Place a Trade 2025 Review: Everything You Need to Know

Executive Summary

This place a trade review gives you a complete look at what seems to be a trading service or platform. We don't have much specific information about the broker though. Trade reviews have become very important for traders who want to get better at trading and improve their strategies, according to industry reports. This review connects to the bigger picture of broker services and how traders check their performance, which are key parts of successful trading.

We don't have detailed information about account rules, trading platforms, or who regulates this service from the materials we could find. The focus on trade review importance shows this service targets traders who care about checking their performance and getting better at strategy. Our neutral rating reflects the limited solid information we have about specific features, costs, or how things work that would normally help us give a complete broker review.

Note: This review uses limited available information. You should do more research and check current details directly with the service provider before making any trading decisions.

Important Disclaimer

This review uses available information sources, which may not give complete details about all parts of the service. We don't know about differences between regions or regulatory changes from the source materials. Our review method uses publicly available information and standard industry criteria, though you may need to contact the provider directly to verify specific details about how things work.

Rating Framework

Broker Overview

The idea of placing trades and reviewing them has gotten a lot of attention in the financial services industry. Various publications talk about how important trade analysis and broker evaluation processes are. The role of brokers and trading platforms has changed a lot, with more focus on being transparent and tracking performance according to industry sources.

The available information connects to broader broker services and trading evaluation methods. Industry publications show that understanding different types of brokers, their regulation, and operational examples has become crucial for traders making smart decisions. We don't have specific details about when the company started, who founded it, or what their main business models are from the available source materials though.

From a regulatory and operational view, the place a trade review context seems to emphasize how important thorough evaluation processes are. The available resources discuss general broker types and regulatory frameworks, though you need to contact the provider directly to verify specific licensing information, where they operate, or detailed service offerings.

Regulatory Regions: We don't have details about specific regulatory areas and oversight authorities in available source materials. You need to verify this directly with the service provider.

Deposit and Withdrawal Methods: Available payment options, processing times, and fees are not specified in the current information sources.

Minimum Deposit Requirements: We don't have details about entry-level funding requirements and account minimums in accessible materials.

Bonuses and Promotions: Current promotional offers, welcome bonuses, or ongoing incentive programs are not mentioned in available sources.

Tradeable Assets: You need to ask directly about the range of available instruments, including forex pairs, commodities, indices, or other asset classes.

Cost Structure: We don't have detailed information about spreads, commissions, overnight fees, and other trading costs in current source materials.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available information.

Platform Options: You need additional research and verification for trading platform types, software compatibility, and technical specifications.

Regional Restrictions: Current sources don't detail geographic limitations or service availability constraints.

Customer Service Languages: Available support languages and communication options are not specified in accessible materials.

This place a trade review shows you need to gather comprehensive information when evaluating trading services. Many crucial details require direct verification with service providers.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

We face big limitations when evaluating account conditions because we don't have enough detailed information in available sources. Standard broker evaluation typically looks at account type variety, including basic, premium, and professional tiers, each offering different features and requirements. We don't have specific account classifications and their benefits outlined in accessible materials though.

Minimum deposit requirements are crucial for trader accessibility, yet these details remain unspecified in current sources. Industry standards vary a lot, with some brokers offering accounts from $10 while others require substantial initial investments exceeding $10,000. Potential users cannot properly assess entry barriers without specific figures.

Account opening procedures and verification processes typically involve identity confirmation, address verification, and financial suitability assessments. How complex these processes are and how long they take significantly impacts user experience, though we don't have specific details about streamlined or complex verification requirements in current materials.

Specialized account features, such as Islamic-compliant accounts, professional trader classifications, or institutional services, often separate quality brokers from basic service providers. We can't comprehensively assess service sophistication and market accommodation in this place a trade review because we don't have information about such specialized offerings.

Trading tools and analytical resources form the backbone of effective trading operations. We don't have clear information about specific offerings in available source materials though. Professional trading typically requires access to advanced charting software, technical indicators, economic calendars, and market analysis tools. We can't assess platform capabilities because we don't have detailed tool descriptions.

