ROFX 2025 Review: Everything You Need to Know

Summary

ROFX presents itself as an automated forex trading platform promising risk-free profits through robot-driven trading systems. However, our comprehensive ROFX review reveals significant red flags that investors should consider carefully before making any decisions. The platform has faced serious allegations from regulatory authorities, with the CFTC taking action against ROFX for what they describe as fraudulent forex schemes. User feedback has been overwhelmingly negative across multiple review platforms. The platform receives a 1-star rating based on available reviews on Sitejabber.

The broker requires a minimum deposit of $1,000. They claim to operate offices in Miami, London, and Hong Kong. However, the lack of transparent regulatory information and mounting user complaints raise serious concerns about the platform's legitimacy and operational integrity. ROFX targets investors seeking automated trading solutions, particularly those attracted to promises of consistent, risk-free returns in the volatile forex market. Unfortunately, the reality appears far different from these marketing claims. Multiple reports highlight poor customer service, platform issues, and difficulty accessing funds.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Readers should note that ROFX claims to operate in multiple jurisdictions, but specific regulatory oversight details remain unclear in available documentation and official statements. The company's actual regulatory status appears questionable. Regulatory authorities have taken enforcement action against the platform.

This evaluation has been conducted using available public information, user testimonials, and regulatory findings from official sources. Given the serious nature of allegations against ROFX, potential investors should exercise extreme caution before considering any investment with this platform. Thorough due diligence is essential.

Rating Framework

Broker Overview

ROFX was established in 2009. The company positions itself as an innovative automated forex trading platform designed to generate profits for investors without typical forex trading risks. According to their marketing materials, ROFX maintains offices in major financial centers including Miami, London, and Hong Kong, suggesting a global operational presence that spans multiple time zones.

The platform's business model centers around automated trading algorithms that supposedly execute trades on behalf of clients without human intervention. ROFX markets itself to investors seeking passive income through forex trading, particularly those who lack the time or expertise to trade manually in the complex currency markets. The company promises risk-free returns. This is a significant claim in the volatile forex market.

However, the credibility of these claims has come under scrutiny from regulatory authorities and industry experts. The platform operates through what appears to be a proprietary web-based trading terminal rather than established platforms like MetaTrader 4 or 5 that are widely trusted in the industry. This ROFX review finds that the company's background information lacks the transparency typically expected from legitimate financial service providers operating in regulated markets. The absence of clear regulatory oversight and mounting regulatory actions raise serious questions. These concerns focus on the platform's legitimacy and operational integrity.

Regulatory Status: Available information does not clearly identify specific regulatory oversight for ROFX operations. This represents a significant concern for potential investors seeking legitimate trading platforms.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in accessible documentation or official platform materials.

Minimum Deposit Requirements: ROFX requires a minimum deposit of $1,000 to begin trading on their platform.

Bonus and Promotions: No specific bonus or promotional offers are mentioned in available platform information or marketing materials.

Available Trading Assets: The platform primarily focuses on forex trading. The full range of available currency pairs is not clearly specified in accessible documentation.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not transparently provided in available materials or official documentation.

Leverage Options: Specific leverage ratios offered by ROFX are not clearly disclosed in accessible documentation or platform information.

Platform Options: ROFX operates through a proprietary web-based trading terminal. They do not use industry-standard platforms like MetaTrader 4 or MetaTrader 5.

Geographic Restrictions: Specific regional limitations for ROFX services are not clearly outlined in available information or official statements.

Customer Support Languages: The range of languages supported by ROFX customer service is not specified in accessible documentation or platform materials.

This ROFX review notes that the lack of transparency regarding these fundamental aspects of the trading service represents a significant concern. Potential clients should be aware of these information gaps.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

ROFX's account conditions present several concerning aspects that contribute to the low rating in this category. The platform requires a minimum deposit of $1,000, which is significantly higher than many legitimate brokers who offer accounts starting from $10-$100 for new traders. This high barrier to entry, combined with the lack of transparency about account types and features, creates immediate red flags for potential investors seeking accessible trading opportunities.

