jp exchange 2025 Review: Everything You Need to Know

Abstract

This jp exchange review gives a detailed look at JP Exchange, a broker that gets mixed feedback from users. The broker gets a neutral rating with both good and bad comments from people who use it. One key strength is that it supports the MetaTrader 5 trading platform, which works on different devices and gives traders a modern interface with many features. But people thinking about using it should be careful because it has no regulatory licenses, which creates concerns about legal and safety risks.

The platform targets traders who like MT5 for its advanced charts, analysis tools, and automated trading features. Even though it has good technology, the lack of clear background details like when the company started, regulatory oversight, and full account conditions makes people doubt it. This review uses available user experiences and public data and shows why you need to do careful research before using JP Exchange.

Caveats

JP Exchange operates across different areas and does not have an established regulatory license, which creates higher legal and safety risks for potential users. This review uses only collected user experiences and publicly available summaries, with no on-site checking done. The lack of detailed regulatory, account condition, and client service information means that conclusions come from limited data points.

Since different sources give different views, this analysis reflects a fair summary of available feedback. Potential clients should carefully think about these factors and look for additional proof before making any trading decisions.

Rating Framework

Broker Overview

JP Exchange is a broker that has created a lot of discussion among traders, even though detailed background information is missing. No clear details about when it was established or the company's history have been outlined in available sources. This leaves potential users with limited insight into the broker's origins, financial stability, and overall business plan.

Various reports show that the company operates with a focus on providing an accessible trading environment, though the lack of transparency raises questions about its long-term success. On the trading side, JP Exchange is known mainly for its support of the MetaTrader 5 trading platform. This platform is highly regarded for its advanced charting tools, technical analysis capabilities, and multi-device compatibility.

While the asset offering likely includes forex and CFD instruments—common among brokers in this category—the absence of clear details on other asset classes further shows the need for careful engagement. There is no clear mention of regulatory oversight or licensing bodies responsible for the broker's operations. As such, the jp exchange review continues to highlight that while the MT5 support is a strong point, the overall operational transparency and regulatory compliance remain major areas of concern.