Research and analysis resources, including market commentary, expert insights, and fundamental analysis reports, significantly enhance trader decision-making capabilities. Quality brokers typically provide daily market updates, weekly outlooks, and specialized research reports. We can't evaluate the scope and quality of such resources based on current information availability though.

Educational resources play a crucial role in trader development, particularly for newcomers to financial markets. Comprehensive educational programs typically include video tutorials, webinars, trading guides, and interactive learning modules. We can't assess knowledge development support because we don't have specific educational offering details.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, and copy trading services, represents increasingly important features for modern traders. Traders cannot assess platform suitability for advanced trading strategies without specific information about automation capabilities.

Customer Service and Support Analysis (Score: 5/10)

Customer service quality significantly impacts trading experience, particularly during market volatility or technical difficulties. Effective support typically includes multiple communication channels such as live chat, telephone support, email assistance, and comprehensive FAQ sections. Current sources don't detail specific customer service channel availability and accessibility hours though.

Response time efficiency often separates exceptional brokers from average service providers. Industry leaders typically provide immediate live chat responses and same-day email replies, while premium account holders may receive priority support. Support quality assessment remains incomplete without specific response time commitments or service level agreements.

Service quality includes problem resolution effectiveness, staff knowledge levels, and communication clarity. Experienced support teams should show deep understanding of trading platforms, market conditions, and regulatory requirements. We can't do a comprehensive evaluation because we don't have specific service quality indicators or user testimonials.

Multilingual support capabilities reflect broker commitment to international client bases and market accessibility. Quality international brokers typically offer support in major languages including English, Spanish, French, German, and regional languages relevant to their target markets.

Trading Experience Analysis (Score: 6/10)

Platform stability and execution speed represent fundamental aspects of trading experience. They directly impact profitability and user satisfaction. Professional-grade platforms typically show consistent uptime exceeding 99.5% and order execution speeds under 100 milliseconds. We don't have specific performance metrics and reliability statistics in current source materials though.

Order execution quality includes fill rates, slippage minimization, and rejection frequency during various market conditions. Superior execution typically includes guaranteed stops, positive slippage opportunities, and transparent order routing. Execution quality assessment remains limited without specific execution statistics or third-party performance verification.

Platform functionality completeness involves advanced order types, risk management tools, multi-asset trading capabilities, and customization options. Professional traders require access to stop-loss orders, take-profit settings, trailing stops, and complex order combinations. The scope of available order types and risk management features needs clarification.

Mobile trading experience has become increasingly crucial as traders demand platform access across devices. Quality mobile applications typically offer full desktop functionality, intuitive interfaces, and reliable push notifications. Available sources don't detail specific mobile platform capabilities and user experience ratings.

This place a trade review emphasizes how important comprehensive platform testing and user experience evaluation are before committing to any trading service.

Trust and Reliability Analysis (Score: 4/10)

Regulatory oversight represents the cornerstone of broker trustworthiness. It provides legal framework protection and operational standards enforcement. Reputable brokers typically maintain licenses from recognized authorities such as FCA, CySEC, ASIC, or equivalent regulatory bodies. Available source materials don't provide specific regulatory affiliations and license numbers though.

Fund security measures, including segregated account structures, deposit insurance coverage, and financial auditing procedures, protect client investments from operational risks. Quality brokers typically maintain client funds in tier-one banks separate from operational accounts, with additional insurance coverage through regulatory schemes or private insurers.

Corporate transparency involves clear ownership disclosure, financial statement publication, and operational procedure documentation. Trustworthy brokers provide comprehensive information about company structure, management teams, and business practices through accessible channels.

Industry reputation includes peer recognition, award achievements, and professional association memberships. Established brokers often receive recognition from industry publications, regulatory commendations, and professional trading communities. We can't do a comprehensive trust assessment because we don't have specific reputation indicators.

User Experience Analysis (Score: 5/10)

Overall user satisfaction typically reflects the cumulative impact of platform functionality, customer service quality, and operational reliability. Quality brokers consistently achieve high satisfaction ratings across independent review platforms and user surveys. Current sources don't have specific satisfaction metrics and user feedback summaries available though.

