Is Nixse safe?

Pros

Cons

Is Nixse A Scam?

Introduction

Nixse is a relatively new player in the forex trading arena, having been established in 2020. With its headquarters in Taiwan, the broker claims to offer a wide range of trading instruments, including forex, commodities, and indices. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market, while offering lucrative opportunities, is also rife with scams and unregulated brokers. This necessitates a careful evaluation of brokers like Nixse to determine their legitimacy and reliability. In this article, we will analyze Nixses regulatory status, company background, trading conditions, customer experiences, and overall risk, providing a comprehensive assessment of whether Nixse is a trustworthy broker or a potential scam.

Regulation and Legitimacy

One of the primary factors to consider when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect client funds and promote transparency. Unfortunately, Nixse operates without any significant regulatory oversight.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from reputable authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) raises significant concerns regarding the safety of traders' funds. Furthermore, Nixse has been blacklisted by several regulatory bodies, including Brazil's CVM and France's AMF, which indicates that it is viewed as a high-risk broker. The lack of oversight means that traders have limited recourse in case of disputes or issues with withdrawals, increasing the risk of potential fraud.

Company Background Investigation

Nixse Ltd. was founded in 2020, and its ownership structure remains somewhat opaque. It is registered in Taiwan, a jurisdiction known for its lenient regulatory environment regarding forex brokers. The management team behind Nixse has not been prominently featured in available information, which raises questions about their expertise and experience in the trading industry.

Transparency is crucial in the financial sector, and Nixse's failure to provide detailed information about its executives and operational history is concerning. The lack of clarity regarding its ownership and management team could indicate that the broker is not fully committed to maintaining a trustworthy image. This absence of information, coupled with the broker's relatively short operational history, should prompt potential clients to exercise caution.

Trading Conditions Analysis

Nixse offers various trading conditions, including a minimum deposit requirement that can range from $250 to $10,000, depending on the account type. The broker claims to provide competitive spreads and leverage up to 1:400. However, the absence of a demo account and the high minimum deposit requirements may deter novice traders.

| Fee Type | Nixse | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not specified | Varies |

While Nixse claims to have a transparent fee structure, the lack of detailed information regarding spreads and commissions raises red flags. Traders should be wary of any hidden fees that might not be disclosed upfront. The absence of a clearly defined commission structure could lead to unexpected costs, especially for high-frequency traders.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Nixse's website claims to implement security measures, including SSL encryption and segregated accounts. However, without regulation, there is no guarantee that these measures will be enforced effectively.

Nixse does not provide negative balance protection, which can leave traders vulnerable to significant losses. This lack of protection is particularly concerning given the high leverage offered by the broker, which can amplify both gains and losses. Historical complaints regarding difficulty in withdrawals further exacerbate concerns about fund safety and the broker's overall integrity.

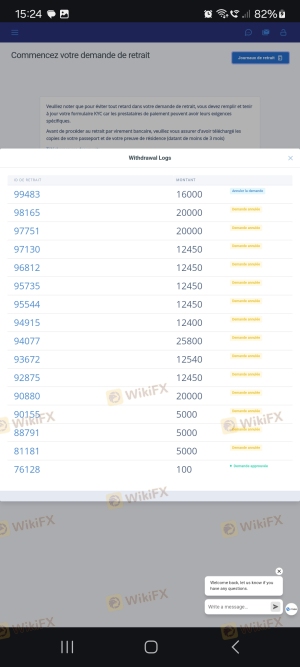

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Nixse reveal a mixed bag of experiences, with some users reporting positive interactions while others voice significant complaints, particularly regarding withdrawal issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Moderate |

| Misleading Information | High | Poor |

Common complaints include difficulties in processing withdrawals, with several users reporting that their requests were either delayed or denied without clear justification. The companys response to these complaints has been criticized as inadequate, further eroding trust among clients. In a few cases, traders have reported that their accounts were blocked after they attempted to withdraw funds, raising suspicions about the broker's practices.

Platform and Execution

Nixse offers a proprietary trading platform known as NX Trader, which is designed to facilitate trading in various asset classes. However, reviews indicate that the platform may not be as stable or user-friendly as competitors like MetaTrader 4 or 5.

Order execution quality is another critical factor for traders. Reports of slippage and rejected orders have surfaced, suggesting that the platform may not always provide optimal trading conditions. The potential for manipulation within an unregulated environment adds another layer of risk, as traders may face unfavorable conditions that could impact their trading outcomes.

Risk Assessment

Engaging with Nixse carries inherent risks, especially considering its unregulated status and the mixed reviews from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the potential for fraud. |

| Withdrawal Risk | High | Many complaints about withdrawal issues suggest potential fund access problems. |

| Platform Risk | Medium | Reports of slippage and execution issues may impact trading performance. |

To mitigate these risks, traders should conduct thorough research before investing, consider starting with a minimal amount, and ensure they have a solid risk management strategy in place.

Conclusion and Recommendations

In conclusion, Nixse raises significant concerns regarding its legitimacy as a forex broker. The lack of regulation, coupled with numerous complaints about withdrawal issues and insufficient transparency, suggests that traders should approach this broker with caution. While some traders may find success, the risks associated with trading with Nixse may outweigh the potential benefits.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers that offer robust protections for client funds and transparent trading conditions. Brokers regulated by authorities like the FCA or ASIC provide a more secure trading environment, ensuring that clients have recourse in case of disputes. Ultimately, the choice of broker should align with individual trading goals, risk tolerance, and the need for security.

Is Nixse a scam, or is it legit?

The latest exposure and evaluation content of Nixse brokers.

Nixse Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nixse latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.