Is Forex trading platform safe?

Pros

Cons

Is Forex Trading Platform Safe or a Scam?

Introduction

The Forex Trading Platform has emerged as a significant player in the foreign exchange market, attracting traders with promises of high returns and user-friendly trading experiences. However, as the popularity of online forex trading has surged, so has the need for traders to exercise caution when selecting a broker. The forex market is notorious for its lack of regulation and the prevalence of scams, making it crucial for traders to thoroughly evaluate the legitimacy of their chosen platform. This article aims to provide an objective assessment of whether Forex Trading Platform is safe or potentially a scam, employing a comprehensive investigative approach.

To arrive at our conclusions, we analyzed various sources, including regulatory information, customer reviews, and expert opinions. Our assessment framework includes an examination of regulatory compliance, company background, trading conditions, customer safety measures, user experiences, platform performance, and an overall risk evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and safety for traders. A well-regulated broker is more likely to adhere to strict guidelines and offer a safer trading environment. Unfortunately, Forex Trading Platform is not regulated by any reputable authority.

Here is a summary of the regulatory information we found:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation from tier-1 authorities like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) raises significant concerns about the safety of the Forex Trading Platform. Without regulatory oversight, traders have limited recourse in the event of disputes or fraudulent activities. Furthermore, the platform's lack of transparency regarding its operational practices and financial stability adds to the skepticism surrounding its legitimacy.

The quality of regulation is also critical. Brokers regulated by stringent authorities are required to maintain capital reserves, segregate client funds, and undergo regular audits. The Forex Trading Platform's lack of such oversight means it operates in a high-risk environment, making it essential for traders to approach it with caution.

Company Background Investigation

Understanding the background of a forex broker is essential for evaluating its reliability. Forex Trading Platform appears to have a limited history, with scant information available regarding its establishment, ownership structure, and management team. This lack of transparency is a red flag for potential investors.

The company's ownership details remain unclear, and there is little information about the individuals behind the platform. A reputable broker typically discloses information about its founders and management team, highlighting their expertise and experience in the financial industry. In contrast, Forex Trading Platform does not provide such insights, which raises questions about its legitimacy.

Moreover, the platform's operational transparency is minimal. Traders often rely on the information provided by brokers to make informed decisions, and the absence of clear communication regarding the company's history and management can lead to mistrust. This opacity is concerning, especially in an industry where scams are prevalent.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Forex Trading Platform claims to provide competitive trading conditions, but a closer examination reveals potential issues.

The overall fee structure and trading costs are critical factors to consider. Below is a comparison of the core trading costs associated with Forex Trading Platform:

| Fee Type | Forex Trading Platform | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Spread Markup | Varies |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

The spread for major currency pairs at Forex Trading Platform is higher than the industry average, which can erode potential profits for traders. Additionally, the commission model appears to be based on spread markups rather than transparent commission structures, which can lead to hidden costs.

Moreover, the overnight interest rates are on the higher end of the spectrum, which can be detrimental for traders who hold positions overnight. Traders should be cautious of any unusual or hidden fees that could significantly impact their trading outcomes.

Customer Fund Safety

The safety of customer funds is a crucial aspect of any forex broker's operations. Forex Trading Platform has not provided sufficient information regarding its fund safety measures, which raises concerns for potential investors.

A reputable broker typically implements strict measures to ensure the security of client funds, including segregated accounts and investor protection schemes. Unfortunately, Forex Trading Platform does not appear to offer such safeguards. The lack of clarity regarding fund segregation and the potential for misuse of client funds is a significant risk factor.

Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment, which is a common safety feature among reputable brokers. The historical context of any past financial issues or controversies related to fund safety is also crucial, yet Forex Trading Platform has not disclosed any such information.

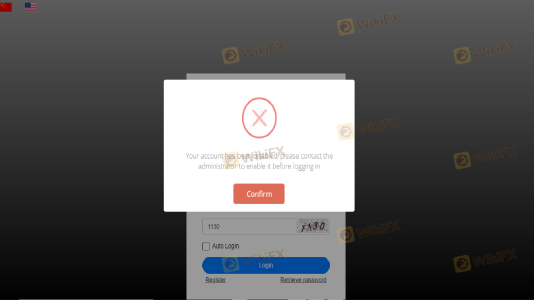

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall user experience with a forex broker. Reviews for Forex Trading Platform reveal a mix of experiences, with several users expressing dissatisfaction regarding the platform's services.

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with order execution. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

| Order Execution Problems | High | Poor |

The severity of withdrawal issues is particularly alarming, as it indicates potential operational problems within the platform. Users have reported prolonged delays in processing withdrawal requests, which can be indicative of a scam or a poorly managed operation.

Additionally, the quality of customer support has been criticized, with many users noting that their inquiries went unanswered or received vague responses. This lack of effective communication can lead to frustration and distrust among traders.

Platform and Trade Execution

The performance of a trading platform is vital for successful trading. Forex Trading Platform claims to offer a user-friendly interface and reliable execution, but user reviews suggest otherwise.

Users have reported issues with platform stability, including frequent outages and slow loading times. These issues can negatively impact a trader's ability to execute orders promptly, especially during volatile market conditions. Furthermore, reports of slippage and rejected orders have raised concerns about the platform's execution quality.

Traders should be wary of any signs of platform manipulation, such as consistent slippage against their positions or sudden price changes that do not align with market movements. A reliable broker should provide a stable and efficient trading environment, and the reported issues with Forex Trading Platform suggest that it may not meet these standards.

Risk Assessment

Engaging with Forex Trading Platform involves various risks that traders should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated platform with no oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund security measures. |

| Customer Support Risk | Medium | Poor response to customer complaints and inquiries. |

| Execution Risk | High | Issues with platform stability and order execution. |

Given the high-risk levels associated with Forex Trading Platform, traders should approach it with extreme caution. It is advisable to conduct thorough research and consider alternative brokers with better regulatory standing and user feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Forex Trading Platform raises several red flags that warrant concern. The lack of regulatory oversight, transparency regarding company operations, high trading costs, and numerous customer complaints indicate that this platform may not be safe for traders.

Traders should exercise caution and consider alternative options that are well-regulated and have a proven track record of reliability. Some recommended alternatives include IG, Forex.com, and Interactive Brokers, all of which offer robust regulatory protections and positive user experiences.

Ultimately, if you are considering using Forex Trading Platform, it is crucial to weigh the risks carefully and explore other options that prioritize customer safety and transparency. Always remember, if something seems too good to be true, it often is.

Is Forex trading platform a scam, or is it legit?

The latest exposure and evaluation content of Forex trading platform brokers.

Forex trading platform Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Forex trading platform latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.