputable authorities, such as those overseen by the FCA, ASIC, or SEC. These brokers provide a higher level of investor protection and transparency, ensuring a safer trading environment. Ultimately, the decision to trade with VRN Capitals should be made with careful consideration of the associated risks and the potential for negative experiences.

Is VRN Capitals a scam, or is it legit?

The latest exposure and evaluation content of VRN Capitals brokers.

VRN Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VRN Capitals latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.