Is p-broker safe?

Business

License

Is P Broker Safe or Scam?

Introduction

P Broker is a Forex brokerage that has recently garnered attention in the trading community. Established in Russia, it positions itself as a platform for trading various financial instruments, including Forex, CFDs, commodities, and indices. However, the legitimacy of P Broker has come under scrutiny, prompting traders to carefully evaluate its credibility. In the volatile world of Forex trading, where the risk of scams and fraudulent activities is prevalent, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of P Broker's safety, regulatory status, company background, trading conditions, and overall user experience, utilizing a structured framework based on the latest available data.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of any brokerage. A well-regulated broker is typically required to adhere to strict operational standards, providing a layer of protection for traders. Unfortunately, P Broker lacks regulation from any recognized financial authority, which raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight means that P Broker is not subject to the same level of scrutiny as regulated brokers. This lack of regulation can lead to potential risks, including unfair trading practices and difficulties in fund withdrawals. Traders should be particularly cautious when dealing with unregulated brokers, as they often lack the necessary investor protection mechanisms that regulated entities provide.

Company Background Investigation

P Broker was founded in 2018 and operates from its headquarters in Moscow, Russia. Despite being relatively new in the market, it claims to have established a reputable presence in the Forex industry. However, the lack of transparent information regarding its ownership structure and management team raises concerns about its operational integrity.

The management team at P Broker has not been extensively documented, which limits the ability to assess their professional backgrounds and experience in the financial sector. Transparency in this regard is vital, as a knowledgeable management team can significantly impact the broker's reliability and trustworthiness. Furthermore, the absence of comprehensive information about the company's operations and history can deter potential clients from investing their money.

Trading Conditions Analysis

Understanding the trading conditions offered by P Broker is crucial for traders seeking to optimize their trading experience. The broker's fee structure is a key component of its overall trading conditions. P Broker's trading fees are not well-defined, and traders have reported experiencing unexpected charges, which can significantly affect profitability.

| Fee Type | P Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low to Moderate |

The table above illustrates that P Broker's spreads can be variable and potentially higher than industry averages. This inconsistency can be a red flag for traders, as it may indicate a lack of transparency in pricing. Additionally, the absence of a clear commission structure could lead to hidden fees that traders may encounter during their trading activities.

Client Fund Security

The safety of client funds is paramount when evaluating any brokerage. P Broker has been criticized for its lack of robust security measures to protect client deposits. The broker does not offer any information regarding segregated accounts or investor protection schemes, which are standard practices among reputable brokers.

Traders should be aware that without clear policies on fund segregation and negative balance protection, their investments may be at risk. Moreover, the absence of historical data on any past fund security issues or disputes raises concerns about the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

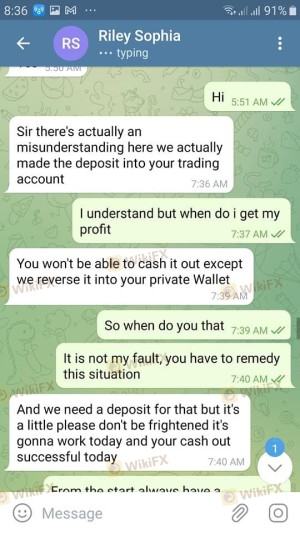

Analyzing customer feedback is essential for understanding the overall user experience with P Broker. Many users have reported difficulties with withdrawals, which is a common complaint among unregulated brokers. The inability to access funds can be a significant issue, leading to frustration and loss of trust.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Poor |

Customer complaints predominantly revolve around withdrawal issues, with many users claiming that their requests were either delayed or ignored altogether. For instance, one user reported that their account manager insisted on trading more before processing a withdrawal, raising concerns about potential manipulative practices. Such patterns of behavior can be indicative of a broker that does not prioritize client satisfaction.

Platform and Execution

The trading platform offered by P Broker is another critical aspect of the user experience. While the broker claims to provide a stable and user-friendly platform, many users have reported issues with order execution and slippage. Problems such as high slippage rates and rejected orders can significantly impact trading performance.

Traders should be cautious about any signs of platform manipulation, which can lead to unfair trading conditions. A transparent and efficient trading platform is essential for traders to execute their strategies successfully, and any discrepancies in execution quality can be detrimental to their overall experience.

Risk Assessment

Using P Broker involves several risks that traders should consider before opening an account. The lack of regulation, unclear fee structures, and negative customer feedback contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | Medium | Potential hidden fees |

| Operational Risk | High | Withdrawal issues and complaints |

To mitigate these risks, traders are advised to conduct thorough research and consider using a demo account to test the platform before committing real funds. Additionally, traders should only deposit amounts they can afford to lose, given the high-risk nature of trading with an unregulated broker like P Broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that P Broker is not a safe option for traders. The lack of regulation, combined with numerous complaints regarding withdrawal issues and unclear fee structures, raises significant red flags. Traders should exercise extreme caution when dealing with this broker, as the potential for scams and fraudulent practices appears high.

For those seeking reliable alternatives, it is advisable to consider well-regulated brokers with transparent fee structures and strong customer support. Options such as brokers regulated by the FCA, ASIC, or other top-tier authorities can provide a safer trading environment. Ultimately, ensuring the safety of your investments should be the top priority when choosing a Forex broker.

Is p-broker a scam, or is it legit?

The latest exposure and evaluation content of p-broker brokers.

p-broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

p-broker latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.