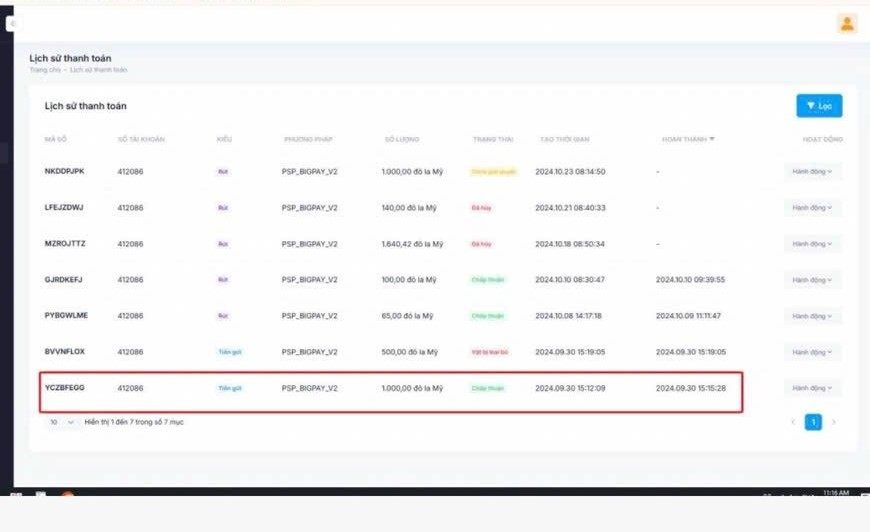

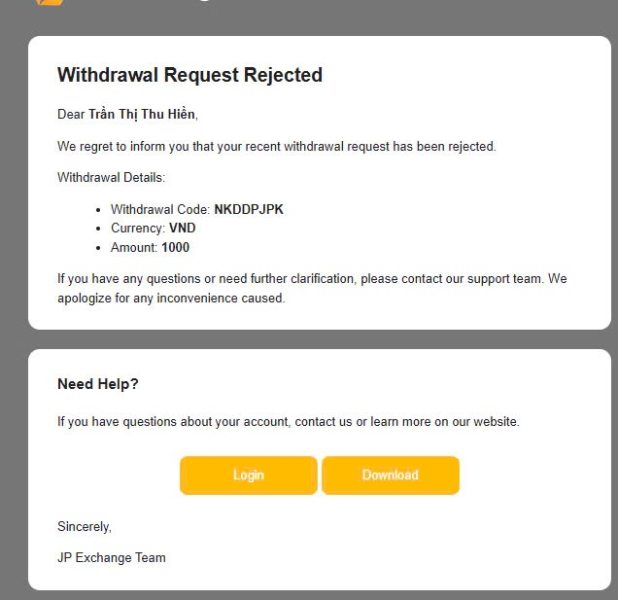

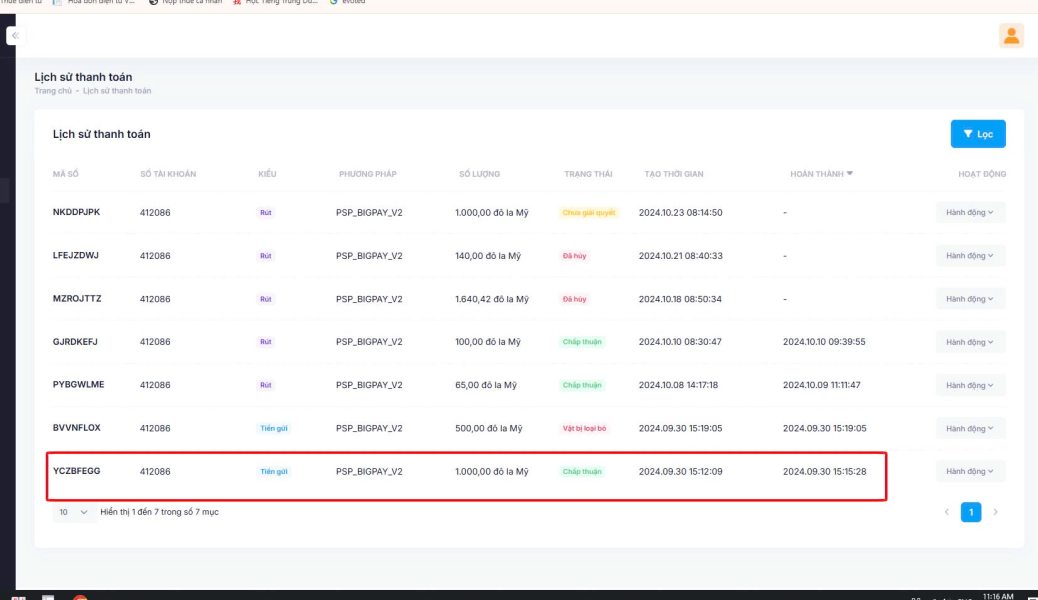

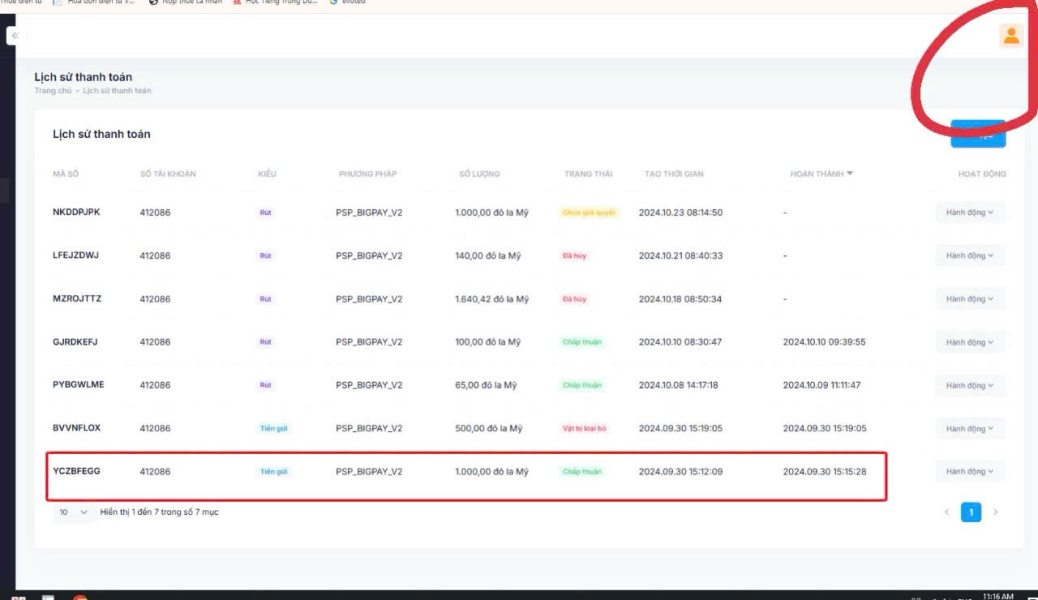

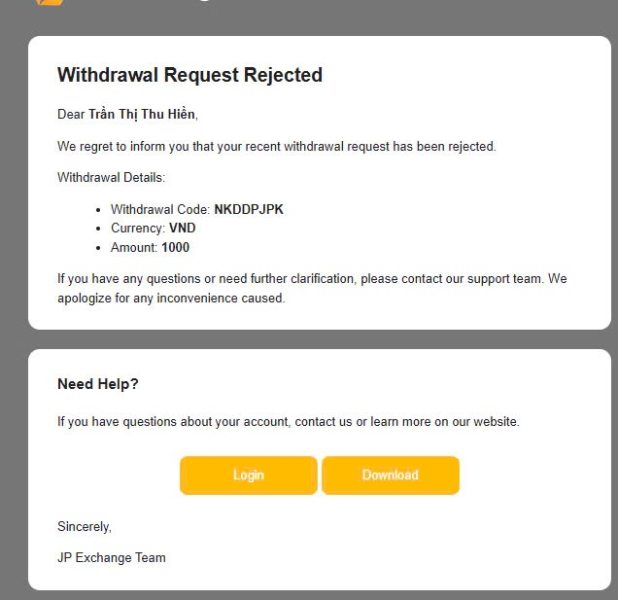

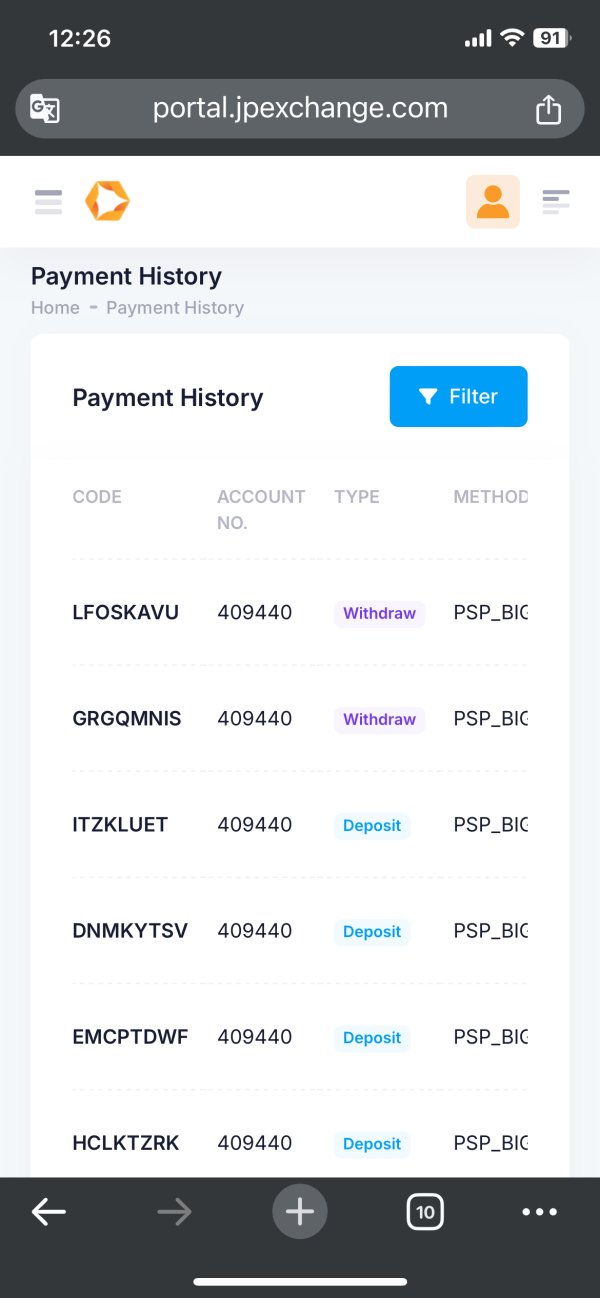