The ROFX review process reveals that specific account types and their respective features are not clearly outlined in available documentation or official materials. Users have reported dissatisfaction with the terms and conditions, particularly regarding fund access and withdrawal processes that seem unnecessarily complicated. The absence of detailed information about account benefits, trading conditions, and special features like Islamic accounts further undermines confidence. This lack of clarity makes it difficult for traders to understand what they are signing up for.

User feedback consistently indicates problems with account management and unclear terms of service that seem to favor the platform over clients. The platform's failure to provide transparent information about leverage, margin requirements, and other essential trading conditions makes it difficult for traders to make informed decisions about their investments. Compared to regulated brokers that typically offer multiple account types with clear specifications, ROFX's opaque approach to account conditions represents a significant disadvantage. Potential clients cannot properly evaluate whether the platform meets their trading needs.

The trading tools and resources offered by ROFX fall significantly short of industry standards established by reputable brokers. Rather than utilizing established platforms like MetaTrader 4 or MetaTrader 5, which are trusted by millions of traders worldwide, ROFX operates through an unspecified web-based trading terminal that lacks proven reliability. This proprietary approach limits traders' access to the comprehensive analytical tools and expert advisors available on standard platforms that have been tested extensively.

Available information suggests that ROFX provides limited research and analysis resources compared to reputable brokers in the industry. The platform's emphasis on automated trading robots, while potentially appealing to some investors, lacks the transparency needed to evaluate the effectiveness and reliability of these systems properly. User feedback indicates disappointment with the quality and variety of available trading tools. Many traders feel the platform does not provide adequate resources for informed decision-making.

The absence of comprehensive educational resources represents another significant shortcoming that affects trader development and success. Legitimate brokers typically provide extensive educational materials, market analysis, and trading guides to help clients improve their skills and understanding of forex markets. ROFX's limited resource offering suggests a focus on quick client acquisition rather than long-term trader development. This approach does not serve the best interests of clients seeking to improve their trading knowledge and skills.

Customer Service and Support Analysis (2/10)

Customer service quality represents one of ROFX's most significant weaknesses based on available user feedback from multiple sources. Multiple reports indicate poor responsiveness from support staff, with clients experiencing extended delays in receiving assistance for their inquiries and concerns. This is particularly problematic for a financial service provider where timely support can be crucial for trading decisions and account management issues that require immediate attention.

The specific customer service channels available through ROFX are not clearly documented, which itself represents a transparency issue. Users have reported difficulty reaching support representatives and receiving satisfactory resolutions to their concerns about platform functionality and account access. The quality of assistance provided appears inconsistent. Many clients express frustration about the level of help received when they encounter problems.

Response times for customer inquiries appear to be significantly longer than industry standards set by reputable brokers. While legitimate brokers typically offer multiple support channels including live chat, phone support, and email with quick response times, ROFX's support infrastructure appears inadequate for serving client needs effectively. The lack of clear information about support hours and available languages further compounds these service quality issues. Clients cannot rely on timely assistance when they need help most.

Trading Experience Analysis (3/10)

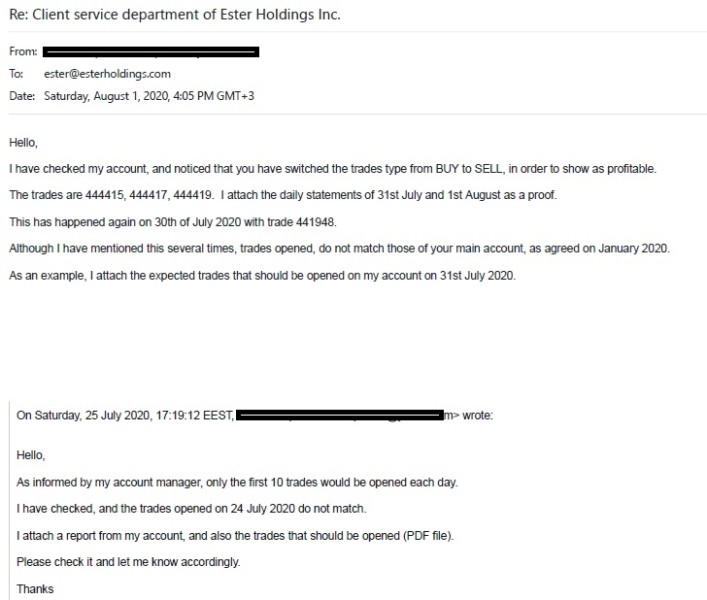

The overall trading experience with ROFX receives poor ratings from users who have engaged with the platform over extended periods. Reports indicate significant issues with platform stability and execution speed, which are fundamental requirements for effective forex trading in fast-moving markets. These technical problems can directly impact trading results and create frustration for users attempting to execute their strategies. Platform reliability is essential for successful trading operations.

