Is GKG safe?

Pros

Cons

Is Gkg Safe or a Scam?

Introduction

Gkg is a forex brokerage that has emerged in the competitive landscape of online trading, claiming to offer a range of financial instruments and trading services. As with any financial service provider, it is crucial for traders to approach Gkg with caution, considering the potential risks involved in trading with an unregulated broker. This article aims to provide an objective analysis of whether Gkg is a safe trading option or if it operates under dubious practices. Our investigation is based on a thorough examination of regulatory compliance, company background, trading conditions, client feedback, and overall risk assessment.

Regulation and Legitimacy

To evaluate Gkg's credibility, understanding its regulatory status is paramount. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. Gkg's regulatory information raises several red flags, as it lacks proper oversight from reputable financial authorities. Below is a summary of Gkg's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

The absence of a valid regulatory license is alarming. Gkg claims to provide trading services but does not appear to be overseen by any recognized regulatory authority, such as the FCA in the UK or the SEC in the US. This lack of oversight increases the risk for traders, as there are no guarantees of fund security or fair trading practices. Furthermore, Gkg has been flagged for low compliance scores and suspicious regulatory history, which raises concerns about its operational integrity.

Company Background Investigation

Gkg, operating under Gkg Global Limited, has been in the market for approximately five to ten years, based in Hong Kong. However, the company's history is shrouded in ambiguity. Gkg was reportedly incorporated in the United States but dissolved shortly after, which raises questions about its legitimacy. The management team behind Gkg is not well-documented, and there is limited information available regarding their professional backgrounds or qualifications. This lack of transparency is concerning, as a reputable brokerage typically provides detailed information about its leadership and operational history.

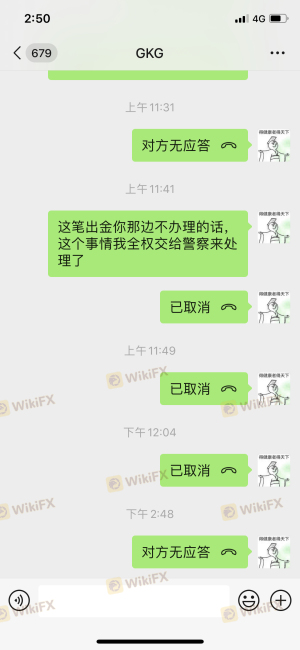

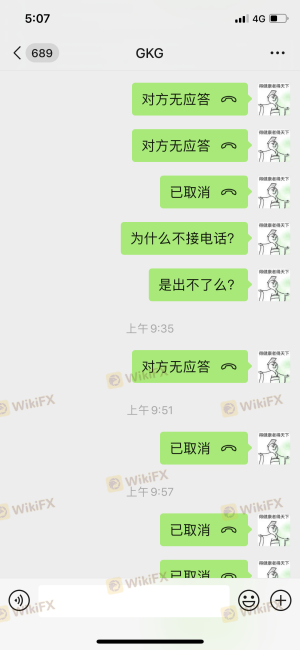

Furthermore, Gkg's website is not consistently accessible, further complicating efforts to verify its claims and operational practices. The companys communication channels, including customer support, have also been criticized for their responsiveness and effectiveness. Therefore, traders must exercise caution and conduct thorough due diligence before engaging with Gkg.

Trading Conditions Analysis

When assessing whether Gkg is safe, it is essential to analyze its trading conditions, including fees and spreads. Gkg's fee structure is not clearly outlined, which can lead to unexpected costs for traders. Below is a comparison of Gkgs trading costs against industry averages:

| Fee Type | Gkg | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2.0% - 4.0% |

The lack of transparency regarding spreads and commissions is a significant concern. Many users have reported unexpected fees and a lack of clarity regarding withdrawal processes. This opacity can be indicative of a potentially deceptive fee structure, which is a common tactic employed by less reputable brokers. Traders should be wary of any broker that does not provide clear and comprehensive information about its fees, as this can lead to financial losses.

Client Fund Safety

The safety of client funds is a critical aspect of evaluating a broker's reliability. Gkg's policies regarding fund security are not well-defined, leading to uncertainty about how clients' funds are managed. Key considerations include whether client funds are held in segregated accounts and if there are any investor protection measures in place.

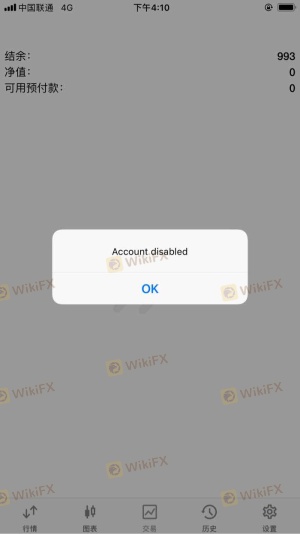

Historically, Gkg has faced allegations of mishandling client funds, with reports of clients experiencing difficulties when attempting to withdraw their money. Such issues are serious red flags that indicate a lack of commitment to client security. Without robust measures to protect client investments, traders may be exposing themselves to unnecessary risks.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the credibility of a broker. Reviews of Gkg indicate a mixed experience among users, with several common complaints surfacing. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support | High | Poor |

Many clients have reported difficulties in withdrawing their funds, which is a significant concern for any trader. The lack of effective customer support has further exacerbated these issues, leading to frustration among users. Additionally, the absence of transparency regarding trading conditions has led to mistrust in the broker's operations. Traders should be cautious of brokers with a high volume of complaints, particularly regarding fund withdrawals and customer service.

Platform and Trade Execution

The trading platform offered by Gkg is another critical factor in determining its safety. Gkg claims to utilize popular trading platforms such as MetaTrader 4 and 5; however, user experiences suggest that the platform may not perform reliably. Issues such as order execution delays, slippage, and occasional rejections of trades have been reported.

In a competitive trading environment, the quality of trade execution is paramount. Traders expect their orders to be filled promptly and at the desired prices. Any signs of manipulation or poor execution can lead to significant financial losses. Therefore, it is essential for traders to evaluate the platform's performance before committing to Gkg.

Risk Assessment

Engaging with Gkg presents several risks that potential traders should consider. Below is a concise risk assessment summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of transparency and history of issues |

| Customer Support | Medium | Poor response to complaints |

| Trading Conditions | High | Unclear fee structure and high complaints |

Given the high-risk levels associated with Gkg, it is advisable for traders to approach this broker with extreme caution. Potential users should consider alternative brokers with established reputations and regulatory oversight to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Gkg operates with several concerning practices that may classify it as a risky option for traders. The lack of regulatory oversight, poor customer feedback, and issues surrounding fund security are significant red flags. Therefore, it is prudent for traders to exercise caution when considering Gkg as their trading partner.

For traders seeking a more secure trading environment, it is recommended to explore brokers that are regulated by top-tier authorities and have a proven track record of positive client experiences. Some alternatives include well-established brokers known for their transparency and customer support. Ultimately, ensuring a safe trading experience should be the top priority for any trader.

Is GKG a scam, or is it legit?

The latest exposure and evaluation content of GKG brokers.

GKG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GKG latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.