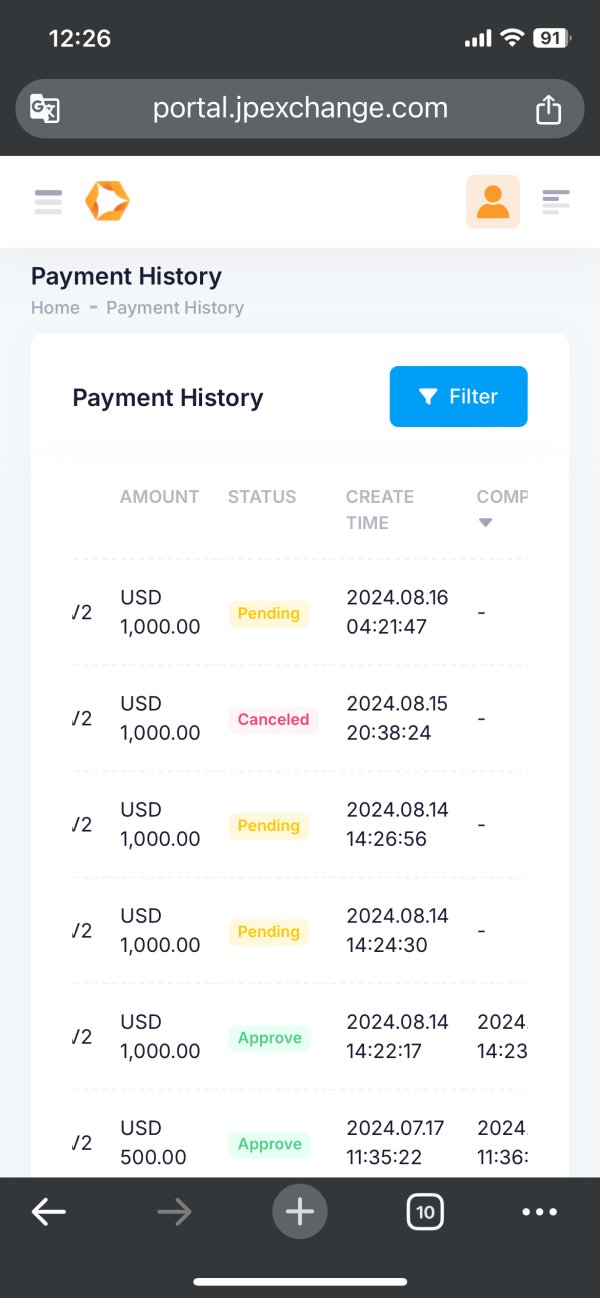

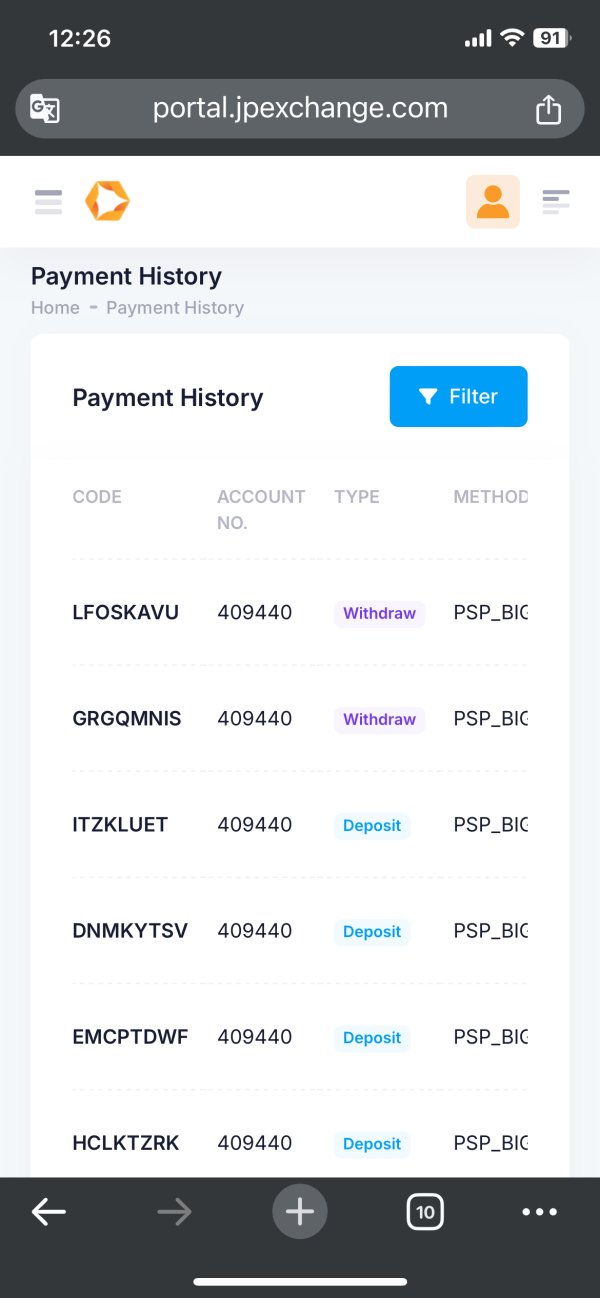

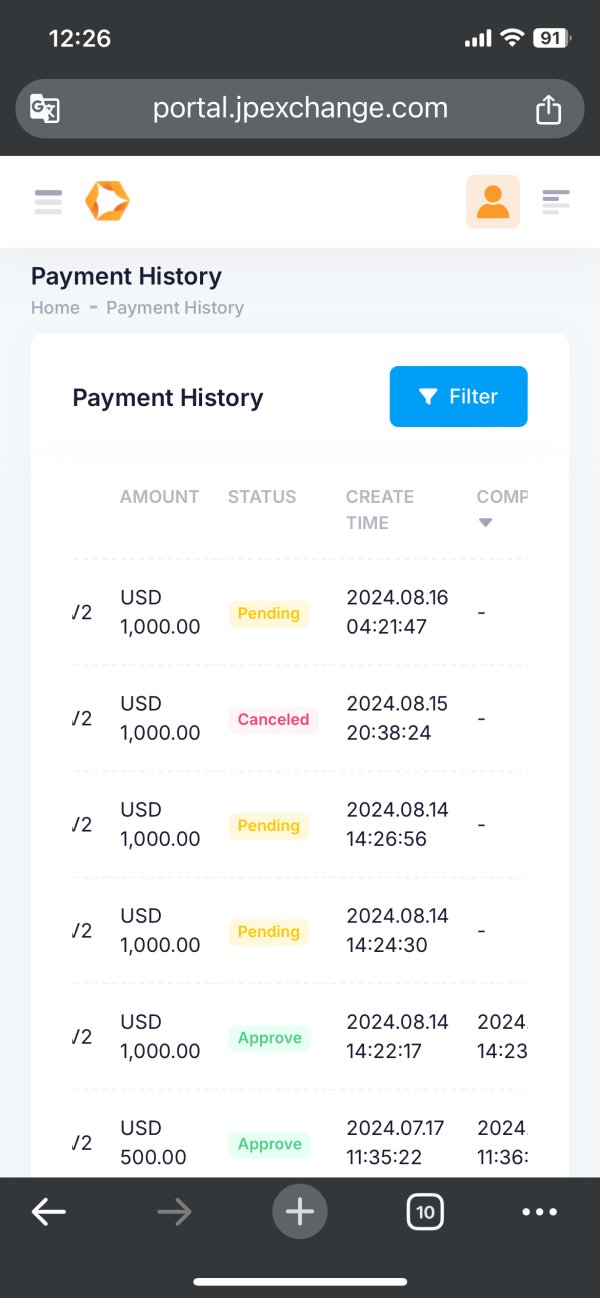

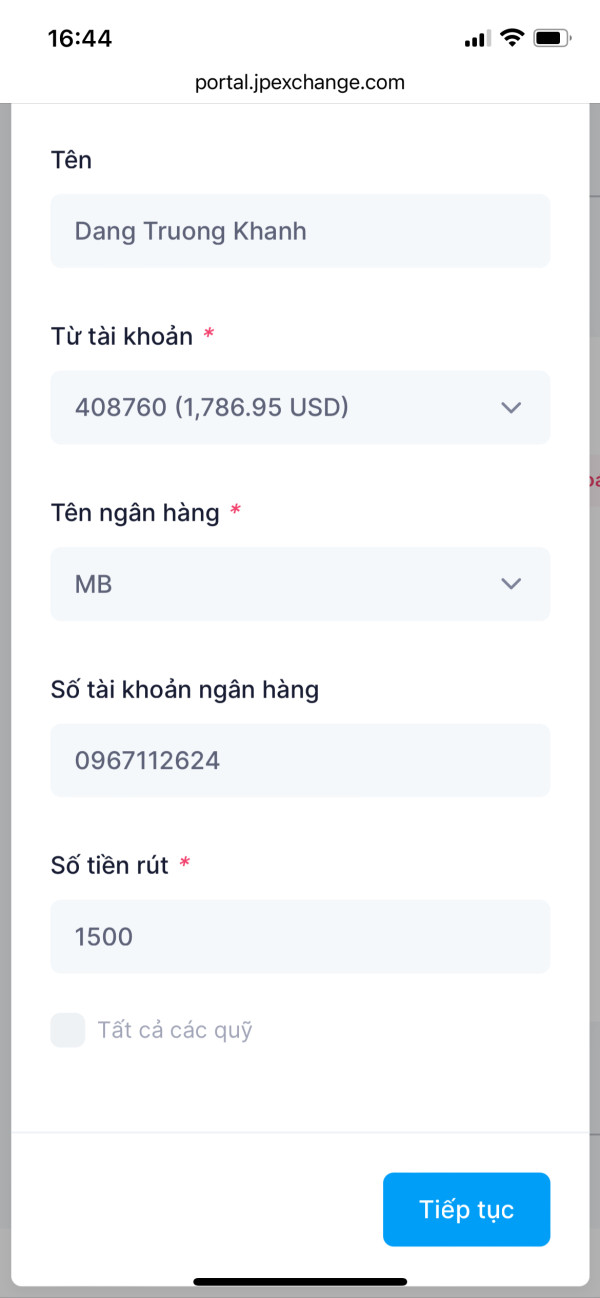

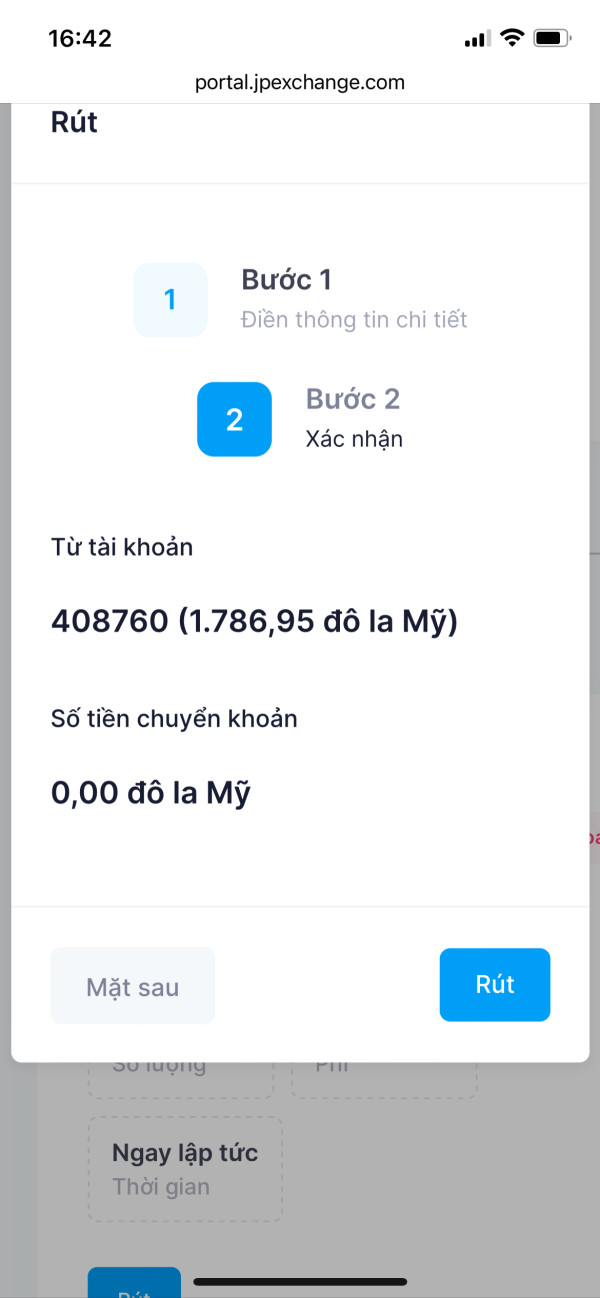

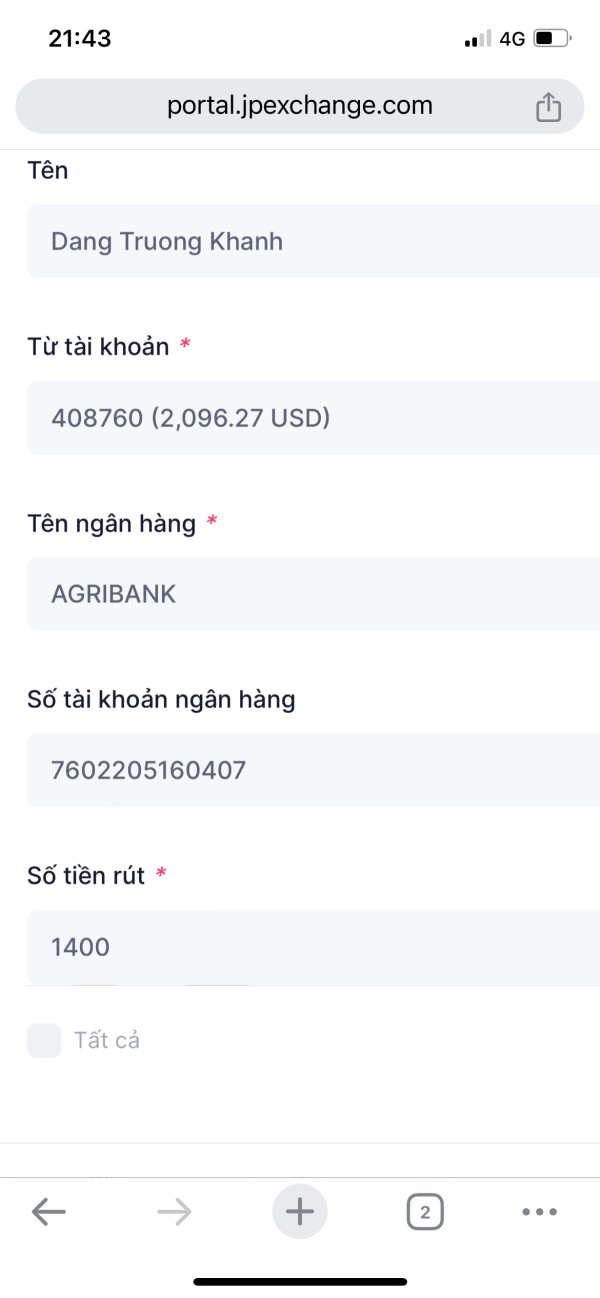

