Is Place a Trade safe?

Pros

Cons

Is Place a Trade A Scam?

Introduction

Place a Trade is an online forex broker that positions itself within the competitive landscape of the foreign exchange market. Established in 2020, the broker claims to offer a wide array of trading instruments, including forex, CFDs, and cryptocurrencies, through popular platforms like MetaTrader 4 and 5. However, with the rapid growth of online trading, it has become increasingly crucial for traders to exercise caution when selecting a broker. The potential for scams and unregulated entities is significant, making it essential for investors to conduct thorough due diligence before committing their funds. This article aims to assess the legitimacy of Place a Trade by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. The investigation draws on various online sources, including user reviews, regulatory warnings, and expert analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in evaluating its legitimacy. Place a Trade operates under the ownership of Focus Markets LLC, which is registered in Saint Vincent and the Grenadines. Unfortunately, this jurisdiction is notorious for its lack of stringent financial regulations, which raises serious concerns about the safety of client funds. The absence of oversight from reputable regulatory bodies such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus) is a significant red flag.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Not Regulated |

The lack of a valid license from a recognized authority means that traders using Place a Trade are not afforded the same level of protection as they would receive from a regulated broker. Moreover, the broker has been blacklisted by several financial regulators, including the CNMV (Spain) and FSMA (Belgium), for operating without authorization to provide financial services. Such warnings indicate that the broker has a history of non-compliance and raises questions about its ethical practices.

Company Background Investigation

Understanding the background of a brokerage firm is vital for assessing its reliability. Place a Trade is operated by Focus Markets LLC, a company that has been in existence for a relatively short period since its establishment in 2020. The company claims to provide a transparent trading environment; however, the lack of detailed information regarding its ownership structure and management team is concerning.

The absence of publicly available information about the executive team and their qualifications makes it difficult to gauge the company's credibility. Transparency is a crucial component of trust in the financial services industry, and Place a Trade's limited disclosure raises questions about its operational integrity. A reputable broker typically offers insights into its management team's experience and professional backgrounds, which is not the case here.

Trading Conditions Analysis

When evaluating whether Place a Trade is safe, it's essential to consider its trading conditions, including fees, spreads, and commission structures. The broker offers two types of accounts—Raw and Standard—both requiring a minimum deposit of $100. However, the trading conditions may not be as favorable as they appear.

| Fee Type | Place a Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips (Raw), 1.5 pips (Standard) | 1.0 pips |

| Commission Model | $3.5 per lot (Raw) | $5.0 per lot |

| Overnight Interest Range | N/A | Varies by broker |

While the spread for the Raw account appears competitive, the absence of a clear withdrawal policy and the potential for hidden fees raises concerns. Many user reviews indicate difficulties in withdrawing funds, often citing vague reasons for denied requests. This lack of transparency in fees is a common tactic employed by unregulated brokers to trap clients into a cycle of unending deposits.

Client Funds Security

The security of client funds is paramount when assessing whether Place a Trade is safe. The broker does not provide sufficient information regarding its measures for safeguarding client deposits. Reputable brokers typically segregate client funds into separate accounts to ensure that traders' money is not used for operational expenses. However, Place a Trade's lack of regulatory oversight means that there are no guarantees regarding the safety of client funds.

Additionally, the absence of investor protection schemes, such as those offered by regulated brokers, leaves clients vulnerable in the event of financial disputes or insolvency. There have been no publicly reported incidents of fund mismanagement or fraud related to Place a Trade, but the potential for such issues remains high given its unregulated status.

Customer Experience and Complaints

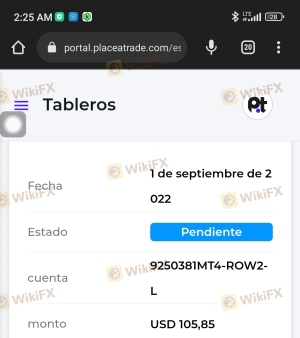

Analyzing customer feedback is crucial for understanding the overall experience of traders using Place a Trade. Numerous reviews highlight significant issues, particularly regarding withdrawal requests and customer service responsiveness. Many users report being unable to withdraw their funds, with the support team providing inadequate explanations or support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Inconsistent |

| Transparency Concerns | High | Lacking |

One typical case involves a trader who deposited funds but faced repeated delays when attempting to withdraw. The support team cited "high volumes of requests" without providing a timeline for resolution, leading to frustration and distrust. Such patterns of complaints are alarming and indicate systemic issues within the organization.

Platform and Execution

The performance of the trading platform is another critical aspect of assessing whether Place a Trade is a scam. The broker offers MetaTrader 4 and MetaTrader 5, both of which are well-regarded in the trading community. However, the user experience can be compromised by issues such as slippage, order rejections, or platform outages.

Traders have reported instances of slippage during volatile market conditions, which can significantly impact trading outcomes. Additionally, the platform's execution quality has been questioned, with some users experiencing delays in order fulfillment. These factors can contribute to a negative trading experience and raise concerns about the broker's operational integrity.

Risk Assessment

Using Place a Trade comes with inherent risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of fund segregation |

| Withdrawal Risk | High | Frequent complaints |

| Execution Risk | Medium | Slippage and delays |

The absence of regulation is perhaps the most significant risk factor, as it leaves clients without legal recourse in the event of disputes. Furthermore, the potential for withdrawal issues and poor customer service exacerbates the overall risk profile of trading with Place a Trade. Traders should be cautious and consider using alternative, regulated brokers to minimize exposure to these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Place a Trade is not a safe option for traders. The lack of regulation, transparency issues, and numerous complaints about withdrawal problems indicate a high risk of potential fraud. While the broker may offer attractive trading conditions, the underlying risks far outweigh the benefits.

For traders seeking safer alternatives, it is advisable to consider regulated brokers that offer robust investor protection, transparent fee structures, and reliable customer support. Some reputable options include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment and peace of mind.

In summary, if you are considering trading with Place a Trade, it is crucial to weigh these risks carefully and explore other options that can offer greater security for your investments.

Is Place a Trade a scam, or is it legit?

The latest exposure and evaluation content of Place a Trade brokers.

Place a Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Place a Trade latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.