Order execution quality appears to be a particular concern, with users reporting problems with trade processing and unexpected delays that can affect profitability. The platform's proprietary trading terminal lacks the reliability and feature set that traders expect from modern trading platforms used by professional traders. The absence of advanced charting tools, technical indicators, and customization options limits traders' ability to conduct thorough market analysis. These limitations can significantly impact trading performance and decision-making capabilities.

User feedback consistently highlights negative experiences with the trading environment, including concerns about price feeds, execution transparency, and overall platform functionality. The ROFX review process reveals that many users feel the trading experience falls significantly short of what they experienced with other brokers in the industry. Mobile trading capabilities and cross-device synchronization, which are standard features with established platforms, appear to be limited or problematic with ROFX's system. Modern traders expect seamless access across multiple devices.

Trust and Safety Analysis (1/10)

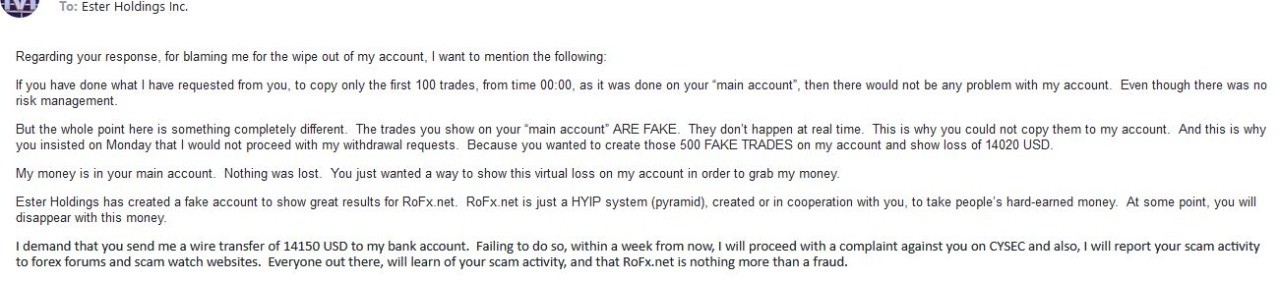

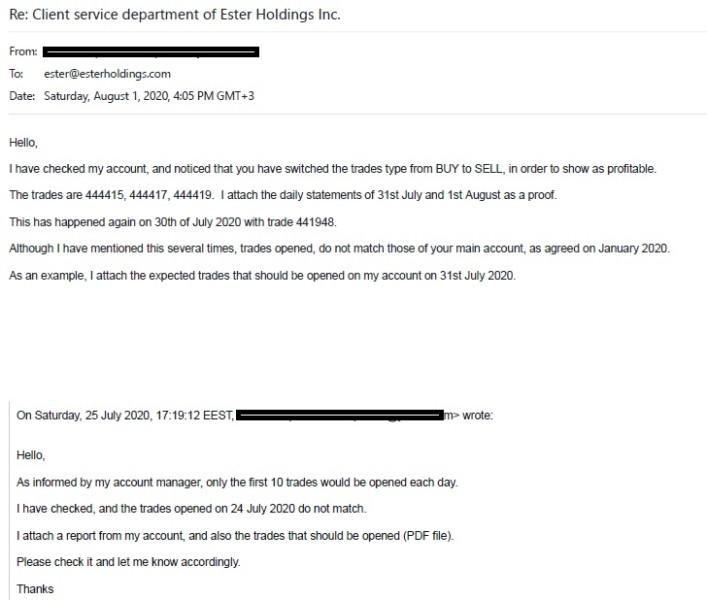

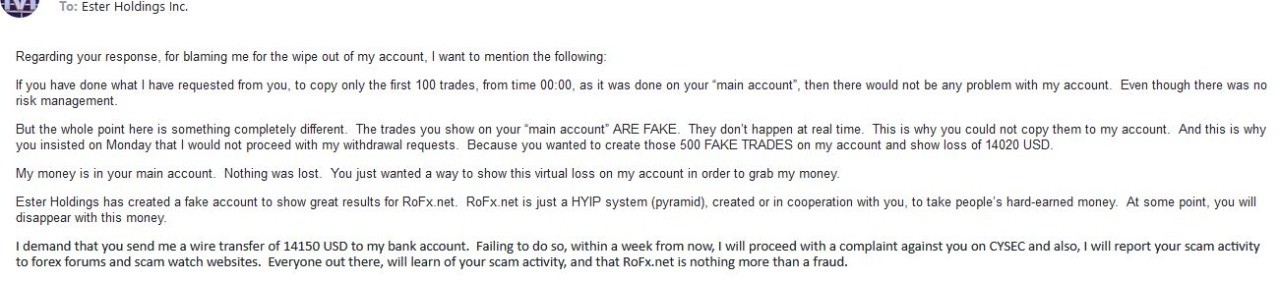

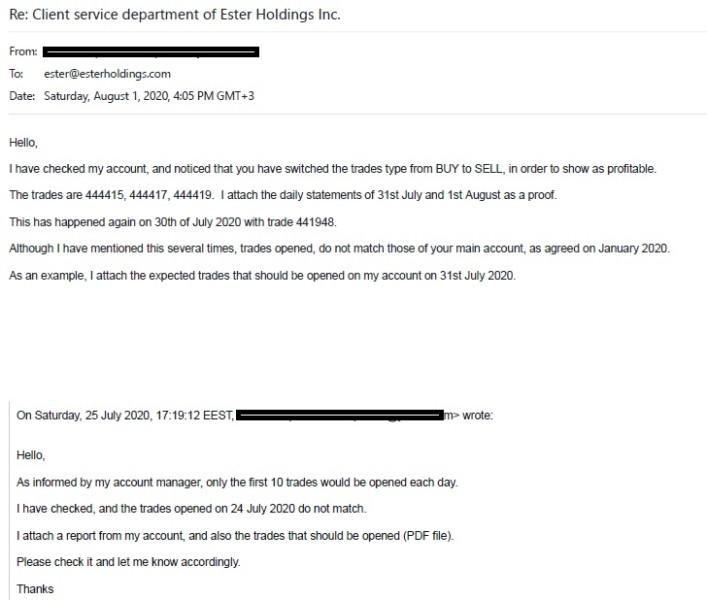

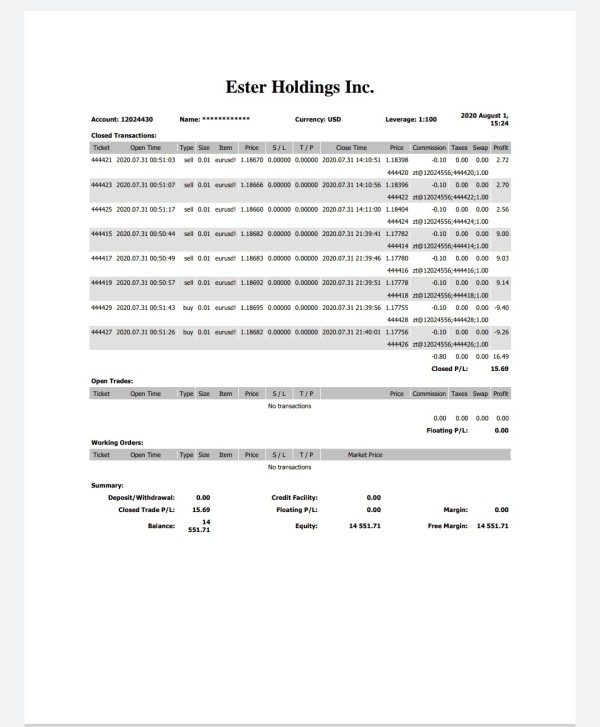

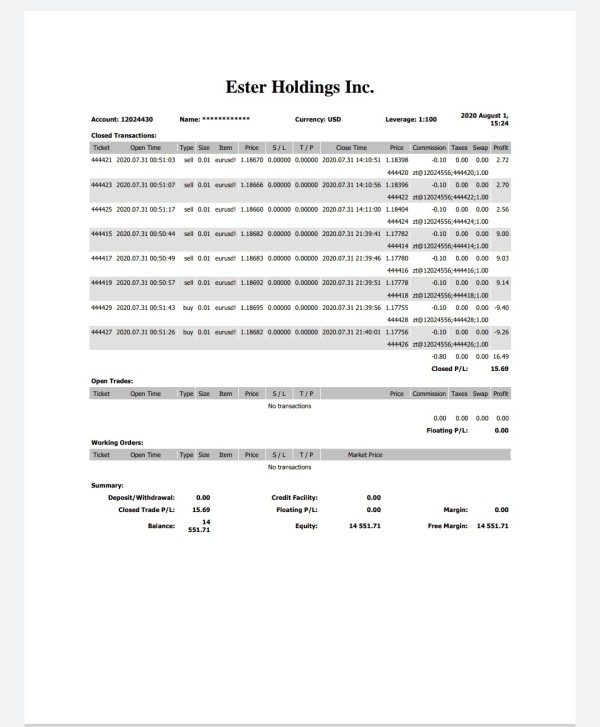

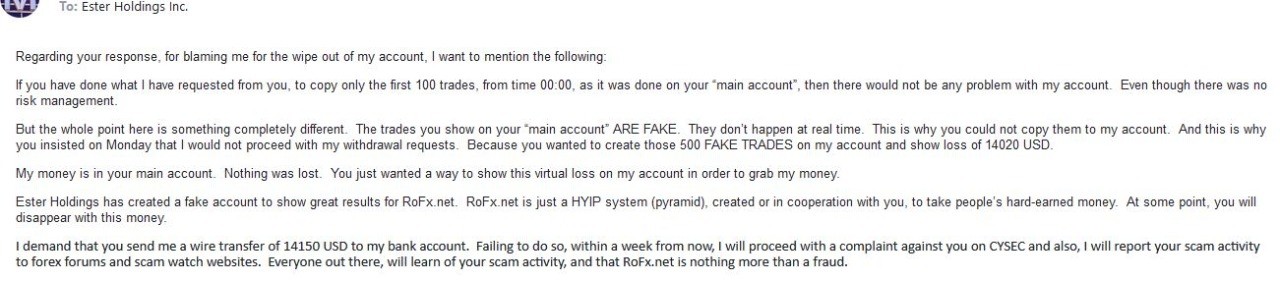