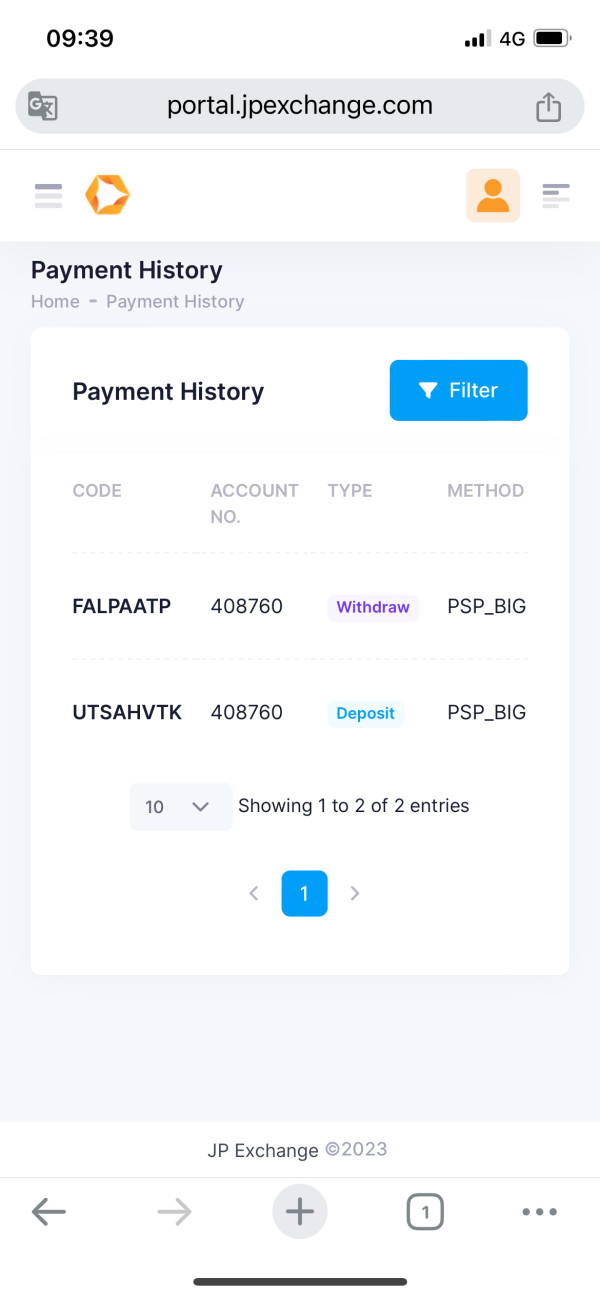

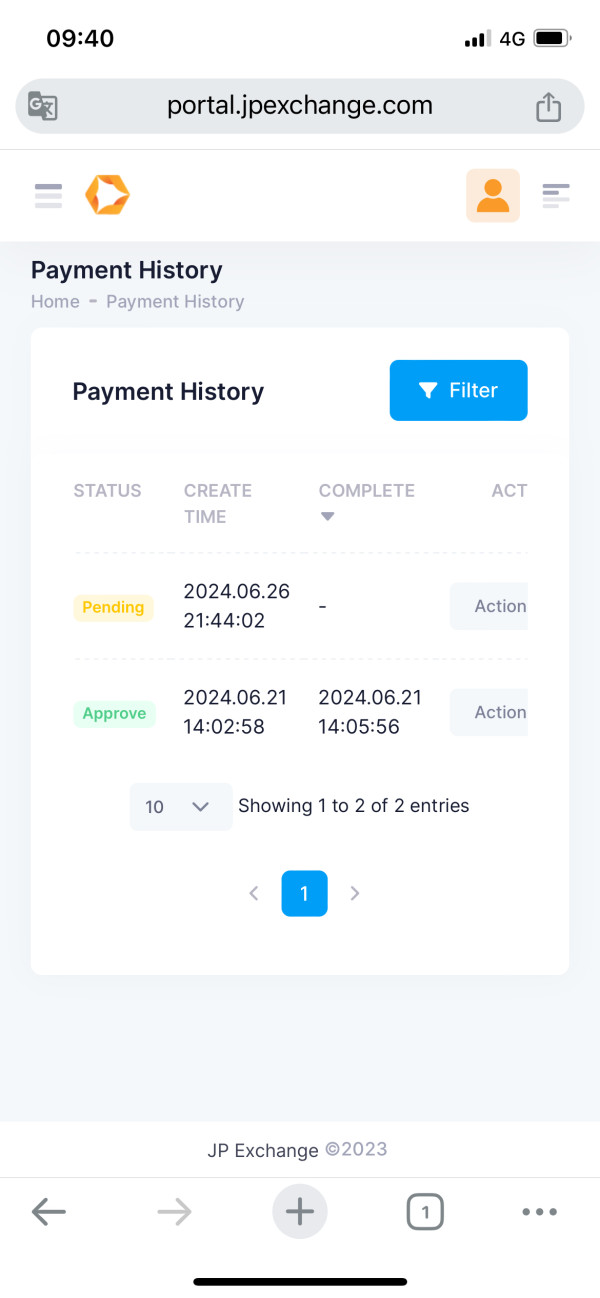

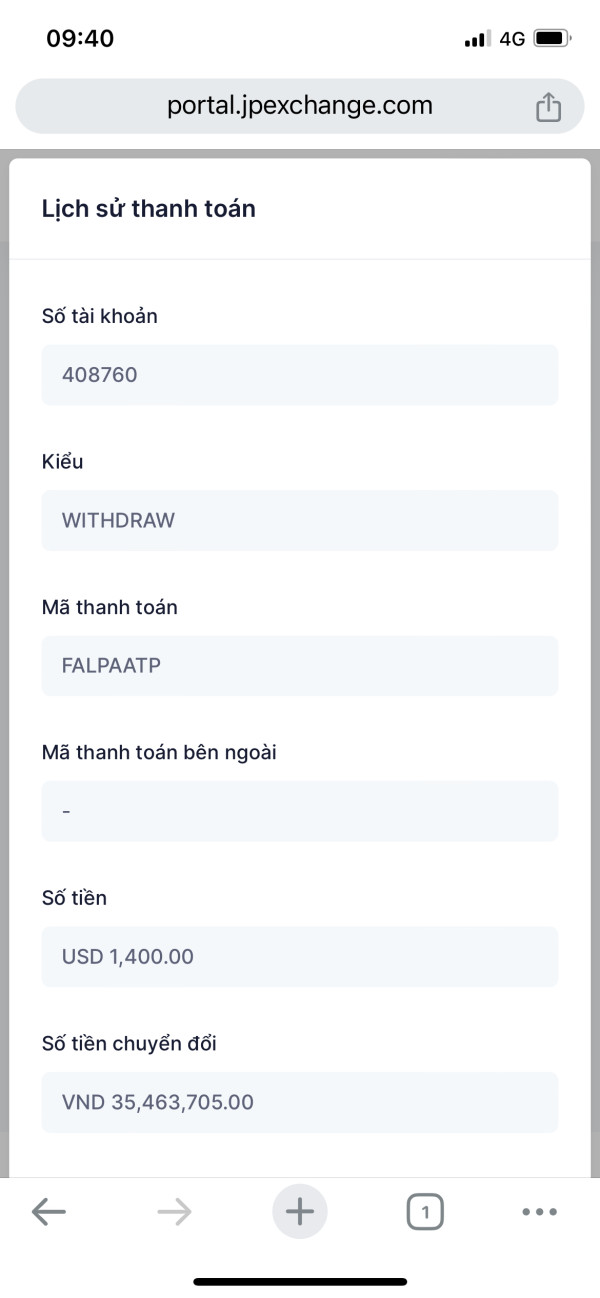

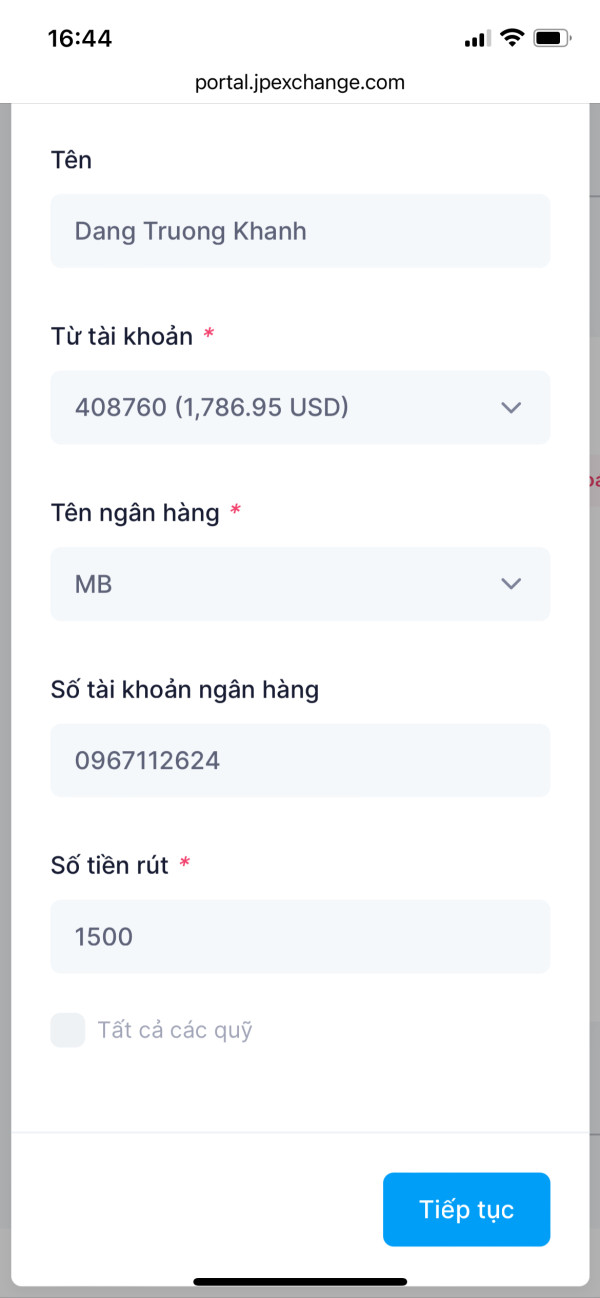

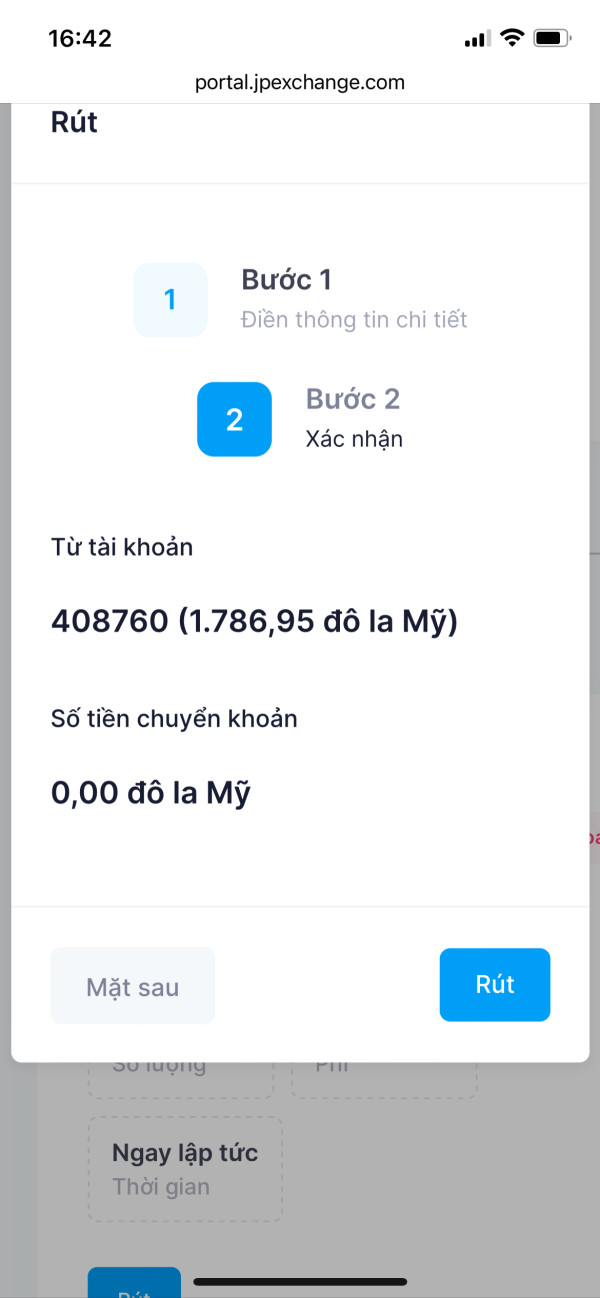

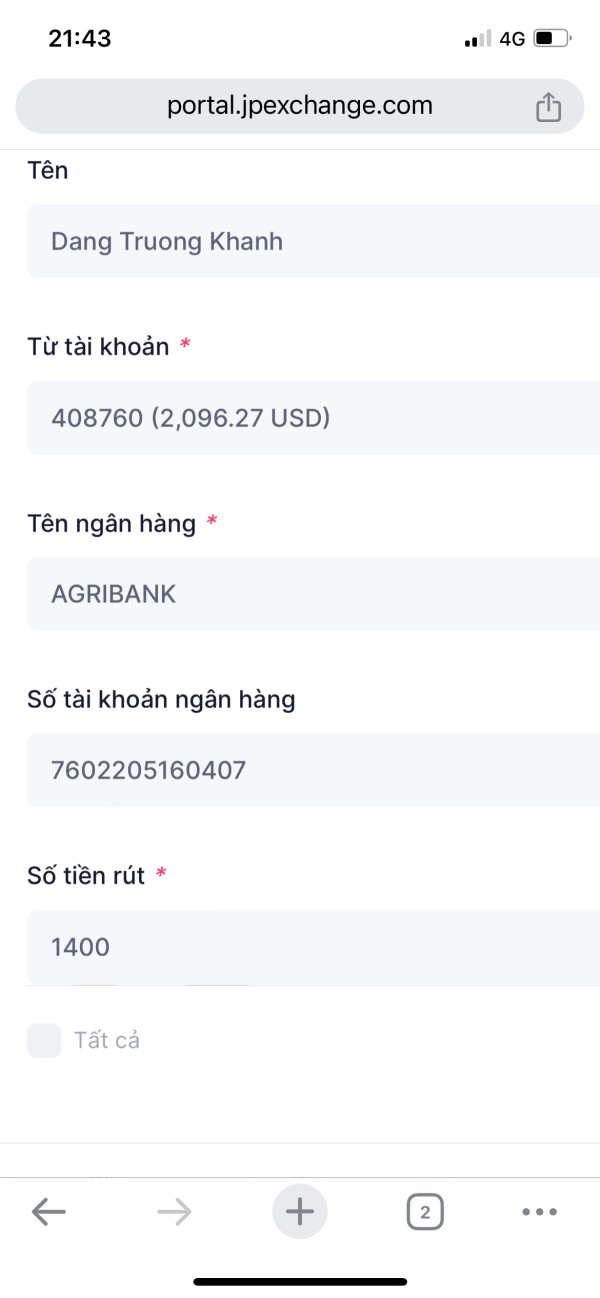

When considering JP Exchange, several key operational aspects must be addressed, even though many specifics remain undisclosed. Regarding regulatory regions, there is no clear indication of any licensing or oversight by recognized authorities, so users should know that the broker operates without the conventional safeguards seen in regulated markets. The deposit and withdrawal methods are not detailed in the available summaries, leaving uncertainty about the range of supported payment systems and the speed of fund transfers.

