Is RoFx safe?

Pros

Cons

Is RoFx Safe or Scam?

Introduction

RoFx is an online trading platform that claims to offer automated forex trading services, positioning itself as a user-friendly alternative for both novice and experienced traders. Established in 2019, RoFx markets itself as utilizing advanced algorithms to generate profits for its users without requiring any prior trading experience. However, the rapid growth of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to carefully evaluate the legitimacy and safety of the brokers they choose. This article aims to provide a comprehensive analysis of RoFx, exploring its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on multiple credible sources, including user reviews, regulatory warnings, and financial reports.

Regulation and Legitimacy

One of the most critical factors in determining the safety of any trading platform is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices designed to protect investors. In the case of RoFx, the broker has been found to operate without any valid regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

RoFx has not been licensed by any recognized financial authority, including the UK's Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or any other reputable regulatory body. This lack of regulation is alarming, as it means that traders have no recourse in the event of disputes or financial losses. Furthermore, RoFx has been blacklisted by regulatory agencies in British Columbia and Italy, which have issued warnings about the broker's operations. This unregulated status significantly heightens the risk associated with trading on this platform, making it essential for potential investors to exercise extreme caution.

Company Background Investigation

RoFx claims to be based in the United Kingdom, but there are serious questions regarding its transparency and corporate structure. The broker does not provide detailed information about its ownership or the individuals behind its operations, which is a common red flag in the online trading space. The absence of identifiable management and operational details can lead to concerns about accountability and trustworthiness.

The company's website lacks comprehensive disclosures regarding its history, development, and operational practices. While RoFx claims to utilize advanced trading algorithms, it fails to provide any concrete information about the technology or methodologies employed. This lack of transparency raises doubts about the broker's credibility and the legitimacy of its trading claims. Moreover, the anonymity surrounding RoFx's ownership makes it difficult for traders to assess the reliability of the services offered.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. RoFx offers various account types, each requiring a high minimum deposit compared to industry standards. The fee structure appears opaque, with no clear information on spreads, commissions, or overnight interest rates.

| Fee Type | RoFx | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of transparency regarding trading costs is concerning. Many complaints indicate that users have been subjected to unexpected fees and charges, which further complicates the trading experience. The absence of a demo account or a clear explanation of trading conditions suggests that RoFx may not be operating in good faith, as legitimate brokers typically provide this information upfront.

Customer Funds Safety

The safety of customer funds is paramount in any trading environment. RoFx has not demonstrated adequate measures to ensure the protection of its clients' deposits. There is no evidence of segregated accounts, investor protection schemes, or negative balance protection policies in place.

Traders should be particularly wary, as the lack of these safety features increases the risk of losing their investments. Furthermore, historical accounts of users facing difficulties in withdrawing funds from RoFx add to the concerns surrounding the broker's operations. If a broker does not prioritize customer fund safety, it raises the question: Is RoFx safe?

Customer Experience and Complaints

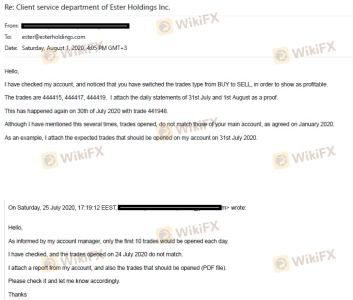

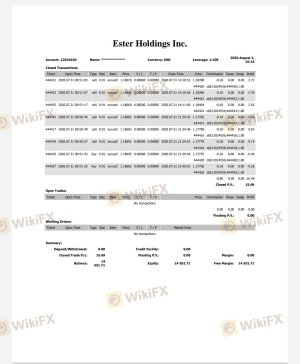

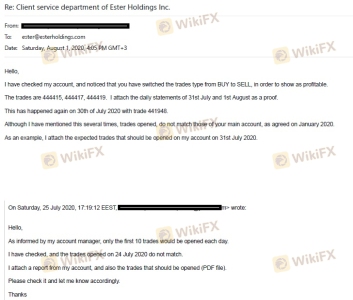

Customer feedback plays an essential role in assessing a broker's reliability. Many users have reported negative experiences with RoFx, highlighting issues such as difficulty in withdrawing funds and lack of responsive customer support. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Misleading Marketing Claims | Medium | Denial |

| Poor Customer Support | High | Slow Response |

Several users have shared stories of being unable to retrieve their investments after requesting withdrawals, suggesting that RoFx may not be operating transparently. These complaints are alarming and indicate a pattern of behavior that potential traders should consider seriously.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a successful trading experience. RoFx claims to offer an automated trading system, but there are significant concerns regarding its execution quality. Reports of slippage, order rejections, and system outages have been noted by users, which can severely impact trading outcomes.

Moreover, the platform lacks the robust features typically found in established trading software, such as MetaTrader 4 or 5. The absence of a credible trading platform raises additional questions about RoFx's legitimacy and whether it can deliver on its promises. Traders should be cautious and consider whether they are willing to risk their capital on a potentially unreliable platform.

Risk Assessment

Using RoFx presents several risks that potential traders should be aware of. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | High minimum deposits, withdrawal issues |

| Operational Risk | Medium | Platform reliability concerns |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and avoid high-risk investments.

Conclusion and Recommendations

In light of the evidence gathered, it is clear that RoFx presents significant risks to potential investors. The lack of regulation, transparency issues, and numerous complaints about customer experiences strongly suggest that RoFx is not safe for trading. The broker's operations raise serious concerns about its legitimacy and whether it can be trusted to handle clients' funds responsibly.

For traders seeking reliable alternatives, it is advisable to consider regulated brokers with proven track records. Look for platforms that prioritize customer safety, offer transparent trading conditions, and have robust customer support. In summary, if you are considering investing with RoFx, it is crucial to weigh the risks carefully and explore safer options to protect your hard-earned capital.

Is RoFx a scam, or is it legit?

The latest exposure and evaluation content of RoFx brokers.

RoFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RoFx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.