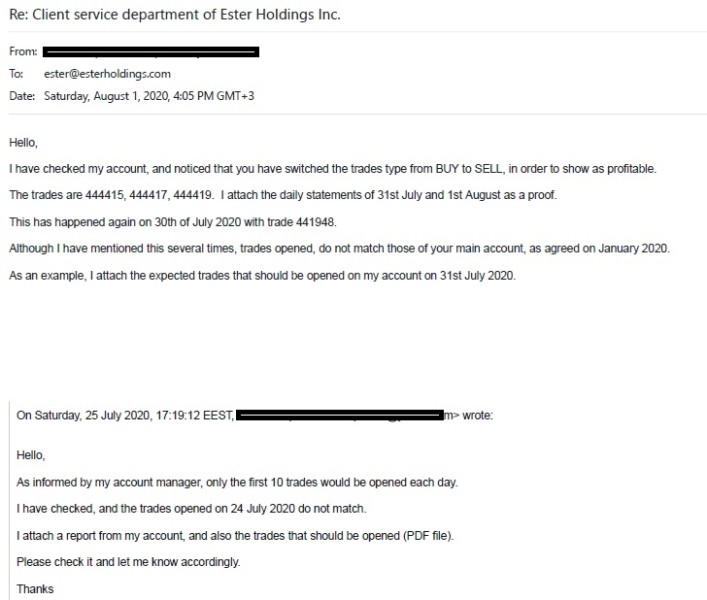

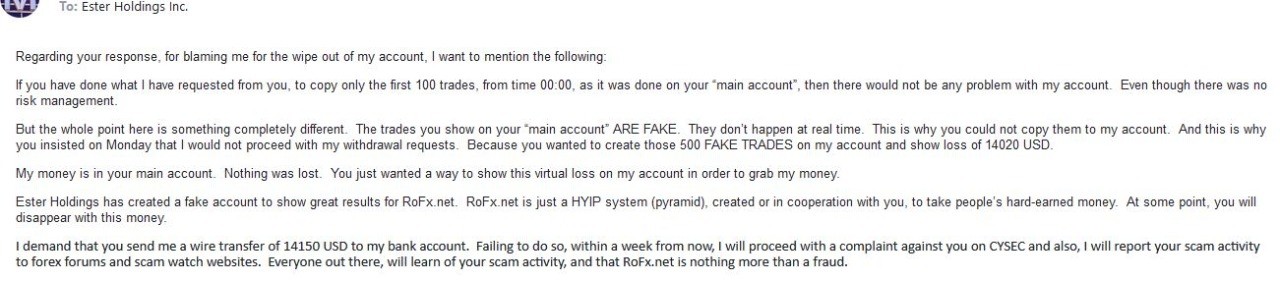

Trust and safety concerns represent the most serious issues with ROFX, earning the lowest possible rating in this critical category. The CFTC has taken enforcement action against ROFX, alleging fraudulent forex schemes, which represents a severe red flag for any financial service provider operating in regulated markets. This regulatory action indicates that authorities have found sufficient evidence to pursue legal action against the platform. Such enforcement actions are not taken lightly by regulatory bodies.

The absence of clear regulatory oversight is a fundamental concern for any forex broker operating in today's financial markets. Legitimate brokers typically hold licenses from recognized financial authorities and maintain segregated client funds in reputable banks to protect investor assets. ROFX's regulatory status remains unclear, with no transparent information about client fund protection or regulatory compliance measures. This lack of oversight creates significant risks for client investments and fund security.

Company transparency is severely lacking, with limited verifiable information about the actual business operations, management team, or financial backing. The platform's reputation in the industry is poor, with multiple warnings from regulatory bodies and negative user experiences contributing to its questionable standing among traders and industry professionals. The handling of regulatory allegations and user complaints appears inadequate. This approach further undermines confidence in the platform's integrity and operational legitimacy.