Similarly, there is no clear information on minimum deposit requirements, which is critical for new traders assessing initial risk exposure. Although bonus promotions are a common feature among brokers, no concrete details about any promotional offers or bonus structures are mentioned in the data reviewed. The list of tradable assets likely includes forex pairs and CFDs, based on typical broker practices, yet no comprehensive asset breakdown is provided.

There is also a lack of detailed disclosures regarding the cost structure, such as spread details or commission fees, making it difficult for traders to calculate potential expenses accurately. Furthermore, specific details on leverage ratios are not available, leaving users without critical information on potential risk and capital exposure. The sole platform option prominently featured by JP Exchange is MetaTrader 5 , which is well-known for its robust functionality and adaptability, however, the lack of additional platform choices may limit trader flexibility.

There is no mention of any regional restrictions or the range of languages supported by customer service teams. Overall, this section of the jp exchange review highlights that while the support for MT5 is a definitive offering, significant gaps in operational transparency persist.

Detailed Rating Analysis

2.6.1 Account Conditions Analysis

The analysis of account conditions for JP Exchange reveals substantial gaps in information. There is no detailed description available regarding the types of accounts on offer, be it standard, premium, or specialized accounts such as Islamic accounts. The absence of any mention of minimum deposit requirements or a structured breakdown of account features leaves potential clients uncertain about the entry thresholds or benefits that may be available to them.

Additionally, there is no insight into the account opening process itself, which could have provided critical context regarding the ease of registration and verification. This lack of information is a significant omission for those who seek clarity on operational procedures and cost transparency. Furthermore, user feedback does not address these areas in detail, leaving traders to speculate whether the broker maintains competitive account conditions or if there are hidden limitations.

In this jp exchange review, the overall evaluation of account conditions is hindered by the lack of comprehensive data. Without explicit details on account types, deposit requirements, and the enrollment process, prospective users are left to rely on indirect user impressions and generic broker comparisons. The limited transparency in account structure increases the perception of risk, urging traders to exercise enhanced caution and seek further clarification before proceeding with JP Exchange.

JP Exchange stands out in its provision of the MetaTrader 5 platform, an industry-standard tool celebrated for its robust charting, advanced technical analysis, and multi-device access. This support for MT5 is a clear benefit, as it enables traders to execute automated strategies and perform complex analyses that are crucial in a competitive forex environment. User feedback has generally been positive regarding the MT5 interface, highlighting its stability, responsiveness, and broad range of functionalities.

However, the review also indicates that while the trading tools such as MT5 are strong, there is an absence of supplementary research resources or educational materials that can guide both novice and experienced traders. Additionally, automated trading support in the form of expert advisors is mentioned implicitly through the capabilities of MT5, yet detailed evaluations or specific user experiences in this area are not provided. This makes it challenging to fully assess the range and quality of the broker's toolkit beyond the primary trading platform.

In summary, while the broker's technical offering via MT5 is a key strength reflected in this jp exchange review, the limited information on additional trading tools and ongoing educational resources restricts the overall utility of the platform for traders who rely on comprehensive market insights and instructional support. Ultimately, prospective users may appreciate the strong platform functionality yet remain mindful of the resource gaps that could impact long-term trading success.

2.6.3 Customer Service and Support Analysis

The customer service and support aspect for JP Exchange remains one of the most unclear areas in the available information. There is no detailed disclosure of the support channels provided by the broker, whether these include live chat, telephone support, or email correspondence. Additionally, the absence of information regarding response times or service quality leaves a significant gap in understanding the efficiency of client support.

A reliable customer service framework is essential, especially for a broker that lacks regulatory backing, as traders require prompt and effective responses to resolve technical issues or account-related queries. Without clear evidence of multi-language support or round-the-clock service availability, it is challenging to gauge how well the broker can accommodate traders from different regions or those who operate during non-standard market hours. User reviews often emphasize that effective customer support can mitigate operational issues and foster greater trust, yet in the case of JP Exchange, there is no substantive feedback on this front.

Consequently, the overall evaluation of customer service is limited by the absence of tangible data regarding support infrastructure and performance. This uncertainty contributes to the overall cautious sentiment expressed in this jp exchange review. Potential users are thus advised to seek further independent verification or direct communication with the broker before committing to an account, as robust customer support is paramount in navigating the complexities of forex trading.

2.6.4 Trading Experience Analysis

The trading experience with JP Exchange is mainly centered around the capabilities of the MetaTrader 5 platform, which is renowned for its comprehensive suite of trading tools and advanced functionalities. MT5 is widely recognized in the industry for its efficient order execution, robust charting tools, and support for automated trading—features that are critical for a seamless trading experience. However, details concerning the overall trading experience, such as platform stability under heavy trading volumes and order latency, are not sufficiently provided.

There is also a lack of insights into the trading environment beyond the MT5 interface, such as the quality of order execution, the depth of liquidity, and possible technological hiccups that might affect trade outcomes. Moreover, while the platform's capabilities are clear, the absence of feedback on aspects like mobile experience or the availability of customization options restricts a thorough evaluation. In essence, although the broker offers a reliable tool in MT5, the overall trading experience remains difficult to assess due to limited additional details.

This gap in information has contributed to the mixed reviews found in various user reports. Without comprehensive data on execution quality and technical performance, prospective traders are advised to approach JP Exchange with caution. In this jp exchange review, it is evident that while the technological foundation is solid, the broader trading experience warrants further investigation to ensure it meets the high expectations of today's dynamic trading community.

2.6.5 Trust Analysis

Trust is a critical pillar in the evaluation of any broker, and in the case of JP Exchange, significant concerns arise. The most glaring issue is the complete lack of regulatory licensing or oversight from recognized authorities—a factor that immediately undermines confidence. Without regulatory validation, there is little assurance regarding the safeguarding of client funds or adherence to industry-standard best practices.

