MES 2025 Review: Everything You Need to Know

Summary

This comprehensive mes review examines a company established in 1997 and headquartered in Brooklyn, New York. MES operates as a domestic commercial entity located at 335 Bond Street, Brooklyn, NY 11231, based on available information. The company has maintained its presence in the business sector for over two decades. This suggests some level of operational stability and market experience.

However, our analysis reveals significant information gaps regarding trading conditions, regulatory oversight, and user feedback. The available data primarily focuses on basic corporate information rather than detailed service offerings or client testimonials. This mes review provides a neutral assessment based on limited available information. Making definitive recommendations for potential users proves challenging due to these limitations.

The company appears to target domestic traders seeking commercial services. Specific details about their trading platforms, account types, and service quality remain unclear from current sources.

Important Notice

Readers should be aware that this evaluation is based on limited publicly available information. The information summary provided does not include specific regulatory details, which means potential clients should exercise caution and conduct additional due diligence before engaging with this service provider.

Different jurisdictions may have varying trading rules and investor protection measures. We recommend verifying regulatory compliance and seeking current information directly from official sources before making any trading decisions. This review methodology relies on industry standards and available company information. However, it lacks comprehensive user feedback and detailed service analysis that would typically inform a complete assessment.

Rating Framework

Broker Overview

MES was incorporated on February 18, 1997, establishing itself as a long-standing entity in the business sector. The company maintains its headquarters at 335 Bond Street, Brooklyn, NY 11231. This positioning places the company within New York's commercial landscape. With over 25 years of operational history, the company has demonstrated longevity in a competitive market environment.

The organization operates as a domestic commercial company. It focuses on business services within the United States market. This business model suggests a concentration on local market needs and regulatory compliance within U.S. commercial frameworks. The Brooklyn location places the company within a significant commercial hub. This potentially provides access to diverse business networks and professional resources.

However, this mes review must note that specific details about trading platforms, asset classes, and regulatory oversight are not clearly specified in available documentation. The company's primary business activities, target market segments, and service delivery mechanisms require further clarification. Potential clients seeking comprehensive information about their offerings need these details.

Regulatory Jurisdiction

The information summary does not specify particular regulatory jurisdictions or oversight bodies governing MES operations. Potential clients should verify current regulatory status independently.