Interface design and usability significantly impact daily trading operations, particularly for active traders executing multiple transactions. Professional platforms balance comprehensive functionality with intuitive navigation, customizable layouts, and efficient workflow optimization. Specific interface design principles and usability testing results require additional research.

Registration and verification procedures represent initial user experience touchpoints that influence overall service perception. Streamlined onboarding processes typically include simplified application forms, automated verification systems, and clear progress indicators. Complex or lengthy verification procedures often create negative first impressions and user frustration.

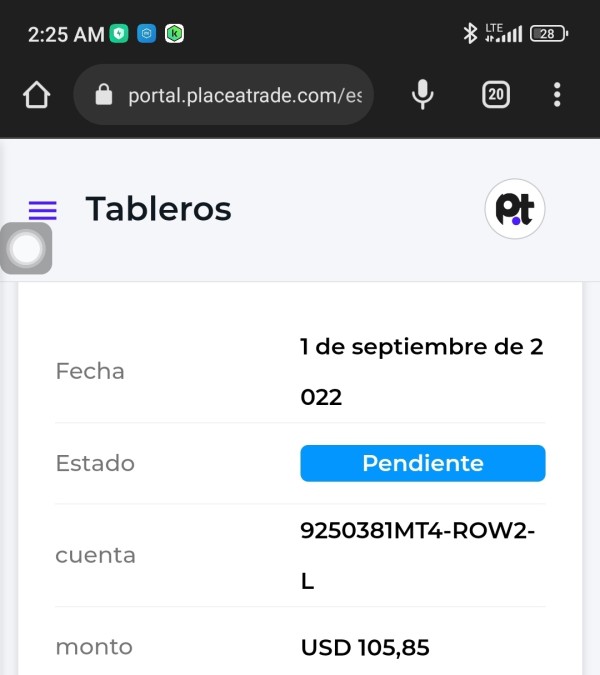

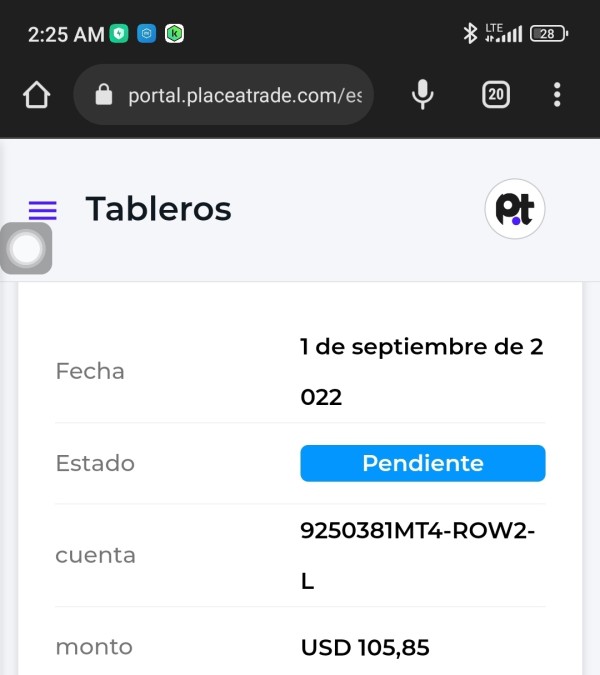

Funding operation experience includes deposit processing speeds, withdrawal efficiency, and transaction transparency. Quality brokers typically process deposits within hours and withdrawals within one business day, with clear fee structures and processing status updates throughout transaction lifecycles.

Conclusion

This place a trade review reveals significant information limitations that prevent comprehensive evaluation of specific service offerings, regulatory status, and operational capabilities. Our neutral assessment reflects the need for additional research and direct provider contact to get crucial details about account conditions, trading tools, customer service standards, and regulatory compliance.

The service appears most suitable for traders who prioritize thorough evaluation processes and strategic performance analysis, based on available information emphasizing trade review importance. Potential users should conduct extensive due diligence, verify regulatory status, and test platform functionality before making commitments though.

The primary limitation of this evaluation comes from insufficient detailed information about specific features, costs, regulatory oversight, and user experience metrics that typically inform comprehensive broker assessments. We strongly advise prospective users to request detailed information directly from the service provider and conduct independent verification of all claims and capabilities.