User Experience Analysis (1/10)

Overall user satisfaction with ROFX is extremely poor, with the majority of available reviews giving the platform the lowest possible ratings across multiple review platforms. Users consistently report feeling misled by the platform's marketing promises and disappointed with the actual service delivery they receive. The gap between advertised features and actual performance appears to be substantial. Many users express regret about their decision to invest with the platform.

The user interface and platform design receive criticism for being unclear and difficult to navigate for both new and experienced traders. Unlike established trading platforms that prioritize user experience and intuitive design, ROFX's proprietary system appears to create confusion and frustration for users trying to execute basic trading functions. The registration and account verification process lacks the streamlined efficiency that modern traders expect. These design flaws create unnecessary obstacles for users attempting to access platform features.

Common user complaints center around difficulty accessing funds, poor customer service, and concerns about the platform's legitimacy as a trading service provider. The ROFX review data shows that users frequently express regret about their decision to invest with the platform and wish they had chosen more reputable alternatives. Many report feeling that their concerns are not adequately addressed and that the platform does not deliver on its promises. Users consistently mention problems with automated trading success and risk-free profits that were promised during the marketing process.

Conclusion

This comprehensive ROFX review reveals a platform with significant deficiencies across all evaluated categories that potential investors should carefully consider. The combination of regulatory enforcement action, poor user feedback, and lack of transparency creates a highly concerning picture for potential investors seeking legitimate trading opportunities. ROFX's overall performance is extremely poor. The platform shows particular weaknesses in trust and safety, customer service, and user experience that cannot be overlooked.

The platform is not recommended for any type of investor, particularly those who are risk-averse or seeking legitimate automated trading solutions. While ROFX markets itself to investors interested in passive forex trading income, the reality appears to involve substantial risks and poor service quality that do not match the marketing promises. The main disadvantages include regulatory concerns, poor customer service, lack of transparency, and negative user experiences. Any potential advantages are overshadowed by these serious issues that affect platform reliability and user satisfaction.