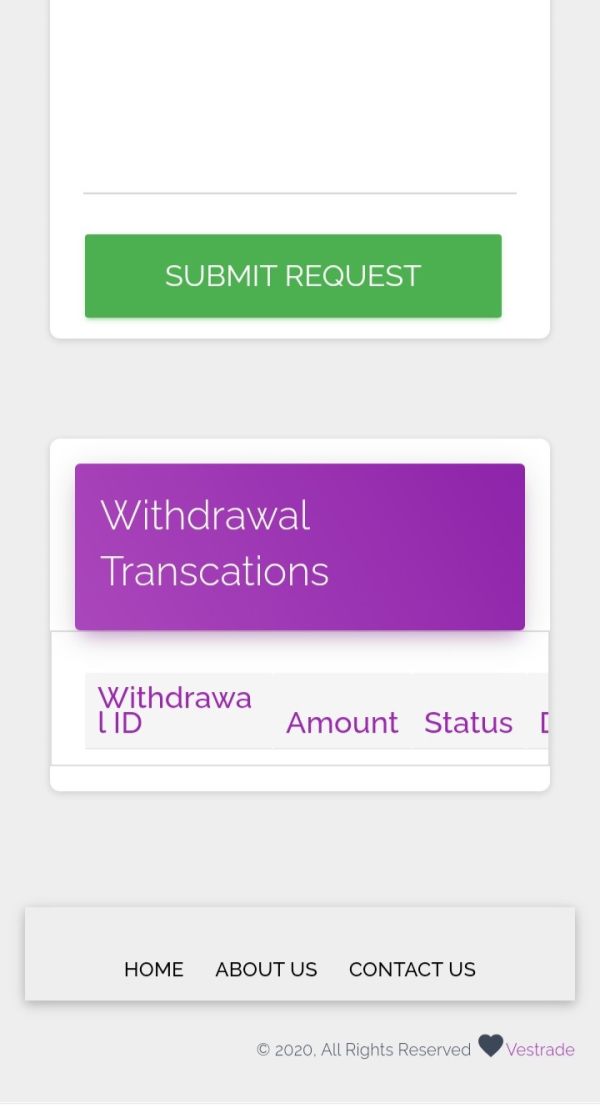

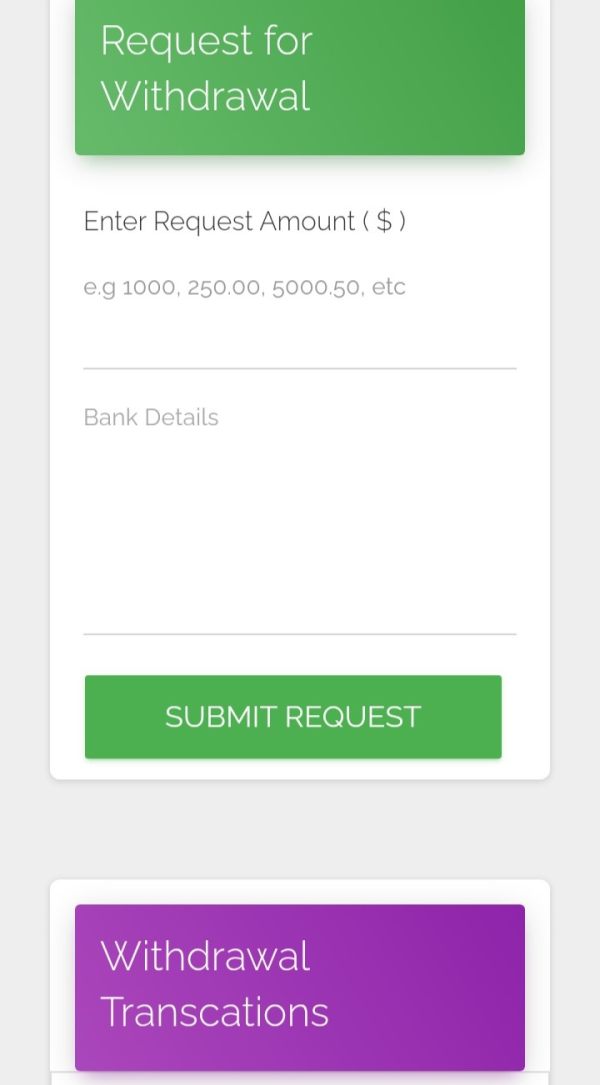

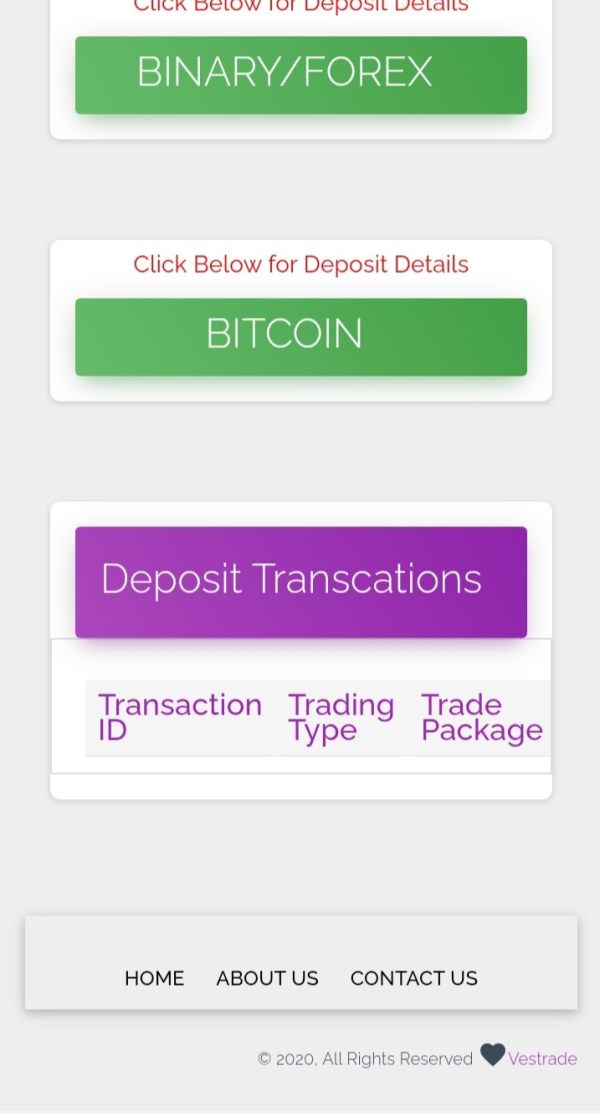

Deposit and Withdrawal Methods

Available sources do not detail the payment methods, processing times, or fees associated with financial transactions through MES services.

