Is RT FINTECH safe?

Business

License

Is RT Fintech Safe or a Scam?

Introduction

RT Fintech, also known as RT Fintech Limited, positions itself as a broker offering trading services in the forex and CFD markets. As the financial landscape continues to evolve, the number of online trading platforms has surged, making it increasingly crucial for traders to conduct thorough evaluations of these brokers before committing their funds. The potential risks associated with unregulated or poorly regulated brokers can lead to significant financial losses, which is why assessing the credibility of RT Fintech is essential for prospective clients. This article aims to provide an objective analysis of RT Fintechs legitimacy by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment.

Regulation and Legitimacy

When considering whether RT Fintech is safe, the broker's regulatory status plays a pivotal role. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict financial standards and practices. Unfortunately, RT Fintech is not regulated by any reputable financial authority. Below is a summary of the regulatory information available for RT Fintech:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation raises significant concerns regarding the safety of client funds and the overall legitimacy of the broker. Furthermore, past warnings from regulatory bodies, such as the British Columbia Securities Commission (BCSC), have categorized RT Fintech as a fraudulent entity due to its unregistered operations and the lack of transparency surrounding its business practices. The importance of engaging with regulated brokers cannot be overstated, as they provide a layer of protection for investors and a channel for grievance redressal.

Company Background Investigation

RT Fintech's company background reveals a lack of transparency and verifiable information. The broker claims to be based in Canada; however, investigations suggest that this assertion may be misleading. There is little to no information available regarding the brokers history, ownership structure, or management team. This obscurity raises red flags, as credible brokers typically provide detailed disclosures about their operations and leadership.

Moreover, the absence of a clear ownership structure and management team with reputable backgrounds contributes to the perception that RT Fintech may not be a trustworthy broker. A transparent company profile is essential for building trust with clients, and RT Fintechs failure to provide such information further complicates its credibility. When evaluating whether RT Fintech is safe, the lack of transparency is a significant concern that potential investors should consider.

Trading Conditions Analysis

In terms of trading conditions, RT Fintech presents a mixed picture. The broker offers a variety of trading instruments, including forex, CFDs, and commodities, but the overall fee structure raises questions. The following table summarizes some key trading costs associated with RT Fintech:

| Fee Type | RT Fintech | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.0 pips | 1.0 - 2.0 pips |

| Commission Structure | $10 per trade | $5 - $10 per trade |

| Overnight Interest Range | Not specified | Varies by broker |

While RT Fintech advertises competitive spreads, the lack of clarity regarding overnight interest rates and other potential hidden fees is concerning. Additionally, the broker requires a minimum deposit of $5,000, significantly higher than the industry average, which may deter new traders. The opaque nature of the fee structure and the potential for unexpected costs contribute to the perception that RT Fintech may not be entirely transparent in its dealings. Therefore, when assessing if RT Fintech is safe, traders should be wary of the broker's fee policies.

Client Fund Safety

The safety of client funds is a critical aspect when evaluating any broker. RT Fintech has not provided sufficient information regarding its client fund safety measures. Key considerations include the segregation of client funds, investor protection mechanisms, and negative balance protection policies. Without regulatory oversight, there is no guarantee that client funds are held in segregated accounts, which is a standard practice among reputable brokers.

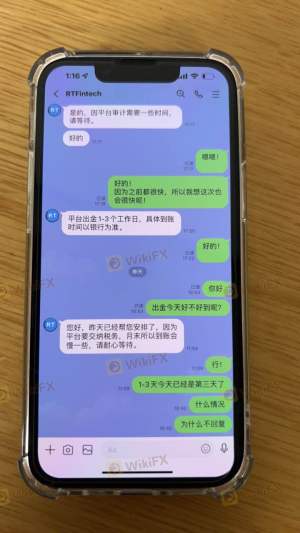

Moreover, historical reports of clients facing difficulties in withdrawing their funds further exacerbate concerns regarding the safety of investments with RT Fintech. Traders must be cautious about entrusting their money to a broker that lacks transparency and regulatory backing. The absence of robust safety measures raises significant doubts about whether RT Fintech is safe for trading.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. A review of client experiences with RT Fintech reveals a pattern of complaints, primarily centered around withdrawal issues and poor customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported difficulties in accessing their funds, with some claiming that the broker imposes unreasonable restrictions on withdrawals. Additionally, the overall quality of customer support has been criticized, with clients experiencing long response times and inadequate assistance. These issues highlight significant concerns regarding the brokers operational integrity and responsiveness. When pondering whether RT Fintech is safe, the volume and nature of customer complaints cannot be ignored.

Platform and Execution

The trading platform offered by RT Fintech is another critical factor in evaluating its safety. While the broker uses the popular MetaTrader 5 platform, user reviews suggest mixed experiences regarding its performance and stability. Traders have reported issues with order execution quality, including slippage and instances of rejected orders. Such problems can severely impact trading outcomes and raise suspicions about the broker's operational practices.

Additionally, any signs of platform manipulation or irregularities in trade execution should be closely scrutinized. The overall user experience and reliability of the trading platform are essential components in determining if RT Fintech is a safe choice for traders.

Risk Assessment

Engaging with RT Fintech carries certain inherent risks that potential clients should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Fund Safety Risk | High | Lack of transparency in fund management. |

| Operational Risk | Medium | Complaints regarding withdrawal issues. |

| Customer Service Risk | High | Poor response times and inadequate support. |

Given these risk factors, it is crucial for traders to exercise caution when considering RT Fintech as a trading partner. Implementing risk mitigation strategies, such as limiting initial investments and conducting thorough research, can help safeguard against potential losses.

Conclusion and Recommendations

In conclusion, the analysis of RT Fintech raises significant concerns regarding its safety and legitimacy as a forex broker. The absence of regulatory oversight, combined with a lack of transparency in its operations and a history of customer complaints, suggests that traders should approach this broker with caution. There are clear indications that RT Fintech may not be a safe option for trading, particularly for those new to the forex market.

For traders seeking a reliable and secure trading environment, it is advisable to consider well-regulated alternatives that provide robust safety measures and transparent operations. Brokers regulated by top-tier authorities such as the FCA or ASIC offer a higher level of security and are better equipped to protect client interests. Ultimately, while the allure of high returns may be tempting, prioritizing safety and regulatory compliance should always be the foremost concern for any trader.

Is RT FINTECH a scam, or is it legit?

The latest exposure and evaluation content of RT FINTECH brokers.

RT FINTECH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RT FINTECH latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.