Is JP Exchange safe?

Business

License

Is JP Exchange A Scam?

Introduction

JP Exchange is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market. As with any trading platform, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market, known for its volatility and complexity, can pose significant risks, making it essential for traders to evaluate the credibility and reliability of their chosen brokers. In this article, we will explore the legitimacy of JP Exchange by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our investigation is based on a comprehensive review of available online resources, trader testimonials, and regulatory databases.

Regulation and Legitimacy

The regulation of a forex broker is a critical factor that can significantly impact its credibility. Regulatory bodies are responsible for overseeing trading practices and ensuring that brokers adhere to industry standards. Unfortunately, JP Exchange currently lacks valid regulatory oversight. According to sources, it has not been licensed by any recognized regulatory authority, which raises concerns about its legitimacy and operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that traders may not have the same protections as they would with a regulated broker. This lack of oversight can lead to potential issues, including unfair trading practices and difficulties in fund withdrawals. Furthermore, historical compliance issues have been reported, with users alleging fraudulent activities and misappropriation of funds. Such claims highlight the importance of regulatory frameworks in protecting traders and ensuring fair market practices.

Company Background Investigation

JP Exchange's history and ownership structure play a significant role in understanding its operations. The broker's background reveals a lack of transparency, with limited information available about its founding, management team, and operational history. This opacity can be a red flag for potential investors.

The absence of a clearly defined management team also raises concerns. A reputable broker typically provides information about its executives, including their experience and qualifications. In the case of JP Exchange, this information is notably absent, which can lead to skepticism regarding the broker's intentions and operational integrity.

Moreover, the level of transparency and information disclosure is crucial for building trust with clients. JP Exchange's failure to provide comprehensive details about its operations and management may deter potential traders from engaging with the platform. Transparency is a hallmark of trustworthy brokers, and its absence can be indicative of deeper issues within the organization.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. JP Exchange presents a varied fee structure, but its lack of regulatory oversight raises questions about the fairness and transparency of these fees.

| Fee Type | JP Exchange | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Structure | $6 per lot | $3 per lot |

| Overnight Interest Range | TBD | 0.5% - 2% |

The spread on major currency pairs appears to be higher than the industry average, which may impact trading profitability for clients. Additionally, the commission structure raises concerns, as the fees charged are significantly higher than those of many competing brokers. Traders should be wary of any unusual or excessive fee policies, as these can erode potential profits and lead to unexpected costs.

Customer Funds Security

The safety of customer funds is paramount when evaluating a forex broker. JP Exchange's lack of regulatory oversight raises concerns about its fund security measures. Reliable brokers typically implement strict protocols for fund segregation, investor protection, and negative balance protection.

However, reports suggest that JP Exchange may not have robust measures in place to safeguard client funds. Instances of withdrawal issues and allegations of fraudulent practices have been documented, indicating potential risks for traders. The absence of effective fund protection mechanisms can expose clients to significant financial losses, especially in the event of broker insolvency or mismanagement.

Customer Experience and Complaints

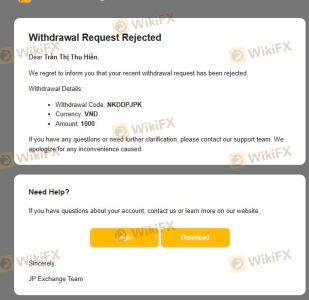

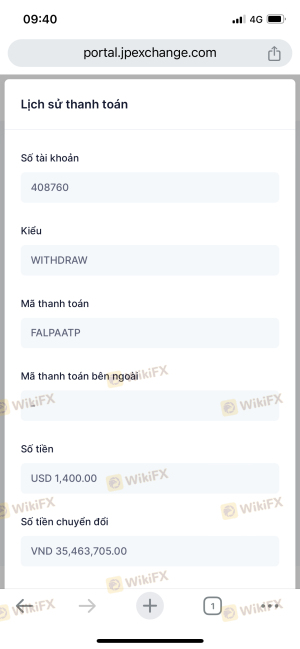

Analyzing customer feedback is essential for assessing a broker's reputation. In the case of JP Exchange, numerous complaints have emerged from users alleging difficulties with withdrawals, lack of customer support, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Poor |

| Trading Platform Issues | High | Inconsistent |

Many users have reported being unable to withdraw their funds after making deposits, leading to frustration and claims of fraud. Additionally, the quality of customer support has been criticized, with many traders expressing dissatisfaction with response times and the effectiveness of the support provided. These complaints suggest a troubling pattern of user experiences that potential clients should consider before engaging with JP Exchange.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. JP Exchange's platform has faced scrutiny regarding its stability and execution quality. Reports of slippage and order rejections have been noted, which can significantly impact trading outcomes.

In addition to execution issues, there are allegations of potential platform manipulation, raising concerns about the integrity of the trading environment. Traders should be cautious when dealing with a platform that exhibits signs of instability or questionable practices, as these factors can lead to significant financial risks.

Risk Assessment

Engaging with JP Exchange comes with a range of risks that potential traders should be aware of. The absence of regulatory oversight, coupled with numerous complaints and issues reported by users, paints a concerning picture of the broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Potential for fraud |

| Operational Risk | Medium | Platform instability |

To mitigate these risks, traders should consider alternative brokers with established regulatory frameworks, transparent fee structures, and positive user experiences. Engaging with a regulated broker can provide additional protections and peace of mind for traders navigating the complexities of the forex market.

Conclusion and Recommendations

In conclusion, the evidence suggests that JP Exchange exhibits several characteristics that warrant caution. The lack of regulatory oversight, coupled with numerous complaints regarding withdrawals and customer support, raises significant concerns about the broker's legitimacy.

Traders are advised to exercise caution when considering engagement with JP Exchange and to explore alternative options that offer robust regulatory protections and positive user experiences. Reputable brokers such as Avatrade, Forex.com, and XM provide reliable trading environments with established regulatory frameworks, competitive trading conditions, and comprehensive customer support. Ultimately, it is crucial for traders to prioritize their safety and security when navigating the forex market.

Is JP Exchange a scam, or is it legit?

The latest exposure and evaluation content of JP Exchange brokers.

JP Exchange Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JP Exchange latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.