Minimum Deposit Requirements

Specific minimum deposit amounts or account funding requirements are not mentioned in the current information summary.

No information about promotional offers, welcome bonuses, or ongoing incentive programs is available in the provided materials.

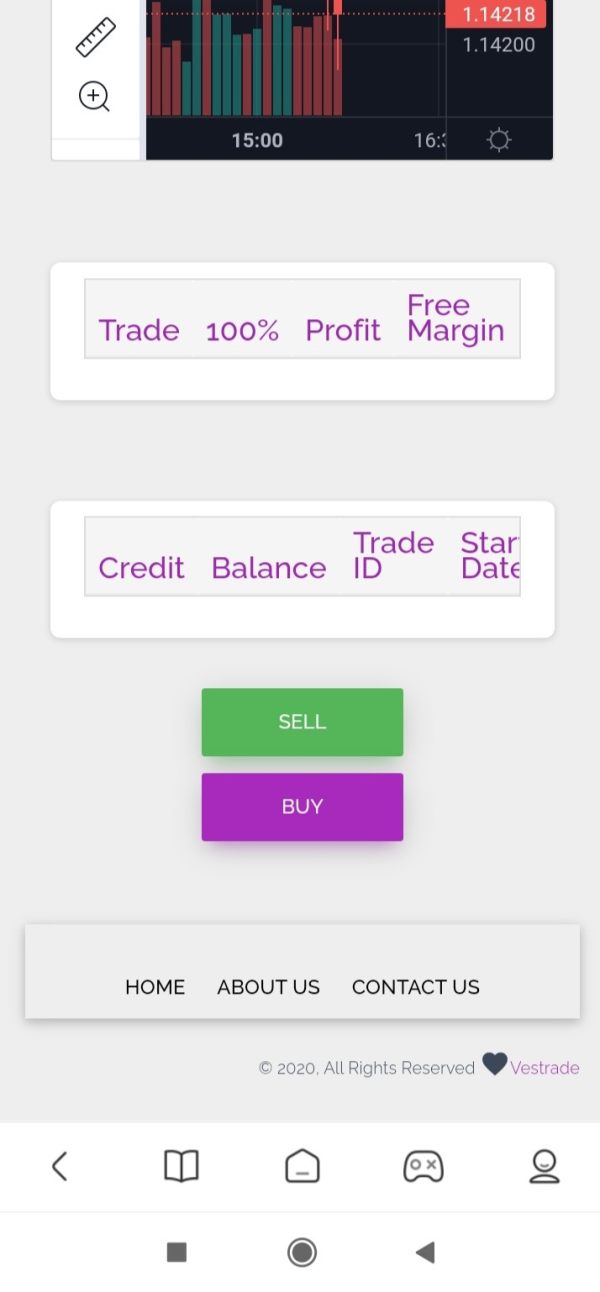

Tradeable Assets

The types of financial instruments, trading pairs, or investment products offered by MES are not specified in available documentation.

Cost Structure

Details regarding spreads, commissions, overnight fees, or other trading costs are not outlined in the information summary. This makes cost comparison difficult.

Leverage Ratios

Maximum leverage offerings and margin requirements are not detailed in current sources.

Information about trading platforms, software compatibility, or technological infrastructure is not provided in available materials.

This mes review highlights the need for additional research to obtain comprehensive service details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of MES account conditions faces significant limitations due to insufficient publicly available information. Traditional forex broker assessments typically examine account tier structures, minimum deposit requirements, and specialized account features such as Islamic accounts or professional trading options. However, the information summary provided does not specify these crucial details.