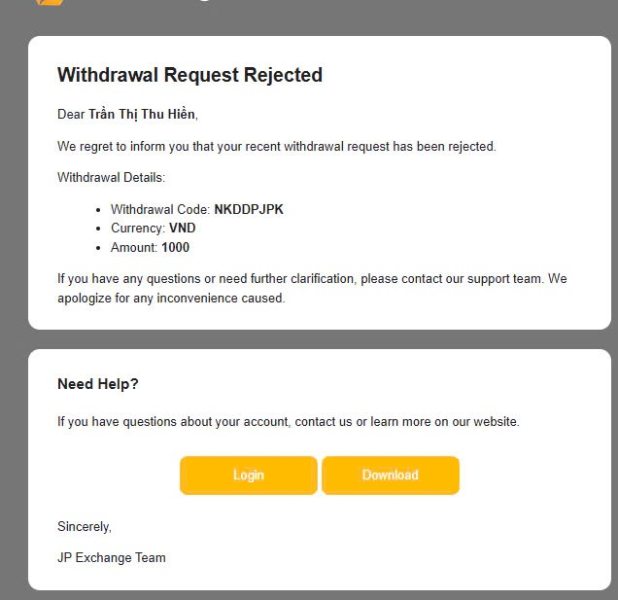

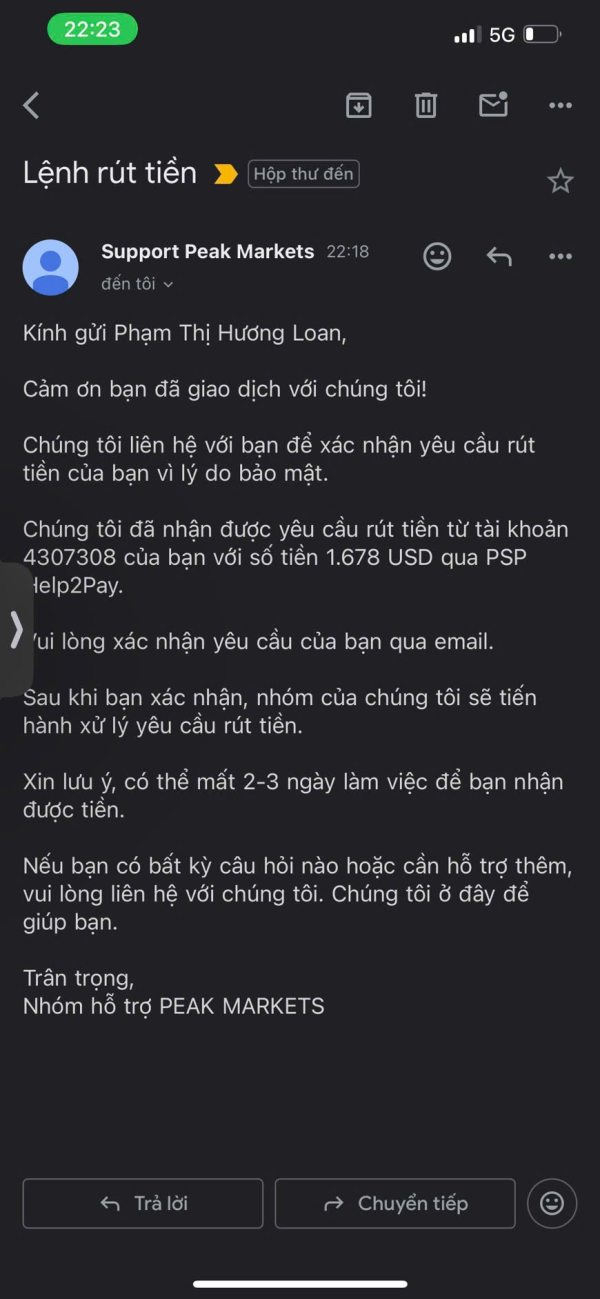

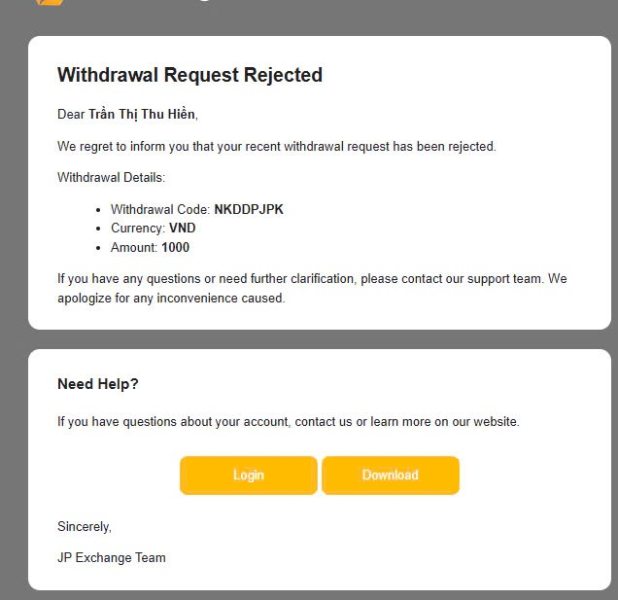

User reviews have echoed these concerns, with several traders warning that the broker has been associated with negative reports and even labeling it as a potential "scam." This sentiment is compounded by the absence of transparent information regarding the broker's corporate structure and financial backing. In this context, the trust factor for JP Exchange is considerably compromised, warranting a low score.

While the platform does offer a technologically advanced MT5 experience, the trade-off in terms of safety and trust cannot be overlooked. The scarcity of concrete details on risk management, fund segregation, and internal controls further exacerbates these concerns. As highlighted in this jp exchange review, potential users should exercise extreme caution and perhaps seek alternative brokers with clear regulatory oversight and reliable reputations.

The current environment, marked by limited transparency and negative user experiences, suggests that trust remains a substantial hurdle for JP Exchange.

2.6.6 User Experience Analysis

The user experience provided by JP Exchange appears to be a mixed bag, largely influenced by the broker's reliance on the MetaTrader 5 platform. For traders who are familiar with MT5, the platform's intuitive interface, robust analytical tools, and multi-device compatibility offer a familiar and efficient trading environment. Some users appreciate the seamless integration of advanced charting functionalities that facilitate technical analysis and algorithmic trading.

However, the overall user experience is hampered by significant gaps in service delivery and operational transparency. The registration process, account verification procedures, and fund management experiences have received limited commentary, leaving several vital aspects unaddressed. Additionally, while some users praise the platform's functional design, others report dissatisfaction stemming from the lack of prompt customer support and inadequate resolution of technical issues.

This divergence in user feedback creates an overall impression that, despite a strong technological foundation, the broker's broader service model is insufficiently robust. The absence of detailed information regarding user interface customization, multilingual support, and streamlined operational procedures further detracts from the experience. In this jp exchange review, it becomes evident that while the platform itself meets basic expectations, improvements in customer service and operational transparency could significantly enhance the overall user experience.

Prospective clients should weigh these factors carefully when considering JP Exchange as their trading partner.

Conclusion

In conclusion, JP Exchange presents a platform with notable technological strengths, particularly for users inclined toward the MetaTrader 5 interface. However, significant concerns persist regarding the lack of regulatory approval, opaque account conditions, and insufficient customer support infrastructure. This jp exchange review underscores that while the interface and tool offerings are strong, the absence of robust oversight and consistent user satisfaction makes it risky for traders with low risk tolerance.

The broker might suit those who prioritize advanced trading technology and are prepared to assume the potential risks associated with unregulated entities. Overall, caution and further due diligence are recommended for anyone considering JP Exchange as a trading partner.