Account opening procedures, verification requirements, and documentation processes remain unclear from current sources. Without specific information about account types, funding methods, or maintenance requirements, potential clients cannot make informed comparisons with industry standards.

The absence of detailed account condition information in this mes review suggests that interested parties should contact the company directly to obtain current terms and conditions. This information gap represents a significant limitation for traders. These traders seek transparent and competitive account offerings in today's market environment.

Assessment of trading tools and analytical resources proves challenging given the limited information available about MES service offerings. Modern trading environments typically provide comprehensive charting packages, technical analysis tools, economic calendars, and market research resources to support informed decision-making.

Educational resources, including webinars, tutorials, and market analysis, play crucial roles in trader development and retention. However, the current information summary does not detail such offerings or their quality levels. Automated trading support, API access, and third-party integration capabilities also remain unspecified.

Without concrete information about research departments, analytical services, or proprietary trading tools, this evaluation cannot provide meaningful insights into MES resource quality. The lack of detailed tool specifications represents a significant information gap. Potential clients should address this through direct inquiry.

Customer Service and Support Analysis

Evaluating customer service quality requires information about support channels, availability schedules, and response time metrics. The information summary does not provide details about customer service infrastructure, staffing levels, or service quality measurements that would enable comprehensive assessment.

Modern trading environments typically offer multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. Language support options, regional service availability, and escalation procedures also influence overall service quality ratings.

Without user feedback, response time data, or service quality metrics, this analysis cannot provide meaningful insights into MES customer support capabilities. The absence of customer service information represents a critical evaluation limitation. This requires additional research for complete assessment.

Trading Experience Analysis

Platform stability, execution speed, and order processing quality form the foundation of positive trading experiences. However, the information summary lacks specific details about MES trading infrastructure, technology platforms, or performance metrics necessary for comprehensive evaluation.

Mobile trading capabilities, platform customization options, and user interface design significantly impact trader satisfaction and operational efficiency. Real-time data feeds, order execution transparency, and slippage management also influence overall trading quality perceptions.

This mes review cannot provide definitive insights into trading experience quality due to insufficient technical and performance information. Platform demonstrations, user testimonials, and independent performance testing would be necessary to complete this assessment dimension accurately.

Trust and Reliability Analysis

Trust evaluation typically centers on regulatory compliance, financial transparency, and operational track record. While MES demonstrates operational longevity since 1997, the information summary does not specify current regulatory oversight, licensing status, or compliance frameworks governing their operations.

Client fund protection measures, segregated account policies, and insurance coverage details remain unspecified in available documentation. Professional indemnity insurance, regulatory reporting compliance, and third-party auditing practices also influence trust assessments. However, these are not detailed in current sources.

The absence of specific regulatory information, combined with limited transparency about operational practices, prevents comprehensive trust evaluation. Potential clients should verify current regulatory status and protection measures independently before engaging with MES services.

User Experience Analysis

Overall user satisfaction assessment requires comprehensive feedback from active clients, platform usability testing, and comparative analysis with industry standards. The information summary does not include user testimonials, satisfaction surveys, or independent reviews that would inform this evaluation dimension.

Registration processes, account verification procedures, and onboarding experiences significantly impact initial user impressions. Ongoing platform navigation, feature accessibility, and problem resolution efficiency also influence long-term satisfaction levels.

Without access to user feedback, satisfaction metrics, or comparative usability studies, this analysis cannot provide meaningful insights into MES user experience quality. Direct user testimonials and independent platform testing would be necessary to complete this assessment accurately.

Conclusion

Based on available information, this mes review presents a company with demonstrated longevity in the business sector, operating from Brooklyn, New York since 1997. However, the significant lack of detailed information about trading conditions, regulatory oversight, and service offerings makes it difficult to provide a comprehensive assessment.

The company may be suitable for users seeking traditional commercial services with an established domestic provider. However, the absence of transparent information about trading platforms, costs, and regulatory compliance represents substantial limitations. Potential clients requiring detailed service comparisons face these challenges.

Prospective users should conduct additional due diligence, verify current regulatory status, and obtain detailed service information directly from MES before making engagement decisions. The information gaps identified in this review highlight the importance of comprehensive research when selecting financial service providers.